It’s crazy to think that a subset of student loan borrowers has never faced a single bill, thanks to the continued pause on repayments since March 2020. But, as they say, all good things must come to an end—and so is the case with this temporary relief.

The Biden administration has alerted the 45 million Americans with student debt that they may have to start paying up sometime around August this year.

Does this decision affect you directly? It’s time to get your head in the game and figure out how to reduce your total student loan cost.

In this article, we’ll cover—

- 15 effective tips on how to pay student loans fast.

- Top student debt resources you need to check out.

- Key FAQs on understanding the basics of student loans.

Check out more articles on student loans:

Get out of student loan debt faster with our free tools:

15 Top Tips for Paying Off Student Loans Faster

Here’s what’s wrong with the student debt narrative—

The conversation centers on interest rates and the total amount of debt—the factors that you (the borrower) can’t control.

Let’s change that and focus instead on the 15 steps you can take to pay off your student loans faster.

1. Increase your credit score

Keeping your credit in good shape can give you more loan options and a lower interest rate. Check your credit score before applying for a loan and figure out where you stand.

If your credit score needs improving, work on:

- Reducing credit card balances.

- Clearing any collection accounts and past-due accounts.

- Making all future loan payments on time.

- Examining your credit report for errors and disputing them if necessary.

2. Compare student loan offers

Are you the sort of person to try out ten shirts and buy the eleventh one? You want to do exactly that when choosing a student loan offer.

Lenders offer rates slightly different from one another. Most will let you check these rates by filling out quick online forms. It’s a win-win situation because checking rates this way won’t impact your credit score.

So don’t accept the first offer you qualify for. Look around for more options, stack them up against each other, and pick the cheapest plan.

Also, prioritize federal loans over private ones. Federal loans have relatively lower interest rates and can give you opportunities to seek loan forgiveness in the future.

3. Try the debt snowball method

The debt snowball method is one of the fastest ways to get out of debt.

Harvard Business Review’s research “The Best Strategy for Paying Off Credit Card Debt” says the technique works because—

- It offers a clear plan of action.

- It increases motivation by focusing on individual debts.

- It allows for a series of small wins.

What’s the debt snowball method?

This incredible debt repayment strategy focuses on paying off your smallest debt first with minimum payments. You then use this momentum to eliminate the next smallest debt, and so on. Snowballing your student loans can effectively help you focus on a single debt at a time.

Curious to see if this method works for you? Check out our Free Student Loan Debt Snowball Spreadsheet.

(Want something more? Want to get out of debt in a year or less? Check out our new Get Out of Debt course.)

4. Pay off student loans early

Since the Congress passed the CARES Act in March 2020, the pause on student loan repayments has been extended nine separate times. The repayments will likely resume in August 2023.

Should you continue enjoying this pause and plan for later this year? By all means. But if you’re in a situation where you can afford repayments, do it right away.

This is the fastest way to pay off student loans, as you can continue making loan repayments during this forbearance period without paying any new interest. Your monthly payments won’t be lower but this 0% interest rate will save you money in the long run.

5. Sign up for automatic payments

Most lenders offer automatic payments. Signing up for them will typically fetch you a 0.25% reduction in your student loan interest rate.

This is a simple yet effective way to reduce your total loan cost. Plus, automating payments will ensure you don’t miss monthly installments.

6. Pay more than your minimum payment

It’s simple—

Making extra payments will enable you to pay off your student loan principal and interest faster.

Most loan companies let you pick how extra funds are distributed. That is, you can ask your provider to redirect the extra payments to your loan’s principal amount rather than the interest.

Remember that the principal is the amount of debt you must repay, whereas the interest is the price you pay your lender for borrowing money. Paying off the principal will help you pay off your student loans significantly faster.

So, if you’re doing well financially, ignore your loan repayment plan and pay off more debt.

7. Choose a shorter repayment term

Choosing a shorter repayment term can help you save money on interest charges over time. Since you’ll make larger payments each month, you’ll pay off the loan faster and pay less in interest overall.

Plus, a shorter repayment term can help you achieve financial freedom faster. Paying off your loan sooner will let you allocate more money towards other goals, such as saving for a down payment on a house or building an emergency fund.

A shorter repayment term can also help you avoid defaulting on your loan. Choosing a longer repayment term may tempt you to make only the minimum payments each month, which can lead to accruing more interest and potentially defaulting on your loan.

8. Make payments while you’re in school

If you’re still in school, it can be tempting to defer payments. We’re all for this pause but remember that your loan continues to accrue interest (that you have to pay later) even during this deferral period.

Once you graduate and your loan enters repayment, any unpaid interest is capitalized, meaning it’s added to your original loan balance. So, the new loan balance is the amount you’ll have to pay back.

So, how can you reduce your total loan cost while in school? Of course, making full monthly payments will result in the lowest overall loan balance. But this isn’t something most students can afford—and that’s completely fine. Even if you’re paying just $25 each month, you’ll save significantly throughout your loan repayment.

9. Work on a strict budget

Trust us when we say no one wants to spend their Sundays planning how they’ll pay their bills. But there’s no substitute for budgeting. It can help you prioritize your expenses, ultimately ensuring you don’t overspend.

This way, you can easily set aside some money to repay your debt in a shorter period. You might also be able to make extra payments, reducing your overall loan cost.

The whole thing can come off as an intimidating task. But we’ve got your back.

Start budgeting efficiently with our free and ready-to-use budget templates:

10. Use your tax refunds, bonuses, and gift money

This one is a cool money management method and a true test of your willpower.

Student loan interests are exempted from taxes, meaning you’ll receive tax refunds on your interest payments.

It may be tempting to use this money to sponsor a short vacation—but instead, consider redirecting the entire refund amount to pay off student debt further.

Try doing the same thing with any gift money or bonus you receive. Remember that even the littlest contribution can help in the long run.

11. Refinance your student loan

When you refinance your student loans, you take out a new loan with a private lender. The lender then pays off your existing debt and offers you new terms.

Refinancing student loans can lower your interest rate and monthly payments. If you play your cards right—you’ll end up paying thousands of dollars less.

This is especially beneficial if your credit situation has changed from the time you took out your loans. As you graduate and start working, you’ll most likely start building a more comprehensive credit history—resulting in a better credit score than when you were 18.

A better credit score will let you qualify for lower interest rates, so you’ll end up with lower monthly payments.

Keep in mind that if you refinance your federal student loan into a private one, you’ll lose certain benefits and repayment options.

12. Look for a loyalty discount

Lenders may offer you an additional discount for things, like having an existing relationship with the bank or credit union, paying on time, and more.

Make sure to check with your servicer or lender for details.

13. Consolidate your loans

If you have several federal student loans, each with its own interest rate, repayment periods, and minimum monthly payment, consider merging them all with a direct consolidation loan.

A direct consolidation loan involves taking out a new federal loan for the sum of all your previous ones. You’ll now only have to deal with one monthly payment and one due date.

Keep in mind that your interest rate will be the weighted average of the rates on previous loans, so you won’t always end up with lower rates.

14. Switch from fixed-rate to variable-rate loans

Variable rates change regularly over the life of your loan and typically begin cheaper than fixed-rate loans. While your loan rate may rise during its term, you may also benefit from a rate decrease.

How do you decide if you should switch to a variable-rate loan?

Robert R. Johnson, professor of finance at Creighton University, says, “The decision to switch from a fixed-rate loan to a variable-rate loan (or vice versa) depends upon two considerations. Firstly—consider the outlook for the interest rate environment.

If rates are expected to fall in the future, moving from a fixed rate to a variable rate loan may save you money. CME’s FedWatch tool currently suggests that the Fed will halt its rate hikes later this year and gradually begin lowering rates in 2024.

Secondly—check your degree of risk aversion. If you aren’t willing to bear the risk of even higher rates in the future, you may want to stick to a fixed-rate loan.”

15. Seek loan forgiveness and look for scholarships

Many organizations assist students who are unable to pay their debts. Graduates who work for non-profit organizations or in the public sector are typically eligible for this opportunity. However, some programs are geared toward those working in other fields.

These programs are frequently career-related, such as loan forgiveness programs for nurses. Keep in mind that the competition here is fierce, and you’ll need to prove that your financial situation is poor to repay the loan.

It also makes sense to apply for a loan only after exhausting all scholarship opportunities. Do a thorough search online and you’ll find scholarships for reasons you may have never considered.

List out your personal information, such as your culture, religion, and even your height. Then, make a list of all of your skills and interests. You’d be surprised to learn that there are awards for each of these attributes.

Useful Resources on How to Pay Off Student Loans Fast

Wondering how to pay off college debt?

There are tons of resources available to help you, including government programs, repayment strategies, and other useful tools.

Here are our top picks:

- The United States Department of Education can help you understand college expenses and explore ways for minimizing them. Use the exit counseling tool to plan your education expenses for the year and estimate your projected student loan balance against your future monthly income.

- StudentAid.gov gathers information from all of the loan servicers to provide you with a full picture of all of your federal student loans.

- The U.S. Department of Education’s payment calculator can help estimate your monthly repayment amount for the student debt you currently have and any additional debt that you expect to borrow. Use it to help you estimate what your monthly payments will look like after school.

- Use our free weekly and monthly budget calculators to manage your expenses while you’re in school. Setting a budget will help you keep track of your income and expenses to make sure you’re not borrowing more than you can afford.

- Use our free debt snowball spreadsheet to plan your repayment strategy and pay off your student debt faster.

Wrapping Up

Figuring out how to reduce student loan payments may seem daunting at first, but fear not—with some strategic planning and savvy financial decision-making, you can tackle that mountain of debt like a pro.

Start by taking a good hard look at your financial situation and creating a budget that works for you.

From there, explore options like refinancing or consolidating your loans to score better rates and terms.

And don’t forget to keep an eye out for easy ways to save money, like signing up for autopay or making extra payments whenever possible.

FAQ

We’ve put together a list of frequently asked questions to help demystify the basics of student loans and get you on the road to financial enlightenment.

What is interest?

Interest is the monetary or extra charge you pay a lender in return for borrowing money. This expense is a percentage of a loan’s unpaid principal amount.

Interest is categorized as a simple one if it’s based on the loan’s principal amount. It’s called compound interest if it’s based on the principal and the loan’s previously earned interest.

What increases your total loan balance interest accrual or interest capitalization?

Typically, loan balances decrease over time as you make repayments. However, student loan balances can increase even if you repay the debt.

In fact, research by Moody’s says almost half of student loan borrowers are further in debt five years after they begin paying back their loans.

This is mainly because of capitalized interest on student loans. This is unpaid interest that typically gets added to your student loan balance after periods when you don’t make payments—such as during deferment or forbearance.

Here’s a deep dive into these scenarios and other possible factors—

1. Paying less than the requested amount

You’ll have to pay a set amount of monthly payments to offset your student loan. But what if you pay less than the amount requested?

To begin with, your monthly payments won’t cover the loan’s interest and principal. This is because a portion of each installment is allocated towards clearing the interest and another towards the principal. Unpaid interest and principal will almost certainly increase your loan balance.

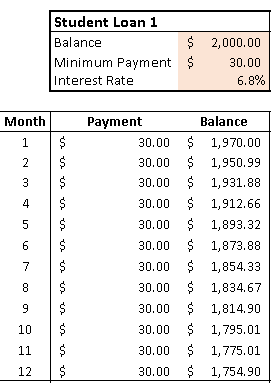

To understand how this affects your loan balance, we’ll use our free student loan debt snowball calculator. Assume you’re required to make a minimum payment of $30 on a $2,000 student loan. Here’s what happens to your balance over time:

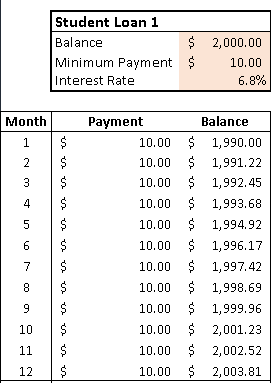

Now, let’s assume you make a partial payment of $10. This will lead to an increased loan balance that’s more than the initial $2,000 loan amount.

2. Delays in loan repayments

Late loan payments incur penalties and costs. These fees are added to your initial loan amount, raising your total loan sum.

What happens if you miss a federal student loan payment?

- 30-day delay: As a late fee, your loan servicer may charge you up to 6% of the amount of your missed payment. For example, if you miss a $100 payment, you may be charged a $6 fee.

- 90-day delay: Your servicer may report late payments to credit bureaus. This may significantly lower your credit score.

- 270-day delay: your student debts will default. This may result in further penalties, such as collection expenses and the confiscation of tax refunds. You should be aware that collection fees might amount to up to 25% of the principal and interest as collection fees.

What about private student loans, though?

Unlike federal loans, private loans aren’t standardized. For instance, a lender’s late fee could be a percentage of your payment or a flat fee. Private lenders typically report late payments after 30 days. Plus, these loans default earlier than federal loans.

A MeasureOne study says the early-stage (30-89 days late) and late-stage (90 days or more) delinquencies for private student loans are 2.73% and 1.75%, respectively.

While these figures look encouraging, experts warn that student loan delinquencies may rise to pre-pandemic levels once federal student loan payments resume.

3. Choosing an extended payment plan

Extended payment plans are student loans that are typically repayable over 20 years or more. These payment options gradually reduce the loan balance.

But don’t these plans let you make smaller monthly payments?

Yes, they do. However, they can be costly in the long run. After all, the longer the payback time, the more interest you’ll pay. So, a ten-year loan will cost more than a five-year loan.

Furthermore, the tiny payments you make on extended plans only cover the interest and a portion of the principal. This means, skipping a payment will likely increase your loan balance.

4. Missing or deferring payments

You can miss a payment on an agreement with your lender. However, this doesn’t mean that your loan balance is no longer accumulating interest. This interest is added to your principal, eventually increasing your loan balance.

Here’s an example:

Lenders can give you a six-month grace period after finishing your studies to make payments. This can help you get a job and build a source of income—but your student loan continues accruing interest during this time, resulting in a higher loan balance.

5. Income-driven payment plans

Income-driven payment plans often have the lowest monthly loan payment of any repayment plan.

Your monthly payment is determined using:

- Your annual income.

- The poverty line based on your family size.

- Your state of residence.

You may find yourself in a scenario where you miss a payment or pay less than the minimum amount due each month. And because the monthly payment is less, this can increase your loan balance.

6. Calculation errors

Unusual calculation errors might sometimes boost your loan debt.

Wondering how to detect such errors? If you’re making the correct loan repayment and still notice your loan balance shooting up, query it.

Such errors can occur for a variety of reasons, including algorithmic problems, incorrect payment amounts, or combining your account with someone else’s.

When do you start paying interest on student loans?

Student loans begin charging interest the moment they are disbursed. That implies your loan sum is already rising, even if you don’t start repaying it until you graduate.

As you approach your repayment period, your loan servicer will capitalize the previously accrued interest.

What does this look like in practice?

Assume you borrow $5,000 in student loans for your final year. And your loan won’t be due for another six months after you graduate. This implies that interest will be charged on your loan for the next 18 months.

If you have a 5% interest rate, your monthly interest will be around $25. An additional $432 will be added to your balance over 18 months. Instead of the original $5,000, you’ll now owe your lender $5,432 in interest.

What are the available options for student loan repayments?

Federal loans and most private student loans come with a grace period that’s usually six months long. While private and unsubsidized loans continue accruing interest during this time, you don’t have to make repayments yet.

Use this grace period to choose a student loan repayment plan that works best for you. Note that you can change your federal student loan repayment plan as often as you need to. Some private lenders also have alternate payment plans you can check out.

Wondering what is the best way to pay off student loans?

Here’s a look at some options for student loan repayment plans:

- Standard repayment plans: the most common repayment plan that features scheduled payments and fixed monthly payment amounts. Federal loans usually have a repayment period of 10 to 30 years. This figure may vary for private loans.

- Graduated repayment plans: available for all federal student loan borrowers. Here, payments start low and increase gradually over time. However, the loan must be repaid within 10 years.

- Income-based repayment plans: you can qualify for an income-based repayment plan if you have a high debt relative to your income. Under this plan, monthly payments are either 10% or 15% of your discretionary income. Payments are evaluated each year based on your family size and income. Note that these are federal-only plans.

- Extended repayment plans: federal-only payment options for direct loan borrowers with over $30,000 in outstanding loans. Here the monthly payments are low, and the time frame for repayment is within 25 years.

What are two ways that can help you keep a budget while trying to reduce debt load from loans?

Here are some top tips on how to reduce student loan debt while keeping a budget:

- Track your income and expenses so you can identify areas where to cut back and save money.

- Look for ways to increase your income, such as taking on a side hustle or gig work.

- Use the debt snowball method to pay off your smallest debts first while making minimum payments on your larger debts. This strategy can help build momentum to continue paying off your debts.

- Negotiate with creditors for new payment terms or interest rates.

- Consider debt consolidation to simplify your payments and lower your interest rate.

- Reach out to a financial advisor or credit counseling service for help creating a plan to pay off your debts.

Why does the amount of interest you owe decrease every month?

As you make monthly payments on your loan principal, the amount of interest you owe decreases.

When you borrow money, the lender charges you interest to earn a profit. The interest is usually calculated as a percentage of the loan amount and is added to your outstanding balance each month.

As you make payments on your loan, the amount you owe reduces, resulting in lower interest rates on the remaining balance.

The interest paid on the remaining balance will continue to drop each month as you pay down your debt. This means a bigger portion of your payment will go toward paying down the loan’s principal rather than interest charges.

How to pay off private student loans?

We’ve discussed in length how to pay federal student loans. But how do you reduce your total loan cost if you have a private loan?

These loans usually have higher interest rates, and the borrower’s credit history and income are significant factors in determining the loan’s interest rate.

Here are some tips on how to lower student loan payments:

- Contact your loan servicer to discuss alternative payment plans or deferment and forbearance options.

- Consider refinancing your private education loans to get lower interest rates or monthly payments.

- Consolidating your private education loans into one loan can help you lower your monthly payments. But this may increase the amount of interest you pay over the life of the loan.

- Create a budget to manage your finances and prioritize your loan payments. Consider cutting back on expenses.

- Seek financial counseling from a reputable organization. They can help you create a plan to manage your debt and improve your financial situation.

Sources

See all

3 Reasons Why Research Says the Debt Snowball Works. (n.d.). FaithFi. Retrieved April 27, 2023, from https://www.faithfi.com/christian-money-solutions/3-reasons-why-research-says-the-debt-snowball-works-801

About the CARES Act and the Consolidated Appropriations Act. (2023, April 17). U.S. Department of the Treasury. https://home.treasury.gov/policy-issues/coronavirus/about-the-cares-act

Extended Plan | Federal Student Aid. (n.d.). Retrieved April 28, 2023, from https://studentaid.gov/manage-loans/repayment/plans/extended

Federal Student Aid. (n.d.). Retrieved April 28, 2023, from https://studentaid.gov/manage-loans/repayment/plans/standard

Graduated Plan | Federal Student Aid. (n.d.). Retrieved April 28, 2023, from https://studentaid.gov/manage-loans/repayment/plans/graduated

Household Debt Relief Enters Critical Transition Period. (n.d.). Retrieved April 28, 2023, from https://www.stlouisfed.org/on-the-economy/2022/mar/household-debt-relief-enters-critical-transition-period

Moody’s—Credit ratings, research, and data for global capital markets. (n.d.). Retrieved April 28, 2023, from https://www.moodys.com/research/Moodys-Slow-payments-a-key-contributor-to-the-continued-growth–PBC_1210392

Options for repaying your private education loan. (n.d.). Consumer Financial Protection Bureau. Retrieved April 27, 2023, from https://www.consumerfinance.gov/paying-for-college/repay-student-debt/private-student-loans/

Poverty Guidelines. (n.d.). ASPE. Retrieved April 28, 2023, from https://aspe.hhs.gov/topics/poverty-economic-mobility/poverty-guidelines

Student Loan Default Has Serious Financial Consequences | The Pew Charitable Trusts. (n.d.). Retrieved April 28, 2023, from https://www.pewtrusts.org/en/research-and-analysis/fact-sheets/2020/04/student-loan-default-has-serious-financial-consequences

Student loan payments are set to restart in 2023. Here’s how borrowers should prepare. (n.d.). USA TODAY. Retrieved April 26, 2023, from https://www.usatoday.com/story/news/education/2023/02/21/student-loan-forgiveness-payment-resume/10964764002/

The key dates for Student loan forgiveness in 2023. (2023, April 23). Diario AS. https://en.as.com/latest_news/the-key-dates-for-student-loan-forgiveness-in-2023-n/

When Will Student Loan Payments Resume? (2023, March 6). https://www.wsj.com/buyside/personal-finance/when-will-student-loan-payments-resume-2d3df4a9