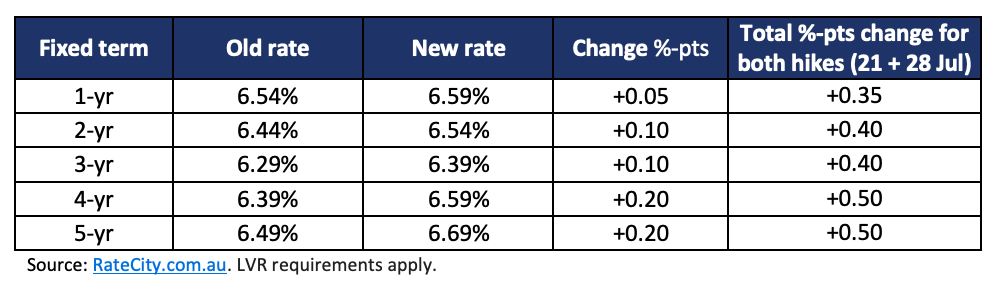

NAB has raised the interest rate it charges on its fixed home loans for owner-occupiers and investors by up to 0.2 percentage points, after a similar move just over a week ago.

The increases, combined with the hikes from 21 July, have seen some rates lift by up to 0.5 percentage points in the space of eight days.

RateCity.com.au showed in the table below the changes to NAB’s lowest fixed rates, for owner-occupiers paying principal and interest:

“Another round of fixed rate hikes from NAB will have borrowers hoping to lock in their rate rattled,” said Sally Tindall (pictured above), RateCity.com.au research director.

According to the comparison website, 71 lenders have lifted at least one fixed rate in the last month, which was equivalent to 63% of lenders in its database.

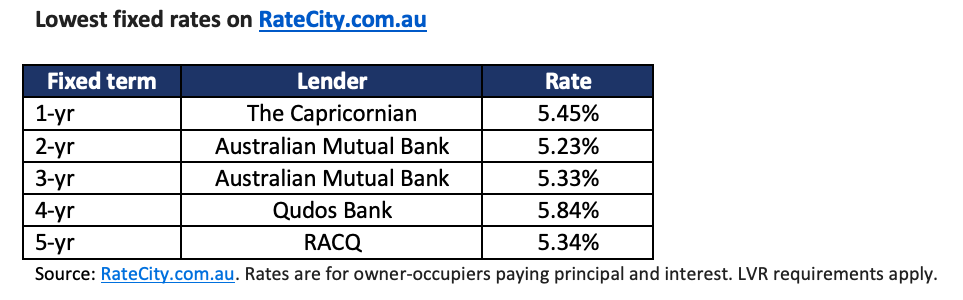

“When push comes to shove, borrowers are overwhelmingly opting to go variable, giving banks the runway to hike fixed rates with little consequence,” Tindall said. “If borrowers are looking to fix anytime soon, they’d do well to keep an eye on what the big banks are doing, or better yet, look beyond them.”

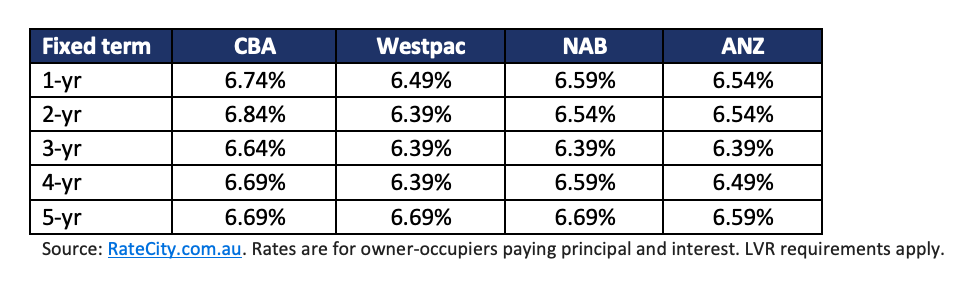

Below are the big four banks’ lowest advertised fixed rates, according to RateCity.com.au:

Below are the lowest fixed rates on the RateCity.com.au database:

Use the comment section below to tell us how you felt about this.