Income tax refund, also known as IT refund, arises in the cases in which tax paid by an Assessee is higher than the amount he/she is liable to pay. In such case, the Income tax department simply refunds you the extra amount.

All eligible income tax refunds are now transferred in electronic mode only. Further, tax refunds will be made only to the bank accounts which are linked with PAN.

So, to receive income tax refund directly to your bank account, you need to meet the below conditions;

- Your Aadhaar number should have been linked to your PAN.

- You PAN is linked to Bank Account (Account can be Savings, Current, Cash or Overdraft).

- Your bank account should have ‘validated‘ status in e-filing Portal.

The Income Tax department has been issuing the refunds to all the eligible assessees at a very fast pace. I have been informed by some of my friends that they have received the refunds, the same day or the very next day of filing their ITRs.

However, some of you are yet to receive the ITR refund (or) might have received an intimation from the IT department that your income tax refund issue is failed.

In this post, let’s understand – How to check if your bank account is pre-validated on e-filing tax portal? How to remove and add back the bank accounts? How to submit Income Tax Refund request online?

Issue of Income Tax Refund Failed & Possible reasons for the failure

The reason for income tax refund failure can be –

- Your Aadhaar and PAN are not linked

- PAN and Bank account are not linked

- The bank details (bank account number, IFSC code, Account type etc.,) provided by you can be inaccurate.

“On account of merger of banks, valid bank accounts may have subsequently got invalidated due to consequent changes in IFSC/Account Number. It may advised to check and re-validate such bank accounts with updated IFSC/Account Number.” – Income Tax Department

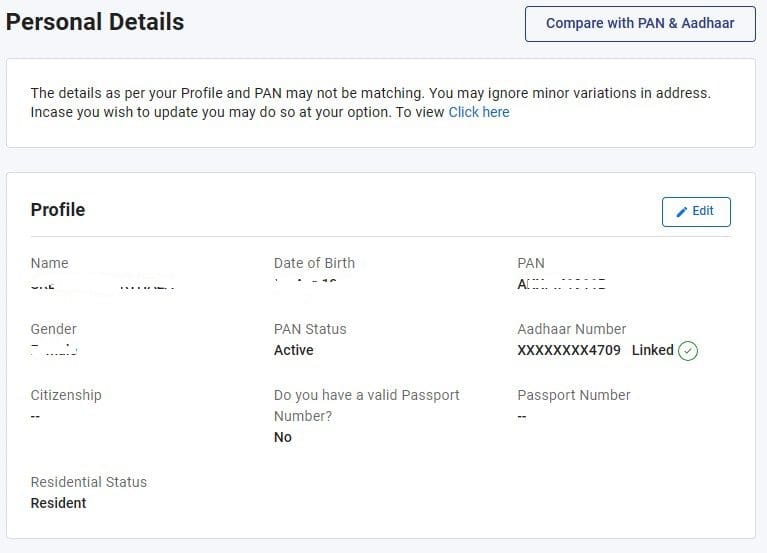

PAN & Aadhaar are not linked

Income tax refund issue failure can be due to the fact that your Aadhaar and PAN are not linked, check the linking status of your PAN with Aadhaar.

- Login to Income Tax e-filing portal

- Go to ‘My Profile’ section

- Make sure your PAN status is ACTIVE and is linked to your Aadhaar. If they are not linked, you got to link them to be eligible for receiving the ITR refunds.

Failure to link would make the pan inoperative effective July 1 2023. With an inoperative PAN, the individual cannot file the tax return and cannot receive a tax refund.

PAN & Bank Account are not linked

Kindly check if your PAN is linked to your Bank account or not. Visit your net banking facility and make sure your KYC is not pending with your bank, and PAN is linked to your bank account. Please note that income tax refund issue fails if your bank account kyc is pending.

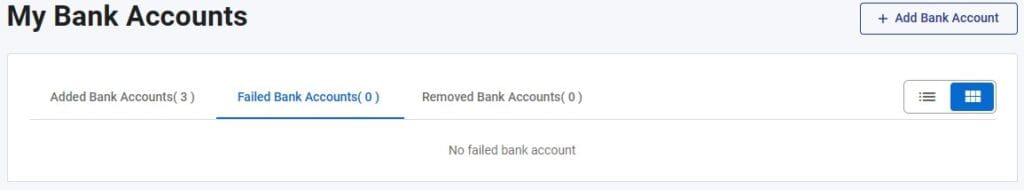

Failed Bank Account(s)

In case, you have already linked and pre-validated your bank account in e-filing portal, check if they are now under ‘failed bank account’ tab.

- Visit and login to e-filing account

- Click on My profile tab

- Click on My Bank accounts and check the ‘failed bank account’ tab.

You may ‘add bank account’ again under ‘may bank accounts’ tab afresh and can pre-validate it using electronic verification (OTP) method. You need to make sure your bank account details are accurate.

You can also pre-validate your bank account by visiting the net-banking facility;

- Login to your bank account through net banking.

- Click link for e-verify ITR.

- You will be directed to IT Portal with auto logged in.

- Your account will get validated immediately.

- You can validate your bank account offline through the ECS Mandate Form. Follow the steps below to validate your bank account offline:

- Download ECS mandate form.

- Take print out of the form and fill the necessary details.

- Get the form signed with bank seal from official Bank.

- Upload the scanned copy of signed form.

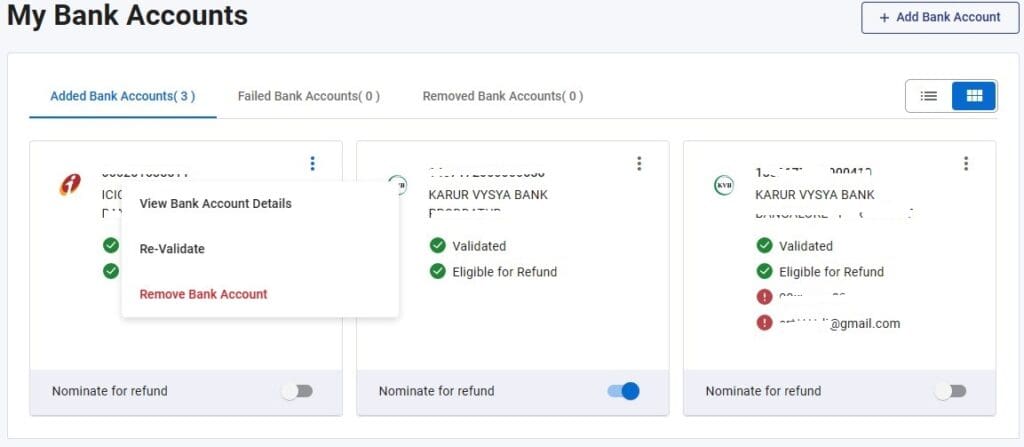

Re-validate your Bank account to receive Income Tax Refunds

Even after adding and pre-validating your bank account(s) on e-filing portal and the issue of refund failure persists, check your banking account details under ‘Added bank accounts’ tab.

- Login to e-filing portal

- Visit my profile section

- click on ‘my bank accounts’

- Access ‘added bank accounts’ tab

- Click on ‘view bank account details and cross-check the data.

- You can re-validate the bank account again.

- Make sure the concerned bank account is ‘nominated for refund’.

- In case you see ‘restricted refund’ status for your bank account, try to re-validate the account again. Else, check with the customer care of your bank.

“Restricted Refund shows when your data in bank is not matching with Pan Data base (IT Department’s). You can get ‘name’ rectified with the bank and make sure it matches with Aadhaar and PAN data.”

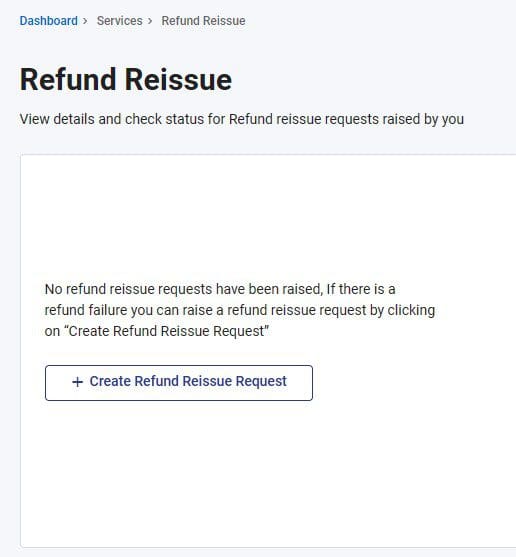

How to raise Income Tax Refund reissue request on e-filing portal?

If you have received ‘refund failed’ message from the Income tax department, make sure you check the above-mentioned validation points. You can now submit a fresh ‘income tax refund reissue request’ online via electronic filing income tax portal. (The pre-requisite for refund re-issue request is Income Tax Return has been filed and there is a refund failure.)

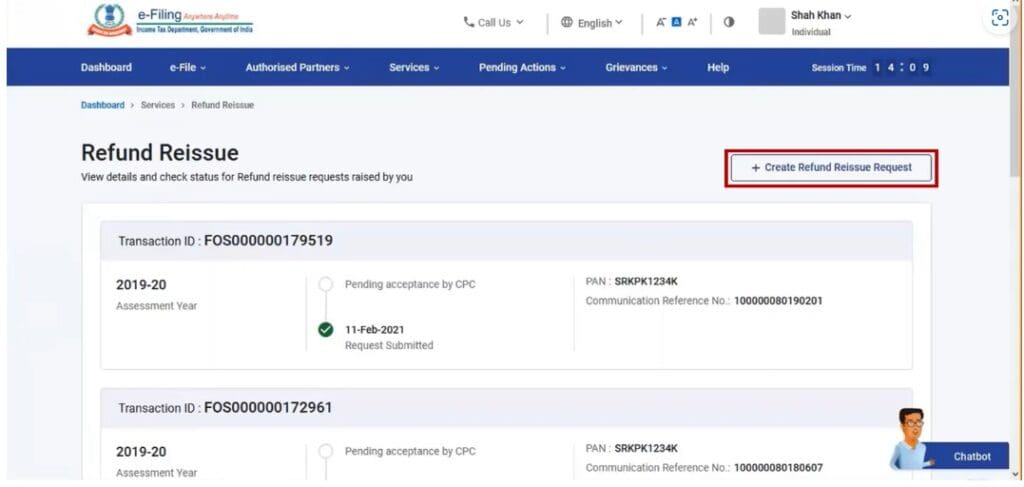

- Login to e-filing portal

- click on ‘Services’ tab

- Click on ‘refund reissue’ option

- Click on ‘refund reissue request’

- On the Refund Reissue page, the details and status of refund reissue requests that you have already raised are displayed. To create a new request for refund reissue, click Create Refund Reissue Request.

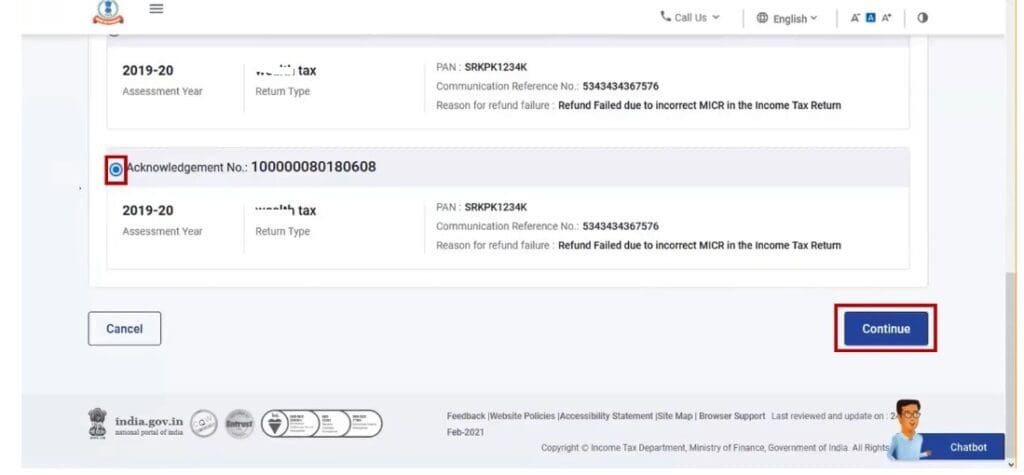

- On the Create Refund Reissue Request page, select the record for which you want to submit request of refund reissue and click Continue. (Here, you can check the reason for refund failure.)

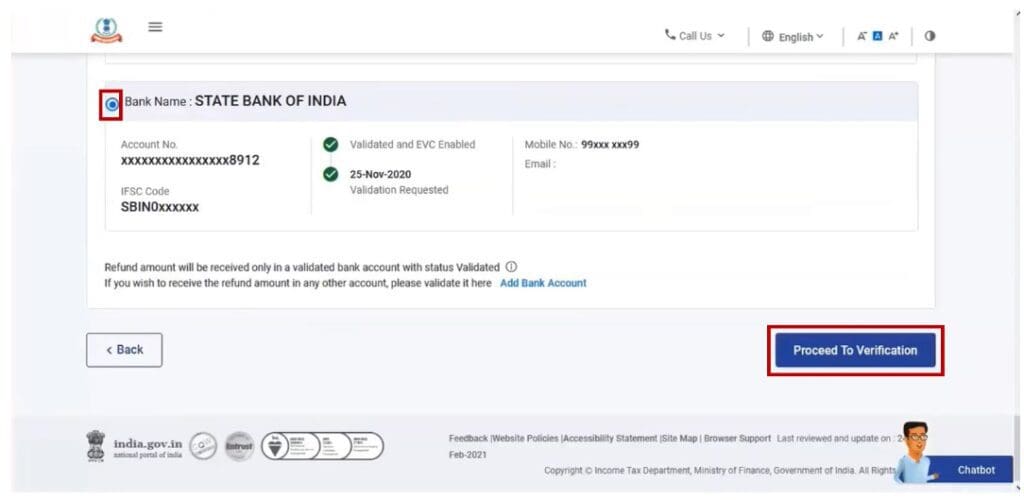

- On the Select a Bank Account page, select the bank account where you would like to receive the refund and click Proceed to Verification. (You can directly proceed to verification if the selected bank account is already validated. If your selected bank account is not validated, you can pre-validate the bank account online through the e-Filing portal.)

- After successful verification of the bank details, select your preferred option on the e-Verify page.

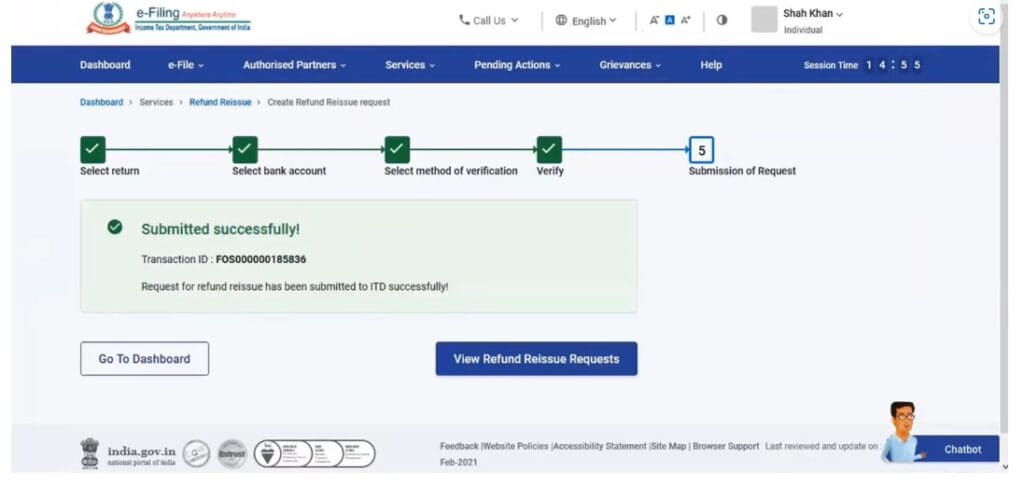

- After successful e-Verification, a success message along with a Transaction ID will be displayed. Please keep a note of the Transaction ID for future reference. You will also receive a confirmation message on the email ID and mobile number registered with e-Filing portal.

- If you click View Refund Reissue Request, you will be taken to the View refund reissue request page where you can also view the status of the submitted requests.

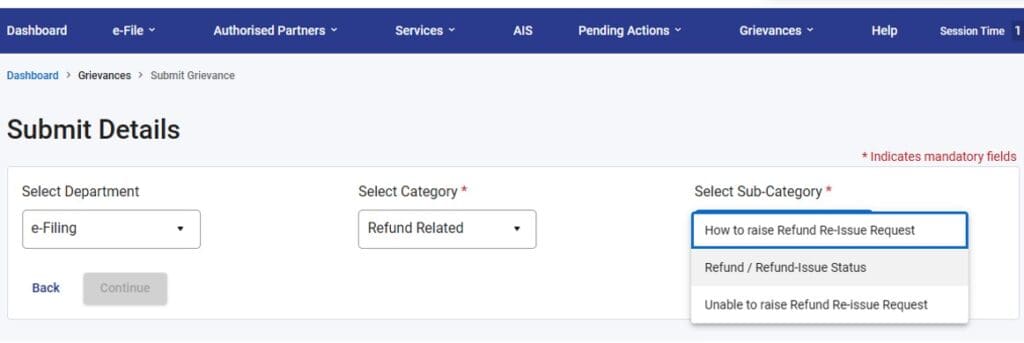

How to submit a grievance request related to Refund or Refund reissue AY 2023-2024?

If you are still unable to receive the refund or would like to submit any grievance request related to the refunds, you can submit a grievance through the e-filing portal.

If you have any query related to your income tax refund, do leave a comment or post it in our Forum section, more than happy to help! Cheers!

Continue reading :

(Post first published on : 31-July-2023)