We all would like to maintain a balance between professional and personal life. Both are equally important to lead a successful, happy and healthier life. All doctors suggest us to eat a healthy balanced diet.

A well-balanced life is very much essential for personal effectiveness, peace of mind and living well. We all would like to maintain a balance between professional and personal life. Both are equally important to lead a successful, happy and healthier life. We need to have a right and well-balanced diet to be healthy and fit.

Investing in Balanced Mutual Funds is not much different. Balanced funds are also known as Hybrid Mutual Funds. Personally, I prefer investing in balanced funds to achieve my medium and long-term goals. I am a strong advocate of Balanced Funds. (Read : My Mutual Fund Portfolio)

Mutual funds are primarily classified as either Equity or Debt, based on where the funds are invested. Equity funds primarily invest in stocks/shares and Debt funds primarily invest in Bonds, Government securities and Fixed interest-bearing instruments. Whereas Hybrid Funds invest in both equity and debt instruments.

From mutual fund taxation point of view, we now have three broad type of funds – Equity, Non-Equity & Specified Funds. Read more at Mutual Funds Taxation Rules FY 2023-24 (AY 2024-25) | Capital Gains Tax Rates Chart

In this post let us understand – What are aggressive hybrid equity mutual funds? What are the benefits of investing in hybrid equity MF schemes? What are the factors to consider while picking best hybrid equity mutual funds? Which are the top 5 best aggressive hybrid equity mutual funds to invest in 2023 & beyond!

What are Aggressive Hybrid Equity Funds?

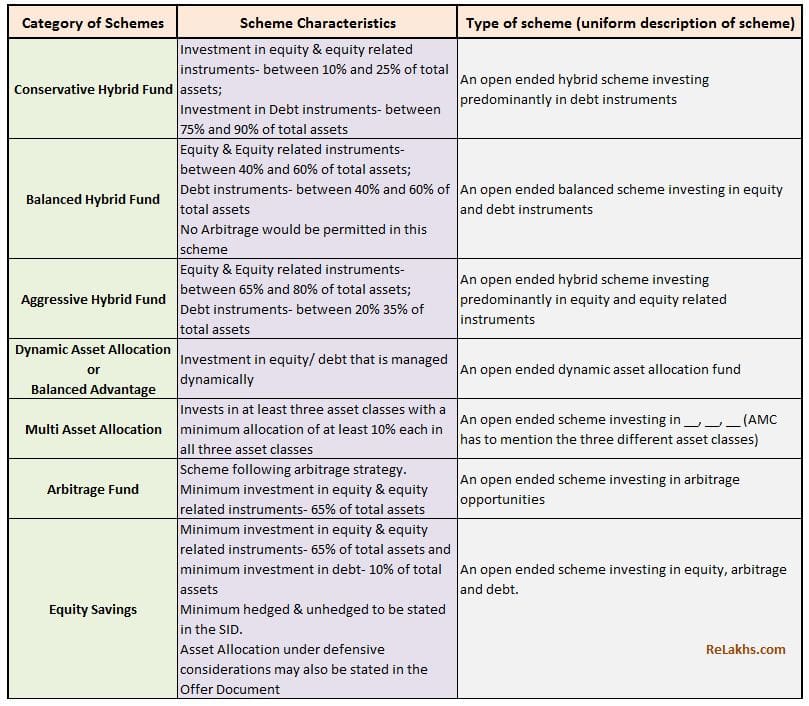

Hybrid Mutual Fund Schemes are broadly classified as below;

So, an Aggressive Hybrid Fund (erstwhile known as Equity Balanced Fund) is a type of Equity Mutual Fund which combines the feature of both equity and debt in a single instrument. It means that the money pooled from the unitholders are invested both in debt and equity related instruments.

However, the equity element in the underlying portfolio of a Hybrid Equity Fund should consist of at least 65% of the entire assets under management. The rest portion of the portfolio can consist of debt instruments and cash in hand. In general, the exposure in equity can range from 65% to 85% and is dependent on the market condition and the fund manager’s investing philosophy.

What are the main advantages of investing in Aggressive Hybrid Funds?

The main benefits of investing in an aggressive Equity Hybrid fund are;

- Diversification : The funds are invested in both equity and debt financial securities leading to diversification of investments.

- Asset Allocation & Re-balance : Hybrid Equity funds may regularly re-balance the portfolio based on market conditions & asset allocation limits. An investor is, thus, saved the hassle of manually re-balancing the portfolio. (But it is prudent not to remain invested in these funds till your reach your Financial Goal target year. You may have to switch to safer investment avenues as you reach your target year.)

- Lower volatility : Aggressive Hybrid funds can be slightly less risky when compared to pure Equity funds. Equity portion will provide the capital appreciation through stock prices appreciation and dividend income. Whereas Debt portion can provide stability through interest income and appreciation in Bond prices.

- Any type of an investor can consider adding an aggressive hybrid fund to his/her portfolio for medium to long-term goals like Retirement Planning or for Kid’s Higher Education goal planning.

- The Long-term Capital gains of up to Rs 1 lakh in a financial year is tax-exempt as these are considered as equity-oriented schemes.

How to pick Top rated & Best Hybrid Equity Funds?

Below are the main factors that you can consider while shortlisting the hybrid equity mutual funds;

Past Performance:

Though the past performance is no guarantee of future performance, we need to look at how the funds under aggressive hybrid equity category have been performing, over the last many years. We need to keep in mind that the current top performers may not remain at the TOP forever. The key point is, we need to pick the consistent performers rather than the recent top performers.

A fund that delivers returns that are above its benchmark across market cycles and different periods can be considered as a consistent performer. So, we need to look at the returns generated by the funds over say 5, 10, 15 or even 20-year periods. You can also have a look at the performance of a fund since its inception.

| Mutual Fund Scheme (Hybrid Equity Fund) | 1 Year | 2Y | 3Y | 5Y | 10Y |

| Quant Absolute Fund – Direct Plan | 17% | 13% | 31% | 21% | 20% |

| ICICI Prudential Equity & Debt Fund | 22% | 19% | 30% | 17% | 19% |

| Canara Robeco Equity Hybrid Fund | 15% | 10% | 19% | 14% | 16% |

| DSP Equity & Bond Fund | 16% | 8% | 19% | 13% | 16% |

| SBI Equity Hybrid Fund | 11% | 9% | 18% | 12% | 16% |

| HDFC Hybrid Equity Fund | 20% | 14% | 24% | 13% | 16% |

| Sundaram Aggressive Hybrid Fund | 14% | 11% | 20% | 11% | 16% |

| Edelweiss Aggressive Hybrid Fund | 22% | 16% | 24% | 15% | 15% |

| Franklin India Equity Hybrid Fund | 18% | 11% | 21% | 13% | 15% |

| HSBC Aggressive Hybrid Fund | 17% | 9% | 18% | 10% | 15% |

| Tata Hybrid Equity Fund | 17% | 13% | 21% | 12% | 15% |

| Aditya Birla Sun Life Equity Hybrid 95 Fund | 13% | 8% | 20% | 10% | 14% |

| JM Equity Hybrid Fund | 26% | 15% | 24% | 14% | 14% |

| UTI Hybrid Equity Fund | 20% | 13% | 24% | 12% | 14% |

Risk related factors:

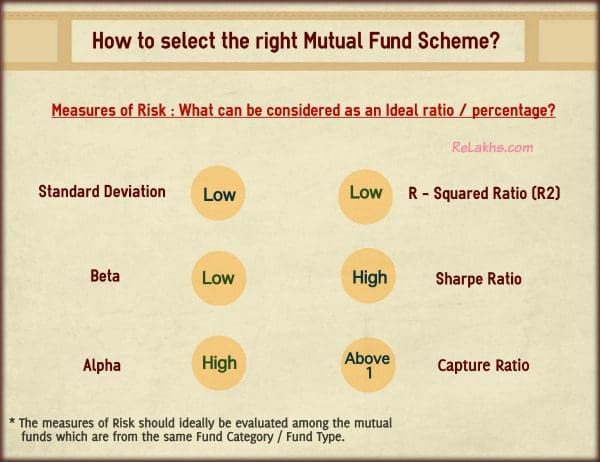

You can use the below image as a reference to review the risk ratios while selecting right equity oriented mutual fund schemes (to know, how consistent the funds have been..?).

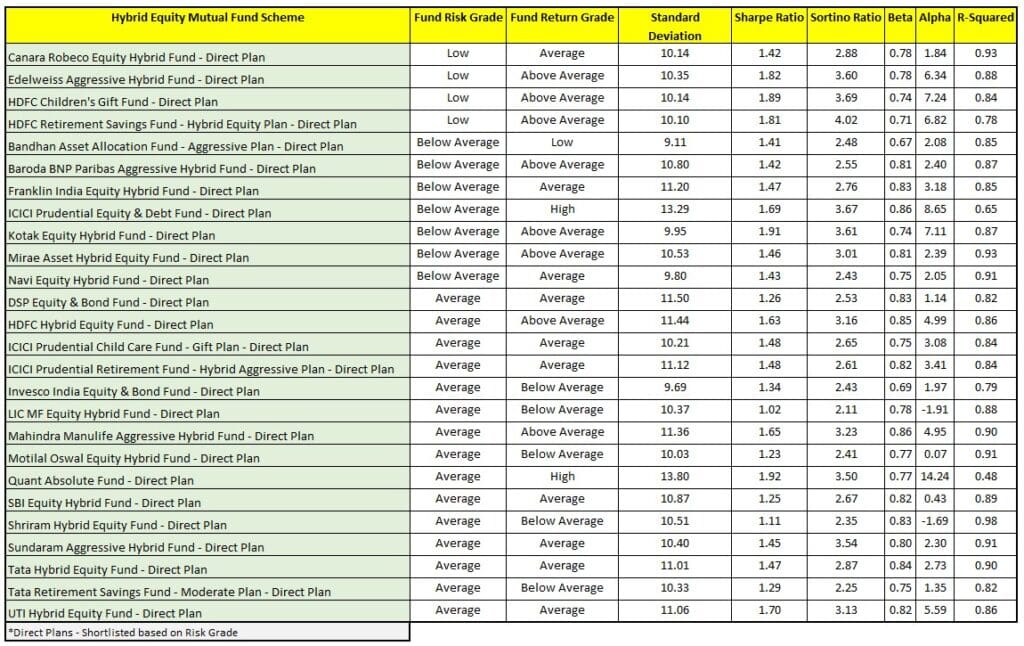

The above list of funds is shortlisted based on their past performance and below list is based on their risk parameters. I have sorted the listed from LOW to AVERAGE risk grade. We can consider the funds which have LOW to AVERAGE risk grade and have AVERAGE to HIGH return grade.

Portfolio Composition:

Hybrid Funds invest in both equity and debt instruments. Hence, you can have a look at the Funds’ equity and debt portfolios. Whether a fund has invested heavily in large cap or mid-cap (and) how is the credit quality of its Debt portfolio.

For example : Top and consistent performer like ICICI Prudential Equity & Debt fund has a portfolio composition of 70% in equities, 18.6% in Debt securities, 2% in real estate related securities (REITs) and around 9.6% in cash. Its equity portion consists of almost 85% in large-cap stocks and 14% in mid and small cap stocks. Its Debt portfolio has 12% exposure to securities which have Sovereign guarantee.

Besides the above factors, we need to look at who is the fund manager and how long he/she has been managing the Scheme, and if there is a recent change of FM.

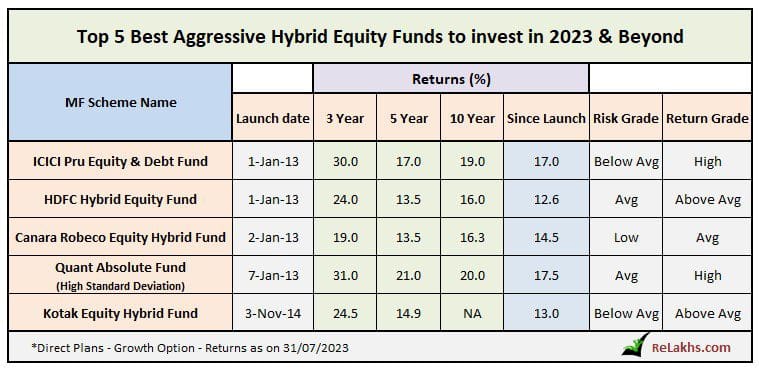

Top 5 Best Aggressive Hybrid Equity Mutual Funds 2023-24

Besides the above Volatility related parameters, I have analyzed the funds based on their past performances i.e., based on the returns generated over the last many years and shortlisted the Top 5 Best Aggressive Hybrid Equity Funds;

- ICICI Pru Equity & Debt Fund

- HDFC Hybrid Equity Fund

- Canara Robeco Equity Hybrid Fund

- Quant Absolute Fund

- Kotak Equity Hybrid Fund

You may also have a look at Mirae Asset Hybrid Equity Fund (launched in 2015). Though the performances of hybrid funds like HDFC Children Gift Fund, HDFC Retirement Savings Fund etc., have been good, I have ignored them due to certain draw-backs associated with these kind of Schemes.

Some important points to ponder over before investing in an aggressive hybrid mutual fund scheme.

- Kindly do not consider aggressive Hybrid Equity funds as low risk-profile Funds. Treat them as part of your Equity-side allocation of your Investment portfolio.

- If you are investing only in Equity index funds, you may add an hybrid equity fund to your MF portfolio for a better down-side protection.

- While shortlisting an equity hybrid fund, do check out the average quality of the fixed income securities (Fund’s debt portfolio) owned by the Fund. You can find these details in portals like Valueresearchonline, morningstar or respective AMC website.

- It is prudent not to invest in Dividend oriented aggressive hybrid equity funds.

- You can consider following a combination of SIP and lump sum investment strategy.

- If you are comfortable picking a mutual fund scheme on your own, consider investing in a Direct plan. Else, consult a financial advisor.

- Though Equity oriented Balanced funds have low risk profile compared to pure Equity funds, but it does not mean that they are totally risk-free. You may have to remain invested for longer period to get decent returns.

Continue reading:

Kindly note that Mutual Funds are subject to market risks and their past performance may or may not be repeated.

(Post first published on : 01-Aug-2023) (References : Valueresearchonline, Moneycontrol, Morningstar & ET Money)