More news on the mortgage rate lock-in effect, this time from Zestimate creator Zillow.

The company conducted a survey and found that homeowners with a mortgage rate above 5% are nearly twice as likely to sell.

This appears to be the “rate-lock tipping point,” where it essentially no longer matters to give up your mortgage rate.

On the other side of the coin, you have the homeowners with sub-5% rates that are essentially locked-in to their properties for fear of losing their low payments.

The latter group explains why housing inventory continues to be at historically low levels, arguably keeping home prices elevated despite affordability issues.

Low Locked-In Mortgage Rates Affect Housing Supply

By analyzing data from the ZG Population Science Quarterly Survey of Homeowner Intentions and Preferences, Zillow discovered that low locked-in mortgage rates affect housing supply.

A homeowner’s reluctance to sell “results in a shortage of housing options, resale supply, homeowner mobility, and places upward pressure on housing prices.”

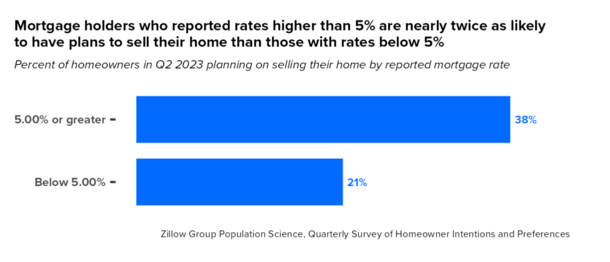

Specifically, they learned that mortgage holders with interest rates above 5% are about twice as likely to have plans to sell their home over the next three years versus those with lower rates.

As you can see from the graphic above, this ratio is 38% vs. 21%, illustrating just how important a low rate mortgage is to existing homeowners.

And of the homeowners who reported plans to sell, 47% of homeowners with a mortgage rate above 5% have already listed their property for sale.

Meanwhile, just 20% of those planning to sell with a rate below 5% have yet to take their home to market.

As to why, it’s due to the huge jump in mortgage rates over such a short period of time. After all, you could land a sub-3% as recently as 2022.

Today, the going rate on a 30-year fixed is closer to 7%, which aside from being an unattractive payment increase, may also be unaffordable for many.

This means a homeowner with a low rate must carefully decide if selling and buying another property makes sense financially.

It’s yet another factor to consider when moving, and partially explains why there’s so little resale inventory at the moment.

Intent to Sell Driven by a Homeowner’s Mortgage Rate

Zillow Home Loans senior economist Orphe Divounguy said the company expects mortgage rates to ease slightly as inflation cools.

But doesn’t see a return to 5% for the 30-year fixed “in the near future.” This means someone selling and buying today must settle for a market rate closer to 6/7%.

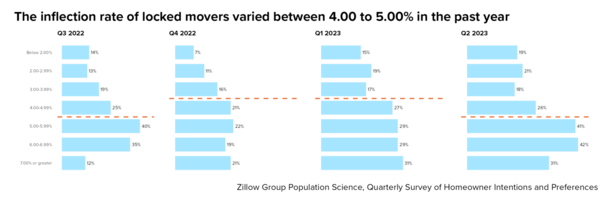

And this may be driving intent to sell, with 41% of homeowners with rates between 5.00-5.99% considering selling, while just 26% with rates between 4.00-4.99% expressing the same.

But the company also found that this sentiment seems to change as the direction of mortgage rates shifts.

For example, the interest rate at which homeowners are less likely to move climbs higher when mortgage rates are trending up.

But when rates seem to have plateaued and/or are showing signs of improvement, homeowners may be more willing to move, even if they have a lower rate.

The idea likely being that their low rate matters less if mortgage rates are expected to improve.

Conversely, if the outlook for mortgage rates is negative, the existing homeowner may be more reluctant to sell and obtain a new purchase mortgage.

This also applies to the housing market climate overall. If mortgage rates are trending lower, there may be more buyers and higher asking prices.

But if mortgage rates are trending up, buyers could be few and far between. And it makes a new home loan less attractive to the seller as well.

Either way, this inflection point seems to have hovered between 4-5% over the past year, which seems to somewhat track the movement of the 30-year fixed mortgage during that time.

Zillow cited another study, which found that for every 1% increase in the difference between a homeowner’s mortgage rate and current market rates, moving rates fall by 9%.

So if we want the existing supply of homes to move again, mortgage rates need to come down.

Per Zillow’s survey, roughly 90% of existing mortgage holders have a mortgage rate below 6.00%, around 80% have a rate below 5.00%, and nearly a third a rate below 3.00%.

Read more: The National Average Mortgage Rate Lock-In Effect Is Worth $55,000