In India, Fixed Deposits or any kind of Investment Scheme where an investor gets fixed rate of interest become an instant hit. Small time investors get attracted to high interest rates offered by the Companies/Entities and invest their hard-earned money in Deposits Schemes (Collective Investment Schemes).

In recent years, investors have started taking a hard look at Corporate Fixed Deposit Schemes (also known as Company FDs) and Collective Investment Schemes, as an alternate to traditional Bank deposits or Post Office Saving Schemes.

What are these Corporate Deposits? – The deposits placed by investors with companies for a fixed term carrying a prescribed rate of interest is called Company Fixed Deposit. Financial institutions and Non-Banking Finance Companies (NBFCs) accept such deposits.

What are Collective Investment Schemes – CIS as its name suggests, is an investment scheme wherein several individuals come together to pool their money for investing in a particular asset(s) and for sharing the returns arising from that investment as per the agreement reached between them prior to pooling in the money.

There is no doubt that these Deposit schemes offer higher interest rates when compared to Bank Fixed posits or Post office Saving Schemes. But, these do come with certain risks.

India has a long history of scamsters, Multi-level Marketing (MLMs), Chit Fund or Ponzi Scheme operators making away with investor money, after disguising their scams as ‘deposit schemes’ promising high and assured returns. Some of these Deposit Schemes offered by the Corporates are genuine and whereas some entities or individuals collect monies from the public without getting the necessary approvals from the Regulators. And, some of the entities collect the deposits but do not pay the interest amount as per the schedule to the depositors.

So, what precautions should be taken by the investors when someone offers a Scheme that offer high rates of interest / return?

Corporate Fixed Deposits & Investment Schemes – What precautions should you take as an Investor?

Before you commit your hard-earned money to any entity wooing you with assured returns, do take these precautions and save yourself from being scammed.

Who can collect the Deposits from the Public :

Before investing in any scheme/ financial products, you must ensure that the entity offering such returns is registered with one of the financial sector regulators and is authorized to accept public deposit, whether in the form of deposits or otherwise.

| Sr. No. | Entity Category | Regulator |

| 1 | Commercial and Cooperative Banks | Reserve Bank of India (RBI) |

| 2 | Non-Banking Finance Companies (NBFCs) | Reserve Bank of India (RBI) |

| 3 | Housing Finance Companies (HFCs) | National Housing Bank (NHB) |

| 4 | Other Companies | Ministry of Corporate Affairs (MCA) |

| 5 | Cooperative Credit Societies | Registrar of Cooperative Societies (RCS) |

| 6 | Multi State Cooperative Societies | Central Registrar of Cooperative Societies |

The Public Deposit Schemes are primarily offered by NBFCs (Non-Banking Finance Companies) and Housing Finance Companies (HFCs) like ;

- NBFCs

- Bajaj Finance

- Fullerton India

- Mahindra & Mahindra Financial Services

- Muthoot Capital Services

- Shriram City Union

- Shriram Transport Finance

- Sundaram Finance

- Tamilnadu Power Finance & Infra Development Cor. etc.,

- HFCs

- DHFL

- HUDCO

- HDFC

- LIC HFL

- PNB Housing Finance etc.,

Check if the Entity can collect the Deposits from the Public :

Only the above mentioned entities can offer deposit schemes. It is not legally permissible for other entities to accept public deposits.

Kindly note that Chit Fund Entities cannot collect Public Deposits. Also, Proprietorship and partnership concerns are un-incorporated bodies. Hence, they are also prohibited under Section 45S of the RBI Act, 1934 from accepting public deposits or running any collective investment scheme.

If you are planning to invest in a corporate fixed deposit scheme or any collective investment scheme, you can check if such entity has been allowed to run such a scheme or not.

- Visit ‘Sachet’ portal maintained by the RBI.

- Go to the ‘Registered Entities’ section of the portal

- You can check if the entity (under respective regulators’ link) has been given the necessary approval to collect deposits from the public (or) if they are disallowed to run such schemes.

Is the offered Rate of Interest very high?

You need to be generally careful if the interest rates or rates of return on investments offered are very high. Typically, such entities will either indulge in high risk business (to generate higher returns) or they have fraudulent intention from the beginning. Do note that the likelihood of losing money is high in schemes that offer very high rates of interest / return.

Presently, the maximum rate of interest an NBFC can offer is 12.5%. The NBFCs are allowed to accept/renew public deposits for a minimum period of 12 months and maximum period of 60 months. They cannot accept deposits repayable on demand.

The depositor must insist on a proper receipt for every amount of deposit placed with the company. The receipt should be duly signed by an officer authorized by the company and should state the date of the deposit, the name of the depositor, the amount in words and figures, rate of interest payable, maturity date and amount.

Don’t go by the Effective Yield Rates

As we all know, the ‘Rate of interest’ is the main selling point of these schemes. So, I have observed that these schemes generally highlight the Effective Annualized Yields. Let’s understand the difference between nominal interest rate and effective yield.

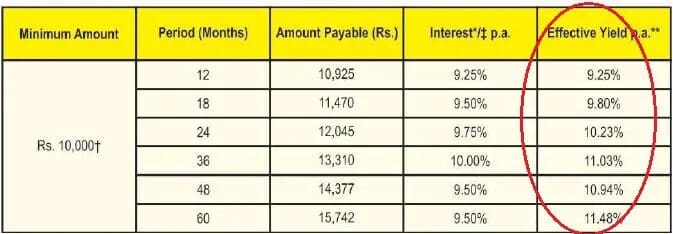

- Example: Let’s assume that above are the interest rates offered by a FD scheme (Cumulative). They display Effective yields on deposits. If you observe the effective yield rates are higher than the interest rates. Lets us understand this concept.

- As per this scheme, a Deposit of Rs 10k becomes Rs 15,742 after 60 months (5 years). It’s s a gain of Rs 5,742 (Rs 15,752 -Rs 10,000). One year gain is Rs 1148 (5742/5). In percentage term it is 11.48%, which is shown as EFFECTIVE YIELD.

- Always compare two Company FD or Investment schemes in terms of nominal interest rates. Do not go by effective yields. Also, these yields are not tax adjusted.

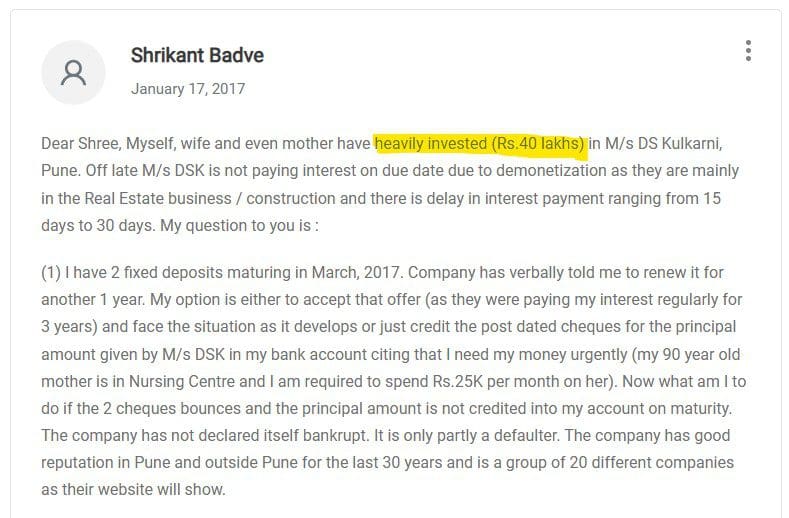

Avoid investing huge lump sum amount in one Scheme alone!

It is advisable to invest in couple of good schemes offered by two different entities, instead of investing the entire corpus in one scheme alone.

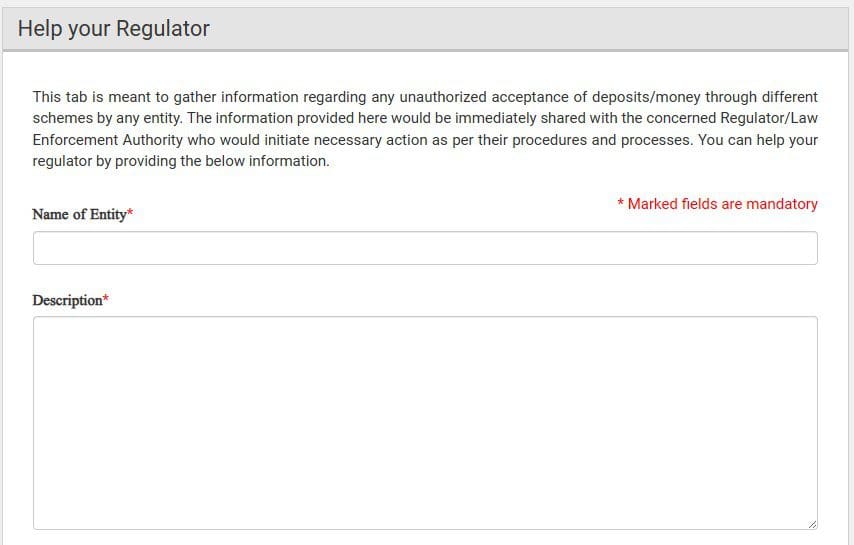

Help your Regulator :

In case you have noticed any suspicious activity such as unauthorized acceptance of deposits/money under different schemes, the same can be brought to the notice of the regulators by clicking on the “Help your Regulator” tab. You could also attach documents/pictures to support your information.

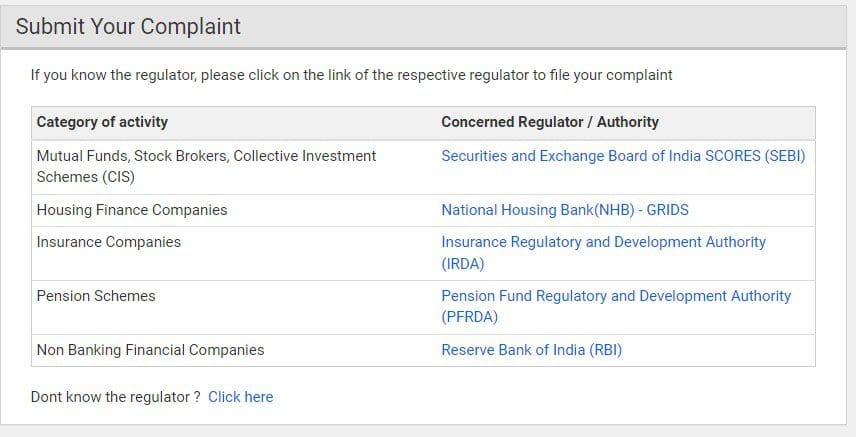

How to file & track your complaint against an illegal entity?

You can file and track a complaint on this website about any entity which has illegally accepted money from you and/or defaulted in repayment of deposits or interest amount.

- Visit RBI’s Sachet portal

- Click on ‘File a Complaint‘ link.

- If you know the regulator, please click on the link of the respective regulator to file your complaint

- Even if you don’t know the regulator, you can submit your complaint by clicking on ‘don’t know the regulator? click here’ link. The complaint(s) submitted on this website would be immediately forwarded to the concerned Regulator/Law Enforcement Authority who would take necessary action as per their procedures and processes. You can track your complaint based on Complaint number / Mobile number or your Email-Id.

A word of advice : Do not invest in a company FD scheme which offers unusually high rates of interest. Avoid FD schemes offered by companies which you are not aware of. Do not invest in FD schemes which do not have credit ratings. Kindly avoid investing lump sum amount in one scheme. Please remember, Return of capital and return on capital, both are equally important. It’s your hard-earned money!

The depositor must bear in mind that public deposits are unsecured and Deposit Insurance facility is not available to depositors of NBFCs or any Collective investment schemes.

Continue reading :

(If you have any questions on your personal financial matters, you can post them in our Forum section. We are more than happy to answer and help you in making informed investment decisions.)

(Post first published on : 02-Aug-2023)