I started investing in a Roth ten years ago, thinking it was earning me more money. It wasn’t. I should have done the math.

By investing in a Roth 401k instead of a Traditional 401k, I lost over $375,000.

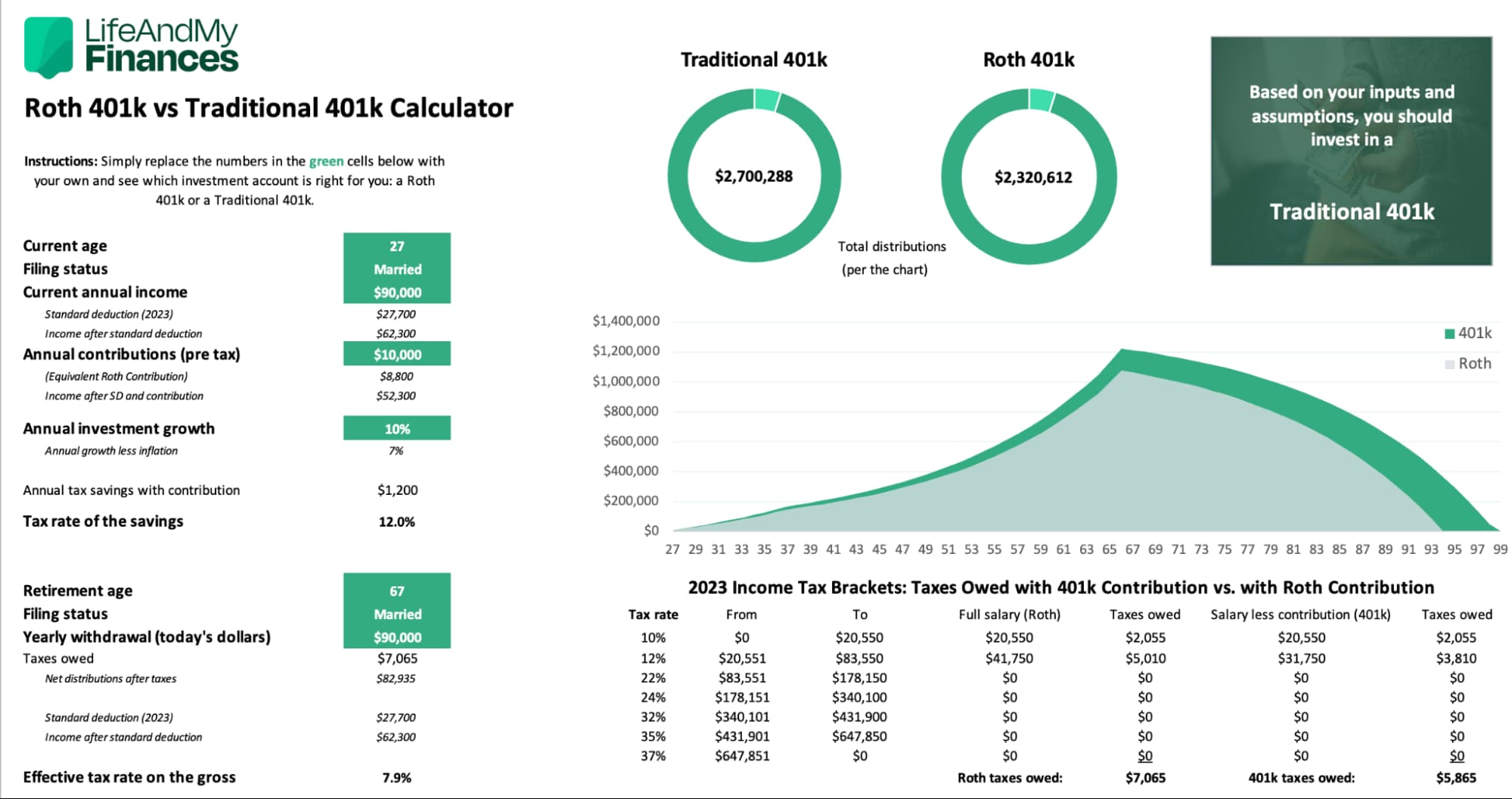

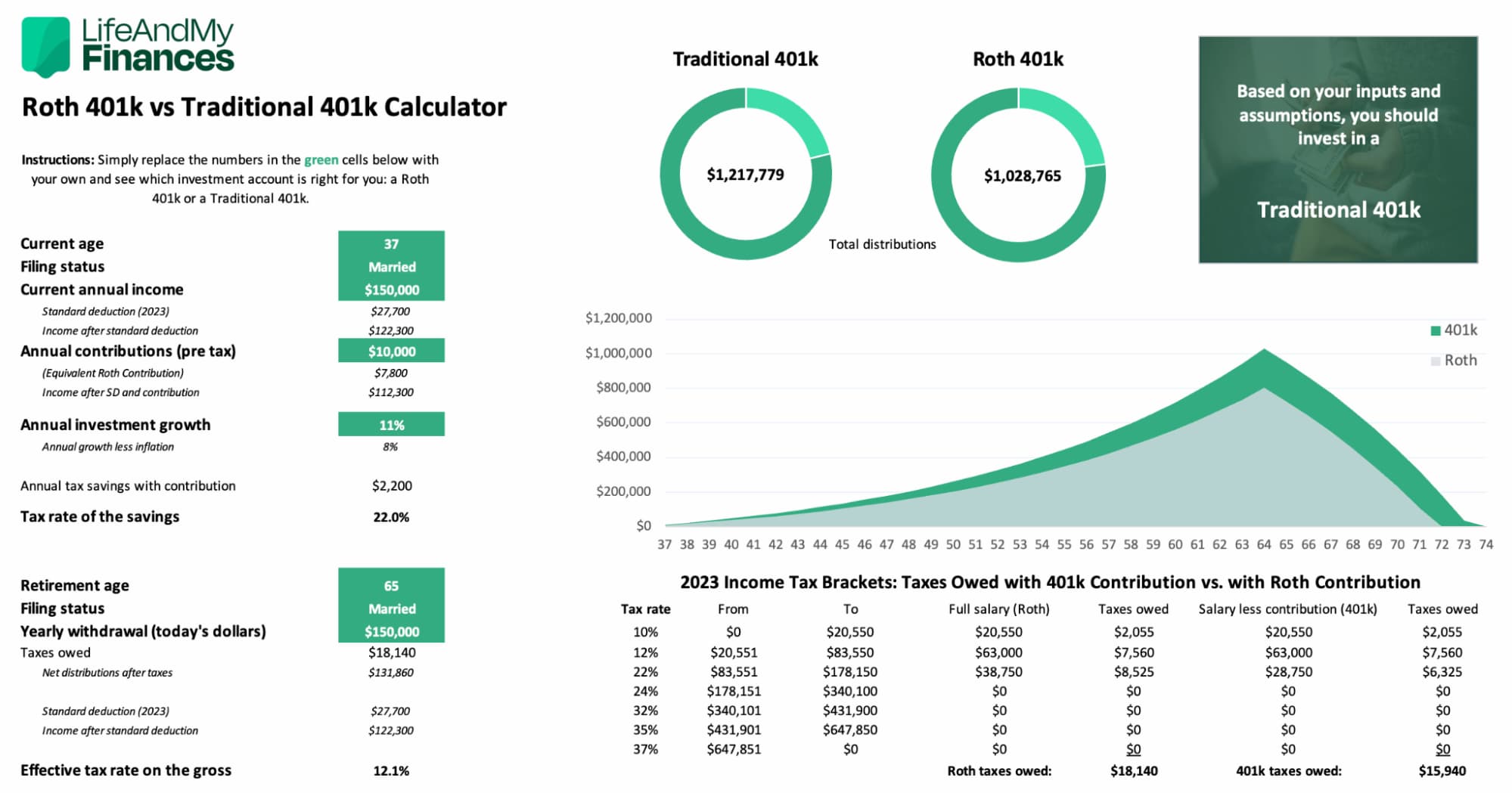

I mean, look at the stats below—they don’t lie. (Sneak peek of our free Roth 401k calculator here. And if you want to include more income sources, estimate retirement taxes and standard deductions, check out our full Roth 401k calculator on Etsy.)

Am I the only one that didn’t know this? Is everyone more in tune with these retirement accounts than me?

I was so curious that I set up a Roth 401k Retirement Survey. In the end, I gathered ages, incomes, retirement contributions, and withdrawal plans from 635 individuals. The results were fascinating.

Perceptions vs. Reality—The Results of the Roth 401k Retirement Survey

Out of 635 people, 583 said they thought they should invest in a Roth 401k. That’s 92% of the respondents.

Were they right? No. Actually, they were horrifyingly wrong.

Based on their age, income, contributions, and the amount they expect to withdraw in retirement, we found that only 9% of the respondents should actually invest in a Roth 401k—that’s just 60 people out of 635.

The facts and figures of the 9%

What were the stats of those that should actually put money away into a Roth 401k?

- Average age = 33.6 years old

- Average income = $59,000/year

- Expected annual retirement withdrawal = $225,000

These figures align perfectly to my newfound understanding of the Roth. If you’re young, early in your career, and you plan to withdraw far more in retirement than you earn today, then a Roth is for you.

What Is a Roth 401k vs a 401k?

Roth 401k

A Roth 401k is an employer-sponsored retirement savings account funded with after-tax dollars.

The process:

- Your salary is calculated.

- You’re taxed on your earnings.

- And then (after your taxes are withdrawn), your desired contribution is put into your retirement savings account.

When you retire and decide to withdraw money, you won’t owe taxes on the withdrawals. You already paid them before you invested in the Roth 401k.

Traditional 401k

The Traditional 401k is a pre-tax retirement account. It’s also known as a tax-deferred account (since you defer paying taxes on your income until later).

The process:

- Your salary is calculated.

- Your contribution is made to your Traditional 401k and deducted from your taxable earnings.

- You then pay taxes on your adjusted income (after your 401k contribution).

When you retire and remove funds from your Traditional 401k, you’ll pay income tax on the money you pull out each year.

A tangible example of the Roth vs a Traditional 401k

- Salary: $150,000

- Annual contribution: $10,000

- Tax bracket: 22%

If you invest in a Traditional 401k, your $10,000 goes into your retirement fund tax-free.

Your taxable salary becomes $140,000, which means you save $2,200 on your federal taxes.

So the net cost of your contribution wasn’t $10,000—it was only $7,800.

If you invest in a Roth 401k and you make $150,000, you’ll get taxed on your total earnings, and then (after the tax payment) your $10,000 contribution goes into the fund.

You don’t save $2,200 on your taxes—but you won’t need to pay any tax in your retirement when you pull the money out.

The Basics of the Roth vs the Traditional 401k

Before we dive into the calculator (so that you can choose which method is best for you), there are some basics you need to understand between the pre-tax retirement fund and the post-tax Roth—

1. If you contribute the same amount to a Roth and Traditional 401k, the Roth will net you more in retirement.

(I’m not contradicting my intro statement here. Keep reading to the end of the post. You’re in for a shocker.)

Why does the Roth 401k net you more money in retirement?

It’s simple. You’re contributing more out-of-pocket dollars by investing the same amount into a Roth (since you’re using after-tax dollars).

Remember the example above? A $10,000 contribution into a 401k saves you $2,200 in taxes, so you’re effectively only paying $7,800.

By investing in a Roth, you’re essentially paying $2,200 in taxes and still investing $10,000 into the Roth.

Sure, it’ll net you more in retirement, but only because you’re shelling out an additional $2,200 to do it!

2. If the tax rates are the same now vs. in retirement, the Roth and Traditional 401k yield the same results.

In other words, if you save 12% in taxes by putting money into a Traditional 401k today (and then you owe 12% on your withdrawal in retirement) there’s no benefit to putting your money into a Roth 401k. The amount nets out to the same with either retirement fund.

But, the real question is—

Will you really be paying the same tax percent in retirement?

Heads up—don’t miss this. More to come after we walk you through how to use the retirement calculator.

What Our Roth 401k vs Traditional 401k Calculator Will Do for You

The above example tells you the basic difference between a 401k and a Roth 401k—one is taxed immediately, and the other is taxed later in life. But which one should you do?

Which type of 401k should you invest in, given your scenario?

I honestly wouldn’t have been able to give you a definitive answer a few weeks ago.

But since tackling the topic and creating the Roth vs Traditional 401k calculator below, not only can I tell you what you should do—I’m giving you the tools (and the power) to figure out what method of investing is right for you.

First, download the Roth vs Traditional IRA calculator. Then follow the step-by-step instructions below.

Put in your numbers, give some thought to the output—and make an informed decision on your exact scenario in minutes.

No more generic guidance from investment firms that may or may not know what they’re talking about. Input your numbers, and get the answer that’s right for you.

(Remember, if you want to include more income sources, estimate retirement taxes and standard deductions, we have a much more expansive Roth 401k calculator on Etsy.)

How This Roth Vs Pre-Tax Calculator Works

What exactly does this tool do?

Once you put in your current data and your retirement info, the tool will do the following—

- Reduce your income with the standard deduction.

- Automatically calculate your estimated federal taxes.

- Calculate the deferred tax amount if you contribute to a Traditional 401k.

- Calculate your Roth investment (contribution amount minus the taxes you’d have saved if you put into a Traditional 401k).

- Run your complete investment picture for the pre-tax 401k and Roth contributions.

- Finally, go through the tool’s recommendation on where you should put your money based on the total retirement distributions for each option.

How Most Roth 401k Calculators Work—And Why They’re Misleading

Most Roth 401k calculators assume two things:

- That you’ll contribute the same dollar amount into a Roth as you would a Traditional 401k.

- That you’ll pay the exact same tax percent in retirement as you do today.

Both assumptions are horrible—and they often make the Roth look like the best option by far.

But’s it’s probably not.

Instead of trusting those calculators, use ours and see what it tells you. I believe it’s a far better representation of the Roth 401k vs. the Traditional 401k.

How to Use the Roth 401k Calculator—Step-By-Step Instructions

If you haven’t already, be sure to download the Roth 401k excel tool so you can follow along with these steps:

- Enter your current age, filing status (married or single, for example), and total gross income.

- Enter the annual amount you’d contribute into a Traditional 401k and the average growth you’re expecting on your investments, less inflation. (I typically use an assumed 10% growth rate on my S&P 500 index funds—7% after inflation.)

- Enter your desired retirement age, your assumed filing status, and the annual income you’d like in your retirement. (Don’t worry about inflation here. If you earn $150,000 today and you want to match that lifestyle in retirement, then put $150,000 into the retirement income box.)

Then simply review the results—

- “How much will my 401k be worth?” You’ll see the numbers for both the Traditional 401k and the Roth 401k.

- The tool will then clearly state which 401k option is likely best for your scenario.

Should I Do a Roth or Traditional 401k? A Full Example Walk-Through

We can talk all day about the tool and what it does, but I find it’s always best to walk through a real-life example.

And who better to use as an example than myself? (To be honest, I just think this tool is better than anything else out there, and I desperately want to try it out for myself.)

So bear with me as I selfishly input all my numbers.

- Age: 37

- Filing status: Married

- Annual income: $150,000 (this is a lie—but it’s close, and makes for a great example)

- Annual contributions (pre-tax): $10,000

- Estimated annual growth: 11%

- Retirement age: 65

- Filing status (at retirement): Married

- Estimated annual withdrawal: $150,000 (for the same lifestyle as we live today)

And here are the results—

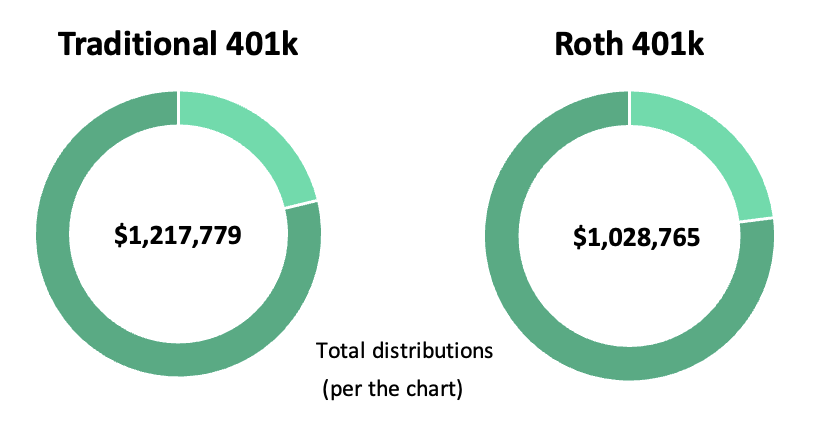

As you can see in the charts, an investment into a Traditional 401k would earn more money in distributions (and therefore last longer in retirement)—so that’s where I should put my money.

If all the tax tables stay the same, I’d have distributions of $1.2 million with a Traditional IRA and only $1 million with a Roth IRA—a $200,000 difference. And this is on top of the $379,000 I figure I lost by investing in the Roth from my mid-twenties until now.

What The Results Tell You

When you put in all your numbers, the tool shows you what all your investments will net after taxes, and how much you’ll earn in total with the Traditional 401k and the Roth 401k methods.

The method that results in a higher number is the one you should likely go for at this stage in your life. It’ll last longer in retirement.

Look at my results above.

If I invest $10,000 a year into the pre-tax 401k fund vs. the $7,800 in the Roth, of course my investment grows to a larger amount before I take distributions at retirement. But it also lasts longer in retirement. It earns me roughly $200,000 more than if I had invested in the Roth 401k.

But why? Shouldn’t it be equal?

Didn’t I say that the total net distribution should be the same if the retirement tax rates were the same?

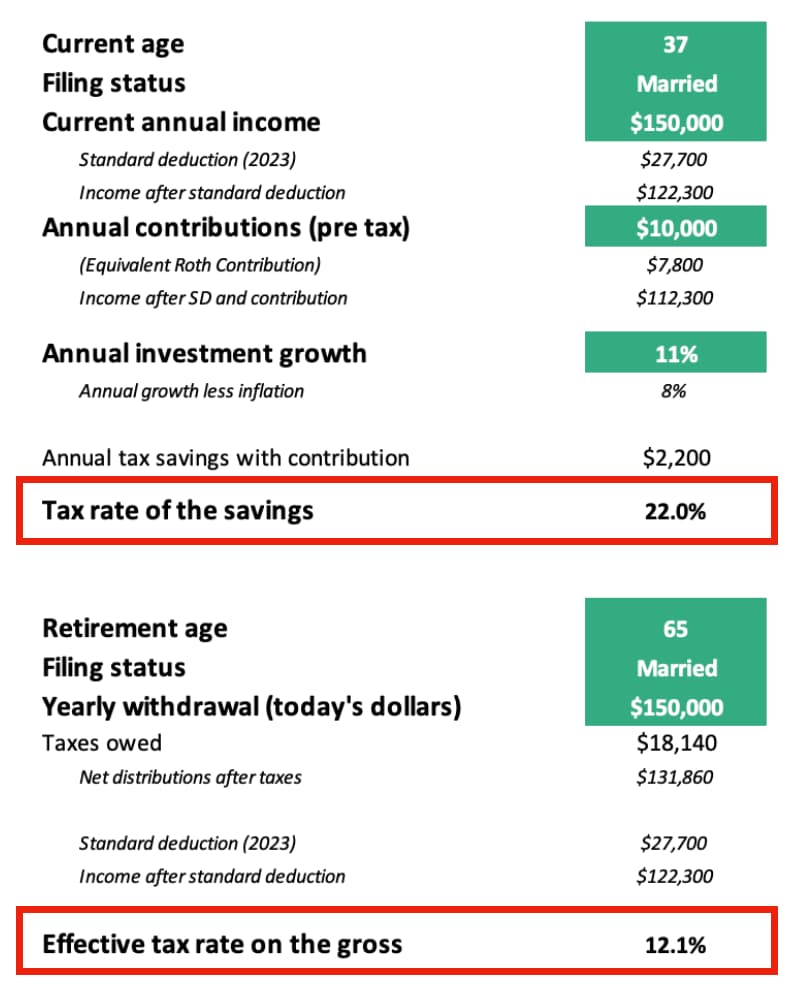

I sure did. But here’s the thing—the tax rates aren’t the same.

Look at the screenshot of the Excel tool. What is the effective tax rate on the withdrawals? (Again, this is the overall average you pay in taxes on the withdrawals).

Even though the withdrawal amount is the same as my current income, the tax rates are different.

- When I put the $10,000 into the 401k, I was in the 22% tax bracket—so I saved 22% on taxes that year.

- When I withdraw the funds at $150,000 annually in retirement, my effective tax rate would be only 12.1%. This is why—in my scenario—it’s best to defer the tax payment until later in life.

(Still doesn’t make sense? Don’t worry. We’ll hit this again later in more detail so you can better understand what your numbers tell you.)

But first, let’s walk through what the “experts” tell you (and why it usually leads you to choose the wrong investment method).

Why Everyone Says a Roth 401k Is a Good Idea—And Why They’re All Myths

What are the benefits of the Roth 401k, according to the experts?

Here’s what they say (and what I mostly don’t believe in):

- If you put the same amount into your Roth as the Traditional 401k, the Roth will be worth more in retirement since it’s not taxed.

- Tax rates will probably go up, so it makes sense to pay taxes now.

- If you’re young, you’ll get decades of tax-free growth, so it makes sense for young people to invest in a Roth.

- If you earn very little now, and are in a low tax bracket, you should invest in a Roth 401k because your withdrawals will probably be at a higher tax rate in retirement.

With all due respect to the financial advisors and investment professionals, I say most of these “benefits” are total crap.

I know that’s a pretty bold statement—but the more I dig into this, the more angry I get about putting all my investments into a Roth 401k for the last ten years of my life.

Don’t make the same mistake as me. Run your numbers through our simple 401k calculator just to be sure—but more than likely, you shouldn’t invest in the Roth either.

Here are all the reasons why. It’s time to dispel the myths—

Myth #1: The Roth will be worth more since it’s not taxed

Okay, this isn’t necessarily a myth as such, but it’s just a dumb statement.

It’s like saying, “If you put more money into your 401k now, it’ll net you more in the future.” Of course, it will. You paid more into it, so it should be worth more.

When you put $10,000 into a Roth 401k vs. $10,000 into a Traditional 401k, you’re paying more because you’re not getting any tax savings on that contribution—so yes, it’ll be worth more.

Myth #2: Tax rates will probably go up, so you should invest in a Roth 401k today

This seems to make logical sense. But when you dig into it and really try to understand what will happen in your retirement, this statement doesn’t hold true for most people.

There are three major reasons why:

1. No one knows what the tax rates will be decades from now.

If you asked an expert thirty years ago what they thought tax rates would be today, they probably would have said 50%. That obviously didn’t happen.

In the same light, we shouldn’t just automatically assume they’ll go up thirty years from today.

2. It’s not about the tax bracket in retirement—it’s about the effective tax rate.

To help explain the above, let me first ask you this question:

How much money will you earn in retirement if you don’t count your retirement fund withdrawals?

In other words, what other sources of income will you have?

Maybe you’ll have some Social Security income (but we all know that system is broken and could implode at any moment). And aside from that, what’s there? For most, there isn’t any.

When you’re young and put money into a Traditional 401k, you’re removing funds from a high tax bracket and saving a lot of money by doing so.

Then—when you pull funds for retirement—you’re initially paying income tax at the low end of the tax bracket. First from the 10% bracket, then the 12% bracket. And then perhaps the 22% bracket if you’re living large.

Even if you start paying taxes in the 22% bracket or higher, your effective tax rate is still in the 12%–15% range (which is likely lower than the percentage you could have saved by investing in the Traditional 401k).

Let’s nail this point home. Look at my example calculation again:

I was making $150,000 when I put money into the 401k. I plan to pull that same amount in retirement.

The effective tax rate in both cases is the same—but by putting money into the Traditional 401k in my younger years, I’m saving taxes on the upper tax bracket (not off the effective tax rate).

So when I’m putting money in, I save 22%. Then when I take it out, I’m only paying a tax rate of 12.1%.

3. With the above example, the tax rates would need to go up a lot for the Roth 401k to make sense.

Remember the results of my inputs? I’d earn distributions of $1.2M with the regular 401k and $1 million with the Roth 401k.

What if each tax bracket went up by 20% in retirement (so the 10% bracket moves up to 12%)?

I’d still earn $150,000 more with a Traditional 401k.

What if each tax bracket went up by 50% in retirement (the 10% bracket moves up to 15%)?

I’d still earn almost $100,000 more with a Traditional 401k.

What’s the tipping point? How much would taxes need to increase for the Roth to make sense in this scenario?

For this example, each tax bracket would need to go up by 83% for the Roth 401k to net out to more money in retirement.

Yikes.

Why was I investing in a Roth?

I have no idea. Now I’m just angry.

Myth #3: If you’re young, you’ll get decades of tax-free growth

It makes absolutely no difference if you’re young or old.

If you pay into your 401k at 12% and withdraw your money at an effective tax rate of 12%, the net after-tax earnings on your money are the same—regardless of whether you choose a Roth 401k or a 401k.

What might be true is that because of those decades of growth, you could develop a massive pile of money, which means you could withdraw far more than you’re used to living on today (which may mean a higher effective tax rate in retirement). This is unlikely for most, though.

What might also hold true is if you’re young and earning barely anything (and thus at a super-low tax rate), it would make sense to invest in a Roth because the tax rate on your contributions will be less than your tax rate in retirement.

This leads us to our final myth—

Myth #4: If you’re in a low tax bracket, you should invest in a Roth 401k

This could be true, but only if your contributions equate to big dollars in retirement.

Let’s say you’re in the 12% tax bracket now, and you can only contribute $3,000 a year. It only amounts to roughly $300,000 by the time you retire.

Since you don’t have loads of cash in retirement, it wouldn’t make sense to withdraw hundreds of thousands of dollars each year, so you’d never have an effective tax rate of 12.1% or more.

At most—to help your money last in retirement—you should withdraw $40,000 annually, which means you’d pay an effective tax rate of just 3.1% (which is far below the tax you would have paid if you contributed into a Roth).

If you’re in a low tax bracket and can invest heavily to produce millions of dollars in retirement, then investing in a Roth would likely make sense.

But again, this scenario isn’t likely for most people. If they don’t earn much, chances are they can’t contribute much to retirement.

When Should You Invest in a Roth 401k? A Real Example

The deck is pretty stacked against the Roth 401k right now. But to be fair, let’s find a scenario where investing in a Roth would be wise.

- Age: 30

- Filing status: Married

- Annual income: $100,000

- Annual contributions (pre-tax): $10,000

- Estimated annual growth: 10%

- Retirement age: 70

- Filing status (at retirement): Married

- Estimated annual withdrawal: $200,000

Bob and Betty would start saving at age 30 and invest in their Roth 401k until age 70. It would be worth roughly $2 million at retirement—so withdrawals of $200,000 would be feasible.

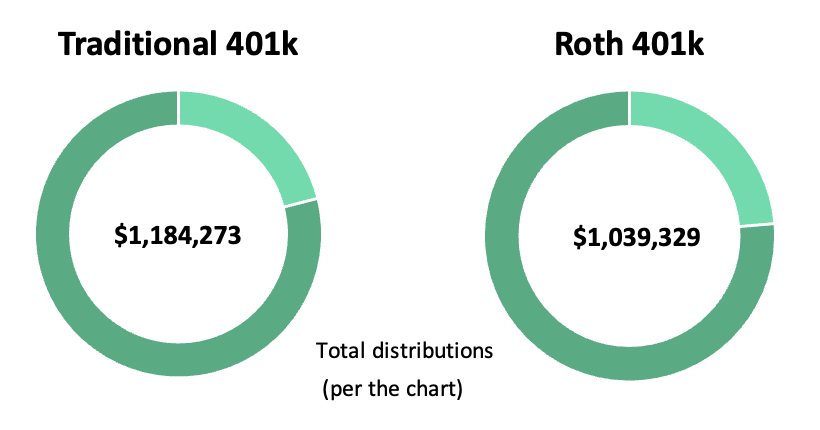

Which retirement method would earn them more? The Roth 401k or the Traditional 401k?

The Roth would be the best option in this scenario—by roughly $200,000.

With the higher effective tax rate in retirement (14.6% vs. the 12% they would have saved in their younger years), it makes sense to pay taxes early and then owe zero taxes in retirement.

When Is the Roth 401k Better Than a 401k?

A Roth 401k is better when your average tax rate in retirement is higher than the tax bracket you’re in today.

The Roth is best for those that plan to withdraw far more money in retirement than they earn currently, which is an unlikely scenario for most people.

For most people that earn more with a Roth 401k, it’s because they’re shelling out more out-of-pocket dollars when they’re funding it.

Why 91% of People Shouldn’t Invest In a Roth 401k

Our survey found that 9% of people should invest in a Roth 401k. Simple math tells us then that 91% of people shouldn’t put their money into a Roth.

Yikes.

The Roth works best if you have a low salary, invest heavily into it, and withdraw large sums of money in retirement.

How much of the world did I just describe?

Barely anyone.

According to the American Savings Statistics of 2023:

- 57.4% of people have less than $1,000 in their savings accounts.

- Roughly 63% of Americans have less than $50,000 in their retirement accounts.

- And those 35 and under have an average of only $30,000 in their retirement savings.

We’re not exactly describing the optimal situation for the Roth 401k, are we?

If you’re earning average (or above-average) money, it’s best to take the tax break today and invest in the Traditional 401k.

Still not convinced? Take it from Lawrence Delva-Gonzalez, a US Department of Treasury Auditor, and blogger/podcaster at The Neighborhood Finance Guy:

Most people think they’re going to save money with a Roth. You know, pay taxes now so you can save on them later. But the reality is they’re earning more money now than they ever will in retirement. Unless you’re young, earning very little, and contributing a big chunk of money into a Roth every year, it’s likely not worth it for you.

How Much To Contribute to a 401k and Roth IRA

Some people like to do a split—contribute some money to a Traditional 401k and some to the Roth 401k. Does this ever make sense?

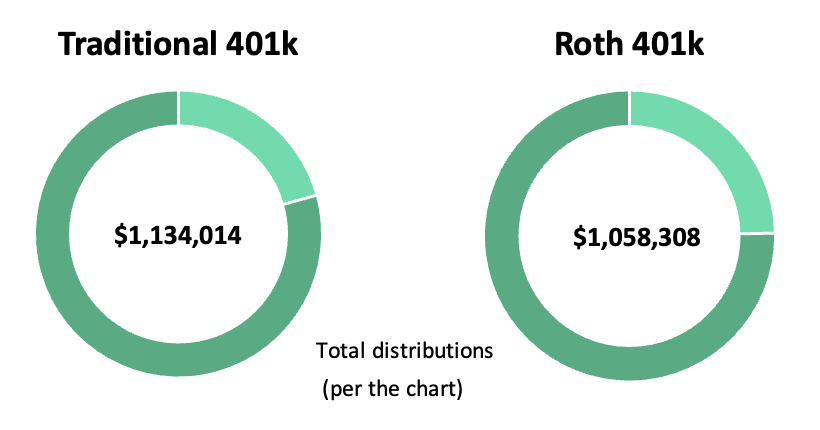

Absolutely. Let’s say you intend to withdraw $200,000 a year in retirement.

So—as the Roth 401k tool would tell us—your effective tax rate in retirement would be 14.6% (based on today’s tax numbers).

Then let’s also say your current gross earnings are $116,250. After your standard tax deduction of $27,700, your adjusted gross income is $88,550.

At that income, you’re still in the 22% tax bracket—but only by $5,000.

Since your retirement tax rate is 14.6%, it would make sense to invest the $5,000 into a Traditional 401k to reduce your taxable income and shield yourself from the 22% tax.

It wouldn’t make sense to invest any more into the Traditional 401k since you’d only save yourself 12% on the rest of your contribution.

Instead, it would be better to save the 14.6% in retirement, and pay the 12% tax now. So you’d direct all other contributions to your Roth 401k.

What’s Best for You? Use the Roth vs Traditional 401k Calculator

So, which option is best for you?

Even though I’m led to believe that the Roth 401k is a garbage option for many, it still might be worth it for you and your scenario. You’ll simply have to put your numbers into the tool to find out.

Free Roth 401k calculator – Excel download

FAQ

What if I invest in a Roth 401k? Does the 401k company match go to my Roth?

No. The 401k company match can’t be made to the Roth 401k.

You won’t lose out on the match, though. It will be contributed to your Traditional 401k instead.

How much will my 401k be worth based on my contributions?

Everyone’s scenario is different. By using our 401k calculator, you’ll be able to see how much your Traditional 401k would be worth (as well as your Roth 401k if you choose to invest there).

What is the max employer contribution to a 401k?

The IRS.gov site says the maximum total contributions (for the employer and employee combined) is $66,000 (for 2023) or 100% of the employee’s compensation—whichever is less.

How much does a 401k contribution reduce taxes?

A traditional 401k contribution will reduce taxes by the percentage of the tax bracket you’re in.

If you make $150,000 a year, you’re in the 22% tax bracket—so each dollar you contribute to your pre-tax 401k, you’ll save $0.22 on your taxes.

(This is true until your contribution exceeds the income recorded into the current tax bracket. If your contribution is larger, then you’ll begin saving at the percentage of the lower tax bracket.)

How do you calculate a Roth IRA contribution?

If you want to know the equivalent contribution from a Traditional IRA to a Roth IRA, simply take your contribution, and subtract the tax savings.

In other words, if you’re in the 22% tax bracket and wish to invest $10,000 into a 401k, you’d save $2,200 in taxes that year. An equivalent Roth 401k contribution would be $7,800 (which is the $10,000 less the $2,200).

How do you figure out the 401k to Roth IRA tax rate?

If you want to move money from your 401k into a Roth IRA, you’d pay tax based on the tax bracket you’re in.

If you earn $150,000 a year, you’re in the 22% tax bracket—so you’d need to pay 22% to convert the funds. If the funds are large enough to push you into a higher tax bracket, you’d need to pay the higher tax percent on the additional funds in that tax bracket.

What is the Roth 401k 5-year rule?

To withdraw from your Roth 401k account, you must have contributed to the account for at least five years and be 59.5 years old.

Are there required minimum distributions (RMDs) on a Roth 401k?

Yes. Through 2023, there are required minimum distributions if you’re age 73 or more.

Starting in 2024, however, the Roth 401k accounts will no longer have to take RMDs.