In Budget 2023-24, Finance Minister Nirmala Sitharaman raised the tax-rebate limit under the new tax regime to Rs 7 lakh, from the earlier limit of Rs 5 lakh.

This tax rebate has been made applicable if an individual’s (Resident Individuals including Senior Citizens) taxable income is less than or equal to Rs 7 Lakhs.

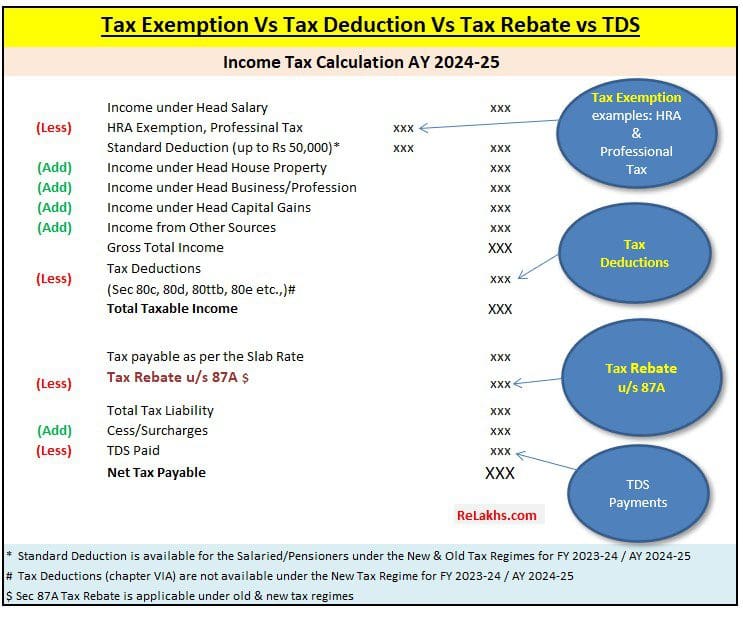

In this post, let us understand : What is Tax Rebate? What is the difference between Income Tax Rebate Vs Tax Exemption Vs Tax Deduction? What is the tax treatment and applicability of Section 87A Tax Rebate FY 2023-24 (AY 2024-25)? What is the eligibility criteria to claim Tax rebate of up to Rs 25,000 in AY 2024-25?

What is Tax Rebate?

Tax rebate is a refund on taxes when the liability on tax is less than the tax paid or liable to pay, by the individual is referred to as Income Tax Rebate.

Income Tax Rebate Vs Tax Exemption Vs Tax Deduction

Let us understand the difference between a tax rebate and tax exemption/deduction with the help of the below illustration.

- Income Tax Exemptions are allowed to be claimed from a specific source of income (ex : Salary) and not from the Gross Total Income. Ex : HRA

- Income Tax Deductions are allowed to be claimed under each Head and also from Gross Total Income. The taxpayer can claim deductions in case he/she incurs specified expenditure or make specified investments under various sections of the IT Act. Examples: Investments u/s 80c (or) Health Insurance premium u/s 80D.

- Whereas Income Tax Rebate is allowed to be claimed from the total tax payable (before availing the basic exemption limit). So, the tax exemptions and deductions are allowed to be claimed from the Income and Rebate is allowed from the tax payable. Sec 87A rebate threshold limit is based on the total taxable income.

Treatment & Applicability of Rebate under Section 87A for AY 2024-25

Now that you understand what exactly tax rebate is, let’s jump to our ‘main topic’ as to how much tax rebate you can claim under Section 87A for FY 2023-24.

- Firstly, note that Section 87A Tax rebate is available under both new and old tax regimes for Assessment Year 2024-25.

- Individuals having total taxable income of up to Rs 5 lakh are eligible for tax rebate under section 87A of up to Rs 12,500, thereby making zero tax payable in the Old and New Tax regimes.

- Individuals having taxable income of up to Rs 7 lakh are eligible for tax rebate under section 87A of up to Rs 25,000, thereby making zero tax payable in the New Tax regime only.

Eligibility & Rebate U/S 87A Limit for FY 2023-24

The threshold limit us/ 87A is Rs 12,500 or Rs 25,000 depending on the type of tax regime you opt for.

- Only Individual Assesses earning net taxable income up to Rs 5 lakhs are eligible to enjoy tax rebate u/s 87A under both new and old tax structures.

- Indiiduals earning net taxable income of up to Rs 7 lakh are eligible to claim tax rebate u/s 87A but under new tax regime only.

- The Tax Assessee is first required to add all incomes i.e. salary, house income, capital gains, business or profession income and income from other sources and then deduct the eligible tax deduction amounts u/s 80C to 80U and under section 24(b) (Home Loan Interest) to come up with the net taxable income. (If you opt for new tax regime then you can not claim income tax deductions u/s 80c, 80d etc.,)

- The amount of tax rebate u/s 87A is restricted to the maximum of Rs 12,500 or Rs 25,000. In case the computed tax payable is less than Rs 12,500, say Rs 10,000 the tax rebate shall be limited to that lower amount i.e., Rs 10,000 only.

FAQs on Rebate under Section 87A AY 2024-25

- Can NRIs claim rebate under section 87A? – No, this tax rebate is only allowed for Resident Indians. Therefore, taxpayers qualifying as Non-Resident Indians are not eligible for a rebate under 87A.

- Can this rebate be claimed by a Firm or Company? – This rebate is only allowed to individuals. HUFs or firms or companies cannot claim this tax rebate.

- Are Cess & other charges (if any) need to be added before or after claiming this Tax Rebate? – Education Cess and SHEC are levied on the Tax payable after allowing for tax rebate of up to Rs 12,500 or Rs 25,000.

- Is income tax rebate u/s 87A available on Long Term Capital Gains (LTCG)? – Rebate u/s 87A is not available on sale or transfer of equity shares i.e. on Long Term Capital Gains from equity or others as specified under section 112A. It is available on all other capital gains.

- Is rebate u/s 87A available on agricultural income? – Yes, income tax rebate u/s 87A is available on taxable income which includes agricultural incomes as well.

- My Taxable income is less than Rs 5 Lakh, so my tax liability would be NIL. Do I still need to file my Income Tax Return for FY 2023-24 / AY 2024-25? – You can avail of the zero-tax benefit, but you still need to file your income tax return (ITR). The income tax exemption limit for all citizens below 60 years still remains at Rs 2.5 lakh. Therefore, if you are earning anything above these basic exemption limits annually then you are mandatorily required to file your ITR.

Continue reading :

(Post first published on : 04-Aug-2023)