Tax planning is an important part of a financial plan. Whether you are a salaried individual, a professional or a businessman, you can save taxes to certain extent through proper tax planning.

The Indian Income Tax act allows for certain Tax Deductions / Tax Exemptions which can be claimed to save tax. You can subtract tax deductions from your Gross Income and your taxable income gets reduced to that extent.

The Government of India introduced two types of tax regimes and left the right to choose between the old & new regimes to the individual taxpayers. The two regimes differ based on the income tax rate and the income tax slab.

From FY 2023-24, the NEW TAX REGIME is a default scheme and whoever not opting the old regime, will automatically be liable to comply with the New TAX regime. So, Govt would eventually like to move to a simple and exemption-free tax structure with lower rates.

While the new tax regime offers reduced rates for the taxpayers, it disallows certain tax deductions and exemptions. And the old tax regime has a higher rate for the individual income tax slab in comparison but offers tax deductions and exemptions for taxpayers who have invested in different financial instruments.

In this post, let’s understand – What are the income tax slab rates for FY 2023-24 under old and new tax regimes? What are the available income tax deductions list FY 2023-24 under old & new tax regimes? How to save income tax in Financial Year 2023-24 (Assessment Year 2024-25)?

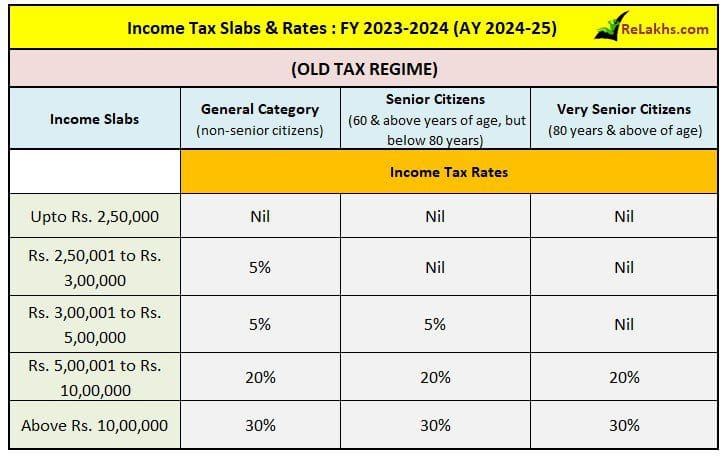

Latest Income Tax Slab Rates FY 2023-24 / AY 2024-25

If you wish to claim your IT deductions and exemptions then your income will be subject to tax as per the below income tax slab rates.

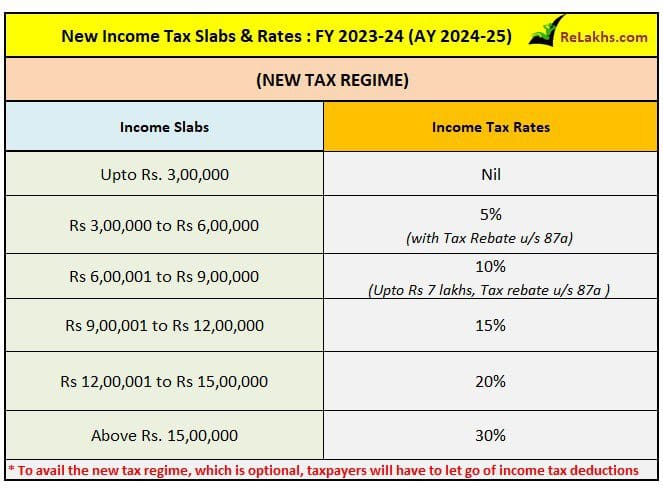

If you opt for new tax regime, the applicable income tax slabs and rates for FY 2023-24 are as below;

Income Tax Deductions List FY 2023-24 / AY 2024-25

Individuals opting to pay tax under the new proposed lower personal income tax regime will have to forgo almost all tax breaks that you have been claiming in the old tax structure.

Let’s first have a look at all the tax deductions and/or exemptions that are not available under the new tax regime for FY 2023-24;

- The most commonly claimed deductions under section 80C will go.

- Section 80C deductions claimed for provident fund contributions, life insurance premium, school tuition fee for children and various specified investments such as ELSS, NPS, PPF cannot be availed.

- House rent allowance

- Leave Travel Allowance

- Deduction available under section 80TTA (Deduction in respect of Interest on deposits in savings account) and 80TTB (Deduction in respect of Interest on deposits to senior citizens).

- Interest paid on housing loan taken (Section 24).

- Under the new tax regime, set-off & carry forward of loss under Income from House Property is not allowed. However, you can still use it to nullify rental income from a let-out property.

- The deduction claimed for medical insurance premium under section 80D will also not be claimable.

- Tax break on interest paid on education loan will not be claimable-section 80E.

- Tax break on donations to charitable institutions available under section 80G will not be available

So, all deductions under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc.) will not be claimable by those opting for the new tax regime.

Income Tax Deductions & Exemptions List for AY 2024-25 | Under Old & New Tax Regimes

Below are the important income tax deductions and exemptions that are available under both old and new tax regimes for AY 2024-25;

Standard Deduction of Rs 50,000

Earlier, the standard deduction under Section 16 was allowed only under the old tax regime only.

With effective from FY 2023-24, the benefit of the standard deduction has been extended to the new tax regime as well. A salaried employee can now avail of a standard deduction of Rs 50,000 from their taxable income under both the regimes. You don’t need to submit any investment or expense proof to avail of this.

Family pensioners opting for the new tax regime will be eligible to claim standard deduction of Rs 15,000. Family pension under Section 57 (IIA), up to 33.33% or Rs 15,000, whichever is less, is eligible. Under the income from other sources, family pension is taxable u/s 57(iia). However, a deduction of 1/3rd of the family pension up to Rs 15000 is allowed under the old tax regime; the same deduction is now available under the new tax regime as per Budget 2023.

The standard deduction benefit has replaced the medical reimbursement and travel allowances for the salaried individuals.

Section 80CCD (2)

Investing in NPS Tier I offers three tax deductions:

- Deduction of up to Rs 1.5 lakh from taxable income under Section 80C.

- Additional deduction of up to Rs 50,000 under Section 80CCD (1B) of the Income Tax Act, exclusively available through NPS investment.

- The third deduction (Sec 80CCD-2, applies to the salaried only) is in the form of employer’s contribution of up to 10 per cent of salary (basic component + dearness allowance) to the NPS Tier I account. It is not considered taxable income, which reduces the tax burden. In the case of government employees, it’s 14 per cent instead of 10 per cent.

- Under the new tax regime, the first two deductions are not available, but the third one continues.

- Employer contribution on account of employee in notified pension schemes like EPF, NPS and/or Super Annuation Account can be claimed up to Rs 7.5 lakh limit.

Interest received on Post office Account

Under Section 10(15)(i) of the Income Tax Act, interest received from the post office savings account is exempt from tax for up to Rs 3,500 for individual accounts and Rs 7,000 in the case of joint accounts per financial year.

Gratuity & Other retiral benefits

Gratuity is tax-exempt up to Rs 20 lakh in a lifetime for non-government employees. For government employees, all gratuity received is tax-exempt, irrespective of the amount received by them.

Below benefits up to certain threshold limits (if any) are allowed under new tax regime as well;

- Commutation of pension

- retrenchment compensation

- VRS benefits

- NPS withdrawal benefits

- Education scholarships

- Payments of awards instituted in public interest

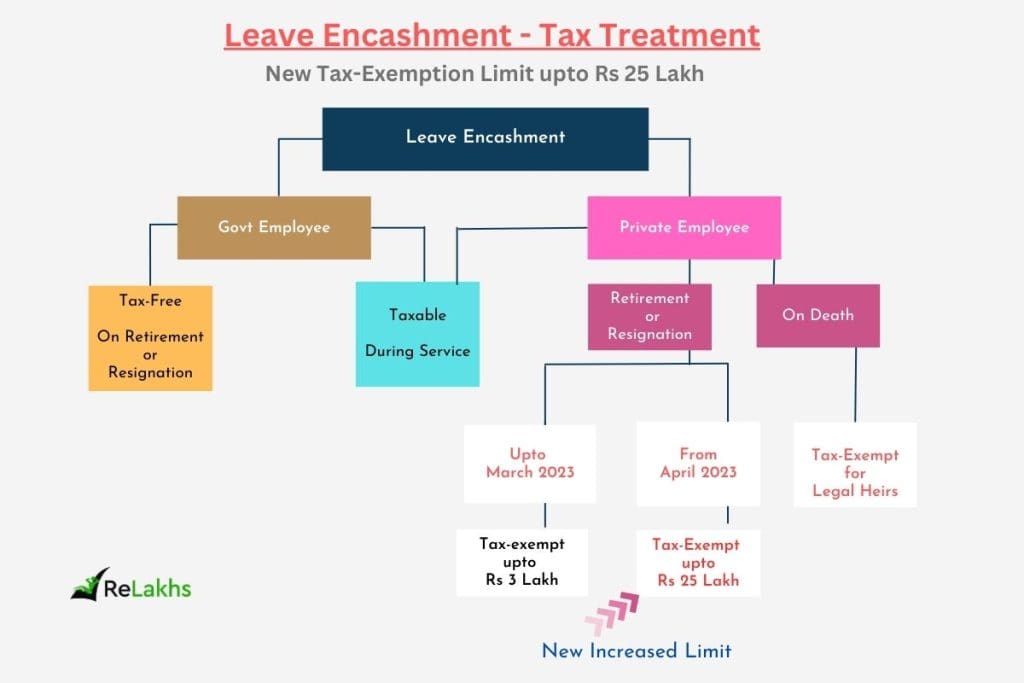

Revised Leave Encashment Benefit

Most of the companies allow you to encash the unused balance of leaves during your service or during resignation. You are also allowed to encash them on retirement. So, encashing the leave balance is known as ‘Leave Encashment’. (Leave encashment is a defined benefit scheme). Leave encashment rules fall under Section 10 (10AA)(ii) of the Income-tax Act.

Many organizations provide the facility of encashment of leave either;

- During the period of employment (or)

- At the time of retirement (including separation on account of resignation, retrenchment, VRS etc other than termination) of the employee (or)

- At the time of Termination of the employee.

Related comprehensive article : Latest Leave Encashment Taxation rules | Increased Tax Exemption Limit

Interest on EPF Account

Effective 1 April 2022, any interest on an employee’s contribution to EPF upto Rs 2.5 lakhs per year is tax-free and any interest earned on a contribution over and above INR 2.5 lakhs is taxable in the hands of the employees. However, when there is no employer contribution, as is the case for government employees, individuals can contribute up to Rs. 5 lakh without being taxed.

The Interest and maturity amount received on Sukanya Samriddhi account, PPF account are tax-free in both old and new tax regimes.

Conveyance Allowance

You can claim income tax exemption for conveyance, travel and other allowances given by your employers under both the regimes.

Section 87A revised Tax Rebate of upto Rs 25,000

The threshold limit us/ 87A is Rs 12,500 or Rs 25,000 depending on the type of tax regime you opt for.

- Only Individual Assesses earning net taxable income up to Rs 5 lakhs are eligible to enjoy tax rebate u/s 87A under both new and old tax structures.

- Individuals earning net taxable income of up to Rs 7 lakh are eligible to claim tax rebate u/s 87A but under new tax regime only.

- The Tax Assessee is first required to add all incomes i.e., salary, house income, capital gains, business or profession income and income from other sources and then deduct the eligible tax deduction amounts u/s 80C to 80U and under section 24(b) (Home Loan Interest) to come up with the net taxable income. (If you opt for new tax regime then you cannot claim income tax deductions u/s 80c, 80d etc.,)

- The amount of tax rebate u/s 87A is restricted to the maximum of Rs 12,500 or Rs 25,000. In case the computed tax payable is less than Rs 12,500, say Rs 10,000 the tax rebate shall be limited to that lower amount i.e., Rs 10,000 only.

Related article : Section 87A Tax Rebate FY 2023-24 | Is Sec 87A Tax Rebate Available under New & Old Tax Regimes?

Section 54

Hence, with effect from Assessment Year 2024-25, the Finance Act 2023 has restricted the maximum exemption to be allowed under Section 54. In case the cost of the new property (capital asset) exceeds Rs. 10 crore, the excess amount shall be ignored for computing the exemption under Section 54. Up to FY 2022-23, there was no tax exemption ceiling limit u/s 54.

Exemption under section 54 can be claimed in respect of capital gains arising on transfer of capital asset, being long-term residential house property. With effect from Assessment Year 2021-22, a taxpayer has an option to make investment in two residential house properties in India to claim section 54 exemption. This option can be exercised by the taxpayer only once in his lifetime provided the amount of long-term capital gain does not exceed Rs. 2 crores.

Related Article : Capital Gains Tax Exemption Options on Sale of House or Plot | Latest Rules

Income Tax Benefits available under Old Tax Regime for FY 2023-24 / AY 2024-25

Below are the income tax deductions that are available under the old tax regime only;

Section 80c

The maximum tax exemption limit under Section 80C is Rs 1.5 Lakh for FY 2023-24. The various best tax saving and investment options that can be claimed as tax deductions under section 80c are as below;

- PPF (Public Provident Fund)

- EPF (Employees’ Provident Fund)

- Five year Bank or Post office Tax saving Deposits

- NSC (National Savings Certificates)

- ELSS Mutual Funds (Equity Linked Saving Schemes)

- Kid’s Tuition Fees

- SCSS (Post office Senior Citizen Savings Scheme)

- Principal repayment of Home Loan

- NPS (National Pension System) Income Tax benefits are currently available on Tier-1 deposits only. The contributions by the central government employees (only) under Tier-II of NPS will also be covered under Section 80C for deduction up to Rs 1.5 lakh for the purpose of income tax, with a three-year lock-in period. This is w.e.f April 2019.

- Life Insurance Premium

- Sukanya Samriddhi Account Deposit Scheme

Kindly note that the maximum limit of Rs. 1,50,000 is the aggregate of the deduction that may be claimed under sections 80C, 80CCC and 80CCD.

Section 80CCC

Contribution to annuity plan of LIC (Life Insurance Corporation of India) or any other Life Insurance Company for receiving pension from the fund is considered for tax benefit. The maximum allowable Tax deduction under this section is Rs 1.5 Lakh.

Section 80CCD

Employee can contribute to Government notified Pension Schemes (like National Pension Scheme – NPS). The contributions can be upto 10% of the salary (salaried individuals) and Rs 50,000 additional tax benefit u/s 80CCD (1b) is also available.

The self-employed (individual other than the salaried class) can contribute up to 20% of their gross income and the same can be deducted from the taxable income under Section 80CCD (1) of the Income Tax Act, 1961.

Contributions to ‘Atal Pension Yojana‘ are eligible for Tax Deduction under section 80CCD.

Kindly note that the Total Deduction under section 80C, 80CCC and 80CCD (1) together cannot exceed Rs 1,50,000 for the financial year 2020-21. The additional tax deduction of Rs 50,000 u/s 80CCD (1b) is over and above this Rs 1.5 Lakh limit.

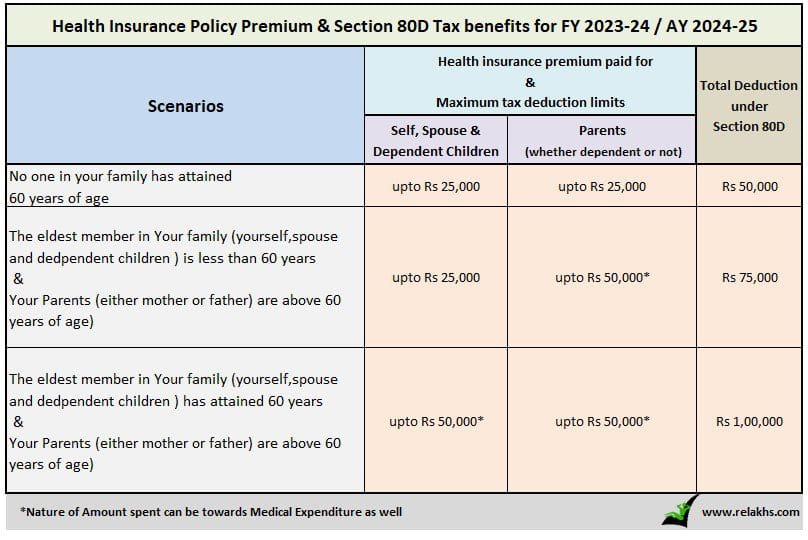

Section 80D Tax Benefit for AY 2024-25

The below threshold limits are applicable for Financial Year 2023-2024 (or) Assessment Year (2024-2025) u/s 80D.

Medical expenditure of up to Rs 50,000 can be claimed by a senior citizen provided he/she has no health insurance. So, aggregate amount of deduction cannot exceed Rs 1,00,000 in any case.

Preventive health checkup (Medical checkups) expenses to the extent of Rs 5,000/- per family can be claimed as tax deductions. Remember, this is not over and above the individual limits as explained above. (Family includes : Self, spouse, parents and dependent children).

NRIs also can claim tax deduction u/s 80D.

Section 80DD

You can claim up to Rs 75,000 for spending on medical treatments of your dependents (spouse, parents, kids or siblings) who have 40% disability. The tax deduction limit of upto Rs 1.25 lakh in case of severe disability can be availed.

To claim this deduction, you have to submit Form no 10-IA.

Section 80DDB

An individual (less than 60 years of age) can claim upto Rs 40,000 for the treatment of specified critical ailments. This can also be claimed on behalf of the dependents. The tax deduction limit under this section for Senior Citizens and very Senior Citizens (above 80 years) has been revised to Rs 1,00,000 w.e.f FY 2018-19.

To claim Tax deductions under Section 80DDB, it is mandatory for an individual to obtain ‘Doctor Certificate’ or ‘Prescription’ from a specialist working in a Govt or Private hospital.

Section 24 (B) (Tax Benefits on Home Loan EMIs)

- From FY 2017-18, the Tax benefit on loan repayment of second house is restricted to Rs 2 lakh per annum only (even if you have multiple houses the limit is still going to be Rs 2 Lakh only and the ceiling limit is not per house property).

- The unclaimed loss if any will be carried forward to be set off against house property income of subsequent 8 years. In most of the cases, this can be treated as ‘dead loss‘.

- If construction/acquisition is not completed within 5 years from the end of the financial year in which capital was borrowed, the deduction limit is Rs 30,000 only.

- Interest for pre-construction/acquisition period is allowable in five equal instalments beginning from the year of completion of house property.

- If the home loan is taken on joint names then the deduction is allowed to each co-borrower in proportion to his share in the loan.

- To claim tax benefit under Section 24, you should have received possession certificate of your house.

- Deduction towards principal repayment of housing loan is not available under the new tax regime.

Section 80E (Tax Benefit on Education Loan)

If you take any loan for higher studies (after completing Senior Secondary Exam), tax deduction can be claimed under Section 80E for interest that you pay towards your Education Loan. This loan should have been taken for higher education for you, your spouse or your children or for a student for whom you are a legal guardian. Principal Repayment on educational loan cannot be claimed as tax deduction.

There is no limit on the amount of interest you can claim as deduction under section 80E. The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier.

Section 80E is available to NRIs as well.

Section 80EEA

Besides the tax deductions under Section 80C and 24b, an individual can claim up to Rs 1.5 lakh under Section 80EEA from FY 2019-20. The same is continued for FY 2023-24 or AY 2024-25 as well, subject to below conditions;

- The home loan should have been sanctioned between 1st April, 2019 to 31st March 2020.

- The Stamp duty value of the property should not exceed 45 Lakhs.

- Taxpayer should not own any other residential property on the date of loan sanction.

- This tax benefit will be available from 1st April 2020 (AY 2020-21) and till the end of the home loan tenure (closure).

- The total interest deduction is now Rs. 3.5 lakh (Rs 2 Lakh +

- Rs 1.5 Lakh).

Kindly note that the deduction under Section 80EEA is available for home loans from banks and approved financial institutions only. Under Section 24, even interest paid on home loans from friends and relatives is eligible for tax benefit.

To claim tax benefit under Section 24, you should have received possession of your house (interest paid before possession is eligible for deduction over the next 5 years in 5 equal installments). Section 80EE and 80EEA do not impose any requirement of possession or completion of construction. Therefore, Section 80EEA provides you immediate tax relief even if you have purchased an under-construction property.

Both resident Indians and non-resident Indians (NRIs) can claim the deduction u.s 80EEA.

Section 80EEB

A Tax deduction of up to Rs 1.5 lakh can be claimed on Interest paid on Loans taken to purchase Electronic Vehicles. You can claim tax deduction benefits only if the loan is approved between 1 January 2019 and 31 March 2023.

Section 80G

Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G of the Income Tax Act. This deduction can only be claimed when the contribution has been made via cheque or draft or in cash. In-kind contributions such as food material, clothes, medicines etc do not qualify for deduction under section 80G.

The donations made to any Political party can be claimed under section 80GGC.

W.e.f FY 2017-18, the limit of deduction under section 80G / 80GGC for donations made in cash is reduced from current Rs 10,000 to Rs 2,000 only.

If you want to donate some fund to a political party of your choice, you can do so in cash of up to Rs 2,000. Beyond that you cannot donate the amount in cash mode. It can be done through Electoral Bonds.

Section 80GG

The Tax Deduction amount under 80GG is Rs 60,000 per annum. Section 80GG is applicable for all those individuals who do not own a residential house & do not receive HRA (House Rent Allowance).

The extent of tax deduction will be limited to the least amount of the following;

- Rent paid minus 10 percent the adjusted total income.

- Rs 5,000 per month.

- 25 % of the total income.

Section 80 TTA & Section 80TTB

For Senior Citizens, the Interest income earned on Fixed Deposits & Recurring Deposits (Banks / Post office schemes) of upto Rs 50,000 is tax exempted. This deduction can be claimed under new Section 80TTB. However, no deductions under existing 80TTA can be claimed if 80TTB tax benefit is claimed.

Section 80TTA of Income Tax Act offers deductions on interest income earned from savings bank deposit of up to Rs 10,000. From FY 2018-19, this benefit will not be available for late Income Tax filers.

- No TDS of up to Rs 40,000 on interest income from Bank / Post office deposits (the FY 2018-19 TDS threshold limit u/s 194A is Rs 10,000). Kindly note that no TDS does not mean no tax liability. Interest income on Deposits (FDs/RDs) is still a taxable income.

Interest income from deposits held with companies will not benefit under this section. This means, senior citizens will not get this benefit for interest income from corporate fixed deposits us/ 80TTB.

Section 80U

This is similar to Section 80DD. Tax deduction is allowed for the tax assessee who is physically and mentally challenged.

Comparison of Tax Deductions & Exemptions available under Old & New Tax Regimes

Below is the comparison table to get an overall idea of all the important tax exemptions and deductions available under the old and/or new tax regimes for Financial Year 2023-24 (AY 2024-25).

| Deduction (or) Exemption | Old Tax Regime | New Tax Regime |

|---|---|---|

| Standard Deduction of Rs 50,000 | Yes | Yes |

| HRA Allowance | Yes | No |

| Rebate u/s 87A (upto Rs 25,000 in new tax regime) | Yes | Yes |

| Professional Tax | Yes | No |

| Interest on Home loan u/s 24B on Self-occupied property | Yes | No |

| Interest on Home Loan u/s 24b on let-out property | Yes | Yes |

| Chapter VI A Deductions (80c, 80CCC, 80CCD, 80D, 80E, 80G etc.) | Yes | No |

| Deduction u/Sec 80CCD(1B) of Up to Rs. 50,000 | Yes | No |

| Employees Contribution to NPS/EPF (Sec 80CCD-2) | Yes | No |

| Employer’s Contribution to NPS | Yes | Yes |

| Bank Account Interest Sec 80TTA & 80TTB | Yes | No |

| Gratuity Benefit | Yes | Yes |

| Leave Encashment Benefit | Yes | Yes |

| Section 54 (Reinvestment of Long-Term Capital Gains) | Yes | Yes |

A word of advice:

It is prudent to avoid last minute tax planning. Do not invest in low-yielding life insurance polices or in any other financial products just to save taxes. It is better you plan your taxes based on your financial goals at the beginning of the Financial Year itself.

It is OK to pay some taxes when you cannot save or cannot invest in right financial products. But do not invest just to save TAXES. The cost of buying wrong financial products may outweigh the cost of taxes. Tax Planning is not a goal but a tool. Remember “Tax Planning alone is not Financial Planning.”

Kindly understand the tax treatment of the selected investment products across the different investment stages (i.e., investment, accrual & withdrawal) and then invest.

As discussed, under the new tax regime, the individuals can opt to pay tax at the reduced rates without claiming the various tax exemptions and deductions. So, you will have to work out your tax liability under the old and new tax regime before deciding which one is more beneficial.

Continue reading :

(If you have any questions on your personal financial matters, you can post them in our Forum section. We are more than happy to answer and help you in making informed investment decisions.)

(Post first published on : 07-Aug-2023)