A bank account can be operated by a single account holder (or) multiple account holders. A Joint Bank Account is an Account with more than one holder.

Joint accounts are very common and popular, mostly used by married couples, business partners, friends or couples who live together. Such an account can be a Savings Account, Current Account, Fixed Deposit, Loan Account, etc. One can choose the joint account option while opening an account or whenever you require.

Though Joint Accounts render several benefits in terms of operational convenience and ease, one needs to exercise extra caution while selecting the type of joint account. You need to be clear as to who is the owner, who can withdraw money and what is the mode of operation?

In this post let’s understand – What are different types of joint bank accounts in India? What happens if one of the joint account holders die? Can a surviving account holder of a joint account withdraw monies? Is it possible for a surviving joint account holder to make premature withdrawal of deposits? Can legal heirs of a deceased first holder claim monies of a joint account? How to ensure smooth succession of deposits or monies in a joint bank account if one account holder or all of the holders die?

Types of Joint Bank Accounts in India:

Let’s have a look at different types of joint accounts offered by banks, based on the mode of operation and accessibility.

Either (Or) Survivor Joint Account

This is the most common form of joint account. Only two individuals can operate the account i.e., primary account holder and secondary account holder. Both can access the account and transfer the funds.

The final balance and interest (if any) will be paid to the survivor on death of anyone of the account holders. The survivor can opt to continue the account.

If the nominee is a different person then the balance money is paid to him/her after the death of the survivor.

Example : Husband and wife can open a joint account. On death of anyone of them, the surviving person can continue the account or get the account balance transferred to his/her name.

Former (Or) Survivor

In this type of joint account, only the first account holder (primary) can access and operate the account till the time he/she is alive. The second account holder (second applicant) can operate the account only on death of the primary holder (first applicant). The survivor can also get the balance transferred to his/her name (if required).

Anyone (Or) Survivor

This is similar to “either or survivor” option. The only difference is, more than two individuals can operate the account.

If you want your father, mother and spouse to be able to access and operate your bank account then this is the best option. In case of death of anyone of the account holders, the remaining survivors can continue to operate the account.

Latter (Or) Survivor

This is similar to “former/survivor” option. The main difference is, only the second account holder can access and operate the account till the time he/she is alive. The primary/first account holder can operate the account only on death of the secondary account holder.

Example : Husband and wife are the joint-account holders. Wife is a second account holder. Then in this case, only wife can operate the account. Only after she is no more, can the husband have access to operate the account.

The restricted survivorship clause in the joint account comes in the form of ‘former or survivor’ and ‘later or survivor’.

Jointly

In this type of account, all the transactions need to be signed and mandated by all the account holders. If any of the account holder dies then the account cannot be further operated. The balance proceeds shall be payable to survivor.

Along with the above options there is another type which is “Minor Account.” If the primary account holder is less than 18 years of age then there should be an adult guardian, as a joint account holder.

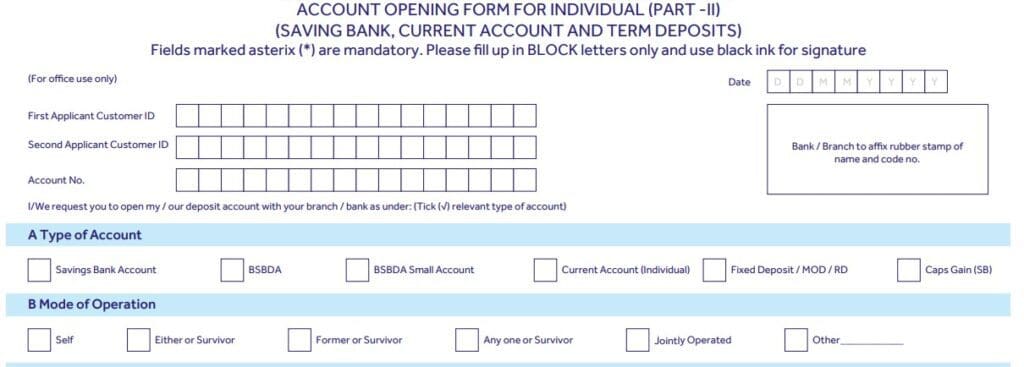

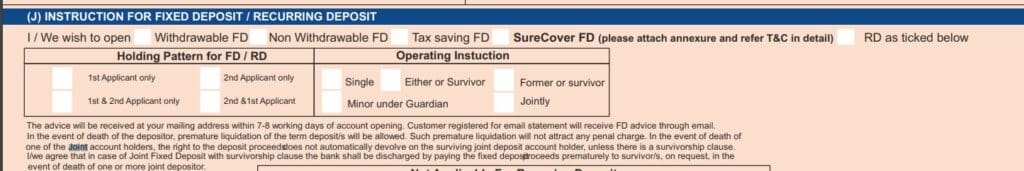

‘Mode of Operation’ instruction for Joint Fixed Deposits or Recurring Deposits

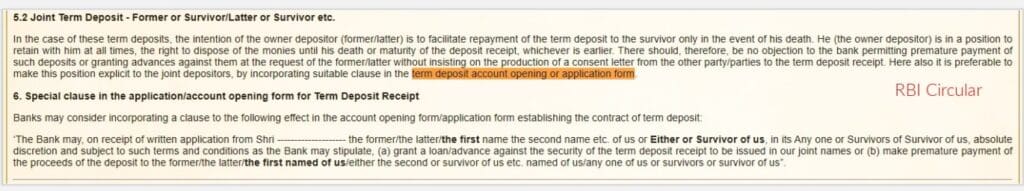

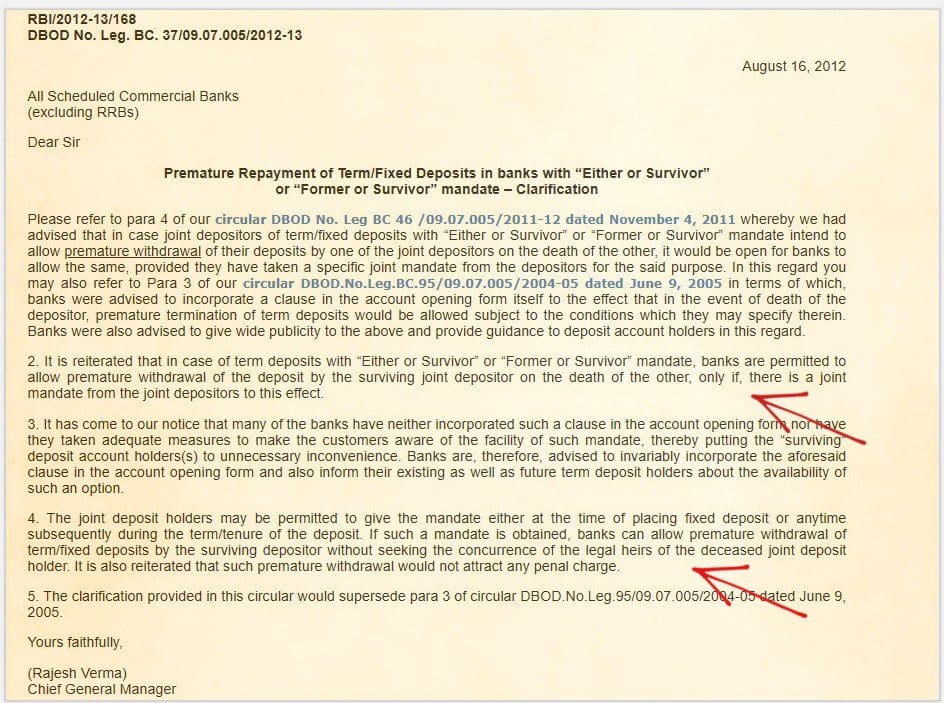

RBI in one of its master circulars suggested the Banks to collect ‘mode of operation’ instruction, while accepting an application for opening of joint fixed deposits or recurring deposits as well from the customers.

Hence, you can see most of the banks have incorporated this clause in their account opening forms.

The joint deposit holders may be permitted to give the mandate either at the time of placing fixed deposit or anytime subsequently during the term/tenure of the deposit – RBI

What happens to a Joint Bank Account when one of the Account holders dies?

The procedure for claim settlement in case of joint bank accounts having Survivorship Clause (E or S, F or S, L or S and Any one or Survivor etc.) can be simple and straightforward.

- If the one of the account holders of a joint account dies, then it is sufficient for the survivor(s) to make a simple application along with a photo copy of the Death Certificate for record of the Bank.

- In case of Current Account/ Savings Bank Account, the survivors are generally advised to transfer the joint account balance to a new account in their own name and Bank asks for a fresh account opening form.

What if the joint account is without survivorship clause?

When a joint account holder dies, in the absence of a clause like E or S, F or S, L or S, the balance can be paid jointly to the survivors and the legal heirs of the deceased.

Example: If an account in the joint name of A and B, and if A dies, the balance will not be paid to B alone. It has to be paid to B and to the legal heirs of A jointly. The settlement can be made to the legal heirs of A either through legal representation or without legal representation as the case may be.

What happens to a Joint Term Deposit when one of the Account holders dies?

in case of Joint bank term deposits with a clear ‘survivorship clause’, the surviving joint holder(s) have access to funds without consent from others.

- For time deposits, the survivors can continue with the account by deleting the deceased depositor’s name from the TDR/STDR / Other FDs.

- In case of term deposits, on request from the legal heir(s)/representative(s)/nominees, the deposit can be split into two or more receipts individually in the name of legal heir(s)/representative(s)/nominees. It shall not be construed as premature withdrawal of the term deposit for the purpose of imposing penalty clause for premature withdrawal provided the period and the aggregate amount of the deposit do not undergo any change.

What about Pre-mature withdrawal of Term deposits? Can a surviving joint account holder withdraw the monies from a joint term deposit?

In case of term deposits with “Either or Survivor” or “Former or Survivor” mandate, banks are permitted to allow premature withdrawal of the deposit by the surviving joint depositor on the death of the other, only if, there is a joint mandate from the joint depositors to this effect. (The mandate should have been given at the deposit account opening time or during the deposit tenure.)

When a joint account holder dies, in the absence of a survivorship clause, the deposits can be withdrawn prematurely on joint consent of surviving depositor and legal heir(s) of the deceased only.

Who can claim the Joint Bank Account monies when all the owners die?

In case all the joint account holders die unfortunately then the bank can pay the account balance and deposit amounts to the Nominee(s) of the account, provided the nomination exists.

In a Joint account where there is neither Survivorship clause nor Nomination, banks generally deliver the assets only to the legal heirs. The heirs have to submit indemnity cum affidavit declaration.

This is applicable only when:

- The customer has died INTESTATE i.e. without a WILL and

- There are no disputes among the legal heirs and all the legal heirs (other than those who have furnished a Letter of Disclaimer) join in indemnifying the Bank and there is no reasonable doubt about the genuineness of the claimant(s) being the only legal heirs.

Two important point that need to be noted are;

- Can right of survivorship bank account be challenged? – Yes. The Surviving Joint Account Holder of a Joint Bank Account is accountable to the Legal Heirs of the Deceased First Holder unless otherwise established.

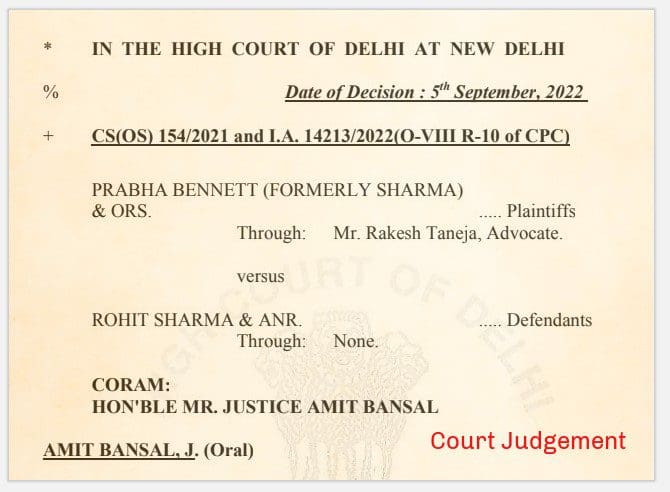

The Delhi High Court in its recent decision in Prabha Bennett v. Rohit Sharma & Anr. reiterated the stand that in a joint bank account, following the death of the first account holder, the subsequent joint holder would be authorized to withdraw the amounts but would be accountable to the heirs of the first holder when the circumstances do not establish the intention of the first holder to make the surviving joint holder the exclusive owner.

- Also, note that a nominee is again just a Care-taker of your investments. He/she has to receive the asset/money from the concerned bank or financial institution and transfer/distribute that to Legal owners. Your legal heirs will have rights on your investments.

How to ensure smooth succession of deposits (or) monies in a joint bank account?

One of the biggest pain areas of Estate Planning is, the inability of legal heirs accessing the deceased person’s bank account and deposits.

Having a joint account with your beloved ones is a solution to many such deposit succession issues but you need to do it meticulously.

So, how to ensure smooth succession of your bank deposits to your legal heirs?

- Clearly declare your preferred ‘mode of operation’ and opt for suitable ‘survivorship’ clause while opening joint bank accounts and term deposits accounts.

- Ensure you submit nomination forms for all your bank accounts and declare your nominees (preferably your legal heirs).

- Inform your legal heirs about your joint bank account details and the nomination facility.

- Last but not the least, write a WILL and ensure you declare the joint accounts and deposits details in it. Make sure you update the WILL as when there are changes to your ownership of accounts.

Continue reading:

(If you have any questions on your personal financial matters, you can post them in our Forum section. We are more than happy to answer and help you in making informed investment decisions.) (Post first published on : 09-Aug-2023)