If your student loan payments have been paused due to Covid, payments will be starting up again this fall. Federal student loan payments have been paused for three years now even though it doesn’t seem like it’s been that long.

Last month, the Supreme Court voted against President Biden’s one-time student loan forgiveness plan and Biden signed a Federal bill ending the student loan pause where interest rates were also set to 0%. Many people are in limbo about what to do once their student loan payments resume. With many individuals being financially impacted by the pandemic, the added pressure of student loan payments can be stressful.

When Exactly Do Student Loan Payment Resume?

For most borrowers, student loan repayments will resume in September 2023. Federal student loan interest rates will start accruing on September 1, 2023 although your payment due date may be later in the month. Federal student loan interest rates are set by Congress and fixed.

This means your interest rate should be the same as what you were paying before the pandemic. You should have heard from your lender by now with instructions to set up payments and details about your loans.

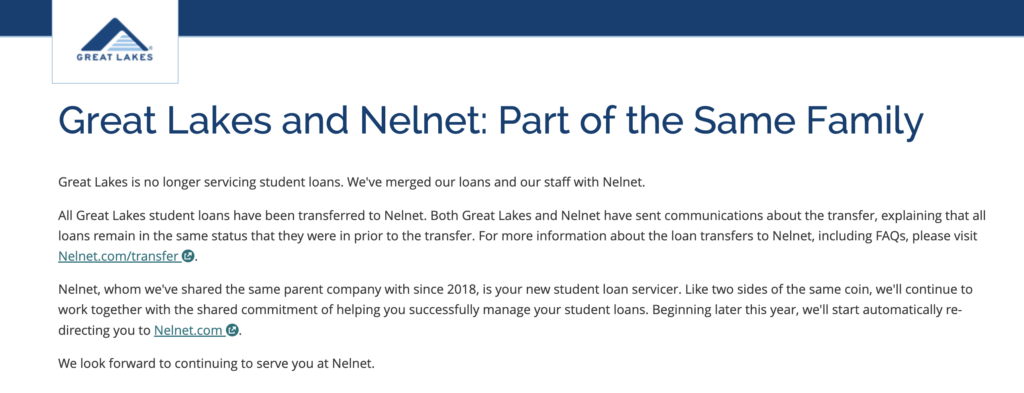

If you’ve had My Great Lakes as your federal student loan lender before, you probably have Nelnet now as all their loan accounts were transferred to Nelnet. Just confirm who your lender is and when payments will start. If you’re unsure, you can always visit your last student loan lender’s website (before the pause) and see if they’ve posted an update about whether they’ve transferred loan accounts or are still servicing student loans.

With private loans, each lender has dealt with the pandemic in different ways and offered various solutions. So, the best option is to contact your private lender directly to see when and how payments will restart.

Related: Prioritizing Your Debt-Free Strategy

Reflections on Paying Off Student Loans

How to Prepare For Student Loan Payments to Resume

It’s best to start preparing for student loan payments to return now. You don’t want to be surprised at the last minute or expected to make a payment ASAP that you didn’t budget for. Also, always helpful to review your repayment options to see what would work best for your situation.

Update Your Profile with Your Loan Servicer

One of the first things you’ll want to do is update your profile with your loan servicer so they have your updated contact information. It’s important for your lender to be able to reach you with updates and important messages.

Create a login or reset your password if you haven’t already and get familiar with your dashboard.

Review Your Budget

Student loan repayment couldn’t have come at a worse time for some people. The cost of living has increased substantially, including housing expenses and good prices. Adding another bill to your plate could further strain your finances.

However, this is where budget planning can come in handy. Review your expenses to see if you can cut costs anywhere or start setting aside funds for your first payment. This may involve temporarily pausing some of your savings or costs for other hobbies.

Related: The 50-30-20 Budget Plan: What Is It and How Does It Work?

Creating a Student Loan Debt Plan of Attack

Review Your Payment and Due Date

Your loan servicer should have your payment due date ready and provide options for your monthly payment. You may have to approve your payment plan, or you may just see an amount you owe on a specific date each month.

This is the time to ask questions about your payment and any options your loan servicer has.

Options If You Can’t Repay Your Student Loans

If you’re struggling with the idea of having to make payments on your loans when payments resume, you still have options.

Change Your Repayment Plan

If you’re struggling to make your monthly payments, you should first contact your loan servicer to discuss your options for adjusting your repayment plan. There are several different repayment plans available, including income-driven repayment plans, extended repayment plans, and graduated repayment plans.

My husband and I both chose the graduated repayment plans for our loans since payments start low and increase every two years. We figured that would give us time to increase our income and steadily build our careers so we could afford to pay more. Depending on your current financial situation, it may be possible to switch to a different plan that requires a lower monthly payment.

Look Into Consolidation

Consolidating your student loans can be another effective way to lower your monthly payment. When you consolidate your loans, you combine multiple loans into one new loan with a single monthly payment.

While this won’t necessarily lower your interest rate, it can make it easier to manage your monthly payments. Be sure to do your research to see if consolidation is the right option for you, as it can have both pros and cons depending on your individual circumstances.

Apply For Deferment or Forbearance

If you’re struggling to make your payments due to a temporary financial hardship, you may be eligible for a deferment or forbearance. Deferment and forbearance allow you to temporarily postpone your payments or lower your payments for a set amount of time without penalty.

While this can be a helpful solution in certain circumstances, it’s important to remember that interest will continue to accrue during this time, which means you may end up paying more in the long run.

See If You Qualify For Other Forgiveness Options

Depending on your profession, income, or other factors, you may be eligible for loan forgiveness programs that can significantly reduce or eliminate your student loan debt.

Some popular forgiveness programs include Public Service Loan Forgiveness, Teacher Loan Forgiveness, and Income-Based Repayment Plan Forgiveness. Be sure to research all the options available to you and speak with your loan servicer to see if you qualify. FederalStudentAid.gov has some great information on what you’d need to qualify for student loan forgiveness.

Summary

Student loan payments are coming back soon, and it’s crucial to prepare yourself and your finances. Make sure you know when your payments are scheduled to resume and keep an eye out for any policy changes driven by the Biden administration or Congress.

If you’re having trouble repaying your loans, several options can help you manage them, so don’t hesitate to reach out to your loan servicer or lender. While repaying student loan debt can be challenging, taking the time to understand your options and making a repayment plan can help you get back on track toward financial freedom.

Stop Worrying About Money and Regain Control

Join 5,000+ others to get access to free printables to help you manage your monthly bills, reduce expenses, pay off debt, and more. Receive just two emails per month with exclusive content to help you on your journey.