Health Insurance (or) Mediclaim insurance is a must-have for all. Considering the rate at which medical costs are rising, it is very important to have sufficient medical insurance coverage. The medical inflation in India is increasing at a significant rate, almost 12% to 15% year on year (one of the highest rates in Asia). Therefore, it is critical to have an adequate health cover, it is even more important for senior citizens. It is always better to be safe than sorry!

Absence of health insurance can wipe out your savings. Having sufficient coverage will safeguard you and your dependents from getting into financial crisis during hospitalization or critical illnesses’ treatments or accidents.

Besides medical coverage, health insurance plans can provide Tax benefits to you. The premium paid towards medical insurance can be claimed as Health Insurance Tax Deduction under section 80D of the Income Tax Act, 1961.

However, a new income tax regime was introduced in Budget 2020. As per these new amendments, the applicability of Section 80D tax benefit is dependent on whether you opt for the old (or) new tax structure.

Section 80D Income Tax Benefit under the New Tax Regime AY 2024-25 (FY 2023-24)

Can I claim Health Insurance Premium Section 80D Income Tax Benefit under the New Tax Regime for FY 2023-24?

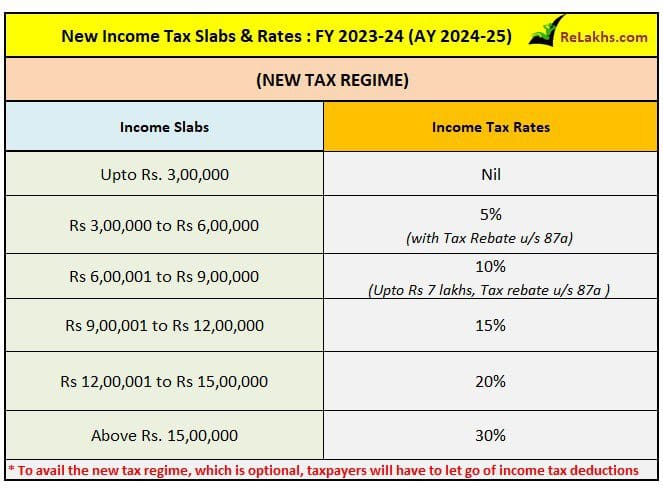

As per the Finance Bill 2023-24, you can now opt for a lower new income tax slabs rates for FY 2023-24 (AY 2024-25).

Individuals opting to pay tax under the new proposed lower personal income tax regime will have to forgo almost all tax breaks (tax benefits) that you have been claiming in the old tax structure.

All income tax deductions under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc) will not be claimable by those opting for the new tax regime.

So, the medical insurance premium tax benefit of Section 80D is not available under the New Tax Regime for FY 2023-24 (AY 2024-25).

To know which Income Tax Deductions & Exemptions are allowed under New Tax Regime AY 2024-25, you may kindly go through this article @ Income Tax Deductions List FY 2023-24 | Under Old & New Tax Regimes

Health Insurance Tax Benefits FY 2023-24 (AY 2024-25) | Under Old Tax Regime

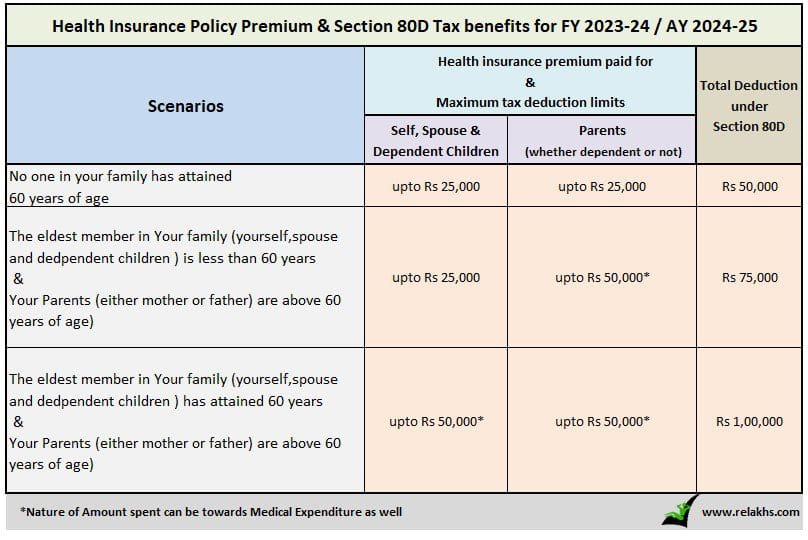

Section 80D Income Tax Benefit is available under Old Tax Regime. Below are the medical insurance tax deduction limits for AY 2024-25.

Medical expenditure of up to Rs 50,000 can also be claimed by a senior citizen provided he/she has no health insurance. So, aggregate amount of deduction cannot exceed Rs 1,00,000 in any case.

Preventive health checkup (Medical checkups) expenses to the extent of Rs 5,000/- per family can be claimed as tax deductions. Remember, this is not over and above the individual limits as explained above. (Family includes : Self, spouse, parents and dependent children).

NRIs also can claim tax deduction u/s 80D.

My View :

- Health insurance cover is a ‘must-have’ for everyone. ‘Tax saving’ is only a value addition in your financial planning process and not the primary factor to plan your investments/savings.

- Kindly first analyze which tax regime (old or new) is beneficial to you. If the new tax structure is right to you, you have to forgo claiming tax benefit on your existing health insurance policy premium, that’s ok!

- In case, you are planning to buy a new health insurance policy, kindly go ahead and get sufficient insurance cover. Do not worry too much about the unrealized tax benefit (if you opt for the new tax regime while filing your taxes).

Let’s start saving/investing/spending without the ‘tax saving’ angle. Most of the personal finance mistakes happen just to save some taxes.

Just because there is no tax saving benefit does not mean that you neglect your savings/investments. Instead, concentrate on how to increase your income, how you can manage your cash-flows (budgeting) better and picking right saving/investment products as per your financial goals!

Continue reading:

(Post first published on : 12-Aug-2023)