Do you know the types of Mutual Funds in India? As on 31st July 2023, there are 45 Mutual Fund Companies in India and the number of schemes offered by all these mutual fund companies in total is 1,453!! Obviously, this will confuse the investors to choose.

How many mutual fund companies are there in India?

As per the current SEBI data, there are 47 Mutual Fund Companies are there in India. I am providing the list of all Mutual Fund Companies. The below list is as on 31st July 2023.

- 360 One Mutual Fund

- Aditya Birla Sunlife Mutual Fund

- Axis Mutual Fund

- Bajaj Finserv Mutual Fund

- Baroda Mutual Fund

- BNP Paribas Mutual Fund

- BOI Axa Mutual Fund

- Canara Robeco Mutual fund

- DSP Mutual Fund

- Edelweiss Mutual Fund

- Franklin Templeton Mutual Fund

- Groww Mutual Fund

- HDFC Mutual Fund

- HSBC Mutual Fund

- ICICI Prudential Mutual Fund

- IDBI Mutual Fund

- IDFC Mutual Fund

- IFCL Mutual Fund

- IL&FS IDF Mutual Fund

- Invesco Mutual Fund

- ITI Mutual Fund

- HM Financial Mutual Fund

- Kotak Mutual Fund

- LIC Mutual Fund

- Mahindra Manulife Mutual Fund

- Mirea Asset Mutual Fund

- Motilal Oswal Mutual Fund

- N J Mutual Fund

- Navi Mutual Fund

- Nippon India Mutual Fund

- PGIM India Mutual Fund

- PPFAS Mutual Fund

- Principal Mutual Fund

- Quant Mutual Fund

- Quantum Mutual Fund

- Samco Mutual Fund

- SBI Mutual Fund

- Sriram Mutual Fund

- Sundaram Mutual Fund

- Tata Mutual Fund

- Taurus Mutual Fund

- Trust Mutual Fund

- Union Mutual Fund

- UTI Mutual Fund

- Whiteoak Capital Mutual Fund

(I have excluded the AMCs like Sahara Mutual Fund and CRB Mutual Fund, even though they are available on SEBI’s list).

How many Mutual Funds are available in India?

According to the latest data of AMFI (31st July 2023), there are around 1,453 mutual funds available for investors to invest in.

This is obviously a confusing factor for many investors (and for that matter even for financial planners also). As an individual investor, we don’t need more than 4-5 funds (including equity and debt). However, mutual fund companies are bombarded with their offerings.

Types of Mutual Funds in India 2023

As per the latest AMFI data, there are around 47 categories of funds available. This list is not exhaustive as for example, Index funds are all categories under one category.

Let us go deeper and try to understand the types of mutual funds in India.

The most important category for any mutual fund investors to choose is DIRECT Vs REGULAR. Regular means you are investing through middlemen and he will earn a certain commission. Direct means you are investing in a fund there is no middlemen commission involved. The rest of the categories I am trying to classify are based on AMFI and SEBI’s mutual fund classification.

In a broader sense, as per AMFI, mutual funds are classified as below.

- Organization Structure – Open-ended, Close ended, Interval

- Management of Portfolio – Actively or Passively

- Investment Objective – Growth, Income, Liquidity

- Underlying Portfolio – Equity, Debt, Hybrid, Money market instruments, Multi-Asset

- Thematic / solution oriented – Tax saving, Retirement benefit, Child welfare, Arbitrage

- Exchange Traded Funds

- Overseas funds

- Fund of funds

1) Scheme classification based on the organizational structure

• Open-ended schemes are perpetual, and open for subscription and repurchase on a continuous basis on all business days at the current NAV.

• Close-ended schemes have a fixed maturity date. The units are issued at the time of the initial offer and redeemed only on maturity. The units of close-ended schemes are mandatorily listed to provide an exit route before maturity and can be sold/traded on the stock exchanges.

• Interval schemes allow purchase and redemption during specified transaction periods (intervals). The transaction period has to be for a minimum of 2 days and there should be at least a 15-day gap between two transaction periods. The units of interval schemes are also mandatorily listed on the stock exchanges.

2) Scheme classification based on the organizational structure

Active Funds

In an Active Fund, the Fund Manager is ‘Active’ in deciding whether to Buy, Hold, or Sell the underlying securities and in the stock selection. Active funds adopt different strategies and styles to create and manage the portfolio.

- The investment strategy and style are described upfront in the Scheme Information Document (offer document)

- Active funds expect to generate better returns (alpha) than the benchmark index.

- The risk and return in the fund will depend upon the strategy adopted.

- Active funds implement strategies to ‘select’ the stocks for the portfolio.

Passive Funds

Passive Funds hold a portfolio that replicates a stated Index or Benchmark e.g. –

- Index Funds

- Exchange Traded Funds (ETFs)

In a Passive Fund, the fund manager has a passive role, as the stock selection / Buy, Hold, Sell decision is driven by the Benchmark Index, and the fund manager/dealer merely needs to replicate the same with minimal tracking error.

3) Scheme classification based on the organizational structure

Mutual funds offer products that cater to the different investment objectives of the investors such as –

- Capital Appreciation (Growth) – Growth Funds are schemes that are designed to provide capital appreciation. They primarily invest in growth-oriented assets, such as equity. Historically, Equity as an asset class has outperformed most other kind of investments held over the long term. However, returns from Growth funds tend to be volatile over the short term since the prices of the underlying equity shares may change. Hence investors must be able to take volatility in the returns in the short term.

- Capital Preservation – The primary reason for choosing such funds is the protection of the principal. Ideally, overnight funds, liquid funds, or money market funds fall under this category.

- Regular Income – The objective is to provide regular income. Income funds invest in fixed-income securities such as Corporate Bonds, Debentures, and Government securities. The fund’s return is from the interest income earned on these investments as well as capital gains from any change in the value of the securities. The fund will distribute the income provided the portfolio generates the required returns. There is no guarantee of income. The returns will depend upon the tenor and credit quality of the securities held.

- Liquidity – Open-ended funds fall under this category. Do remember that open-ended funds include safe funds like overnight or liquid funds to equity funds also. Hence, you have to be cautious while selecting.

4) Underlying Portfolio – Equity, Debt, Hybrid, Money market instruments, Multi-Asset

Mutual fund products can be classified based on their underlying portfolio composition

– The first level of categorization will be on the basis of the asset class the fund invests in, such as equity/debt/money market instruments or gold.

– The second level of categorization is on the basis of strategies and styles used to create the portfolio, such as Income fund, Dynamic Bond Fund, Infrastructure fund, Large-cap/Mid-cap/Small-cap Equity fund, Value fund, etc.

– The portfolio composition flows out of the investment objectives of the scheme.

5) Thematic / solution oriented – Tax saving, Retirement benefit, Child welfare, Arbitrage

Thematic funds mean the funds follow certain themes or sectors like health or automobile.

ELSS funds fall under this category. Nowadays passive index funds are also gaining popularity. However, with the introduction of a new tax regime and not increasing the limit of Sec.80C limit, ELSS funds are slowly turning unpopular among investors.

Along with these, there are certain retirement benefit funds and child welfare-related funds also there in the market. They come with certain lock-in features. I am unsure why Arbitrage is included in this category by AMFI.

6) Exchange Traded Funds (ETF)

There are primarily index funds only but they are traded like stocks in the secondary market. They fall under passive funds and they are low cost in nature. However, in the Indian context, they are still not so liquid. Again, here you may find debt, equity, or gold ETFs based on the assets you wish to invest.

7) Fund of Funds (FoFs)

Fund Of Funds means they invest in another fund based on the theme, style, or asset class. Take for example, if an XYZ Nifty 50 FoF is investing in its own XYZ Nifty 50 ETF, then it is called a Fund Of Fund. Usually, such a setup is made by AMCs to provide liquidity for the investors.

The above classification is as per the AMFI website. The Securities and Exchange Board of India (SEBI) announced a bold move in October 2017. In a circular, it did Mutual Fund Categorization and Rationalization into five broad categories (equity, debt, hybrid, solution-oriented, and others) and a few sub-categories under them (such as large-cap, mid-cap, small-cap under equity). Mutual fund houses would then only be able to have one scheme in each sub-category, with some exceptions.

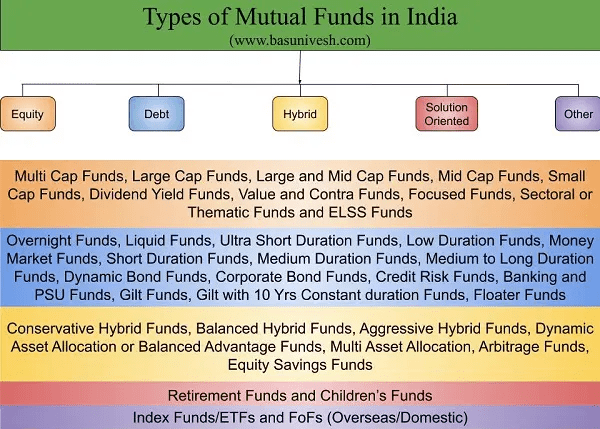

As per the SEBI, the types of Mutual Funds in India are broadly categorized as below.

a. Equity Schemes

b. Debt Schemes

c. Hybrid Schemes

d. Solution-Oriented Schemes

e. Other Schemes

Within these schemes again the various categories are specified. Let us see one by one. Let me share the same through this below image.

Now, let us understand the definition of these categories in detail like how SEBI defined them.

a. Equity Schemes

| 1 | Multi Cap Funds | Minimum investment in equity & equity related instruments–65% of total assets | Multi Cap Fund – An equity mutual fund investing across Large Cap, Mid Cap, Small Cap stocks |

| 2 | Large Cap Funds | Minimum investment in equity & equity related instruments of large cap companies – 80% of total assets | Large Cap Fund – An equitymutual fund predominantly investing in Large Cap stocks |

| 3 | Large & Mid Cap Funds | Minimum investment in equity & equity related instruments of large cap companies – 35% of total assetsMinimum investment in equity & equity related instruments of mid cap stocks – 35% of total assets | Large & Mid Cap Fund – An open ended equity mutualfund investing in both large cap and mid cap stocks |

| 4 | Mid Cap Funds | Minimum investment in equity & equity related instruments of mid cap companies – 65% of total assets | Mid Cap Fund – An equitymutual fund predominantly investing in Mid Cap stocks |

| 5 | Small Cap Funds | Minimum investment in equity & equity related instruments of small cap companies – 65% of total assets | Small Cap Fund – An equitymutual fund predominantly investing in Small Cap stocks |

| 6 | Dividend Yield Funds | Scheme should predominantly invest in dividend yielding stocks. Minimum investment in equity – 65% of total assets | An equitymutual fund predominantly investing in dividend yielding stocks |

| 7a | Value Funds* | Scheme should follow a value investment strategy. Minimum investment in equity & equity related instruments – 65% of total assets | An equitymutual fund following a value investment strategy |

| 7b | Contra Funds* | Scheme should follow a contrarian investment strategy. Minimum investment in equity & equity related instruments – 65% of total assets | An equitymutual fund following contrarian investment strategy |

| 8 | Focused Funds | A scheme focused on the number of stocks (maximum 30) Minimum investment in equity & equity related instruments – 65% of total assets | An equity scheme investing in maximum 30 stocks (mention where the scheme intends to focus, viz., multi cap, large cap, mid cap, small cap) |

| 9 | Sectoral Funds or Thematic | Minimum investment in equity & equity related instruments of a particular sector/particular theme – 80% of total assets | An open ended equity scheme following the theme as mentioned |

| 10 | ELSS Funds | Minimum investment in equity & equity related instruments – 80% of total assets (in accordance with Equity Linked Saving Scheme, 2005 notified by Ministry of Finance) | An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit |

b.Debt Schemes

| 1 | Overnight Funds | Investment in overnight securities having maturity of 1 day | A debt scheme investing in overnight securities |

| 2 | Liquid Funds | Investment in Debt and money market securities with maturity of upto 91 days only | A liquid scheme |

| 3 | Ultra Short Duration Funds | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 months – 6 months | An ultra – short term debt scheme investing in instruments with Macaulay duration between 3 months and 6 months |

| 4 | Low Duration Funds | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 6 months – 12 months | A low duration debt scheme investing in instruments with Macaulay duration between 6 months and 12 months |

| 5 | Money Market Funds | Investment in Money Market instruments having maturity up to 1 year | A debt scheme investing in money market instruments |

| 6 | Short Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 1 year – 3 years | A short term debt scheme investing in instruments with Macaulay duration between 1 year and 3 years |

| 7 | Medium Duration Funds | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 years – 4 years | A medium term debt scheme investing in instruments with Macaulay duration between 3 years and 4 years |

| 8 | Medium to Long Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 4 – 7 years | A medium term debt scheme investing in instruments with Macaulay duration between 4 years and 7 years |

| 9 | Long Duration Fund | Investment in Debt & Money Market Instruments such that the Macaulay duration of the portfolio is greater than 7 years | A debt scheme investing in instruments with Macaulay duration greater than 7 years |

| 10 | Dynamic Bond Funds | Investment across duration | A dynamic debt scheme investing across duration |

| 11 | Corporate Bond Funds | Minimum investment in corporate bonds – 80% of total assets (only in highest rated instruments) | A debt scheme predominantly investing in highest rated corporate bonds |

| 12 | Credit Risk Funds | Minimum investment in corporate bonds – 65% of total assets ( investment in below highest rated instruments) | A debt scheme investing in below highest rated corporate bonds |

| 13 | Banking and PSU Fund | Minimum investment in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions – 80% of total assets | A debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions |

| 14 | Gilt Fund | Minimum investment in Gsecs – 80% of total assets (across maturity) | A debt scheme investing in government securities across maturity |

| 15 | Gilt Fund with 10 year constant duration | Minimum investment in Gsecs – 80% of total assets such that the Macaulay duration of the portfolio is equal to 10 years | A debt scheme investing in government securities having a constant maturity of 10 years |

| 16 | Floater Fund | Minimum investment in floating rate instruments – 65% of total assets | A debt scheme predominantly investing in floating rate instruments |

c. Hybrid Schemes

| 1 | Conservative Hybrid Funds | Investment in equity & equity related instruments – between 10% and 25% of total assets; Investment in Debt instruments – between 75% and 90% of total assets | A hybrid mutual fund investing predominantly in debt instruments |

| 2A | Balanced Hybrid Funds@ | Equity & Equity related instruments – between 40% and 60% of total assets; Debt instruments – between 40% and 60% of total assets. No Arbitrage would be permitted in this scheme | 50-50 balanced scheme investing in equity and debt instruments |

| 2B | Aggressive Hybrid Funds | Equity & Equity related instruments – between 65% and 80% of total assets; Debt instruments – between 20% – 35% of total assets. Most of the balanced funds will fall into this category. | A hybrid scheme investing predominantly in equity and equity related instruments |

| 3 | Dynamic Asset Allocation Funds or Balanced Advantage | Investment in equity/ debt that is managed dynamically. All famous balanced advantage or dynamic funds will fall into this category. | A hybrid mutual fund which will change its equity exposure based on market conditions |

| 4 | Multi-Asset Allocation Funds | Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes. Foreign investment will be considered as a separate asset class. | A scheme investing in 3 different assetclasses. |

| 5 | Arbitrage Funds | Scheme following arbitrage strategy. Minimum investment in equity & equity related instruments – 65% of total assets | A scheme investing in arbitrage opportunities |

| 6 | Equity Savings | Minimum investment in equity & equity related instruments – 65% of total assets and minimum investment in debt – 10% of total assets. Minimum hedged & unhedged to be stated in the SID. Asset Allocation under defensive considerations may also be stated in the Offer Document | A scheme investing in equity, arbitrage, and debt |

d. Solution-Oriented Schemes:–

| 1 | Retirement Fund | Scheme having a lock – in for at least 5 years or till retirement age whichever is earlier | A retirement solution oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier) |

| 2 | Children’s Fund | Scheme having a lock – in for at least 5 years or till the child attains age of majority whichever is earlier | A fund for investment for children having a lock – in for at least 5 years or till the child attains age of majority (whichever is earlier) |

e.Other Schemes:-

| 1 | Index Funds/ ETFs | Minimum investment in securities of a particular index (which is being replicated/ tracked) – 95% of total assets | A mutual fund replicating/ tracking any index |

| 2 | FoF’s (Overseas/Domestic) | Minimum investment in the underlying fund – 95% of total assets | A fund of fund is a mutual fund that invests in other mutual funds |

I have written detailed posts on this aspect. You can refer to the same –

Now, based on the above two classifications, I have created the list with types of mutual funds in India and the number of schemes available under each category of schemes (based on 31st July 2023 AMFI data).

| Types of Mutual Funds in India (www.basunivesh.com) |

|

| Gilt Fund with 10-year constant duration | |

| Income/Debt Oriented Schemes | Number of Funds |

| Overnight Fund | 36 |

| Liquid Fund | 37 |

| Ultra Short Duration Fund | 24 |

| Low Duration Fund | 21 |

| Money Market Fund | 24 |

| Short Duration Fund | 24 |

| Medium Duration Fund | 15 |

| Medium to Long Duration Fund | 12 |

| Long Duration Fund | 7 |

| Dynamic Bond Fund | 22 |

| Corporate Bond Fund | 21 |

| Credit Risk Fund | 14 |

| Banking and PSU Fund | 23 |

| Gilt Fund | 22 |

| Growth/Equity-Oriented Schemes | 5 |

| Floater Fund | 13 |

| Multi-Asset Allocation Fund | Number of Funds |

| Multi Cap Fund | 21 |

| Large Cap Fund | 30 |

| Large & Mid Cap Fund | 26 |

| Mid Cap Fund | 29 |

| Small Cap Fund | 24 |

| Dividend Yield Fund | 9 |

| Value Fund/Contra Fund | 23 |

| Focused Fund | 27 |

| Sectoral/Thematic Funds | 135 |

| ELSS | 42 |

| Flexi Cap Fund | 35 |

| Hybrid Schemes | Number of Funds |

| Conservative Hybrid Fund | 20 |

| Balanced Hybrid Fund/Aggressive Hybrid Fund | 30 |

| Dynamic Asset Allocation/Balanced Advantage Fund | 29 |

| Capital Protection-Oriented Schemes | 13 |

| Arbitrage Fund | 26 |

| Equity Savings Fund | 22 |

| Solution Oriented Schemes | Number of Funds |

| Retirement Fund | 26 |

| Childrens Fund | 10 |

| Other Schemes | Number of Funds |

| Index Funds | 188 |

| GOLD ETF | 13 |

| Other ETFs | 173 |

| Fund of funds investing overseas | 50 |

| Total Open Ended | 1321 |

| b) Close Ended Schemes | |

| Income/Debt Oriented Schemes | Number of Funds |

| Fixed Term Plan | 89 |

| Growth/Equity-Oriented Schemes | 1 |

| Infrastructure Debt Fund | 7 |

| Total Close-Ended Schemes | Number of Funds |

| ELSS | 19 |

| Other Equity Schemes | 4 |

| Total Close Ended Schemes | 120 |

| c) Interval Schemes | |

| Income/Debt Oriented Schemes | 12 |

| Total Mutual Funds in India | 1453 |

| Note – Data as pr 31st July 2023 AMFI Report | |

Number of AMCs increasing day by day and also the mutual funds. Hence, you have to be cautious in choosing mutual funds based on your requirements. Otherwise, you end up selecting the wrong product (especially if you concentrate too much on returns by neglecting the risk).