The US Bureau of Labor Statistics released the latest US inflation data last week (August 10, 2023) – Consumer Price Index Summary – which showed that overall monthly inflation to be 0.2 per cent and mostly driven by housing. And, once we understand how the housing component is calculated then there is every reason to believe that this major driver of the current inflation rate will weaken considerably in the coming months. The rent component in the CPI has been a strong influence on the overall inflation rate and that has been pushed up by the Federal Reserve rate hikes.

The US inflation situation – summary

The BLS published their latest monthly CPI yesterday which showed for July 2023 (seasonally adjusted):

- All Items CPI increased by 0.2 per cent over the month and 3.2 per cent over the year (up from 3 per cent in June).

- The peak monthly rise was 1.2 per cent in July 2022.

- The largest contributor was shelter (by some margin).

The BLS note that:

The index for shelter was by far the largest contributor to the monthly all items increase, accounting for over 90 percent of the increase, with the index for motor vehicle insurance also contributing.

Summary: The supply-side inflation that started this episode is now become a housing issue, which reflects poor policy design overall.

Energy prices, which previously was an important driver have fallen by 12.5 per cent over the 12 months to July.

Fuel is down 26.5 per cent over the 12 months.

The overall monthly increase was fairly moderate.

It is interesting that where municipalities have provided social housing opportunities (affordable housing), the housing inflation rates are much lower.

In the Bloomberg article (August 9, 2023) – First American City to Tame Inflation Owes Its Success to Affordable Housing – we read:

No place in the US has put inflation in the rearview mirror quite as fast as Minneapolis.

In May, the Twin Cities became the first major metropolitan area to see annual inflation fall below the Federal Reserve’s target of 2%. Its 1.8% pace of price increases was the lowest of any region that month …

Well before pandemic-related supply-chain snarls and labor shortages roiled the economy, the city of Minneapolis eliminated zoning that allowed only single-family homes and since 2018 has invested $320 million for rental assistance and subsidies …

The housing initiatives — including the Itasca Project, an alliance of the business, philanthropic and public sectors in the region pushing for at least 18,000 new housing units per year through 2030 — have picked up where the Fed’s monetary tightening leaves off, demonstrating the role state and local policies can play in curbing inflation.

So we see very clearly how insightful policy design can be very effective in eliminating supply bottlenecks that drive inflation.

While this blog post is about the US situation, there was an important event last Friday in Australia that follows on from the above comments about better ways to deal with inflation than the New Keynesian approach of suppressing fiscal investments in infrastructure (particularly accessible social housing) and relying on interest rate hikes to deal with inflationary pressures.

Quite clearly, when the pressures are being driven by supply factors or international factors, interest rate hikes are not an effective anti-inflation tool.

All the talk about fighting inflation by pushing unemployment rates up to the ‘mysterious’ NAIRU (which is core New Keynesian orthodoxy) is just a scam.

The central bankers have little idea of where the NAIRU is and have less idea about the ultimate net distributional impacts of the interest rate hikes.

They just hope and pray.

Last Friday (August 11, 2023), the outgoing RBA boss (he was effectively sacked by the Federal government – in the sense, he was not reappointed to a second term) attended his final meeting with the – House of Representatives Standing Committee on Economics.

In his – Opening Statement to the House of Representatives Standing Committee on Economics – he went through the usual hoops.

But in the Q&A session (full Transcript not yet available), the outgoing governor said that relying on interest rate hikes (a ‘blunt instrument’) was not the best way to deal with inflation.

He indicated there were a range of fiscal tools that could be put to better use:

… at a very high level, I still think there’s worth giving thought to coordination between monetary and fiscal policy …

His excuse for using the blunt hiking instrument was:

The reason that monetary policy has really been assigned to an independent central bank is it’s very difficult for the political class to do what we’re currently doing. That is, putting up interest rates …

Because monetary policy is blunt and … it’s uneven, and some people think that it’s unfair, and I understand where people are coming from.

In principle, I think there is a better way of doing it, but it’s hard because of the governance issues and the fact that you can be unpopular, very unpopular, when constraining the economy.

But he admitted that his policy decisions had inflicted significant pain on low income families but claimed that it was easier for him to be unpopular than the “political class”.

Why?

In his words because the:

… central bank … doesn’t have to worry about being re-elected and being popular,

But he also noted that in some Asian countries demonstrate “closer cooperation between fiscal authorities and the central bank.”

He didn’t mention Japan, but that cooperation and willingness not to follow the rate-hiking Western consensus is apparent in the way the Bank of Japan and the Ministry of Finance there have produced a much fairer and more effective counter to the supply-side factors driving the current inflationary pressures.

Unfortunately, the House of Representatives Committee members did not tease this out further.

But it was clearly an admission that as a result of the elected government not being insightful enough to use fiscal policy in any other way than to eulogise surplus creation, the central bank was forced to use the only tool it has, not matter how unfair and ineffective that might be.

As a professional economist, and reading between the lines, I interpreted his input as a recognition that New Keynesian macroeconomics is bereft and unfit for purpose.

Nothing new there.

Unfortunately, the Committee also did not question the governor on the role the RBA is playing itself in pushing the inflationary pressures on even as the initial driving factors have abated.

We are seeing clear evidence now that interest rate hikes are inflationary themselves, which further demonstrates the poverty of the current state of orthodox macroeconomics.

Current data release

Anyway, back to the current data release.

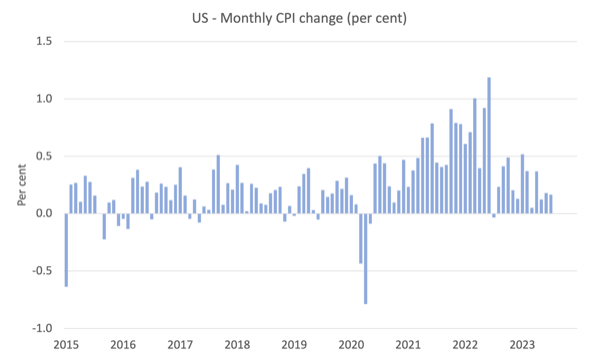

The first graph shows the evolution of the monthly inflation rate since the beginning of 2015.

Even with the housing situation, the overall situation is now contained largely because energy prices have fallen so much.

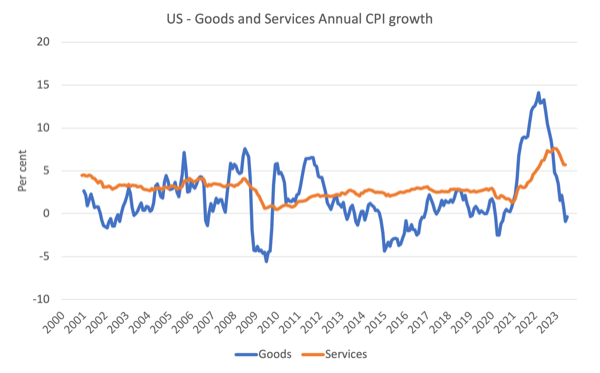

The next graph shows the evolution of annual price rises for the goods sector and for the services sector since 2000 – up to July 2023.

The contention always has been that the inflation has been largely driven and instigated by the supply factors that constrained the ability of the economy to meet demand for goods – the Covid factory and shipping disruptions and the like.

The graph shows clearly that those factors have been in retreat since the second-half of 2022 as the supply chain constraints ease.

The services sector, which is derivative of the supply drivers, lagged behind the goods sector and while still recording higher inflation that the goods sector, now has peaked and is also on the way down.

The goods time series has now recorded monthly deflation for the last two consecutive months.

The other point to note (which is referred to above) is that rental inflation has been an important component of the overall inflatino story.

There are two aspects that are relevant.

First, this is one component that is being driven by Federal Reserve Bank interest rate hikes.

In a fairly tight rental market, the landlords who face higher mortgage costs can easily pass the rate hikes on as increases in rents.

And that is the one conduit through which the central bank actually causes inflation in its efforts to quell it.

But, second, there is an interesting part of the way the BLS measure the rental component, which tells me that the inflation rate in the US is going to fall fairly quickly.

The rental vacancy rate, which measures the proportion of the rental inventory that is vacant for rent has risen since the end of 2021 from 5.6 to 6.3 per cent in the June-quarter 2023 (Source).

The other point to note is that the BLS measures the price changes in rental leases in such a way that a ‘vintage’ of price effects is captured by the monthly measure – that is, the monthly posted result includes new rental leases plus past leases

As a result, there is a lagged effect operating and as new rental leases decline in $ amounts, the overall series declines more slowly.

This BLS Spotlight on Statistics information page – Housing Leases in the U.S. Rental Market – provides more detailed explanations of all this.

It takes about 12 months for the series to reflect what is happening now with respect to new rental leases in the current CPI result.

And we know that rents on new leases are declining.

Data from Zillow (August 10, 2023) – Headline Inflation Increased Less Than Expected In July, Keeping A Lid On Rising Treasury Yields And Mortgage Rates – reveals that:

While core inflation remains high when compared to the Federal Reserve’s target, and shelter costs are still the largest contributor to the core CPI monthly gain, the rent components of the consumer price index are expected to continue to move lower. This is because rent increases have already fallen much more than what is reflected in the CPI calculation. Annual growth of the Zillow Observed Rent Index (or ZORI) – a measure of market rent – has fallen to 3.6% from a peak of 16% in February 2022.

So we can expect the housing component of the US CPI to fall in the coming months and the overall inflation rate to drop sharply.

Conclusion

The inflation is burning out pretty quickly.

My conclusion is that this transitory inflationary episode is about over.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.