If you are an employee of a company, at the beginning of every financial year (or) while joining the company you have to submit ‘Income Tax Declaration’ to your employer. This is a provisional statement that has details about your proposed investments and expenses that are Income Tax deductible.

At the end of the financial year, you need to provide supporting Investment Proofs for these investments that you have specified in IT declaration form. (Most of the employers generally ask for investment declaration or proofs during the third or fourth quarters of a financial year.)

Based on your proposed investments and expenses, your employer deducts TDS (Tax Deduction at Source, if any) from your monthly salary and deposits it to the government account. To calculate TDS, your employer considers the declared investments and expenses that are either Tax Exempted (or) eligible for tax deductions under Income Tax Act.

Related Article : TDS deducted by Employer but not Deposited? How to check TDS details online?

You need to submit both IT investment declaration and Investment proofs (documents) to your employer (IPSF – Investment Proof Submission Form). If you do not submit the required investment proofs by the financial year end, your employer will then be forced to deduct complete tax without considering your provisional investments (IT Declaration).

The Income Tax Department has also issued a circular and made it very clear to all the employers to verify the genuineness of each claim made by the employee. So, the verification of investment proofs has been more stringent by the employers over the last few years.

In this post let’s understand – What is Form 12BB Investment declaration form? What are the different Investment proofs you can submit to claim tax deductions and exemptions for FY 2023-24? When is the last date to submit investment proof documents for FY 2023-24 (AY 2024-25)?

What is Form 12BB Investment Declaration Form?

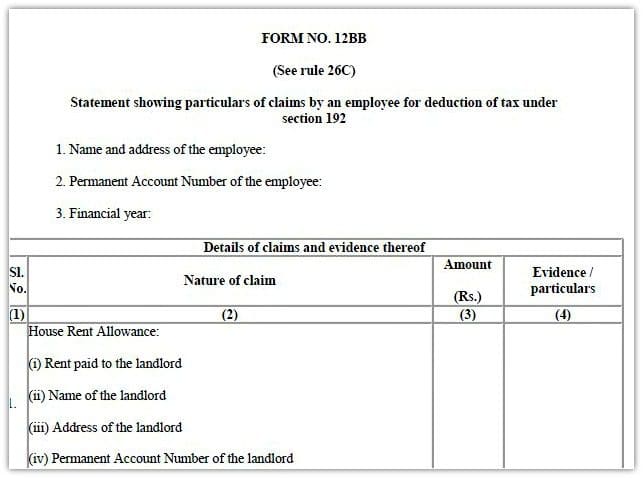

Form 12BB is a statement of claims by an employee for the purpose of income tax deduction, claiming tax benefits, or a tax rebate on investments and expenses, which has to be submitted by the end of the financial year.

Below is the standard Form 12BB. Click on the image to download Form 12BB.

House Rent Allowance : House Rent Allowance is exempt under section 10 (13A) of the Income Tax Act. To claim HRA, you have to provide documentary evidence i.e., Rent receipts. You also have to provide details of landlord (name & address) and the amount paid as rent. Permanent Account Number (PAN) of the landlord shall be furnished if the aggregate rent paid during the year exceeds one lakh rupees.

Leave Travel Allowance : With effective from 1st June, 2016, the CBDT has made it mandatory for all the salaried employees to submit travel related expenditure proofs to their employers.

A Salaried individual can now claim standard deduction of Rs 50,000 and not the transport and medical allowance. This deduction is available without any receipt or any documentary proof.

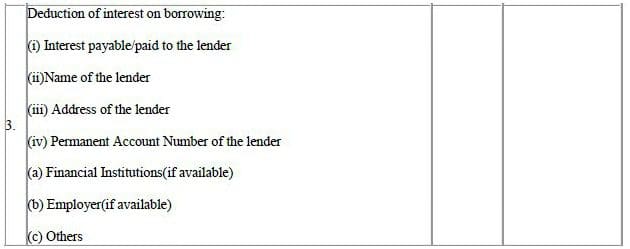

Interest Payments on Home Loans: To claim income tax deduction under section 24 on home loan interest payments, you have to furnish details of interest amount payable/paid, lender’s name & address & PAN number of the lender in Form 12BB.

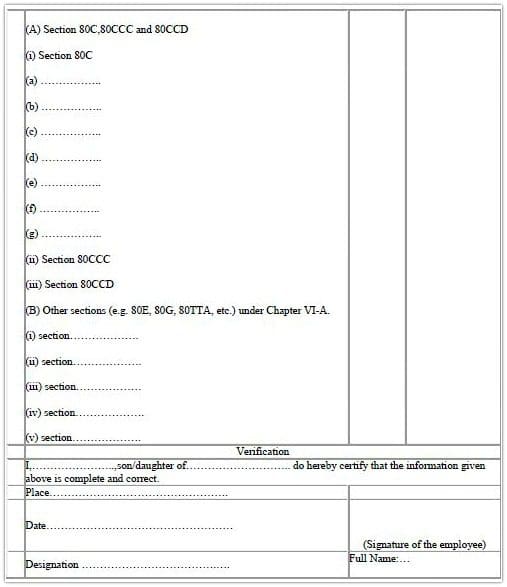

Income Tax Deductions under Chapter VI -A: You have to provide the details & evidence of your investments or expenditures related to various sections like 80C, 80CCC, 80CCD, 80D (medical insurance premium), 80E (deduction of interest on education loan), 80G (donations), Section 80EE etc., in Form 12BB.

The CBDT has advised the employers to assess the evidence submitted by their employees and then accordingly decide the extent of tax that should be deducted at source from their salaries.

“Form 12BB does not have to be submitted to the tax department. It has to be submitted to your employer.“

Income Tax Deductions & Exemptions under New Tax Regime

Individuals opting to pay tax under the new proposed lower personal income tax regime will have to forgo almost all tax breaks that you have been claiming in the old tax structure.

Let’s first have a look at all the tax deductions and/or exemptions that are not available under the new tax regime for FY 2023-24;

- The most commonly claimed deductions under section 80C will go.

- Section 80C deductions claimed for provident fund contributions, life insurance premium, school tuition fee for children and various specified investments such as ELSS, NPS, PPF cannot be availed.

- House rent allowance

- Leave Travel Allowance

- Deduction available under section 80TTA (Deduction in respect of Interest on deposits in savings account) and 80TTB (Deduction in respect of Interest on deposits to senior citizens).

- Interest paid on housing loan taken (Section 24).

- Under the new tax regime, set-off & carry forward of loss under Income from House Property is not allowed. However, you can still use it to nullify rental income from a let-out property.

- The deduction claimed for medical insurance premium under section 80D will also not be claimable.

- Tax break on interest paid on education loan will not be claimable-section 80E.

- Tax break on donations to charitable institutions available under section 80G will not be available.

So, all deductions under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc.) will not be claimable by those opting for the new tax regime.

Below is the comparison table to get an overall idea of all the important tax exemptions and deductions available under the old and/or new tax regimes for Financial Year 2023-24 (AY 2024-25).

| Deduction (or) Exemption | Old Tax Regime | New Tax Regime |

|---|---|---|

| Standard Deduction of Rs 50,000 | Yes | Yes |

| HRA Allowance | Yes | No |

| Rebate u/s 87A (upto Rs 25,000 in new tax regime) | Yes | Yes |

| Professional Tax | Yes | No |

| Interest on Home loan u/s 24B on Self-occupied property | Yes | No |

| Interest on Home Loan u/s 24b on let-out property | Yes | Yes |

| Chapter VI A Deductions (80c, 80CCC, 80CCD, 80D, 80E, 80G etc.) | Yes | No |

| Deduction u/Sec 80CCD(1B) of Up to Rs. 50,000 | Yes | No |

| Employees Contribution to NPS/EPF (Sec 80CCD-2) | Yes | No |

| Employer’s Contribution to NPS | Yes | Yes |

| Bank Account Interest Sec 80TTA & 80TTB | Yes | No |

| Gratuity Benefit | Yes | Yes |

| Leave Encashment Benefit | Yes | Yes |

| Section 54 (Reinvestment of Long-Term Capital Gains) | Yes | Yes |

Income Tax Deductions & Deductible Allowances – Investment Proof Submission FY 2023-24 / AY 2024-25

The above table gives you an idea on the list of deductions and exemptions that you can claim and accordingly you can submit respective investment proofs to your employer for FY 2023-24.

| Income Tax Section | Investment Proof Document | Tax Regime |

|---|---|---|

| Section 80C | * Life Insurance Premium Receipts * Mutual Fund ELSS Statement * PPF Passbook Copy * EPF Statement * NPS Account Statement * NSC Certificate * Home Loan Statement (Principal repayment) * Tuition Fee Receipts * Tax Saving Fixed Deposit Receipts * Sukanya Samriddhi Account Passbook * Senior Citizen Savings Account Passbook * Property Stamp duty & Registration Fees |

Old |

| Section 80D | Health Insurance Premium Receipts (Self, Spouse or Parents) | Old |

| Section 80DD | Form No 10IA | Old |

| Section 80E | Education Loan Statement | Old |

| Section 80G | Donation Receipts | Old |

| Section 80TTA & (B) | Bank/Post Office/Deposits Statements | Old |

| Section 24B | Home Loan Statement / Certificate (Self-occupied Property) | Old |

| Section 24B | Home Loan Statement / Certificate (Let-out Property) | Old & New |

| Section 10(5) – LTA | Travel Tickets, Hotel bills, Taxi receipts etc | Old |

| Section 10(13A) – HRA | Rent Receipts / Rental Agreement | Old |

| Section 80CCD – NPS | NPS Passbook/Statement | Old |

| Section 80CCD (2) – NPS | NPS Passbook/Satement | Old & New |

- Life Insurance Policy can be in the name of Self, Spouse or children.

- Stamp Duty – You must claim the tax benefits in the same financial year in which you have paid the stamp duty charges. To claim this tax benefit, you must not sell the property in its lock-in period, which is five years. If you sell the property before five years, this tax benefit is reversed, and the deduction claimed earlier will be payable.

- Health Insurance premium paid for self, spouse, children or parents can be claimed as tax deduction u/s 80D.

- Tuition Fees – If both parents are taxpayers, then they can claim deductions for 4 children. An individual taxpayers cannot claim the fee paid towards educating more than 2 children as 80C deduction.

- Education Loan –

- The tax benefit can be claimed by either the parent or the child (student), depending on who repays the education loan to start claiming this deduction. This tax deduction is available only on taking an education loan from financial institutions, not from family members, friends, and relatives.

- To avail of tax benefits, an education loan should be taken for the higher education of yourself, your spouse, dependent children, or the student to whom you are the legal guardian.

- HRA (Rent allowance) – Documents like rent receipts and rental agreements will be required to be submitted to the employer for claiming the deduction for the house rent allowance. If the payment of rent is more than Rs 1 lakh per annum, then the PAN of the house owner will be required to be submitted.

Important Points on Investment Declaration & Proof Submission

- Be clear on the type of Tax regime that you are going to opt for. This gives you a fair idea about the possible tax deductions and exemptions that you can claim for the respective financial year.

- The last date to submit Investment proofs will be intimated to you by your employer.

- To safeguard the interest of the organization, your employer has the right to define the verification guidelines and more controls in addition to the income tax rules.

- While submitting the proofs, make sure you only provide real bills/receipts, as giving fake proof can land you in trouble with the tax department. You could end up with a tax notice for under-reporting of income.

- Kindly note that there is no need to submit copies or originals of your investment proofs to the IT department.

- It is advisable to keep copies of all your original documents for your future reference.

- If you join a new company during the middle of the Financial Year, do inform them about your previous income details and also submit fresh Income Tax declaration.

- If your SIP or life insurance premium due date is say in the month of March and the last date to submit investment proofs is say in January, you can provide a declaration that you are going to make these investments in March. You can also submit previous year’s documents that are related to these investments.

- In case, if your declared investment amount is more than your actual investments, you have to pay additional taxes while filing your Income Tax Return (or) your company may re-calculate your tax liability and can deduct taxes accordingly for the months of January to March.

- In case, if your declared amount is less than your actual investments, your company might have deducted higher TDS. So, you can claim this as ‘refund‘ while filing your taxes.

- If you are falling short of your projected declared amount, you can plan your investments by the end of financial year.

- Even if you miss the deadline for submitting the investment proofs, you can still claim all the tax deductions (except Leave Travel Allowance) while filing your Income Tax Return.

- It is prudent to avoid last minute tax planning. Do not invest in unwanted life insurance policies or in any other financial products just to save taxes. It is better you plan your taxes based on your financial goals at the beginning of the Financial Year itself.

(Invitation to join our Telegram Channel..click here..)

Continue reading :

(Post first published on : 16-Aug-2023)