RBI launched a website UDGAM (Unclaimed Deposits – Gateway to Access inforMation) to search or check unclaimed deposits online of all banks at one place.

What is an unclaimed deposit?

The balances in your savings or current accounts which are not been operated for 10 years, or term deposits not claimed within 10 years from the date of maturity are classified as ‘Unclaimed Deposits’. Banks have to report this amount to the RBI. Then banks will transfer this amount to Depositor Education and Awareness Fund (DEAF).

“As per information available with the Reserve Bank of India (RBI), as at the end of February 2023, the total amount of unclaimed deposits transferred to RBI by Public Sector Banks (PSBs) in respect of deposits which have not been operated for 10 years or more, was R,35,012 crore,” Minister of State in the Finance Ministry Bhagwat Karad said in a written response.

Unclaimed deposits, which are 10 years or more, in the public sector banks, have grown by over 70% between December 2020 and February 2023 and more than doubled when compared with end of December 2019 data.

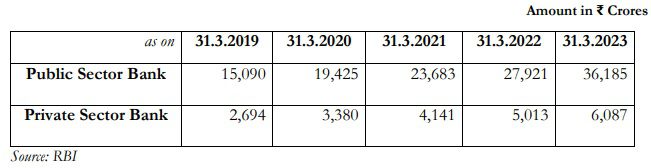

Below is the latest data on the unclaimed deposits both by the public sector and private sector.

All banks have to disclose the unclaimed deposits available to them. Customers can visit the branch of the Bank with the request letter (in the given format) and submit valid proof of identity, address & latest photograph. On verification of the same branch shall convert the account into an Operative category and allow transactions in the account.

RBI will fix the interest to be payable on such unclaimed deposits. Ideally, it is simple interest but not a compound interest.

For savings account, the applicable savings account will be payable until the account will be converted into unclaimed money. Once it is transferred to Depositor Education and Awareness Fund (DEAF), then the rate that RBI will fix is payable.

For fixed deposits, from the date of maturity till the transfer to DEAF, the customer will be eligible for interest for the overdue period as per the prevailing savings account rate. Once it is transferred to Depositor Education and Awareness Fund (DEAF), then the rate that RBI will fix is payable.

Currently, all the banks are advised to calculate the interest payable on interest-bearing deposits transferred to RBI at the rate of 4% a year up to 30th June 2018, 3.5% from 1st July 2018 to 10th May 2021, and 3% with effect from 11th May 11, 2021, till the time of payment to the depositor/claimant, the RBI.

UDGAM – Check Unclaimed Deposit Online

The issue with the current system is that there was no centralized portal where one can check unclaimed deposits online. Instead, depositors or account holders have to check with individual banks. This seems cumbersome and in many cases due to the merger of the banks, few may forget forever with which bank they have accounts or deposits. Hence, to streamline this process, RBI launched a single online platform called UDGAM.

Currently, users would be able to access the details of their unclaimed deposits in six banks available on the portal. These banks include the State Bank of India, Punjab National Bank, Central Bank of India, Dhanlaxmi Bank Ltd, South Indian Bank Ltd, and DBS Bank India Ltd.

However, going forward all the banks are available in the UDGAM portal.

How to check unclaimed deposits online using the UDGAM portal?

1) Visit the UDGAM portal.

2) It will ask for login or registration.

Enter your phone number, name and create your own password. You will get the OTP to your provided number. Once you enter the OTP and verify, then you are registered with the portal.

3) Once you successfully created the login, then you can operate the portal by login to search for any unclaimed deposits.

The search criteria are too simple. You have to enter the account holders name (as per the bank records), choose a bank from the dropdown (if you know the bank), or select all options, and you have to provide a minimum of one input to the information asked (PAN, Voter ID, driving license number, passport number or date of birth. You may choose additional search criteria also like the address (permanent or correspondence address).

Then the result will display the unclaimed deposits. There is an option to select individuals and non-individuals also.

How to avoid the risk of unclaimed deposits?

To avoid your money being moved to unclaimed deposits, it is better to follow the below steps.

1) Make sure your bank accounts and deposits have a proper nomination. If not, then immediately take a step to nominate. Also, the nomination is one process. Informing the person whom you nominated is also important.

2) Share the available savings accounts and bank deposit details with your family.

3) Update the KYC regularly to make sure that you receive the information from the bank through SMS, email, or to your address.

4) Avoid having too many bank accounts. Keep it simple like one your salary credit account and if possible one permanent bank account in which you do all your transactions or investments. In my view, having more than 2-3 bank accounts is risky.

5) Make sure to have fixed deposit reference numbers (if you booked online) or receipts in a secured place and as usual share this information with the family members.

Conclusion – This is a wonderful initiative by RBI. But we have to spread this awareness so that the unclaimed deposit should reach to the account holders.