My wife and I have two kids—ages six and four. We’ve put some money aside for them, but how can we really know how much to save for college?

- The cost of college is going up every year—how do we know what tuition will be in the distant future?

- We have money invested in a 529—but how much will it grow in the next 12 years?

- We think we should probably invest more each month—but we’re basically throwing money at it blindly. It’s really an uneasy feeling.

When I dug into this a bit more, I realized we’re not alone—many other people are searching for the exact same thing, whether they call it “Child plan calculator”, “College fund for baby calculator”, or even a strangely phrased “How much should I save for college calculator?”.

In this post, we’ll tackle these issues and then some—

- How to estimate the future cost of college (based on the average rate of inflation).

- How to figure out how much to save per month for college.

- The 529 rates of return (how much your college investment should earn).

- Tips to better plan and save for college.

Searching For The Best College Saving Calculator

Is there a college savings calculator that can tell us if we’re saving enough? (And if we’re not—how much do we need to invest each month so we will have enough?)

There are some college calculators online, but most are just too complex—and they usually end up asking for your email address so they can spam you for life.

It shouldn’t be like this.

That’s why we built a free college savings calculator in Excel that you can download and call your own. (No strings attached. Sneak peek below.)

But let’s take a step back here—

Before we plunk numbers into an Excel file, you’ll want to see how the file works (and if there’s anything you’d like to change based on where you live and how you’re investing).

How to Calculate the Future Cost of College

When researching the topic, I noticed people are first searching for a “future college cost calculator”—but this isn’t necessary.

All we need to know is how much college costs have been inflating (over the last decade or so)—and then assume that tuition costs will continue to rise at the same rate. We’ll then take this rate and plunk it into the college savings estimator.

The tool will do the rest. (We’ll get to this later in the article.)

The historical inflation rate of college tuition

Education Data says college tuition inflated each year by 4.63% from 2010 to 2020. (The average in-state tuition rose from $7,132 to $9,375 during that time.)

You may not believe it, but the tuition inflation rates have been slowing down:

|

Decade |

College Tuition Annual Inflation Rate |

|

2010s |

4.63% |

|

2000s |

6.99% |

|

1990s |

7.31% |

|

1980s |

12.4% |

|

1970s |

6.90% |

And the slowing trend continued into the 2022-23 school year, with tuition increases of just 1.8%. (Public in-state tuition averaged $10,940 in 2022.)

Tuition cost forecasts

Tuition costs have historically risen at a higher rate than general inflation each year (roughly two percentage points higher). So if the general cost of goods inflates by 4% in a year, you can expect tuition to rise by 6%.

So what can we expect in the future?

- Inflation was 6.5% at the end of 2022.

- It’s expected to drop to 3.2% by the end of 2023.

- And beyond that, the Federal Reserve is targeting a 2% to 2.5% rate of inflation each year.

Given the estimates above, we can assume an average future inflation rate of roughly 3% (which is equivalent to the long-term historical average).

With tuition rising two percentage points higher than general inflation, we can assume that college costs will increase by 5% per year.

The Expected 529 Rates of Return

If you’re investing for your child’s future, you’re likely doing it with a 529 or an ESA (Coverdell Education Savings Account).

The ESA vs. 529 Plan

The ESA and 529 use after-tax contributions, and any growth on your investments is tax-free (as long as you use the money for qualifying educational expenses like tuition, a computer, books, or room and board).

But the ESA is a more archaic savings option with more restrictions around contributions and withdrawals—so many choose the simpler and more current 529 option.

Since the 529 is the college savings tool of choice today, we’ll focus only on it for the rest of this post.

Projected 529 rate of return

How can you estimate 529 growth? As you may have expected, this answer isn’t so simple.

When you open a 529, you likely have a dozen options across multiple categories—all with different rates of return:

- Prepaid tuition plans—where you essentially buy college credits at today’s price.

- Age-based portfolio—where your investment becomes “safer” with a greater mix of bonds as your child grows older.

- Customized portfolio—where you can choose any combination of investments, from a simple savings account to an aggressive growth portfolio.

Prepaid tuition plan

With this option, you’ll essentially “earn” the equivalent of the tuition inflation rate since you’re just prepaying for college credits. Based on our estimates earlier in this post, this will be roughly 5% per year.

It’s more of a guaranteed return, but you could likely do better with the options below.

Age-based portfolio

With the age-based portfolio, you simply choose the year your child was born, and your 529 will take care of the rest.

Your funds will then be invested in a mixture of US equities, foreign stock, and bonds—with a higher mix of bonds the closer your child gets to college age.

Depending on the brokerage you go through, you may also have the option to invest in managed funds (that try to beat the overall stock market returns) or index funds (which have lower fees and model the overall stock market).

Over the last ten years, many age-based portfolios have returned between 8% and 9% annual earnings.

You’ve probably heard the phrase, “Past performance is not an indicator of future performance.” It holds true here and throughout the rest of this post. In the last ten years, the stock market has performed well—the future may not yield the same return.

Customized portfolio

With the customized approach, you’ll be able to mix and match investment options like these below (with the approximate historical returns of similar funds):

- Savings Account: 0.5%

- Stable Fund (bond investments): 1%–2%

- Sustainable Fund: 6%

- Treasury Index: 3%

- International Index: 4%–5%

- Total Market Index: 12%

- 500 Index (models the S&P 500): 12.5%

- Conservative Growth: 1%

- Moderate Growth: 7%

- Aggressive Growth: 9%

- Age-based funds: varies based on the fund and your child’s age.

With the customized approach, you could earn nearly nothing or achieve what the market yields by investing in an index like the 500 Index or the Total Market Index.

Simple Index Investing

I’m a big believer in simplicity—especially with investing.

I’m with JL Collins when he says,

“I don’t favor indexing just because it is easier, although it is. Or because it is simpler, although it is that too. I favor it because it is more effective and more powerful in building wealth than the alternatives.”

By investing in an S&P 500 index fund, you’re essentially taking part ownership in the 500 top companies in the US.

The entire market could go down, but you’re unlikely to lose 50% or more of your money. More likely, you’ll earn money over time—not lose it.

From 2002 to 2022, the S&P 500 averaged an 8% return (and this included the dreadful 2008 recession).

Personally, I don’t mess with age-based funds or mutual funds that supposedly beat the market. I’m putting all our 529 funds into an S&P 500 index fund instead. It’s worked so far—and based on all my reading on the topic, I trust it’ll continue to work in the future.

As for you—choose what you think is best.

I’m banking on the fact that the S&P 500 will earn me an average of at least 8% per year.

How Do You Know How Much to Save For College?

We’ve got a few of our variables figured out now.

- The cost of college will probably increase by roughly 5% per year.

- Investing in an S&P 500 index fund (in your 529) will probably earn you 8% per year.

Okay, so your money is going up by 8%, but it’s facing a 5% headwind of inflation. What do we do with these numbers now?

Enter the 529 Investment Calculator—

Click here for your free download (you’ll see the file pop up in the bottom-left of your screen).

How to Use the College Savings Calculator Excel Tool

When you open up the calculator, you want to answer the main question you’ve had all along—

“Am I saving enough for college?”

So let’s get right to it.

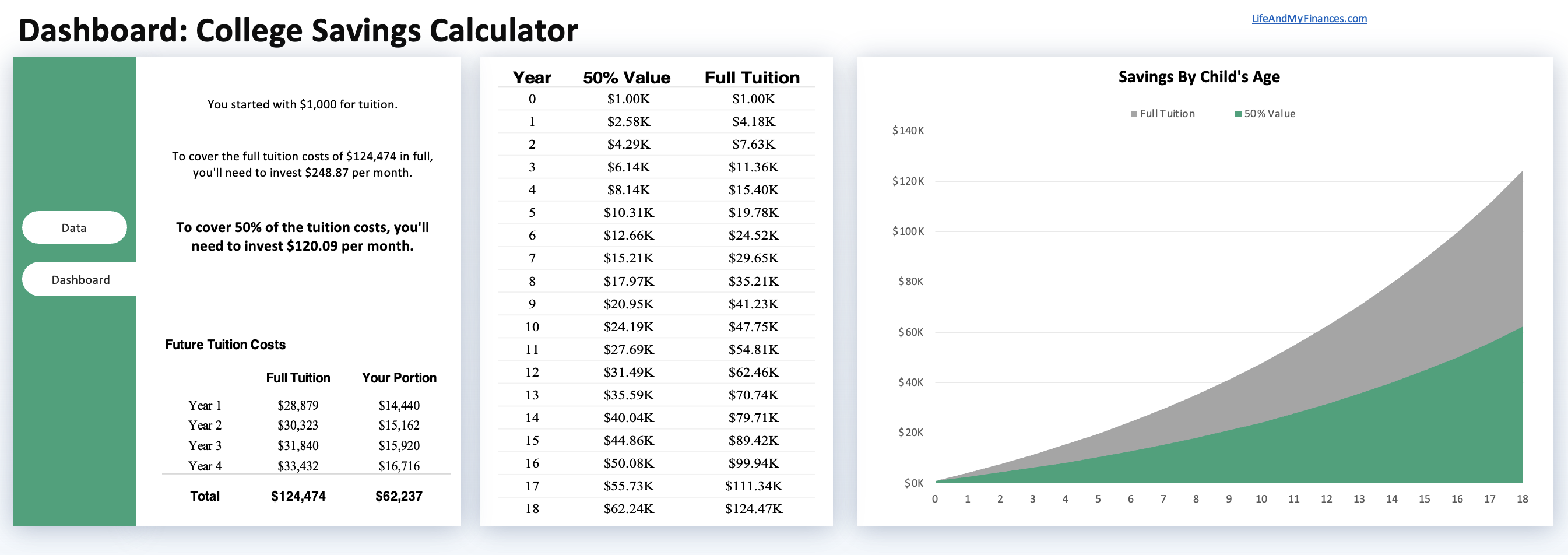

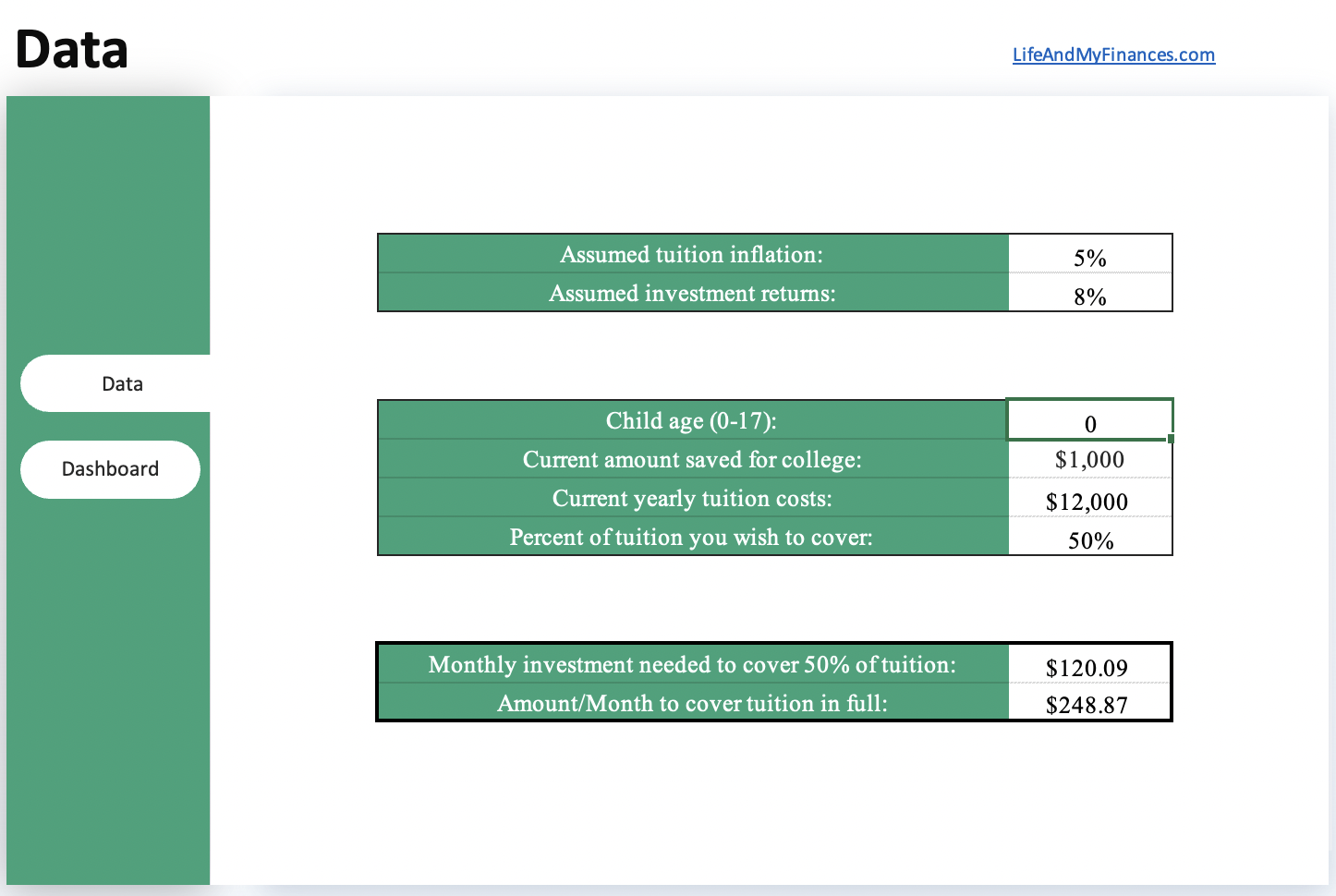

The 529 plan calculator should open up to the Data tab. This is where you’ll enter your inputs:

- The age of your child.

- The amount you have saved right now.

- The current annual cost of tuition.

- And what percentage of their schooling you’d like to cover.

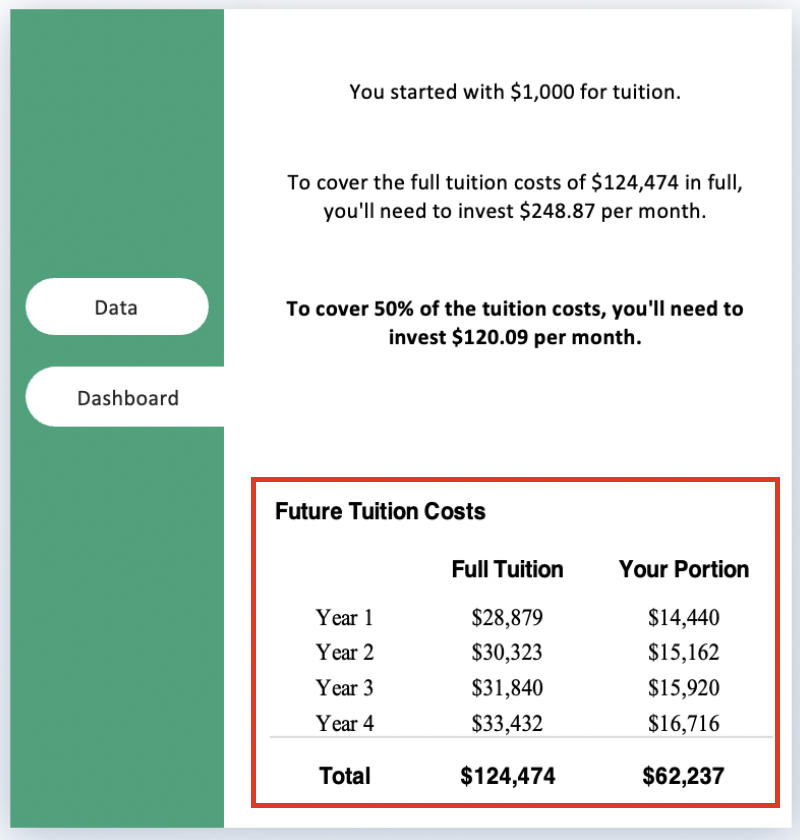

In the screenshot above:

- The child is a newborn.

- They’ve got $1,000 saved.

- Annual tuition is $12,000.

- And they’d like to pay for 50% of tuition when that time comes.

The assumed tuition inflation is at 5%, and the assumed investment returns are at 8%.

How much do these parents need to put into their 529 each month?

The 529 savings calculator makes it clear: $120.09.

(There’s actually more to this tool, by the way. Keep scrolling to see what else it can do.)

Are you saving enough for your child’s future tuition?

If you’re saving less than $120, the answer is no. Simple as that.

The Ultimate Saving for College Calculator

I love this tool—not just because my wife and I used it for our kids’ college investments, but because it can show you everything you need to know.

Saving for college is no longer a mystery (or a concern, for that matter).

Let me show you what I mean.

Let’s keep all the inputs the same—

- Newborn child

- $1,000 saved

- Current tuition of $12,000

- Plans to cover 50% of tuition

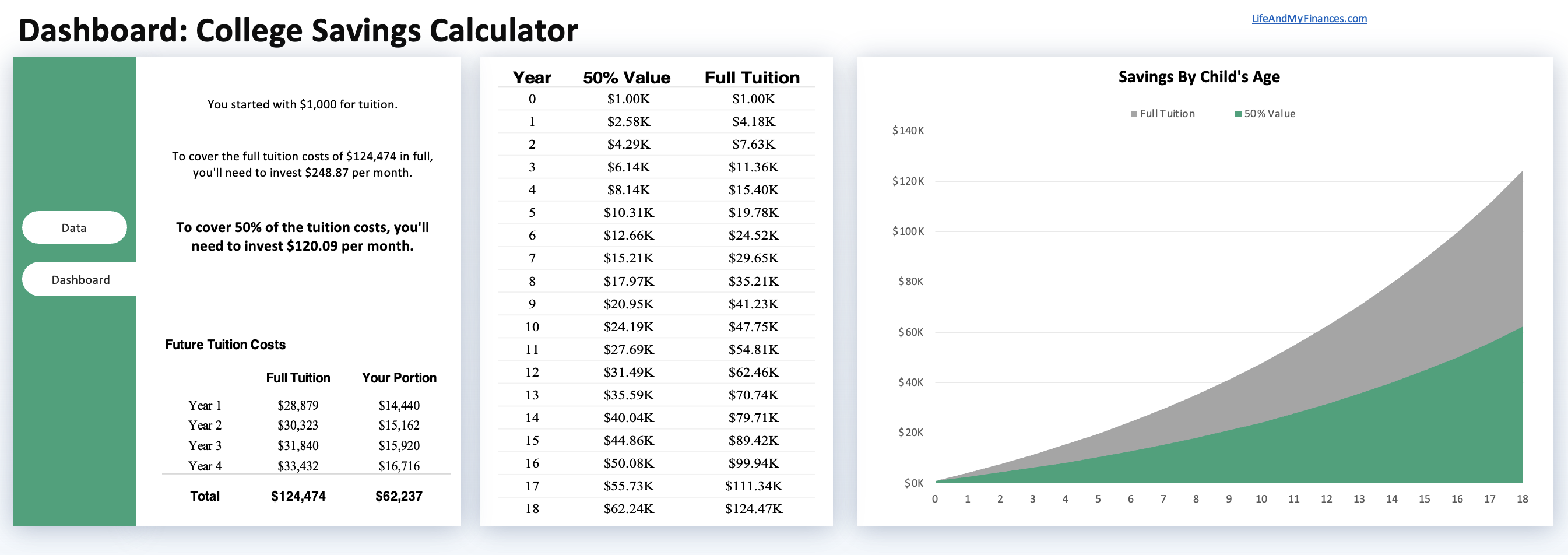

The Dashboard: 529 Plan Calculator

Check this out.

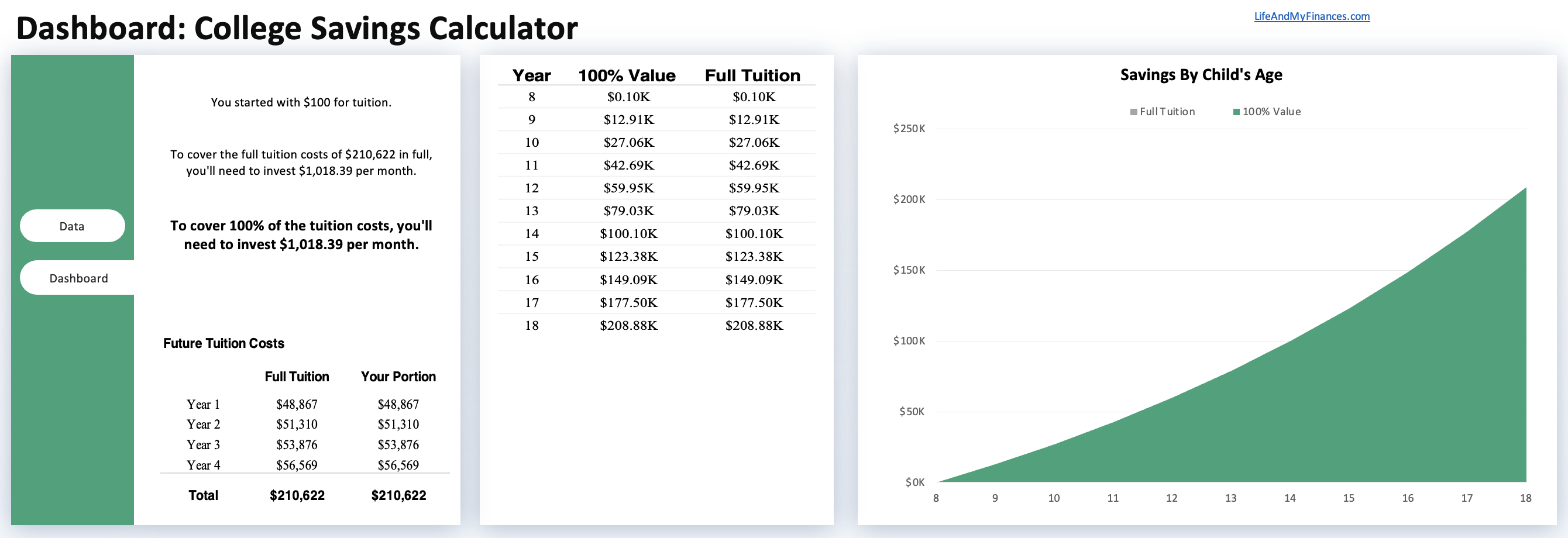

Below is the full dashboard of the 529 college savings calculator:

- The amount you need to invest each month.

- A table showing the four years of future tuition costs.

- A table showing how your investments will grow each year.

- And a chart—so you know what to expect with your investments.

(That image might be too small for you, so let me quickly break it down.)

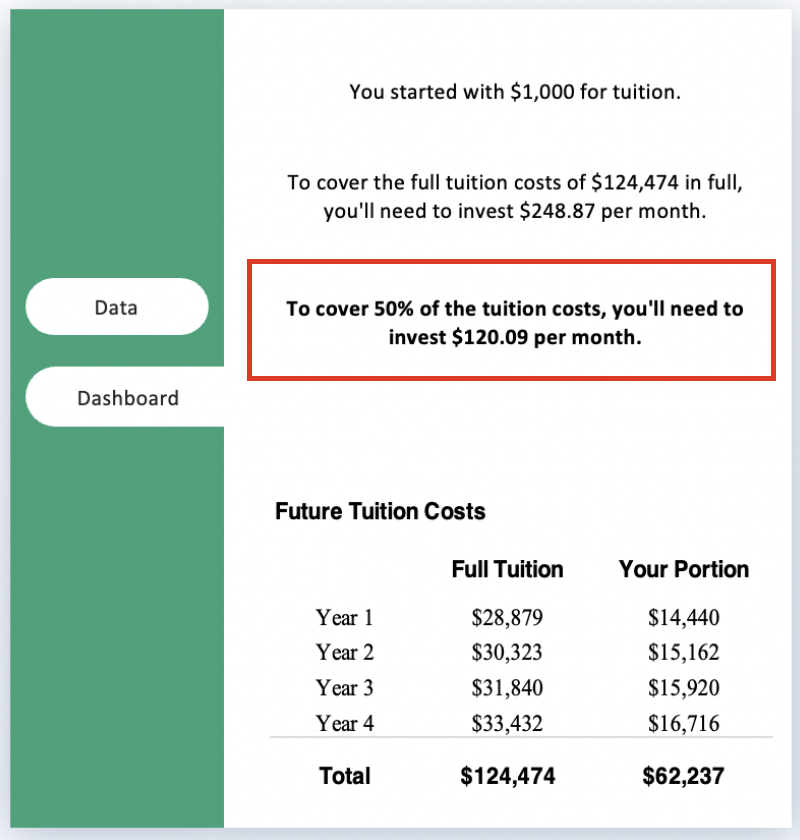

How much to save for college per month

You can find your answer in the data tab, but it’s also shown on the dashboard.

To reach your goal (in this example), you’ll need to invest $120.09 a month.

How much will tuition cost in the future?

How ridiculous will the cost of tuition be years from now? You’ll find that bordered in red below.

In this example, tuition jumps from $12,000 to $30,000 a year over the course of 18 years.

Now you see why this free college savings plan calculator is so valuable.

What should your college investments total each year?

See the table below (in the middle of the dashboard).

In the center column, you’ll see how your initial investment grows into the amount you want to cover by the time they’re 18 years old.

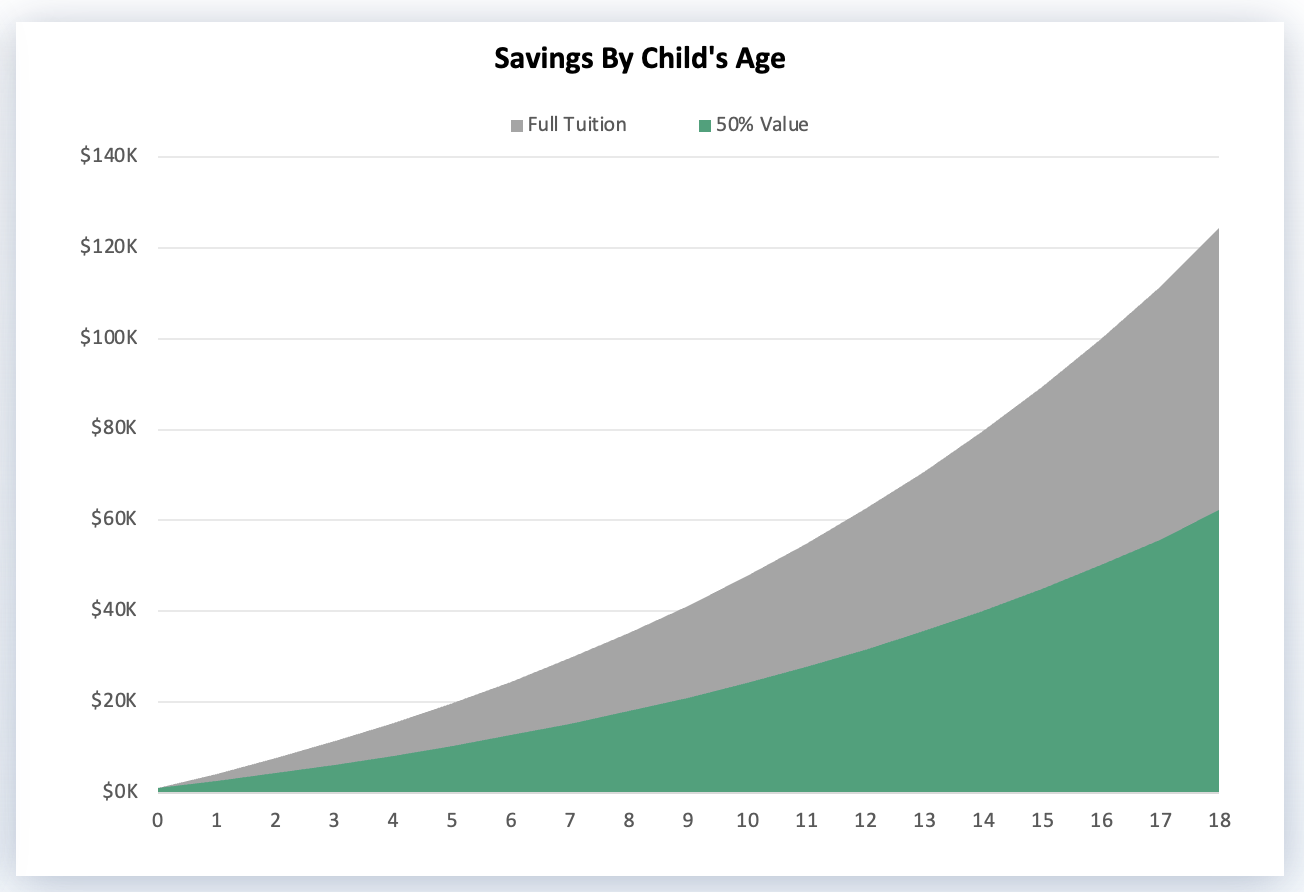

When saving for college, at what rate will your investments grow? What does it look like?

To provide yet another helpful visual, we included a graph of your growing college 529 investment. (Mind you, your savings won’t skyrocket immediately. They’re not supposed to—it takes time.)

The amount you intend to cover is in green. The gray trajectory is if you want your investments to cover the total cost of tuition.

College Fund Calculator: Another Quick Example

To ensure you understand the tool, let’s go through a very different example:

- Anna is eight years old.

- Mom and dad have just $100 saved.

- They want to cover 100% of the tuition.

- Current tuition costs are $30,000 a year.

- Mom and dad figure they can invest aggressively and earn 10% per year on their investments.

This is obviously going to require a higher monthly contribution.

Let’s see what the calculator tells us—

Four years of college will cost over $210,000 in ten years.

To save this much, Anna’s mom and dad will need to invest just over $1,000 per monthto make this happen (and that’s with an assumed 10% return on their investments).

How to Use the College Savings Calculator for Multiple Children

Have multiple children? No problem.

Just download the college savings calculator twice (here’s the link again).

Save one file for little Suzie and the other one for Billy Bob. (You’ll want to track them separately anyway, since each child will have their own 529 plan.)

Top Tips to Start Planning For College Costs

The 529 estimator is great, but what if the monthly savings number is mammoth?

What if you’re like the example above and find out you need to stash away $1,000 a month to pay for your kids’ college tuition?

It can be a tough pill to swallow but don’t give up—I’ve been there, done that, so I’ve got some ideas for you.

1) Write out your expenses

I was the cheapest guy on earth a few years back. I didn’t budget because I figured I couldn’t possibly spend less.

Then I wrote down my expenses for the first time and looked at them.

Boy, was I wrong—

I was overspending everywhere.

Step one to finding money is to write down your expenses and actually look at them.

2) Scour your expenses, cut back, and make your budget

Once you look at your expenses, you’ll quickly realize where you can save:

- Food costs

- Cell phone bills

- Insurance

- Amazon

These are the typical culprits. How much are you spending in these categories?

Here’s what I was able to save per month when I actually budgeted:

- Food: $200

- Insurance: $100

- Cell phone: $30

Still not sure how to put this all together? Need a helpful budget spreadsheet? For less than five bucks, you can have one of the best budget templates on the planet (if we do say so ourselves).

3) Make more money

If you can’t save your way to your goal number, you might need to make more money.

How can you do that?

- Ask for an increase at work (if you deserve it).

- Put in for a promotion.

- Look for a higher-paying job elsewhere.

- Start a side hustle.

(Here’s a great resource to help you earn an extra $1,000 a month.)

4) Change your expectations

Maybe you’re trying to get your child into an out-of-state school that costs three or four times the local university in your state.

Is it really 3x or 4x better? I doubt it.

If you can’t afford it, perhaps it’s time to change your plans.

5) Make a big change

If you absolutely don’t want to reduce your expectations, then you probably have some big life decisions to make.

There are other ways to save big money, but these options aren’t for everyone.

Here’s what I’m talking about:

- How many cars do you have? Two? What if you cut back to one?

- You could sell your car and invest that money into a 529.

- Then you’d save money on insurance, repairs, and gas—all that money could go into the 529 each month.

- How big is your house? Are you in a prime neighborhood? Do you really need to be?

- If you sold your home and moved into a middle-class neighborhood, you’d probably have a big chunk of equity that you could invest. (Put it into the college investment calculator and see how much that would help.)

- Cut back on that big annual vacation.

- Instead of spending $10,000 on that trip to the Caribbean, maybe you drive somewhere warm—and save $5,000 a year.

- Are your kids in private school? Maybe put them in public school and put the savings into their 529s.

6) Be honest and go for scholarships

Maybe there’s no way to do it.

Saving up $100,000+ for college just isn’t going to happen.

It’s time to be honest with your kids.

Want to know why? Maybe they can make it happen.

That’s what Kristina Ellis did.

When she was a young high schooler, her mom told her there just wasn’t money for college. At first, she was crushed. Then she started learning about scholarships.

She read every scholarship book at the library, studied stories about scholarship winners, and even interviewed people.

She earned—get this—$500,000 in scholarships.

That money fully funded her undergrad at Vanderbilt and her master’s degree at Belmont.

Just be honest. Maybe you don’t need to stash away thousands of dollars into a 529 after all.

Key Takeaways

The biggest takeaway: If you’re worried because you don’t know how much to save for tuition, use the tool and find out.

Not knowing and worrying is way worse than having the answer and not quite knowing what to do about it.

Then take action to hit your tuition savings goal:

- Get a clear picture of your expenses.

- Make a budget and cut costs.

- Earn more money.

- Be willing to make big changes.

- Perhaps cut back on your college expectations.

- Be real. Maybe you can’t save $1,000+ a month. (Perhaps scholarships are the answer. Or maybe something else entirely.)

Keep the problem in front of you, and your brain will likely find a solution.

FAQ

Can this tool be used as a MESP calculator?

MESP stands for Michigan Education Savings Plan—it’s a 529 plan for Michigan.

For those searching for a calculator, our college savings calculator would work perfectly with the MESP program.

I’m looking for a Coverdell ESA calculator. Will this tool work for that?

Yes! The ESA is an education savings account where you can invest funds for college.

Our college investment calculator can help you understand if you’re saving enough based on the rising cost of college and the assumed growth of your investments.