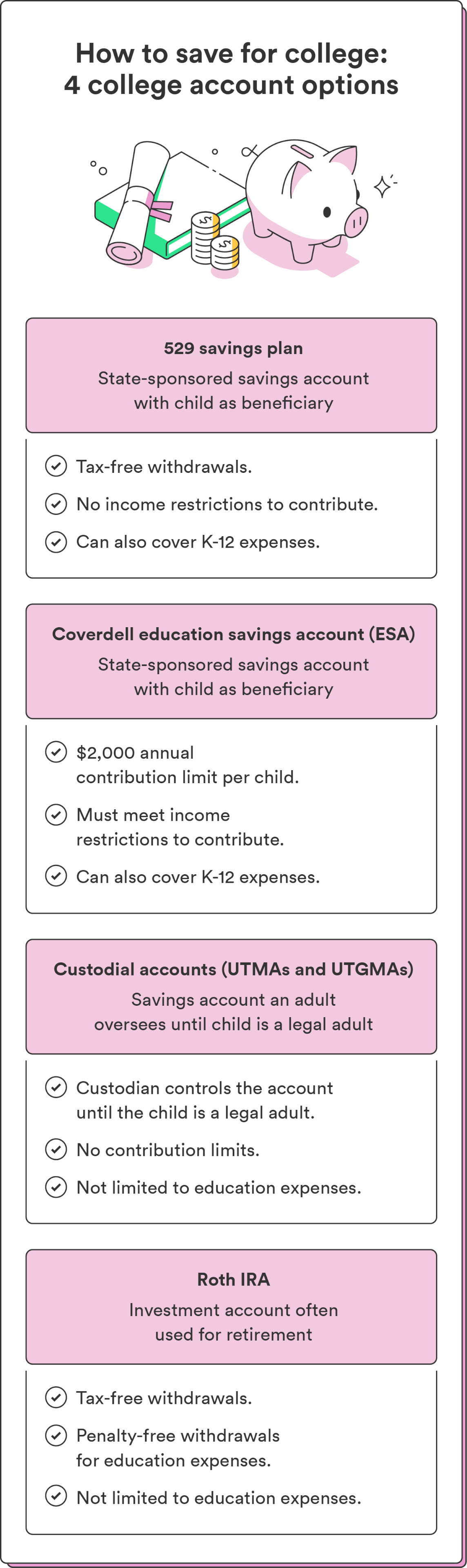

There are numerous ways to save for college, each with benefits and advantages. Below are some common college savings funds to consider.

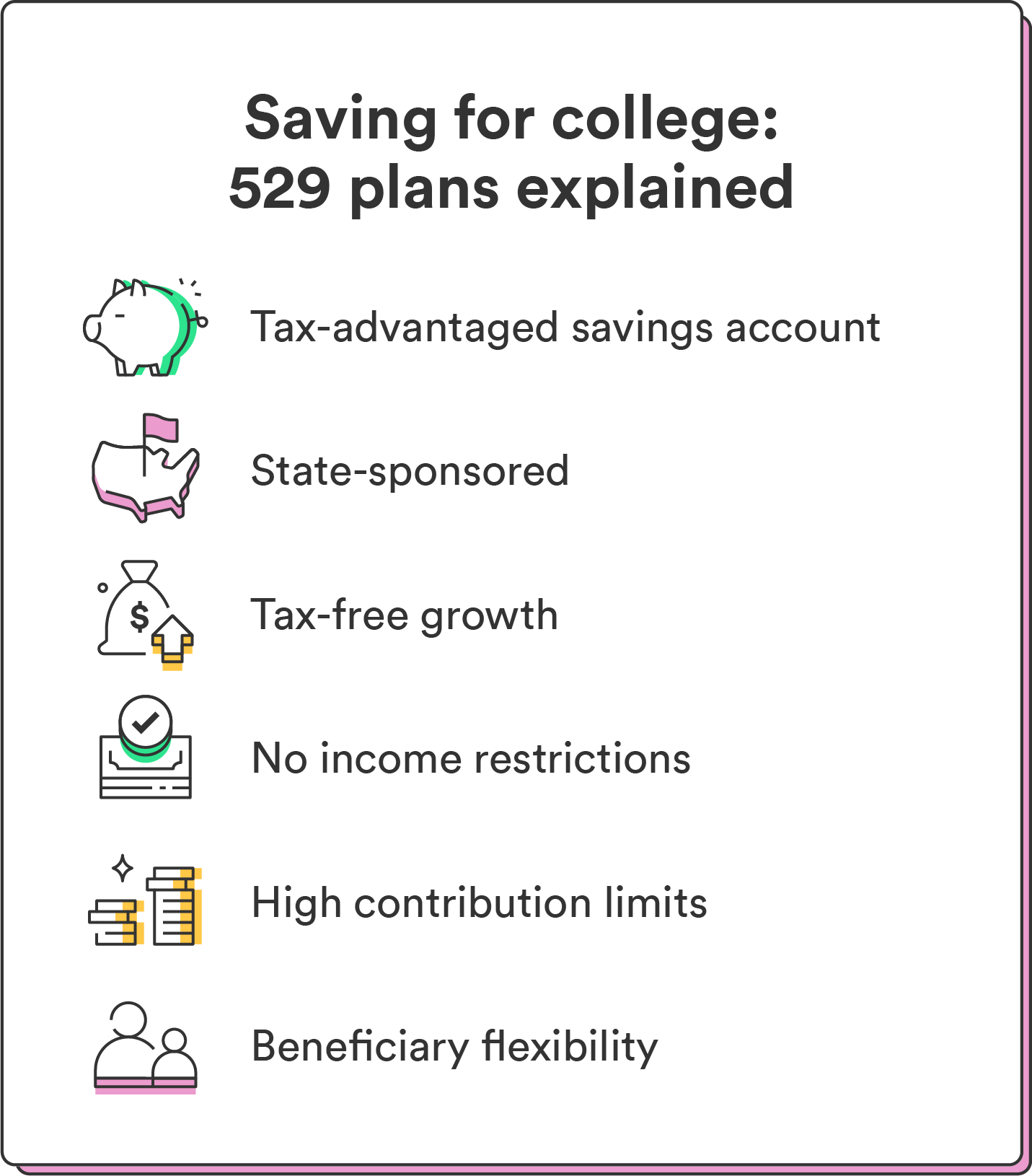

1. 529 plans

Best for: Individuals looking for tax-advantaged savings to cover higher education expenses for a designated beneficiary

A 529 plan is a type of tax-advantaged college savings fund. The earnings and withdrawals on your contributions grow tax-free for qualified educational expenses.² For a 529, that includes higher education or professional certificates and kindergarten through grade 12 education, making them a flexible fund option.²

The funds you put in a 529 go toward various investments, like mutual funds or ETFs. How they’re invested depends on the 529 plan you choose: a prepaid tuition plan or a savings plan.

In a prepaid tuition plan, the investments in your 529 fund are fixed, meaning you can’t adjust your portfolio once it’s set. This option is less flexible than the 529 savings plan, which lets you select your specific investments and change them as you please.³

529 plans generally have high contribution limits, but the exact limit varies by state. Check your state’s 529 limits to determine yours. They also allow you to transfer your beneficiary to another family member if your child doesn’t go to college.² When it’s time to pay for college, you can withdraw money tax-free.

| Pros | Cons |

| Tax advantages and higher contribution limits (vary by state) | Investment options limited by your state |

| No income limit to qualify | Penalties for non-qualified withdrawals |

| Can cover K-12 expenses | Restrictions can apply if you transfer beneficiaries |

2. Coverdell education savings account (ESA)

Best for: Those seeking tax-free growth on contributions and who meet the income limit to qualify

An ESA is a type of college savings account that works similarly to a 529 plan. It also allows your money to grow tax-free, lets you select the specific investments in your fund, and allows beneficiary transfers if needed. Unlike a 529 plan, ESAs have lower contribution and income limits, so you must be below the income limit to qualify.

The income limit for an ESA is $110,00 for individuals or $220,000 for couples filing jointly.2 The contribution limit for an ESA for 2023 is $2,0002 – that’s roughly $167 a month. If you contributed $2,000 per year over 18 years, you’d have $36,000 saved by the time your child goes to college.

Like a 529, parents or guardians can open an ESA for any child below the age of 18.2 The balance in an ESA account has to be distributed by the time the beneficiary reaches age 30.2 If you make less than $$110,00 a year (or $220,000 for couples) or can only contribute $2,000 annually to your child’s fund, consider an ESA.

| Pros | Cons |

| Tax-free growth | Low contribution limits compared to 529 plans |

| Variety of investment choices | Income restrictions to contribute |

| Transferable beneficiary | Funds must be used before beneficiary turns 30 |

3. Custodial accounts (UTMA or UGMA)

Best for: Parents who want to gift assets to minors and transfer control of the account to the child at the age of maturity

While 529 plans and ESAs are set up and owned in a parent’s name on the child’s behalf, custodial accounts like Uniform Transfers To Minors Act (UTMAs) or Uniform Gifts to Minors Act (UGMAs) are a bit different. The account is in the child’s name – the parent (the custodian) only manages them. Once they turn 18 (or 21, depending on your state), they gain full control over the funds in the account.4

Funds saved in custodial accounts also aren’t restricted to educational expenses. Once your child reaches the required age in your state, they can legally spend the funds however they choose. You’re also unable to change the beneficiary once you’ve set it, so you won’t be able to transfer these funds to another child.4

UTMAs or UGMAs don’t offer the same tax advantages as 529 plans or ESAs, and contributions are made with after-tax dollars. Also, earnings in the account totaling more than $2,300 are subject to a specific tax rate set by the IRS.5 That said, custodial accounts can appeal to those looking for more flexibility in spending the funds and don’t want to restrict beneficiaries to college expenses.

| Pros4 | Cons5 |

| Allows transfer of assets to the child without the need for a trust | Beneficiary can’t be changed once selected |

| Funds not limited to college expenses | No control over how the child spends the funds once they turn 18-21 |

| Easy to open at most financial institutions | Few tax advantages |

4. Roth IRA

Best for: Parents aiming to jump-start their child’s retirement savings while also having the flexibility to use the funds for educational expenses.

While not specifically designed for college, Roth IRAs are another account you can use to grow your college savings fund. They allow you to contribute after-tax income and grow your earnings tax-free.

Since they’re technically a retirement account, there’s a 10% penalty for withdrawing any earnings on your funds before the age of 59 ½. But if you want to use your Roth IRA as a college fund, you’re in luck, as you can make penalty-free withdrawals on your contributions for qualified education expenses – but you’ll still have to pay income taxes.6

Roth IRAs also have contribution limits. For 2023, the limit is $6,500 (or $7,500 if you’re age 50 or older). Remember that Roth IRA withdrawals are considered part of your income when calculating your child’s financial aid eligibility, which may impact your child’s eligibility.6

| Pros6 | Cons6 |

| Tax-free growth | Lower contribution limits than 529 plan |

| Penalty-free withdrawals for qualified education expenses | Must pay income tax on withdrawals for education expenses |

| Not limited to education expenses | May impact financial aid |