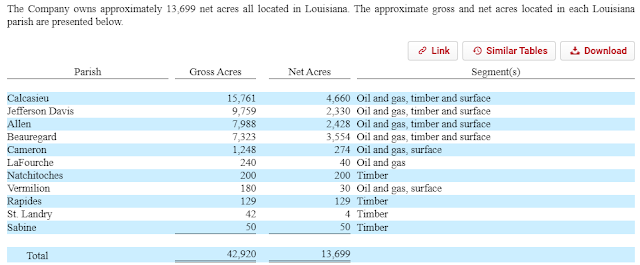

CKX Lands (CKX) (~$27MM market cap) is a sleepy micro-cap that goes back to 1930 when it was spun from a bank. CKX owns 13,699 net acres (about half is wholly owned, the other half is through a 16.67% interest in a JV) in southwest Louisiana which it earns royalties from oil and gas producers, timber sales and other surface rents it collects. Revenue skews towards oil and gas revenues, but the value of the land is likely more in its use as timberland (they don’t give oil and gas reserve numbers).

On Monday, CKX put out the below press release:

CKX Lands, Inc. Announces Review of Strategic Alternatives

LAKE CHARLES, LA (August 21, 2023)—CKX Lands, Inc. (NYSE American: CKX) (“CKX”) today announced that its Board of Directors has determined to initiate a formal process to evaluate strategic alternatives for the company to enhance value for stockholders. The Board of Directors and the management team is considering a broad range of potential options, including continuing to operate CKX as a public, independent company or a sale of all or part of the company, among other potential alternatives.

The company has engaged TAP Securities LLC as financial advisor in connection with the review process. Fishman Haygood, L.L.P. is serving as legal advisor to the company.

There is no deadline or definitive timetable set for the completion of the review of strategic alternatives and there can be no assurance that this process will result in CKX pursuing a transaction or any other strategic outcome. CKX does not intend to make further public comment regarding the review of strategic alternatives until it has been completed or the company determines that a disclosure is required by law or otherwise deemed appropriate.

CKX Lands, Inc. is a land management company that earns revenue from royalty interests and mineral leases related to oil and gas production on its land, timber sales, and surface rents. Its shares trade on the NYSE American market under the symbol CKX.

TAP Securities is an affiliate of TAP Advisors, an investment bank providing financial advisory, mergers and acquisitions and capital-raising services. TAP Securities is located in New York City, phone number (212) 909-9034.

The company’s disclosures lack much detail, it is challenging to value this asset from the outside. Management here has a significant informational edge over public market investors, but with this, they are signaling that CKX is likely worth considerably more than the current trading price. Having read a few of these announcements over time, if I had to guess, the highlighted part sounds like management wants to take it private.

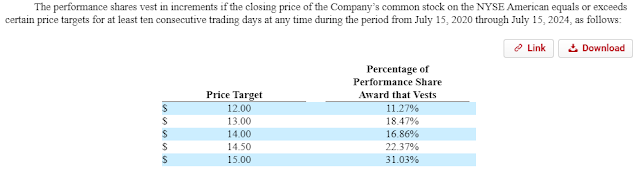

Additionally, management doesn’t take any cash salary and instead the board granted them a generous stock incentive package that vests over time as CKX hits certain share price targets.

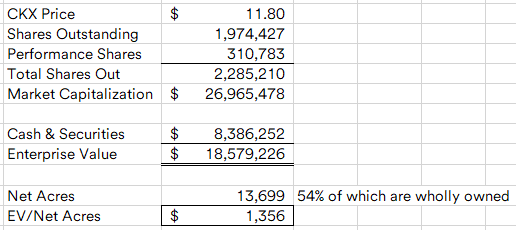

Presumably these are reasonable targets, the $12 threshold was previously met, but the shares currently trade at approximately $12/share. To see if that’s reasonable, on a quick back of the envelope, I have the shares trading for approximately $1350/acre.

I don’t really have a good sense of how much CKX is worth, other than I like the setup, I’d be interested in hearing more complete thoughts from others that have done more work on CKX, please feel free to comment below.

Disclosure: I own shares of CKX