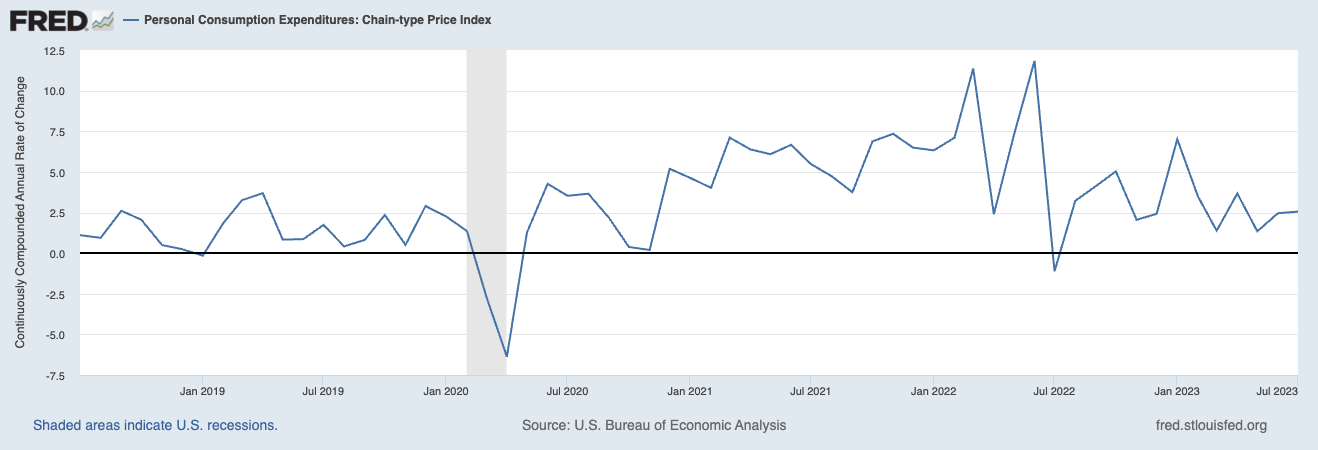

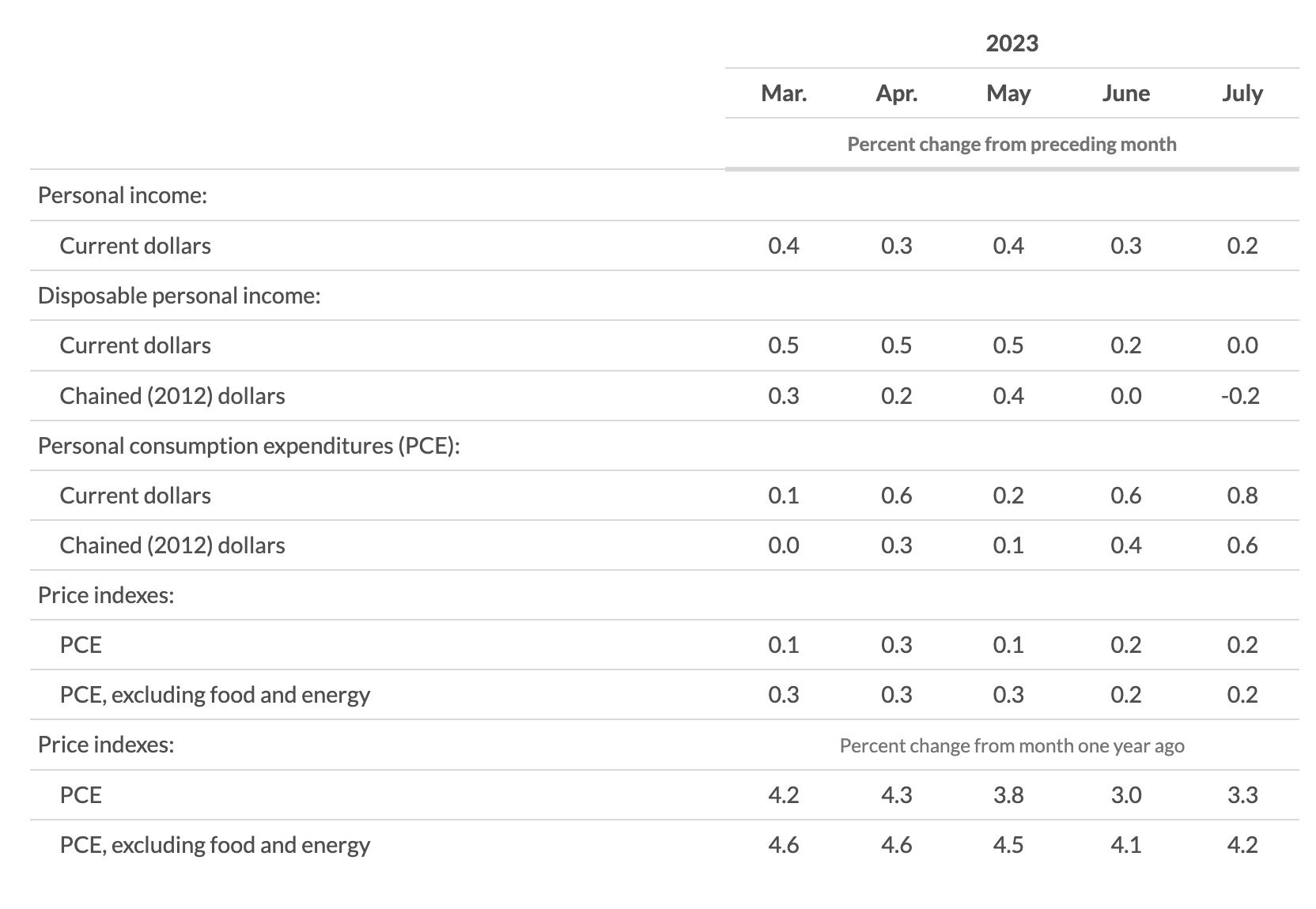

The Fed’s favored inflation report was a 2.1% annualized (3 months through July) and 3.3% year-over-year.

Here is BEA:

Personal income increased $45.0 billion (0.2 percent at a monthly rate) in July, according to estimates released today by the Bureau of Economic Analysis (table 3 and table 5). Disposable personal income (DPI), personal income less personal current taxes, increased $7.3 billion (less than 0.1 percent) and personal consumption expenditures (PCE) increased $144.6 billion (0.8 percent).

The PCE price index increased 0.2 percent. Excluding food and energy, the PCE price index increased 0.2 percent (table 9). Real DPI decreased 0.2 percent in July and real PCE increased 0.6 percent; goods increased 0.9 percent and services increased 0.4 percent (tables 5 and 7).

I feel like a broken record here, but 0.2%? PUH-leeze, the FOMC is done.

Source:

Personal Income and Outlays (BEA, July 2023)

Previously:

Five Ways the Fed’s Deflation Playbook Could Be Improved (Businessweek, August 18, 2023)

2% Inflation Target is Silly (July 26, 2023)

A Dozen Contrarian Thoughts About Inflation (July 13, 2023)

Inflation Expectations Are Useless (May 17, 2023)

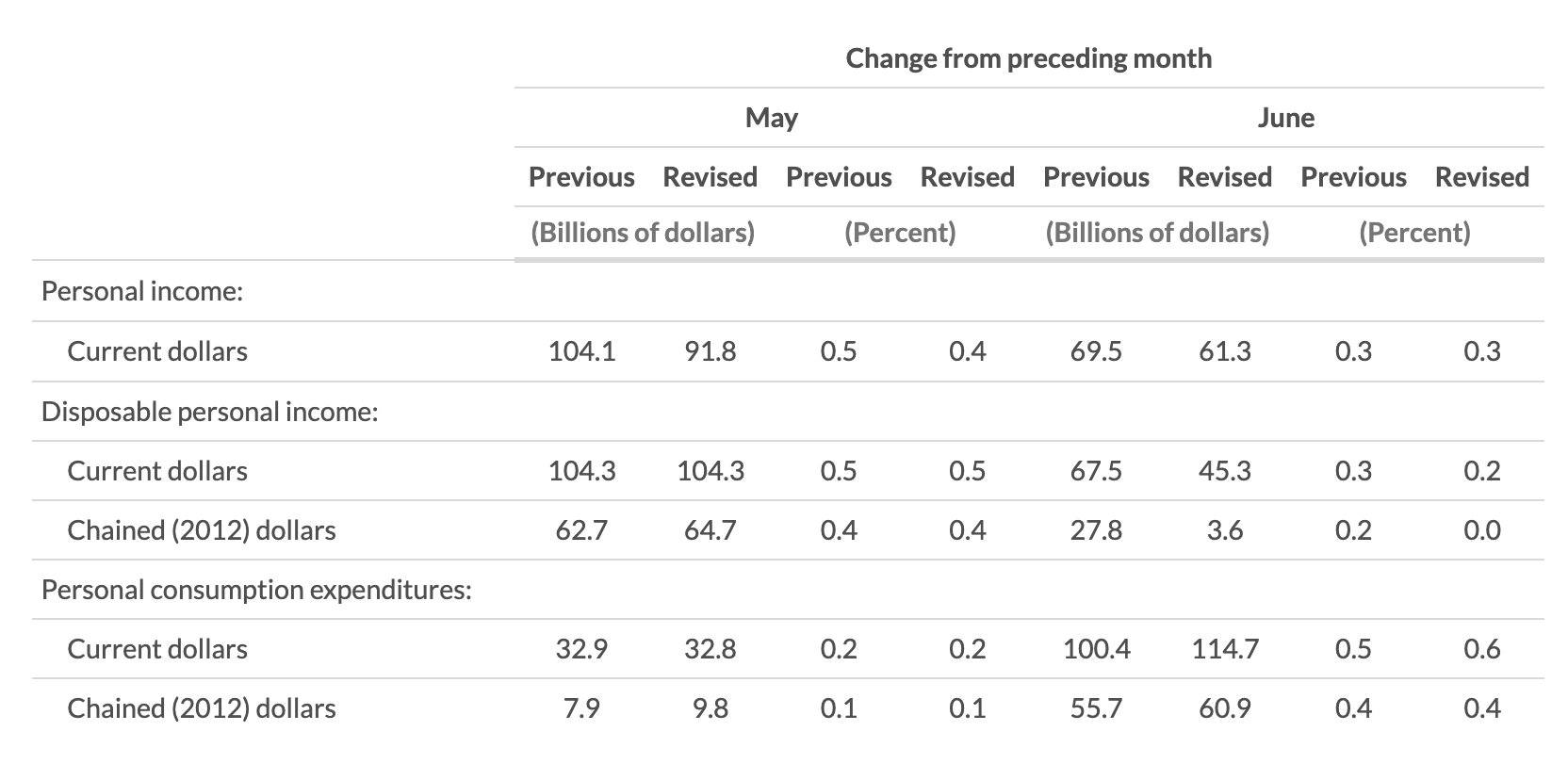

Some charts that make it look like I know what I am talking about…