“Credit cards are the devil!” Pretty sure that’s what Waterboy’s mamma would say—especially if she got behind on her bills.

The truth is, credit cards can be pretty helpful—they’re convenient, they come with introductory bonuses, and they even pay monthly rewards.

But it’s all too common to lose track of your expenses (or get surprised by a few). Suddenly, you have a running balance on a few credit cards.

Put simply, you’re in credit card debt, you want out, and you need a simple tool that can help. I’m happy to say we’ve got just the thing for you. Enter the credit card payoff calculator Excel sheet—

Similar calculators and templates:

How to Calculate Your Credit Card Payoff in Excel and Google Sheets—A Sneak Peek

We’ve built one of the best multiple credit card payoff calculators. Here’s a sneak peek of our top-tier debt payoff tool (with download links for Excel and Google Sheets).

It can handle 32 credit card debts, and you can purchase it from Etsy for less than $10—quite a steal if you ask us (we should honestly raise our prices soon).

Bebe J recently bought and reviewed this monthly credit card spreadsheet— “Just what I needed!” She gave it 5 out of 5 stars. In short—download the tool, enter your credit card stats—and the template will show you how long it will take to pay off all your debts.

Want to see how the tool works? Here’s a video tutorial for you:

Does this Excel credit card payoff calculator work in Google Sheets?

It sure does! Just download the Credit Card Snowball from Etsy, and you’ll be sent an email with two download links: one for Excel and one for Google Sheets.

(Want Something More? Check Out Our New Get Out of Debt Course!)

Want to get out of debt even faster?

We recently created a full get out of debt course. This is for those that want more. For those that want to pay off debt fast. For those absolutely hate their debt and want it gone for good.

This course includes the debt snowball spreadsheet, but also includes sooo many more extras!

This course includes…

- The debt snowball vs. debt avalanche calculator ($15 value)

- The weekly and monthly budget template ($10 value)

- An early mortgage payoff calculator ($10 value)

- 80 minutes of video instruction ($200 value)

- A complete slide deck of the video

- A full workbook

- And a live Q&A session with me in the next few weeks… ($100 value)

That’s $335 of value…all for just $79? Yeah, we’re doing that! Oh, and if you buy it and you’re not satisfied, we’ll give you a full refund.

It’s a complete steal—we truly want to help as many people as possible.

If you want to get serious about your debt payoff journey, take the course. You won’t regret it. I can’t wait to meet you and hear your questions in the live Q&A!

Should You Pay Off Your Credit Card Debt ASAP? Is It Worth It?

You might be asking, “Should you pay your credit card off right away?” If you pay it off quickly—and keep your credit card balance at zero—wouldn’t that hurt your credit?

Based on my experience, paying off your credit card is far better than having too much debt.

If your credit utilization rate (how much debt you have vs. your total limit) is over 30%, you’re dinging your credit score. It’s better to pay off your credit card consistently and completely than to have too much debt sitting on it.

For yet another data point in the reasons to pay off your credit card debt—I paid off all of my debt (including my house) over ten years ago—and I never carry a credit card balance. My credit score continues to hover around 800. (Still pretty solid if you ask me).

Are you worried about paying your credit card right away? Don’t be. Just use the simple credit card payoff spreadsheet in this post and get rid of it.

What Is The Best Way to Pay Off Credit Card Debt?

I get asked a lot, “What’s the best way to pay off credit card debt?”

- Do you tackle the credit cards that have the highest interest?

- Maybe try to take down the one with the highest balance?

- Or do you start with the smallest debt?

What’s the correct answer? Well, as you may have guessed, there’s no right answer for everyone—

There are two main methods for paying off credit card debt:

- The debt avalanche method

- The credit card snowball method

Some people swear by the snowball method. Others think the debt avalanche is best. But before we get too deep into the pros and cons—let’s be sure to define them.

What is the avalanche method? It’s pretty simple, actually—

- You line up your debts from the highest interest to the lowest interest.

- Start paying the highest interest debt first.

- Once you pay the high-interest debt off—move on to the next highest interest debt.

- Keep this going until you get to your last debt (the lowest-interest one) and pay that off to finish your credit card debt.

Mathematically, it makes sense. (The highest interest debts cost you the most money each month, so pay those suckers off first.) But is it really the best option?

What did we model our credit card tracking spreadsheet after? (By the way, want to see the difference between the snowball and the debt avalanche method? Check out our debt snowball vs. avalanche calculator.)

The debt snowball method

What about the credit card debt snowball method? Just like the avalanche method, the debt snowball method is pretty simple—

- Line up your credit card debts from smallest to largest.

- Start paying on the first (smallest) credit card.

- Once that’s paid off, pay the next one in line (the slightly bigger but new smallest debt).

- Then—when you pay that one off—move onto the next one.

- Keep going with this process until all the credit cards are paid off.

You might be wondering about interest rates—how do they play into this method? Quite simply—they don’t. The idea is to gain momentum on paying off your credit cards—

- Start with the smallest one and pay it off quickly.

- You feel good about yourself—and quickly tackle the next credit card debt.

- Then, you really feel like you’re gaining traction and put it into full gear—you pay off all your debts faster than you thought possible.

So, if you commit and work to pay off your credit card debt quickly, the interest really shouldn’t matter that much. The key is that you get started, stay committed, and polish off all the debt. The credit card snowball method is best at that.

(Want a larger, more inclusive debt payoff tool? Check out The Best Debt Snowball Excel Template).

What is the best way to pay off credit card debt? Debt snowball or avalanche?

Which way to pay off your credit cards is best then? The credit card snowball or the avalanche method? You’ve probably already caught my bias—

When it comes to paying off debt, momentum and progress are key. That’s why the credit card snowball is the best method for paying off your credit card debts.

(Don’t believe me? Even Harvard agrees!) And since the debt snowball method is the preferred choice of Harvard and myself, our credit card debt payoff spreadsheet is set up for it instead of the avalanche method.

Credit Card Tracking Spreadsheet—Don’t Make Your Own

Now that you know the debt snowball is the best way to pay off credit cards—

How can you map out the payments on your credit card? Put simply, you might be asking yourself, “How do I keep track of credit cards in Excel?”

You could make a list of them, put dollar amounts in—and then make monthly updates as your statements come in. But why do that when you can download the multiple credit card payoff calculator spreadsheet in Excel?

In the intro, we featured the large 32-debt template for paying off credit card debt. (There’s also a smaller, free version if you want to check that out. Download the Free Credit Card Payoff Spreadsheet here.) Don’t waste your time putting together an Excel credit card tracker template—just use the free one we’ve already made for you!

How to Create a Credit Card Payoff Spreadsheet in Excel

I bet quite a few people are asking themselves, “How do I make a debt payoff spreadsheet?” And along with that—

- Is there a spreadsheet to keep track of credit cards?

- How do I calculate my credit card payoff?

- And how do I figure out how long it will take to pay off a credit card in Excel?

If you don’t want to use our tools (and instead want to make your credit card payoff spreadsheet in Excel), here’s everything you need to know—

Step-By-Step Process For Making a Snowball Credit Card Payoff Calculator in Excel

1) Open a blank page in Google Sheets or Excel.

2) List your debts across the top with your balance, minimum payment, and interest rates.

3) Add a column for months and extra payments on the left-hand side.

4) Be sure to have columns for “payment amount” and “balance amount” for each debt.

5) Enter a calculation like the below to reduce the balance each month (by the payment amount)—or calculate it manually.

6) To include the interest incurred during the previous month, be sure to include a formula like the one below (taking 1/12 of the annual interest—since there are 12 months in each year):

7) Adjust the calculations at the point where each debt pays off (since you’ll need to have some dollars applied to the first debt—and then the remaining amount to the next debt).

8) Once you work your way through all the cells, you’ll have the appropriate Excel credit card payoff formulas—and your own credit card snowball worksheet.

How to calculate interest on the balance of the credit card

Want to better understand how interest works on a credit card?

The APR is the yearly interest rate on your card. If you want to apply this interest daily (like the credit card companies do), take the total APR and divide it by 365 (the number of days in the year).

If you want to apply the interest monthly (which, frankly, is close enough for the purpose of the debt payoff tool), then take the APR and divide it by 12 (the number of months in a year). You’ll then take the current balance each month and multiply it by the monthly interest rate—to see how much interest you’ll owe in that month.

Are you still trying to make your own credit card payoff sheet? Please stop.

Setting up your own credit card snowball Excel is a pain. It seriously makes more sense to head to the LifeAndMyFinances Etsy page and buy a fully functioning template that will automate everything (for $3.99 max).

If you download one of the debt snowball spreadsheets, all you need to do is enter your debt amounts, interest rates, and minimum payments. It’ll take you, like, three minutes. (For real. The tool automatically calculates everything.)

The Credit Card Payoff Calculator—Excel Download

It’s time to learn how to use this amazing tool. And there’s no better way to learn than with an example. Download the credit card payoff template, learn from the example, and then take down your debt once and for all.

How long will it take you to pay off your credit card debts?

How long will it take to pay off your credit card debts with the credit card payoff spreadsheet? Let’s use the tool and walk you through an example—

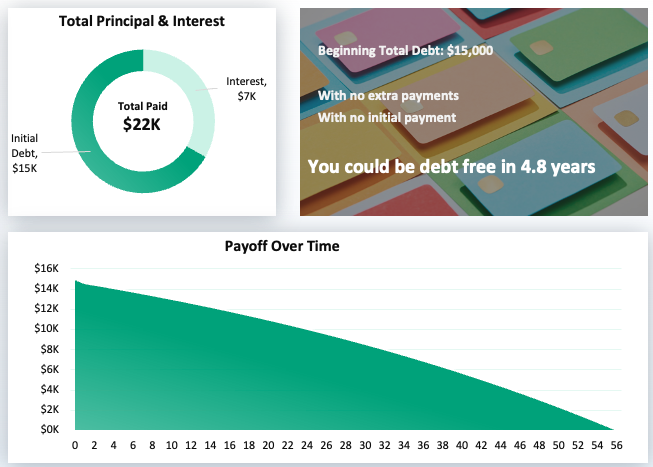

How long will it take to pay off a credit card balance of $15,000, paying just minimum payments?

Let’s say the interest is 20%, and the minimum payment is $400. How long before the $15,000 credit card balance is fully paid off?

According to the multiple credit card payoff Excel calculator, the debt will be gone in 57 months (or roughly five years). Not great.

Keep reading to figure out how to pay that beast off way faster—

How to pay off your credit cards fast

Alright, so here’s what this entire article is about. I mean, it’s certainly about the automated debt snowball calculator—but even more so, it’s about figuring out how to get out of credit card debt fast.

How can you pay off your credit cards fast? Paying off your credit cards is about just two things:

- Putting as much money toward the debt right at the beginning.

- Paying as much as you can toward the credit cards each month.

I could write a whole article about the first bullet (and another full post on the second), but we’re not going to go into depth on these items here. Here’s the condensed version—

How to pay off your credit cards fast—start with a big payment

If you want to get out of credit card debt fast, do whatever you can to drop a big dollar amount on those debts immediately.

- Some people have a bunch of stuff they could sell. (If this is you—do that.)

- Others have credit card debt, but they have $30,000 sitting in the bank for an emergency fund. (If this is you—knock your emergency fund down to $10,000, and then tackle the credit card debt with a vengeance until it’s all gone.)

Don’t dink around with transferring balances to cards with lower interest or trying to negotiate with the credit card companies—just suck it up and try to come up with a hefty payment to get an impressive start.

The impact of a large payment on your credit card debt

Remember our $15,000 credit card example above? It was going to take us 57 months to pay that off.

What if we could put $5,000 toward the debt immediately? How long would it take then?

According to the free credit card payoff spreadsheet, starting with an extra $5,000 payment would reduce your debt payoff time by 25 months (from 57 months to 32).

How to pay off your credit cards fast—increase your monthly payment

Another great way to pay off your credit cards quickly is by paying more every month (in other words, raising your monthly payments).

How do people find the money to increase their monthly credit card payment?

Again, mainly two ways:

- They reduce their monthly expense as much as possible. Put together your monthly expenses and then question everything. Do you really need it?

- And they do whatever they can to earn money—

- Take on a side hustle.

- Get a part-time job.

- Or finally ask for that raise they have deserved for some time.

What if you can reduce your expenses each month and raise your income? You could probably put another $500-$600 toward your credit card debts each month.

What impact will increasing your monthly credit card payment have on your debt payoff?

Let’s continue with the $15,000 credit card debt example—

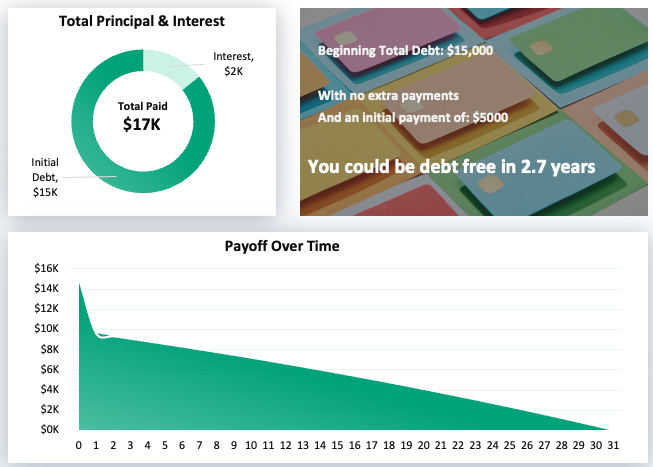

We already know that if we initially put $5,000 at our $15,000 debt, we could drop the payoff time to 32 months. But what if we could increase the monthly payment by $600? Then how quickly could we pay off that $15,000 credit card debt?

The credit card payoff spreadsheet says the timeframe would go down from 32 months to 11 months! Don’t believe me? Here’s the screenshot of the credit card payoff spreadsheet:

Don’t discount it. Boosting your monthly payment can make a huge difference in your credit card payoff date.

Related Spreadsheets

The Free Credit Card Payoff Spreadsheet—Will You Dare to Use It?

This tool is simply the best. I developed it for myself and paid my debts in record time.

Then I decided to share this tool with the world. There have been literally thousands of people that have downloaded and thanked me for it. They used the snowball credit card payoff Excel calculator, which quickly gave them hope to pay off their debts. They got started, got momentum—and never looked back. Today, they’re debt-free—and couldn’t be happier.

What about you? Don’t you think it’s time to download the free printable credit card payoff spreadsheet? What do you have to lose? It’s free.