Welcome to the September 2023 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the news that WiserAdvisor, one of the longest-running lead generation services in the industry, has acquired IndyFin, a startup advisor rating platform that had aspired to be the ‘Yelp for Advisors’ – which on the one hand provides WiserAdvisor with an opportunity to jump into the business of client reviews and ratings (which has garnered significant interest from multiple AdvisorTech startups hoping to promote such services in the wake of the SEC’s new Marketing Rule allowing client testimonials), but on the other hand, raises questions about how much demand there really is for a standalone advisor rating tool, since few advisors are likely to accumulate enough ratings from current or former clients to actually draw in new clients (and advisors with enough clients to get a critical mass of reviews likely have enough clients that they can just rely on client referrals… or don’t even need to add new clients anymore?).

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Former United Capital Partners founder/CEO Joe Duran is reportedly exploring the launch of a new RIA 4 years after selling his firm to Goldman Sachs, with a reported emphasis on providing lead generation opportunities for advisors on its platform – which if successful, could provide a new model for boosting organic growth without the high cost of outsourcing to a third-party lead generation service or relying on inorganic growth via mergers & acquisitions.

- Onramp Invest, the platform that aimed to solve the challenges of cryptocurrency investing for financial advisors, was acquired by Securitize, a platform specializing in blockchain-based tokenization of private market investments, suggesting that advisors’ interest in recommending digital assets for their clients – already limited during previous rallies in the price of Bitcoin and other cryptocurrencies – has declined further amid the price crash and ensuing scandals that have happened in the year-plus since

- Wealthtender, a lead generation and advisor rating service, has announced a partnership with custodial account provider UNest to bring its find-an-advisor technology to UNest’s customer base of parents opening investment accounts for their children – which, while expanding Wealthtender’s footprint in the competitive lead generation market, raises questions about how large of a potential customer base UNest can provide (and whether Wealthtender will be able to secure any larger enterprise partnerships that can help it secure a spot as the “One and only” advisor rating service)

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

- With AI technology proliferating in the financial services industry, regulators are increasingly concerned about possible conflicts of interest if the technology can be manipulated to recommend a company’s products and solutions over others (despite being under a technological veneer of ‘objectivity’), as highlighted most recently by the SEC issuing proposed regulations for RIAs for evaluating and eliminating conflicts of interest in their technology, and Massachusetts Secretary of State William Galvin sending a request for six companies from different areas of the industry to detail their use of AI in their business practices

- Over the last 10–15 years, a number of AdvisorTech providers have gained the majority of market share in certain core categories like financial planning and CRM; but as the most recent Kitces Research on AdvisorTech has found, a new crop of tools has arisen in more recent years that has garnered higher satisfaction ratings than the incumbents, and have been steadily gaining market share – suggesting that the traditional advisor tech stack might eventually be upended and replaced by a new ‘next-generation’ tech stack that reflects the growing shift of advisors into deeper financial planning and non-AUM fee models

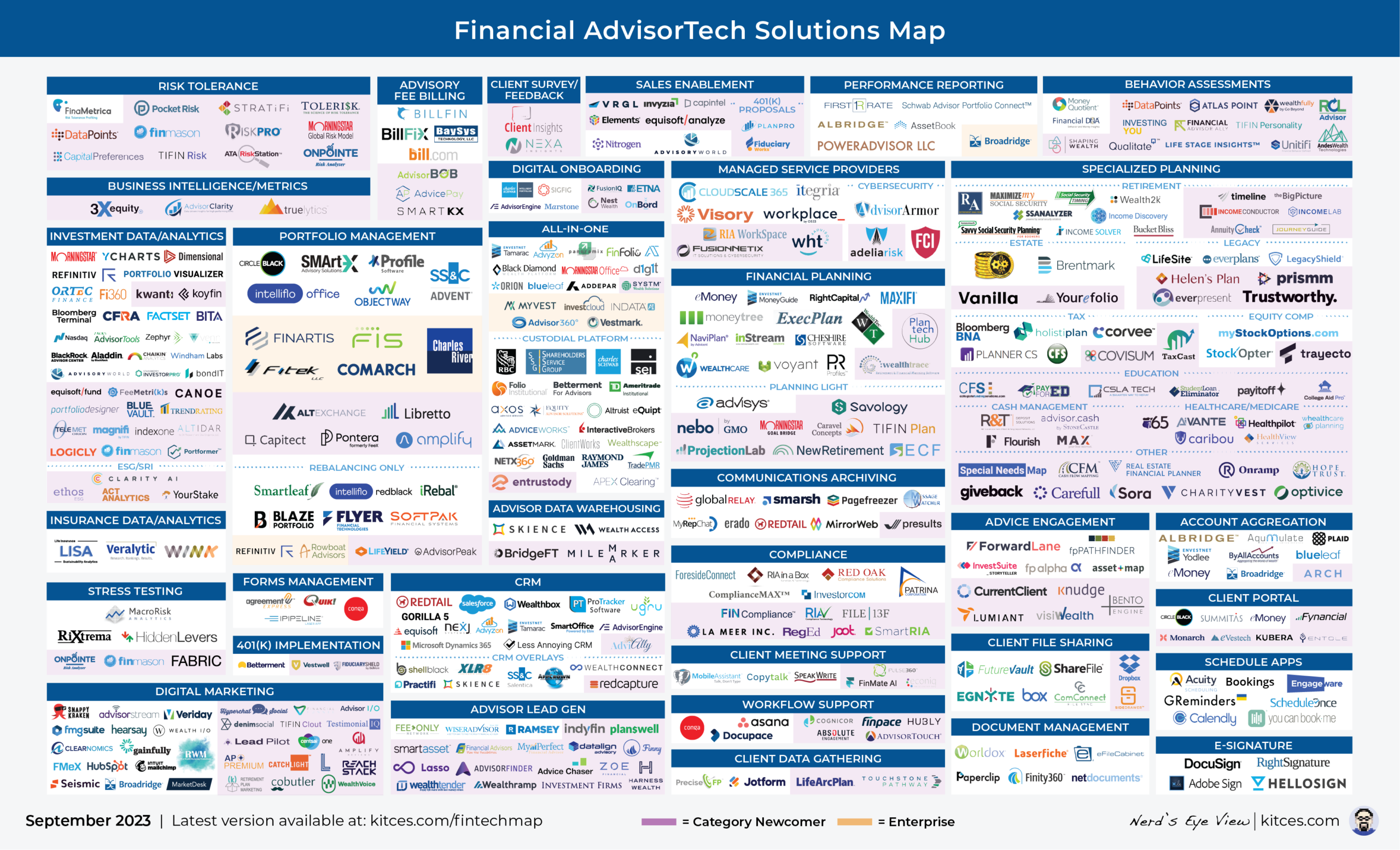

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!