22 million Americans have a personal loan debt – and we owe about $210 billion altogether.¹ While this number may seem quite high, loans are just another part of day-to-day finances to account for while maintaining your financial health.

You should prioritize your regular monthly payments, however, you don’t have to stick to the minimum amount. Ideally, you can pay off your credit card, mortgage, or auto loans quicker and save on total interest. Just ensure there aren’t any penalties and fees your lender might apply for making extra or early payments.

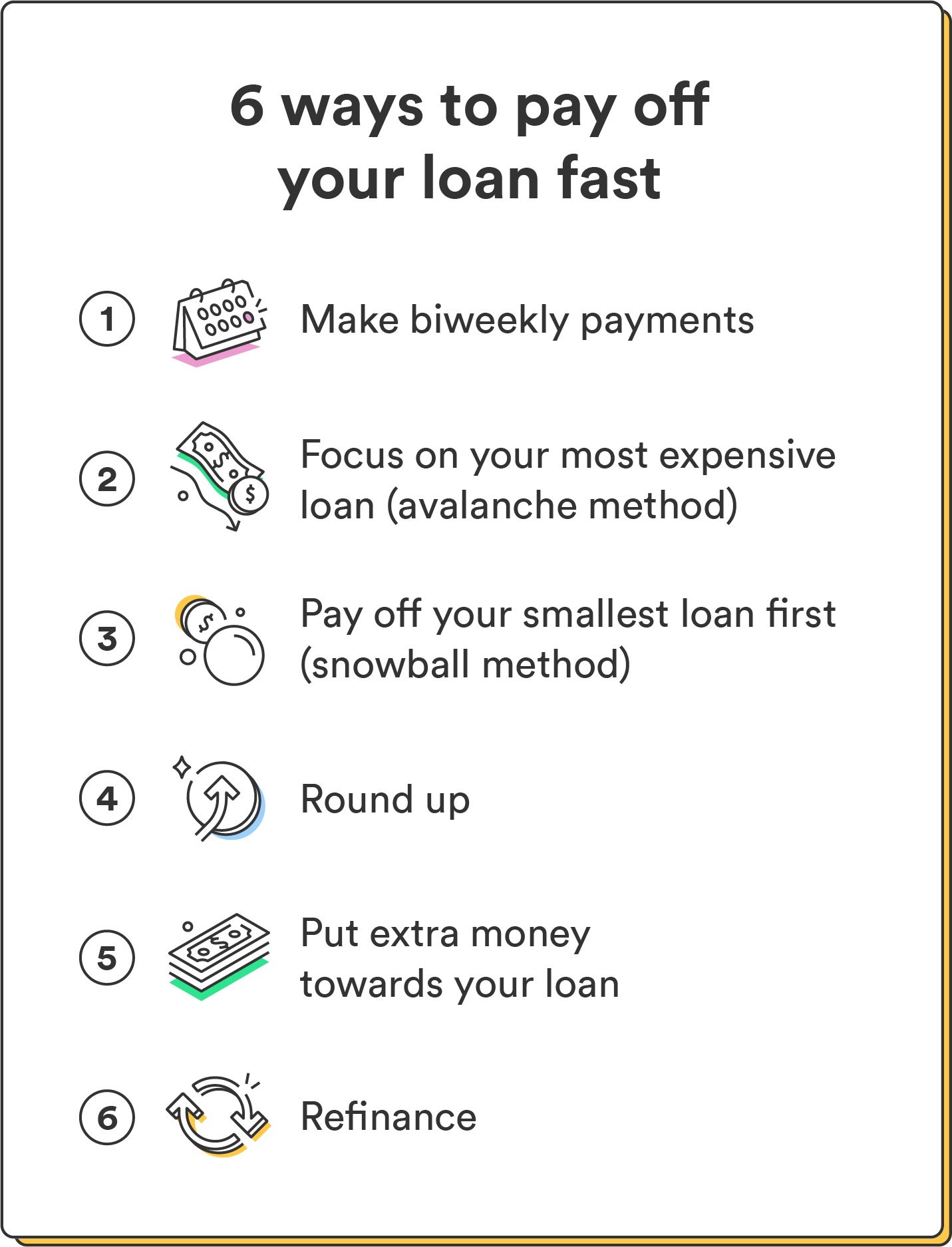

We recommend these tried-and-true techniques if you’re willing and able to pay off your loan faster:

Swap monthly for biweekly payments

Paying half your monthly loan payment every two weeks is a foolproof way to lessen the interest accrued on your loan without feeling like you’re spending more per month.

With this method, you’ll make 26 half-payments a year, which equals a full extra monthly payment. You could shorten your loan term by several months or years!²

Pay off your most expensive loan first

If you’re paying off more than one loan, focus on the highest interest rate first and work your way down. This “avalanche method” will reduce the overall amount of interest you pay on your loans and decrease your overall debt. Just remember to pay the minimum monthly payments on your other loans to avoid any late fees or penalties.

Pay off your smallest balance first

As opposed to the avalanche method, the snowball method prioritizes paying off the loans with the smallest amount first. Seeing all those smaller accounts reach zero fast can help build confidence and momentum as you progress toward your largest loan.

Round up to the nearest $50

Rounding up your monthly payments to the nearest $50 is another way to pay off your loans fast. For example, if your minimum monthly car payment is $365, make payments of $400 to shorten the term. The difference is enough to cut a few months off your term and save you a decent amount of interest.

Put all your extra money towards your loan

Expecting a promotion soon? Congratulations – you’ll be in a great position to start making extra payments on your loan! Side hustles, salary negotiations, and cutting impulse purchases can help you net some extra cash for your debt-free goals.

Refinance

If interest rates have dropped since you took out your loan or you’ve had a huge boost to your credit, one of the best ways to pay off your loan faster is by refinancing. You may be eligible for a lower interest rate that could save you thousands and allow you to pay off the principal early.