Increasing your credit limit can both positively and negatively affect your finances depending on your habits. One clear benefit of a higher credit limit is increased financial flexibility for unexpected expenses, managing debt, or making larger purchases.

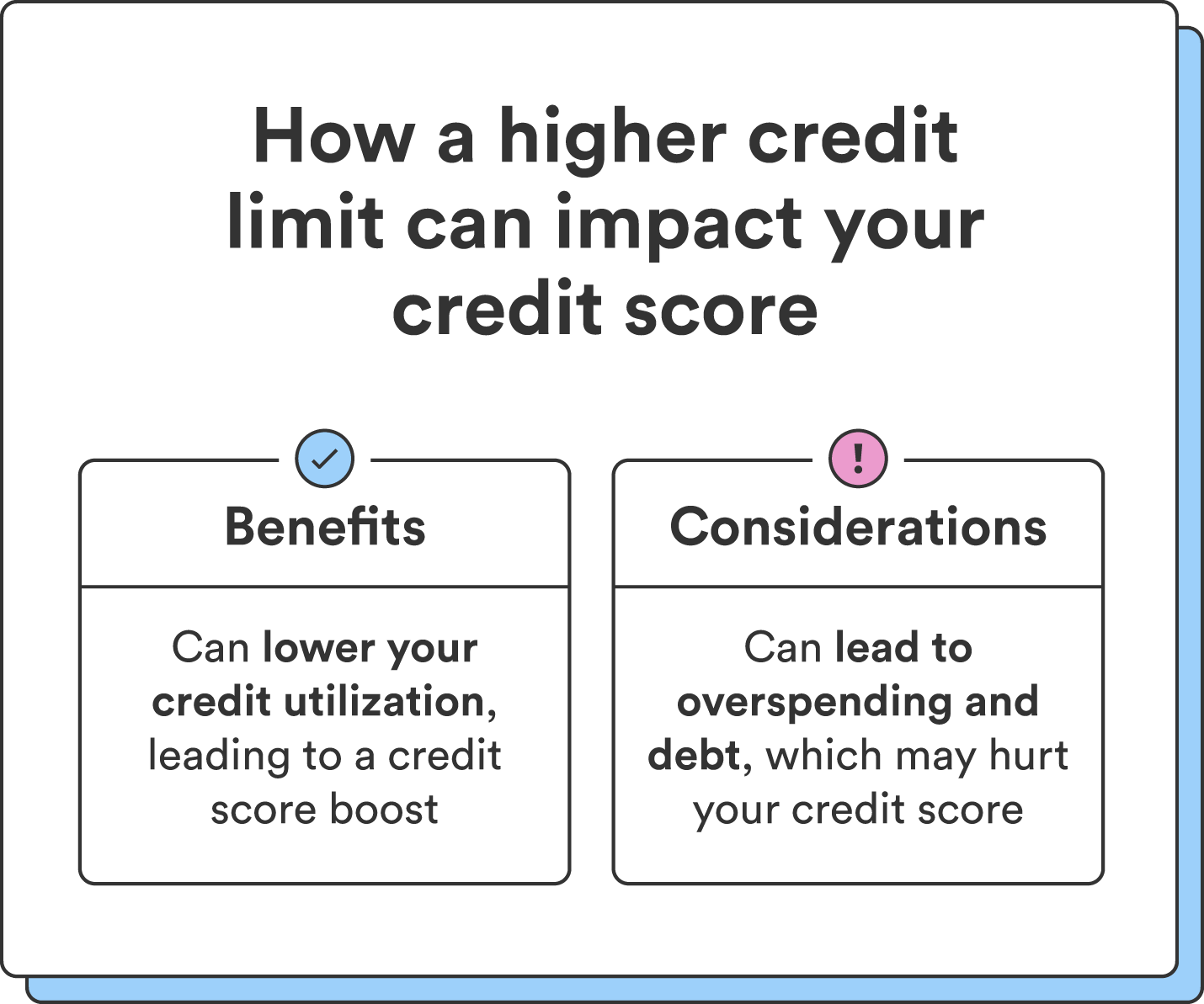

Increasing your credit limit can also reduce your credit utilization ratio, which can improve your credit score. Credit utilization is the percentage of your credit limit that you’re using compared to your total credit limit, and it plays a significant role in your credit score. A lower credit utilization ratio is ideal, as it shows you’re not overly reliant on credit and can manage credit responsibly.

On the other hand, a higher credit limit can present the potential to overspend. While there are benefits to an increased credit limit, they only apply if you manage your credit responsibly. Misusing an increased credit limit can lead to acquiring more debt than you can manage, high interest charges, and financial strain.

Finally, requesting a credit limit increase may result in a hard inquiry on your credit report, which can impact your credit score. The effect of a single hard inquiry diminishes over time and may not cause significant damage. But if you’ve already applied for other types of credit in the last year, your score could drop.

Chime tip: If you’re planning to apply for a major loan, like a mortgage loan, in the near future, avoid multiple hard inquiries from credit limit increase requests. Credit increase requests could lower your credit score and impact your chances of approval.

| Pros | Cons |

| More financial flexibility | Temptation to overspend |

| Improved credit utilization | Potential for debt |

| Potential credit score boost | May come with a hard credit inquiry |