The residential status of taxpayers plays a key role in determining the scope of taxable income (Indian Income / Foreign Income) for a financial year in India and there by the tax payable.

The residential status of an individual is based on the duration for which he/she is present in India. There are 3 types of Residential status.

- Resident & Ordinarily Resident (ROR)

- Resident But not Ordinarily Resident (RNOR)

- Non –Resident Indian (NRI)

Determination of the residential status of an Individual

To determine the residential status of an individual, the first step is to ascertain whether he/she is resident or non-resident. If he turns to be a Resident Indian (RI), then the next step is to ascertain whether he is Resident and ordinarily resident (Resident Indian) or is a Resident but not ordinarily resident (RNOR).

Step 1: Determining whether Resident or Non-Resident Indian

Under the Income-tax Law, an individual will be treated as a resident in India for a year if he satisfies any of the following conditions (i.e. may satisfy any one or may satisfy both the conditions):

- He is in India for a period of 182 days or more in that year; or

- He is in India for a period of 60 days or more in the year and for a period of 365 days or more in immediately preceding 4 years.

Year here is referred to as Financial Year or Previous Year. For Assessment Year 2024-25, the FY or PY is 2023-24 (1-Apr 2023 to 31-Mar 2024). The immediately preceding 4 years are FY 2022-23, FY 2021-22, FY 2020-21 & FY 2019-2020)

The Finance Act, 2020, w.e.f., Assessment Year 2021-22 has amended the above exception to provide that the period of 60 days as mentioned in (2) above shall be substituted with 120 days, if an Indian citizen or a person of Indian origin whose total income, other than income from foreign sources, exceeds Rs. 15 lakhs during the previous year. Income from foreign sources means income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India)

To arrive at Rs 15 lakh criteria, consider Only Indian Income for the FY 2023-243 (other than from foreign sources). Important: Include income derived from a business controlled in or a profession set up in India. Eg. Include Infosys UK income when you went for a consulting project as Infosys Head Quarter is in India.

Another important amendment that was implemented from AY 021-22 was – An Indian Citizen earning total income in excess of Rs. 15 lakhs (other than from foreign sources) shall be deemed to be resident in India if he is not liable to pay tax in any country. Below scenarios can give you better idea about this amendment.

Scenario 1: An HNI businessmen whose Residential status is NRI, resides in different countries in a Financial Year, thus making him a non-tax resident of any country. So, his global income is neither taxable in those countries nor in India. To remove this ‘tax arbitrage’ (loophole), the Govt wants to tax such NRIs’ global income.

Scenario 2 : An HNI businessmen whose Residential Status is NRI, resides and does business in Dubai, his global income is tax-free in Dubai and such income is also not taxable in India (he/she will not be deemed to be resident in India just because he/she is not liable to be taxed in Dubai).

So, the tax status of Resident Indian or NRI is dependent on the below factors;

- Your Legal Status can be ;

- Person of Indian Origin (PIO) or Overseas Citizen of India (OCI)

- Indian Citizen

- Citizen of Foreign Country

- Member of crew on an Indian Ship (Seafarer)

- The quantum of Income earned for Person of Indian Origin & Indian Citizen (above Rs 15 lakhs or below Rs 15 lakhs, other than foreign income)

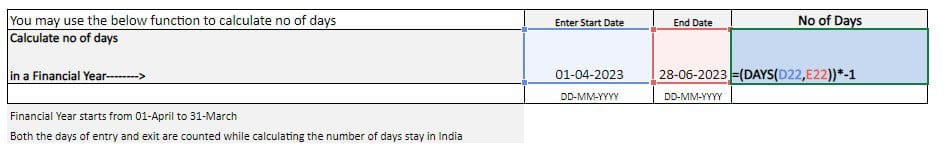

- The actual number of days of stay in India

If you turn out to be a Resident Indian (RI or ROR), then the next step is to ascertain whether you are a Resident and ordinarily resident (Resident Indian) or is a Resident but not ordinarily resident (RNOR).

Step 2 : Determining whether Resident Indian or Resident but not ordinarily resident (RNOR)

A resident individual will be treated as resident but not ordinarily resident in India during the year if he satisfies the following conditions:

- He is resident non-resident in India in 9 out of last 10 years immediately preceding the relevant year; (or)

- His stay in India is for 729 days or less in last 7 years immediately preceding the relevant year.

Effective from Assessment Year 2021-22, the Finance Act, 2020 has inserted a criteria wherein a resident person is deemed to be RNOR – “If an Indian Citizen or a person of Indian origin whose total income (other than income from foreign sources) exceeds Rs. 15 lakhs during the previous year and who has been in India for a period of 120 days or more but less than 182 days.”

Income Tax Residential Status Checklist for FY 2023-24 (AY 2024-25)

Based you legal status, let’s go through the below checklist to determine the residential status for income tax purposes;

Tax Residential Status Check of Person of Indian Origin (PIO)

Below checklist can be used if you are a Person of Origin and have Indian income of above Rs 15 lakh and you are liable to pay tax in other country.

| Checklist | Criteria/Status | Criteria/Status | Criteria/Status |

|---|---|---|---|

| Does your Total Indian Income exceed Rs. 15 Lakhs? | Yes | – | – |

| Are you liable to pay tax in any other Country / Jurisdiction? | Yes | – | – |

| How many days were you in India during FY 2023-24? | Less than 120 days then NRI | 120-182 days | More than 182 days |

| Are you on a Visit to India? | – | If Yes then NRI If no below criteria |

– |

| Did you spend at least 365 days in India, in last 4 years immediately preceding the relevant previous year? | – | If yes below criteria If No NRI |

– |

| Have you been a resident of India in the past 2 out of 10 preceding years immediately preceding the relevant previous year? | – | If No then RNOR If yes below criteria |

If No then RNOR If yes below criteria |

| How long have you been in India for last 7 years immediately preceding the relevant previous year? | – | Less than 729 days – RNOR More than 729 days – RI |

Less than 729 days – RNOR More than 729 days – RI |

Below checklist can be used if you are a Person of Origin and have Indian income of above Rs 15 lakh and you are not liable to pay tax in other country.

| Checklist | Criteria/Status | Criteria/Status | Criteria/Status |

|---|---|---|---|

| Does your Total Indian Income exceed Rs. 15 Lakhs? | Yes | – | – |

| Are you liable to pay tax in any other Country / Jurisdiction? | No | – | – |

| How many days were you in India during FY 2023-24? | Less than 120 days then NRI | 120-182 days | More than 182 days |

| Are you on a Visit to India? | – | If Yes then NRI If no below criteria |

– |

| Did you spend at least 365 days in India, in last 4 years immediately preceding the relevant previous year? | – | If yes RNOR If No NRI |

– |

| Have you been a resident of India in the past 2 out of 10 preceding years immediately preceding the relevant previous year? | – | – | If No then RNOR If yes below criteria |

| How long have you been in India for last 7 years immediately preceding the relevant previous year? | – | – | Less than 729 days – RNOR More than 729 days – RI |

Below checklist can be used if you are a Person of Origin and your Indian income is not above Rs 15 lakh.

| Checklist | Criteria/Status | Criteria/Status | Criteria/Status |

|---|---|---|---|

| Does your Total Indian Income exceed Rs. 15 Lakhs? | No | – | – |

| How many days were you in India during FY 2023-24? | Less than 120 days then NRI | 120-182 days | More than 182 days |

| Are you on a Visit to India? | – | If Yes then NRI If no below criteria |

– |

| Did you spend at least 365 days in India, in last 4 years immediately preceding the relevant previous year? | – | If yes below criteria If No NRI |

– |

| Have you been a resident of India in the past 2 out of 10 preceding years immediately preceding the relevant previous year? | – | If No then RNOR If yes below criteria |

If No then RNOR If yes below criteria |

| How long have you been in India for last 7 years immediately preceding the relevant previous year? | – | Less than 729 days – RNOR More than 729 days – RI |

Less than 729 days – RNOR More than 729 days – RI |

How to check Residential Status of an Indian Citizen for income tax purposes?

Below checklist can be used if you are an Indian Citizen and have Indian income of above Rs 15 lakh and you are liable to pay tax in other country.

| Checklist | Criteria/Status | Criteria/Status | Criteria/Status |

|---|---|---|---|

| Does your Total Indian Income exceed Rs. 15 Lakhs? | Yes | – | – |

| Are you liable to pay tax in any other Country / Jurisdiction? | Yes | – | – |

| How many days were you in India during FY 2023-24? | Less than 120 days then NRI | 120-182 days | More than 182 days |

| Did you go abroad on employment? | – | If Yes then below criteria If no below criteria |

– |

| Did you spend at least 365 days in India, in last 4 years immediately preceding the relevant previous year? | – | If yes RNOR If No NRI |

– |

| Have you been a resident of India in the past 2 out of 10 preceding years immediately preceding the relevant previous year? | – | – | If No then RNOR If yes below criteria |

| How long have you been in India for last 7 years immediately preceding the relevant previous year? | – | – | Less than 729 days – RNOR More than 729 days – RI |

Below checklist can be used if you are an Indian Citizen and have Indian income of above Rs 15 lakh and you are not liable to pay tax in other country.

| Checklist | Criteria/Status | Criteria/Status | Criteria/Status |

|---|---|---|---|

| Does your Total Indian Income exceed Rs. 15 Lakhs? | Yes | – | – |

| Are you liable to pay tax in any other Country / Jurisdiction? | No | – | – |

| How many days were you in India during FY 2023-24? | Less than 120 days then NRI | 120-182 days | More than 182 days |

| Did you go abroad on employment? | – | If Yes then below criteria If no below criteria |

– |

| Did you spend at least 365 days in India, in last 4 years immediately preceding the relevant previous year? | – | If yes RNOR If No NRI |

– |

| Have you been a resident of India in the past 2 out of 10 preceding years immediately preceding the relevant previous year? | – | – | If No then RNOR If yes below criteria |

| How long have you been in India for last 7 years immediately preceding the relevant previous year? | – | – | Less than 729 days – RNOR More than 729 days – RI |

Below checklist can be used if you are an Indian Citizen and have an Indian income of less than Rs 15 lakh.

| Checklist | Criteria/Status | Criteria/Status | Criteria/Status |

|---|---|---|---|

| Does your Total Indian Income exceed Rs. 15 Lakhs? | No | – | – |

| How many days were you in India during FY 2023-24? | Less than 120 days then NRI | 120-182 days | More than 182 days |

| Did you go abroad on employment? | – | If Yes then NRI If no below criteria |

– |

| Did you spend at least 365 days in India, in last 4 years immediately preceding the relevant previous year? | – | If yes below criteria If No NRI |

– |

| Have you been a resident of India in the past 2 out of 10 preceding years immediately preceding the relevant previous year? | – | If No then RNOR If yes |

If No then RNOR If yes below criteria |

| How long have you been in India for last 7 years immediately preceding the relevant previous year? | – | Less than 729 days – RNOR More than 729 days – RI |

Less than 729 days – RNOR More than 729 days – RI |

Citizen of Foreign Country & Residential Status Checklist

| Checklist | Criteria/Status | Criteria/Status | Criteria/Status |

|---|---|---|---|

| How many days were you in India during FY 2023-24? | Less than 120 days then NR (Non-Resident Foreigner, similar status as NRI) |

120-182 days | More than 182 days |

| Did you spend at least 365 days in India, in last 4 years immediately preceding the relevant previous year? | – | If yes below criteria If No NRI |

– |

| Have you been a resident of India in the past 2 out of 10 preceding years immediately preceding the relevant previous year? | – | If no RNOR If yes |

If No then RNOR If yes below criteria |

| How long have you been in India for last 7 years immediately preceding the relevant previous year? | – | Less than 729 days – RNOR More than 729 days – RI |

Less than 729 days – RNOR More than 729 days – RI |

Residential Status Checklist for Member of crew on an Indian Ship (Seafarer)

| Checklist | Criteria/Status | Criteria/Status | Criteria/Status |

|---|---|---|---|

| How many days were you in India during FY 2023-24? | Less than 120 days then NRI | 120-182 days | More than 182 days |

| Did you spend at least 365 days in India, in last 4 years immediately preceding the relevant previous year? | – | If yes below criteria If No NRI |

– |

| Have you been a resident of India in the past 2 out of 10 preceding years immediately preceding the relevant previous year? | – | If no RNOR If yes |

If No then RNOR If yes below criteria |

| How long have you been in India for last 7 years immediately preceding the relevant previous year? | – | Less than 729 days – RNOR More than 729 days – RI |

Less than 729 days – RNOR More than 729 days – RI |

We hope that above information is comprehensive enough for you to ascertain your Residential status for income tax purposes in India. In case you have any questions, kindly do post them in the below comments section (or) in Forum.

Continue reading:

(Post first published on : 08-Sep-2023) (References : eztax.in & incomecometaxindia.gov.in)