Have you ever wondered what are Participating and non-participating Life insurance plans?

You might have noticed these terminologies being used in a life insurance policy advertisement (or) product sales brochure.

For example, the below picture is an advertisement of an insurance plan called Nav Jeevan offered by the LIC. You can observe that this plan is a non-linked and PARTICIPATING life insurance plan.

Similarly, some of the life insurance plans can be non-participating ones, like the one shown below.

So, what is the difference between a participating and non-participating life insurance policy? – A participating (or) par policy provides the policyholder with profit-sharing benefits. These profits are shared in the form of bonuses or dividends. It is also known as a with-profit policy. In non-participating policies, the profits are not shared and no dividends are paid to the policyholders.

In this post let’s understand – What are the different types of benefits in a traditional life insurance plan? What are the various types of bonuses under life insurance policies? How is bonus on a life insurance policy calculated?

Types of Benefits in a Traditional life insurance policy

Below are the various benefits that are generally available on life insurance plans;

Maturity Benefit

Maturity benefits are the sum assured along with bonuses (if any) that your life insurance provider pays to you when you survive the policy tenure. These are paid at the end of the policy tenure.

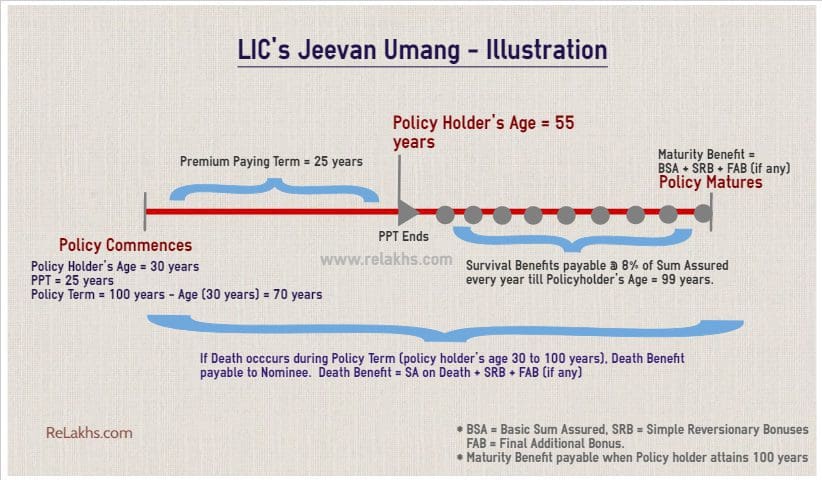

Survival Benefit

Survival benefit is a percentage of the sum assured amount that the insurer will give the policyholder after specific years or at regular intervals. These are generally popular with money-back plans.

The different between maturity benefit and survival benefit is – Maturity Benefit is paid out if the life assured survives the whole policy term. Whereas survival benefits are paid out if the life assured survives specific years within the policy term.

Death Benefit

The amount of claim proceeds paid to the nominee/beneficiary under the life insurance policy after the life insured passes within the policy term is called the death benefit.

Bonus

This is an extra amount paid to the policy holder in addition to the benefits mentioned above. Bonus in life insurance is the extra amount paid over and above the sum assured amount to the customers based on the policies they hold. When the bonuses are allocated, they become vested with the policy and are payable on maturity or on death of the assured during the term of the policy.

When you buy a life insurance policy, you pay your premiums in exchange for the life cover, isn’t it? Like you, all policyholders pay their premiums to the insurer. All these funds collected as premiums, form the insurer’s asset pool. It’s this money that insurers use to settle the claims they receive. But claims aren’t raised every day. So, instead of letting these funds sit idle, insurers invest the premiums collected in a variety of assets like bonds, securities, other debt instruments, and occasionally, a little bit in equity (stocks).

Over a period of time, these investments may generate profits for the insurer. These profits are then distributed to eligible policyholders as bonuses at the end of each financial year. Bonuses are typically paid out on participating life insurance plans, and they are not ‘guaranteed.’

“It is important to note that bonus is paid only to policyholders of a Participating life insurance policy.”

So, the next time you see an advertisement of a participating life insurance policy, you are aware that it is eligible to get a share in company’s profits and thus eligible to receive bonuses (if any).

What are different types of Bonuses in Life insurance?

Here are the different types of bonuses offered with life insurance policies;

- Simple Reversionary Bonus

- Compound Reversionary Bonus

- Interim Bonus

- Terminal Bonus or Final Additional Bonus

- Loyalty Additions

Simple Reversionary Bonus

This type of Bonus declaration usually happens once in a financial year. This bonus is immediately added to the value of insurance policy but they are only paid when the policy matures or when the policy-holder expires.

For example, you have a 10-year life insurance policy that offers a sum assured of Rs. 5 lakhs. Your policy offers a simple reversionary bonus at the rate of 5% of the sum assured. Now, you will be eligible for a simple bonus of Rs. 25,000 each year for the next 10 policy years.

Compound Reversionary Bonus

A compound reversionary bonus is similar to a simple reversionary bonus, except for one key difference. The bonus rate percentage is applied not just on the sum assured, but also on the previously accrued bonus. So, this is something like compound interest.

For example, you have a life insurance policy that offers a sum assured of Rs. 5 lakhs. Your policy offers a simple reversionary bonus at the rate of 5% of the sum assured. For the first policy year, you will be eligible for a simple bonus of Rs. 25,000 each year. In the second policy year, the 5% is calculated on Rs 5,25,000 amount.

Interim Bonus

In case a claim is raised in-between two successive bonus declaration dates, insurers calculate the interim bonus for the period from the last bonus declaration date. This is to ensure that policyholders or their nominees do not miss out on the benefits due.

For example, let’s say policy matures on Dec 31, 2023. You would have earned your last reversionary bonus at the end of the financial year 2022-23.

But what about the 9 months since then, from April 1, 2023 to December 31, 2023? Here’s where an interim bonus becomes relevant.

Terminal Bonus or Final Additional Bonus

It’s paid to those policies which are of a longer duration and has run for say more than 15 years. This is a one-time payment and payable at the end of the policy term. It is a kind of reward for persisting with the policy till its entire tenure and hence it is also known as ‘persistency bonus’ or Final Additional bonus.

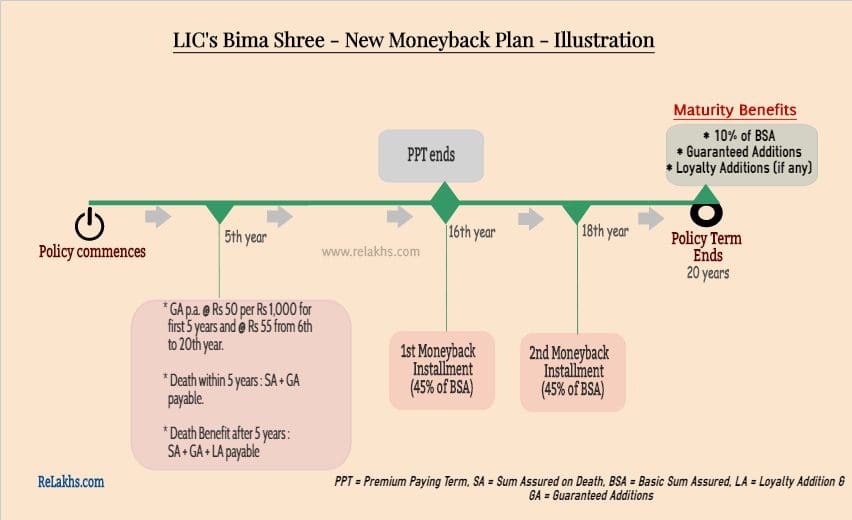

Loyalty Additions

These are similar to Final additional bonus.

Difference between Guaranteed Additions and Bonuses

Bonus depends on the insurer’s profit while Guaranteed Additions (GA) is an assured addition to the life insurance policy and is generally disclosed upfront. GA can be paid-out on both participating and non-participating plans.

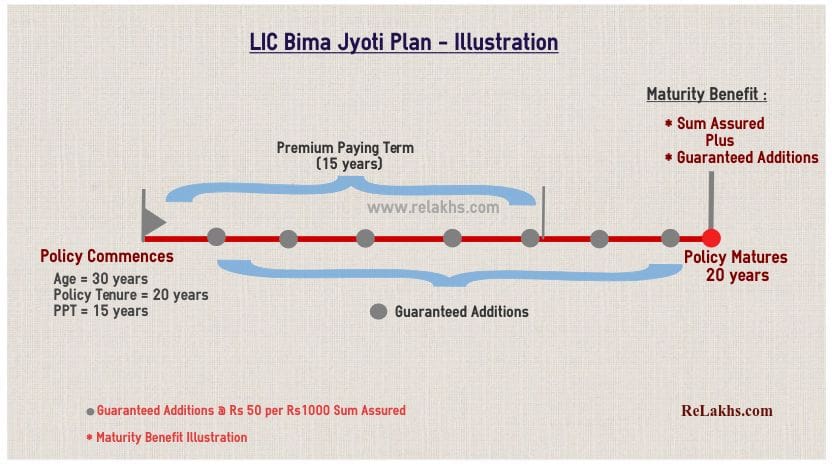

For example, LIC’s Bima Jyoti plan on 22nd Feb, 2021. LIC Bima Jyoti (Plan No.860) is a Traditional, Non-linked, Non-participating, Limited Premium Payment and Life Insurance Savings Plan. As this is a non-participating plan, bonuses are not accrued but Guaranteed Additions are payable at the rate of Rs 50 per Rs 1,000 Basic Sum Assured at the end of each policy year throughout the policy term. This is part of the maturity benefit under this plan.

How is bonus on a life insurance policy calculated?

The rate of bonus allocated on your with-profit or participating life insurance policy depends upon:

- The type of Plan and Term of the policy.

- Your insurer’s Investment experience and the surpluses generated during the year.

- Bonus declared is always based on the Sum assured and not on the premium amount paid by you.

There are two common ways in which bonuses are generally calculated – 1) As a percentage of the sum assured and 2) As a certain amount per Rs. 1,000 of the sum assured.

For example, let’s say LIC declares a bonus of Rs 41 per Rs 1000 sum assured on “New Jeevan Anand” 15 years plan and if you had bought a similar plan for a Sum Assured of Rs 5,00,000 then the bonus amount on your policy would be Rs 20,500 ( ( SA / 1000 ) * 41). Like this, every year your insurer may declare bonus rates. Bu do note that the rates can vary year or year. Remember, these bonus amounts are not paid to you immediately, they are just accrued and paid on maturity or claim.

A word of advice:

Any life insurance policy that pays some bonus or survival benefit turns a regular insurance plan into a savings product. The plans which fall under the category of ‘Participating plans’, the percentage of returns are not guaranteed and are typically ‘low yielding saving plans’. So, be aware of the pros and cons before buying such long-term insurance-cum-saving plans.

Continue reading:

(Post first published on : 11-Sep-2023)