When a financial advisory firm owner first starts their business, much of their time is spent on finding clients that they can serve. But as they (hopefully) onboard more clients and get busier with servicing those clients, they will also find that they eventually start to run short on time. Because in addition to providing ongoing services (e.g., annual plan reviews) to their current clients, they will continue to prospect and onboard new clients as well. And at some point, they might find they hit a ‘capacity wall’ where they no longer have the resources to service new clients (often once they reach 30-40 clients) and where their wellbeing starts to suffer because of the time demands of a growing client base that they can no longer manage without recruiting additional help or outsourcing financial plan preparation.

One potential solution for advisors nearing such a capacity wall is to hire a full-time employee to take on some of the tasks that are eating up the advisor’s time (e.g., a client service associate to handle various administrative and client communication tasks, or a paraplanner or associate advisor to work on more planning-centric issues such as building out drafts of financial plans). However, some advisors might not be ready to take on the burden of hiring an employee (from the time spent recruiting and managing the hire to the dollar cost of providing a salary and benefits). For these advisors, an alternative approach would be to outsource the tasks they want to remove from their plates.

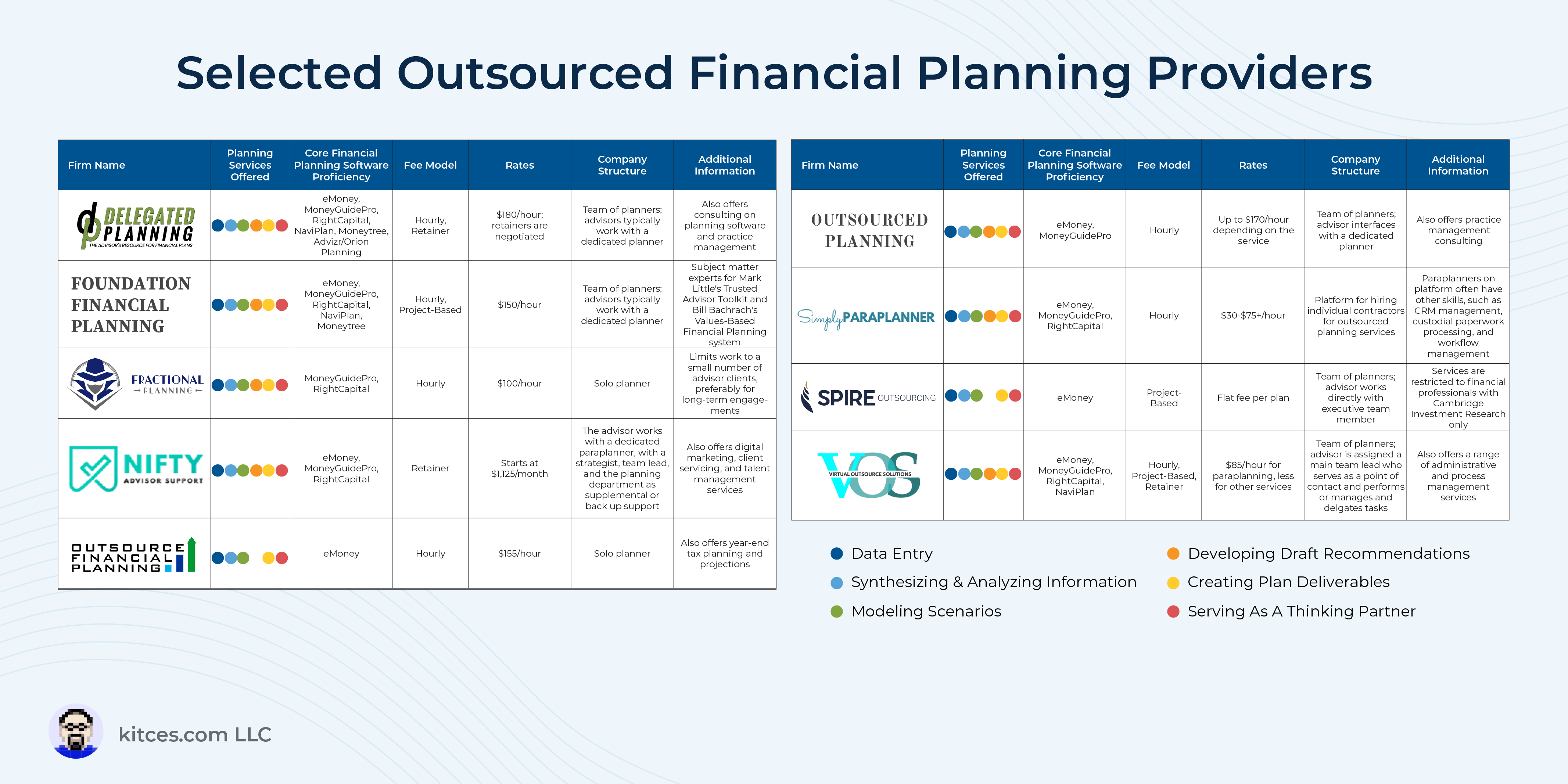

Looking at the financial plan development process specifically, a variety of outsourcing providers are available that can perform the range of required tasks, from data entry to scenario modeling to the creation of plan deliverables. Given that most advisors probably won’t want to outsource the entire plan development process, they can take a methodical approach to identify the tasks that they do not enjoy and/or that take up too much of their time (i.e., creating a “Stop Doing” list) and then review the range of outsourcing partners, assessing their core proficiencies, fee models, rates, and company structures, to find the best fit for their work needs and budget.

Ultimately, the key point is that because solo firm owners who approach their capacity walls can become overwhelmed with the wide range of responsibilities on their plate, finding ways to outsource certain financial planning tasks can help free up time and help them avoid hitting their capacity wall in the first place! And while some advisors might choose to make a full-time hire to handle items from their “Stop Doing” list, others who do not feel ready to do so (or simply prefer not to bring on full-time employees) can consider outsourced planning providers as an alternate solution. And while choosing this option does involve time and monetary costs, doing so could pay worthwhile dividends – not only for the firm’s growth and profitability but also for the advisor’s overall wellbeing!