Nifty 50, the stock market index from NSE, has crossed 20,000, the first time ever. And yet, it doesn’t inspire confidence. As if, something is about to go wrong.

I speak to Amey Kulkarni, one of the finest investors and thinkers, on how he sees the current market and what approach is good for investors at this stage.

VK: Amey, let me take the bull by the horns. What is your take on the market? Should I withdraw money or invest more?

AK: Let me tell you a story from 2016.

Donald Trump won the US elections and it was widely opined that this is not good for the stock markets. This was also the time around demonetisation in India and there was a lot of uncertainty. I had a discussion with one of my closest friends and my first client. Even though I mildly opined against it, my friend ended up selling a part of his mutual fund portfolio as a matter of caution. And the stock markets just kept going up and in fact, smallcaps had a phenomenal run in 2017 and 2018.

Come circa March 2020, Covid hit us.

I was cautious and circumspect. The only thing I knew was this is not the time to sell your stocks / mutual funds. By this time, my friend had evolved. He was busy with his work and hardly looked at the stock market. He quickly realised that this was a great time to buy. When he called me up to have a discussion, I suggested caution and prudence as the future looks too uncertain from this vantage point.

Being outside the market, he was able to assess the situation and act on his conviction. He bet heavily in March and April 2020 on mutual funds and made a handsome return.

The joke is that today, I keep reminding each and every one that March 2020 was the best time to buy and my friend just keeps quiet and does not remind me that in March 2020, I was not as sure.

My take on the market?

- 10% of the times is a bear market

- 10% of the times it is a bull market

- 80% market makes sure, we are confused

Even though we cannot predict the stock market, most of us can easily tell whether we are in a bull market or a bear market.

What is the learning above?

- No one can predict the stock markets

- Stock markets will always surprise us – either on upside or on downside

- The only thing we can do is invest more money when the stock markets fall

VK: Let me push this further. On the one hand,Nifty 50 is at all time high of 20000. On the other hand, there are news / rumours about an upcoming recession especially in the USA. I feel confused as an investor. What’s your take?

I am also confused.

But let me lay out the investment scenario as I see it.

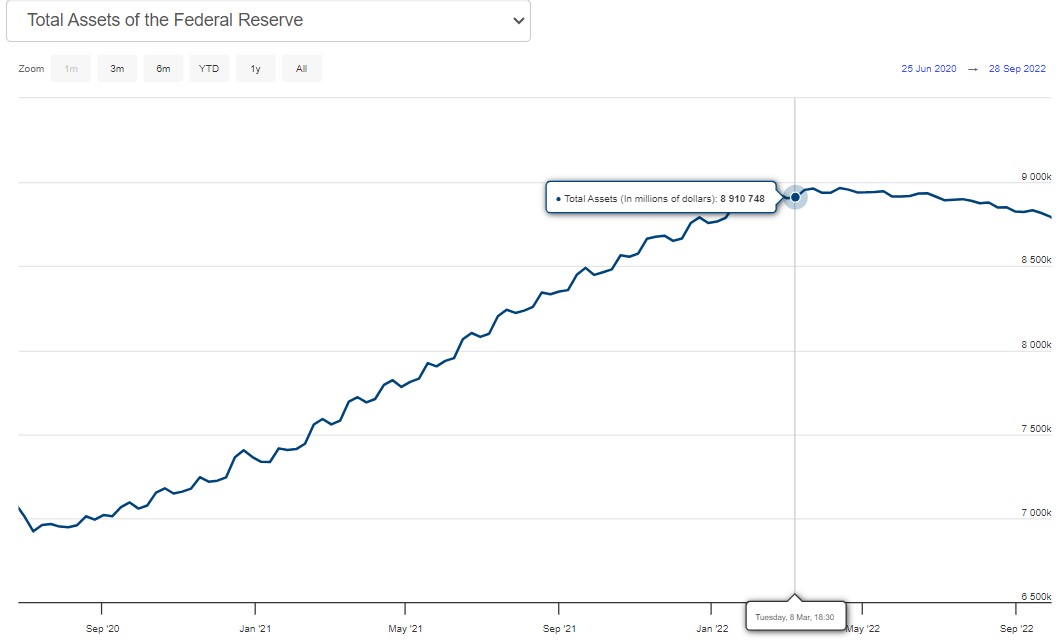

Interest rates in the US have gone up from 0% to 5.25% after being practically zero for 12 years since 2009. The Federal Reserve has also started monetary tightening.

Total Fed assets have reduced from $ 8.9 Tr in mid-2022 to about $ 8.1 Tr in Sep 2023.

The bubble in tech companies and cryptocurrencies has already burst in the US and there is probably more to come.

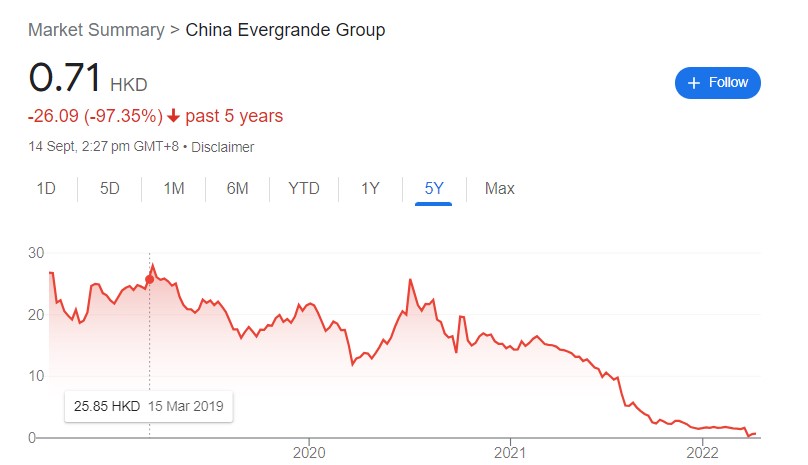

As regards China, news from their property market is not good. Their two largest property developers Evergrande and Country Garden (which are many times bigger than DLF) are both in financial trouble. When the entire developed world is increasing interest rates to control inflation, China is cutting interest rates to boost their real estate sector.

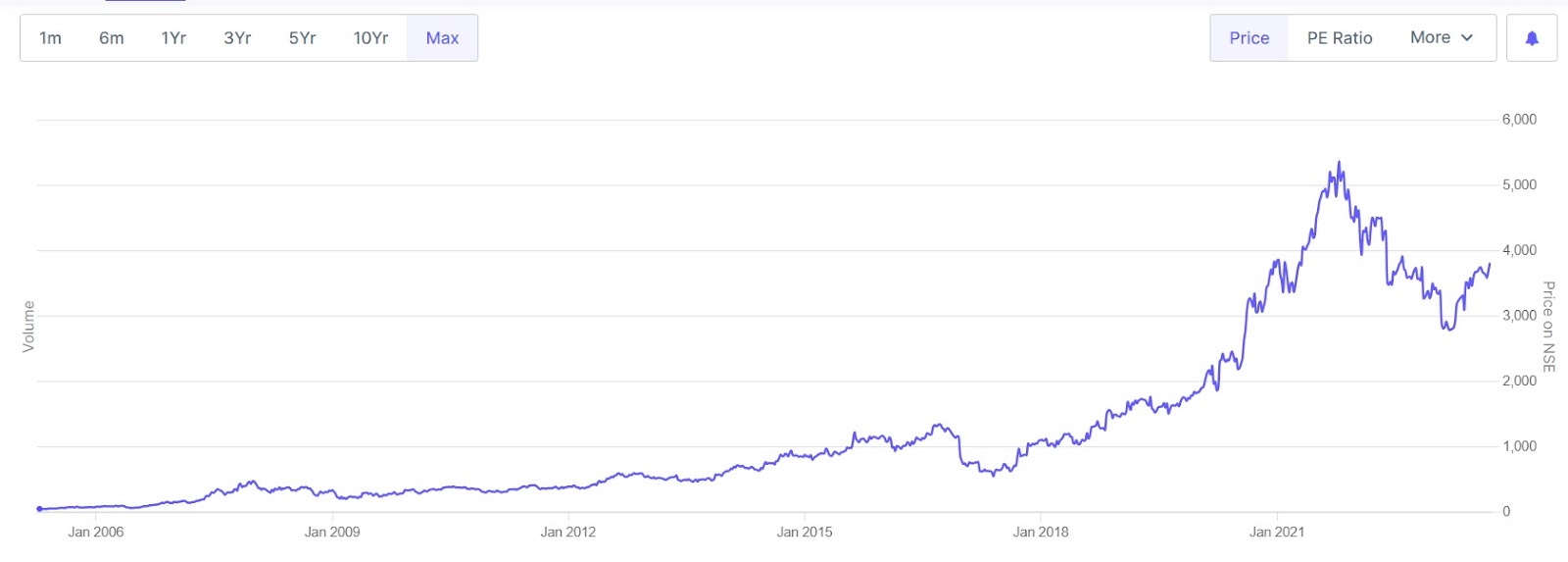

Stock Price – Country Garden (Property developer in China)

Stock Price – Evergrande (Property developer in China)

Maybe the wild bubbles that existed in 2021 have already gone bust in the US / Europe / China.

What about India?

India is in a sweet spot.

We have entered the period where we have a large working age population and this demographic dividend advantage will play out for us till about 2050.

Working age population is shrinking everywhere else in the world (except Africa).

This same demographic dividend played out for England in the 1800s, for the US in late 1800s and early 1900s, for Japan in 1950s and 1960s, South Korea in 1970s and 1980s and for China in 1990s and 2000s.

Also, the template for economic growth in Asia has been closer economic ties with the US for the last 70 years – Japan, South Korea, Singapore, China have all grown through closer economic ties with the US, it is now our turn.

Inflation is stable in India since about 2016.

Major reforms have been carried out – GST, RERA, bankruptcy code etc.

Major push by the government through CAPEX in roads, railways and PLI schemes

We are the only large economy where the developed world wants to invest. China’s time is up – in terms of incremental foreign capital inflows.

If global funds want to invest in emerging markets especially since their local stock markets seem to be unattractive, India is the only large country which looks promising.

So what is the bottomline?

Developed world is in trouble, but India is looking good.

VK: Let me try and see if history is a guide here. If you were to compare today’s market situation with something similar in the past, what would be the closest one?

AK: Let us look at data.

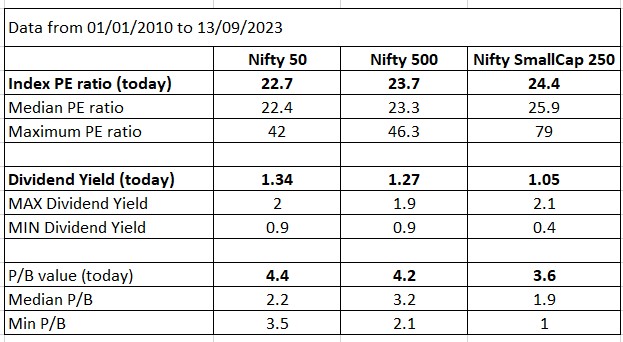

I have taken data for Nifty50, Nifty500 and Nifty SmallCap 250 indices from 1st Jan 2010 till 13th Sep 2023.

(Note – Nifty SmallCap 250 index was launched in Jan 2016)

If we look at PE ratio or dividend yield, in aggregate the Nifty indices do not look very expensive. However, P/B value for all the indices is high.

Also, in the last 6 months since March 2023 that small and midcap stocks have gone up a lot and that is why there is unease amongst most value investors.

One more data point to consider is the Nifty VIX (volatility)

The Nifty volatility index is at an all-time low. Historically stock returns have been volatile. A low VIX index warrants some caution.

VK: Which period in history can we loosely compare today’s market with?

AK: A couple, actually.

Period – 2000s

US stock market returns were mediocre especially after the massive tech bubble burst in Mar 2000. However, the stock market returns in India and China were remarkable.

Period – 1990s

At one point in time, it was predicted that Japan may overtake the US to become the largest economy. The Japanese bubble burst in 1990. It did not have much of an impact on other Asian markets or the US stock markets. Most Asian markets have phenomenal returns between 1990 and 1997 when the Asian currency crisis happened.

So, it is quite possible that even if there is a recession in the US / developed world, India may continue to do well – both in terms of economic growth and stock market returns.

There is a variance of opinion amongst experiences value investors

Source – Tweet from Jiten Parmar

Source – Interview quote from Prashant Khemka – Whiteoak Capital

However, there are also bullish experiences investors out there.

Source – Tweet from Ravi Dharamshi – ValueQuest

VK: So what should my portfolio strategy be?

AK: I can only tell you what I do with my portfolio.

- 80% of my networth is invested in equity

- My mutual fund SIP continues irrespective of any market conditions

- I don’t sell stocks in fear of the market going down.

- I am cautious in buying new stocks in my portfolio for the last 8-10 months

- I am also finding it difficult to find new ideas in the current market

- All my incremental earnings are adding to my dry powder

- I am patient. Waiting out my time to find great new opportunities to buy

- I will get opportunities either because I discovered new stocks which look attractive from growth / valuations perspective or the markets fall a lot

VK: Would you say that the next few years could be muted in terms of returns?

AK: April 2020 to now has been a dream run for stocks markets

Returns in the next 3 years are definitely going to be lesser than in the last 3 years

Every year does not yield positive returns.

Since we do not know which year is going to be a negative return year, we have to hold on and be patient.

The decision to hold / sell / buy needs to be made on a stock specific basis.

VK: Mid and small cap funds are witnessing record inflows. There seems to be a sense of bubble in this segment. How should an investor approach this market cap for now? Is it time to book some profits?

AK: Smallcaps and midcaps, as a category, definitely move in cycles (does not apply to individual stocks). There are periods when midcap and smallcap stocks are in the zone of pessimism and at other times they are in a zone of exuberance. What time is it now?

Nifty SmallCap 250 index returns from

- Sep 2013 to Sep 2023 = 20% CAGR

- Sep 2014 to Sep 2023 = 13% CAGR

If we look at line 1, we may conclude we seem to be in a zone of exuberance.

However, line 2 above suggests maybe times are optimistic, may not be exuberant

I treat direct stock investing and mutual fund investing completely differently.

Mutual fund investing is all about discipline and consistency – SIP over long periods of time.

Direct stock investing has to be opportunistic.

Both need to have a long time horizon, however in case of stocks, we don’t need to compulsorily invest every month. We have to wait for the right stock at the right price and then take advantage of the mispricing in the stock markets to bet heavily.

Going by the current market scenario, one needs to be cautious when allocating more to midcap / smallcap mutual funds. If your allocation to smallcap / midcap mutual funds is very high, you might want to have a rethink. This is because a mutual fund by design invests in several (50+) stocks and a severe market decline will end up testing your conviction and patience. It pays to be cautious. We end up making more money in the long run.

Having said this, investment made in the correct stock at a reasonable or a cheap enough price will deliver good returns irrespective of what the index does.

VK: Should an investor put in more money via SIPs? And, is large cap space a better option to invest for now? Or, should one play much more safely and use real estate, gold, etc.

AK: I don’t think in terms of maximization of returns. It is just impossible to predict which asset class is going to give the best returns over the next 1/2/3 years.

Over the next 5/7/10 years, equity is the asset class which will in all likelihood give the maximum returns.

SIP in mutual funds is one of the safest, easiest and hassle-free ways of investing in equities irrespective of the market sentiment / stage.

If and when the markets fall a lot, one can and must get more aggressive on direct stocks.

About other asset classes:-

Gold is not an investment. Enjoy gold jewelry.

Real estate – most of us have enough real estate. There is no point in buying your 3rd or 4th house. In either case, over the long term 10+ yrs, real estate returns hover around inflation.

VK: If I am an investor with a large lump sum with a 20 year horizon, should i invest everything now or do it gradually?

AK: What needs to be done immediately is to think and decide the following

- Which asset do I want to invest in?

- Who will my advisor be?

- What investment philosophy / strategy I am not comfortable with?

- How much will I be bothered with volatility in returns?

- How much more savings will I have in the next 5 years?

Once you have found answers for all the above questions, and it may take some time and effort to find answers to the above, irrespective of the markets you should go ahead and implement the strategy.

If you have chosen a conservative advisor, he will himself take a cautious and gradual approach to deploy the lump sum corpus.

VK: You know, sometimes, as individuals and investors, if we end up doing a lot of work or research, we develop a sense of forced action. That we have to take some action now else it will all be futile. And that may not be the case. Do you struggle with that too? What’s a good way to deal with this issue?

AK: I have struggled a lot with this issue.

Fortunately, with experience I struggle much less now.

One good way of dealing with this is to be what S Naren – the CIO of ICICI mutual fund says – “ a part-time investor”.

People like me end up spending a lot of time reading about companies and being updated about the stock markets. However, having extra curricular activities / interests is very important. It puts things in perspective.

I have recently started to learn swimming along with my son. I read books not related to investing and stock markets and engage myself in such other non-investing pursuits.

One of the other tricks I use is to try and not look at daily stock price movements (though I am not very successful at that).

Look at the long term price chart for Divis Lab – 450 bagger stock in 20 years

Observe closely

- Zero returns between Dec 2007 and Sep 2013 – 6 long years

- 50% fall in stock price around March 2016

- 60% fall in stock price in 2009

If one is tracking the “markets” too closely the investor will just get scared out of his / her holding in a good company.

VK: Let me ask you something more personal. How have you changed / grown as an investor In the last 5 years? How many investing ideas that you worked on ended up getting the money?

AK: There has been a lot of learning in the last 5 years for me personally as an investor.

If I reflect back, the areas in which I have improved are the following

- I am more uncomfortable with uncertainty

I don’t know whether I will make money in ‘a’ stock or not. But, if I have done my research well, I am not concerned about the stock price movement

- I have become more patient.

I know that success is inevitable in the stock markets if the process is in place. However, stocks never move on the timelines that we envisage.

- I am more comfortable with regret

Regret is inevitable when investing in stocks.

“I should have invested more money in April 2020”

“I should have invested more money in this stock which became 4X”

“I should have never invested in this share – no stock price growth since 3 years.”

“I should have invested in this in 2021 instead of putting money in 2018”

“I missed investing in this stock in spite of doing research on it”

Money is not made by making many decisions.

Money is made by waiting for the correct opportunity and then having the courage to bet big. Stock market does not reward activity – it rewards patience and wisdom.

For stability of the portfolio and lesser volatility, one must invest in mutual funds.

VK: Fantastic. Let’s find out how you add to your knowledge. Would you like to recommend a few books or any other resources that investors can benefit from?

AK: I would highly recommend Pulak Prasad’s – “What I learned about investing from Darwin”

Pulak Prasad is the founder of a Singapore based fund named Nalanda Capital.

The reason I recommend this book is because of the clarity of thought that Pulak has. He has it sorted – what is his investment style and strategy, what sorts of investments is he going to pass, what is he going to avoid.

Video: Circle the wagons – Mohnish Pabrai

Mohnish analyzes extreme success – why some investors like Rakesh Jhunjunwala and Warren Buffet made phenomenally much better than everyone else.

Watch this video to develop the mindset required to make large sums of money in stocks.

–

Thanks Amey, this was extremely helpful. I don’t feel anxious anymore. I hope that the readers too get the same sense of calm.

Disclaimer:

Amey Ashok Kulkarni is a SEBI registered investment advisor. The above post is purely educational in purpose and intent. Please consult your investment advisor before taking any decisions.

Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Investment in securities markets are subject to market risks. Read all the related documents carefully before investing