Homology Medicines (FIXX) (~$70MM market cap) is a clinical stage genetics biotech whose lead program (HMI-103) is meant to treat phenylketonuria (“PKU”), a rare disease that inflicts approximately 50,000 people worldwide. In July, despite some early positive data, the company determined to pursue strategic alternatives as FIXX wouldn’t be able to raise enough capital in the current environment necessary to continue with clinical trials. Alongside the strategic alternatives announcement, the company paused development and reduced its workforce by 87% which resulted in $6.8MM in one-time severance charges.

Outside of approximately $108MM in cash (netting out current liabilities), FIXX has a potentially valuable 20% ownership stake in Oxford Biomedia Solutions (an adeno-associated virus vector manufacturing company), a joint venture that was formed in March 2022 with Oxford Biomedia Plc (OXB in London). As part of the joint venture, FIXX can put their stake in the JV to OXB anytime following the three-year anniversary (~March 2025):

Pursuant to the Amended and Restated Limited Liability Company Agreement of OXB Solutions (the “OXB Solutions Operating Agreement”) which was executed in connection with the Closing, at any time following the three-year anniversary of the Closing, (i) OXB will have an option to cause Homology to sell and transfer to OXB, and (ii) Homology will have an option to cause OXB to purchase from Homology, in each case all of Homology’s equity ownership interest in OXB Solutions at a price equal to 5.5 times the revenue for the immediately preceding 12-month period (together, the “Options”), subject to a maximum amount of $74.1 million.

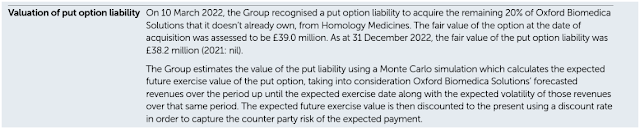

Poking around OXB’s annual report, they have the below disclosure:

Using the current exchange rate, that’s approximately $47MM in value to FIXX. Now OXB isn’t a large cap phrama with an unlimited balance sheet, so there is some counterparty risk that OXB will ultimately be able to make good on this put. In my back of the envelope NAV, I’m going to mark this at a 50% discount to be conservative.

Unlike GRPH, the operating lease liability at FIXX is mostly an accounting entry as the company’s office space is being subleased to Oxford Biomedia Solutions, but doesn’t qualify for deconsolidation on FIXX’s balance sheet. I’m going to remove that liability, feel free to make your own assumption there. Additionally, even though HMI-103 is very early stage, it wasn’t discontinued due to a clinical failure and might have some value despite me marking at zero since I can’t judge the science.

It is hard to handicap the path forward, maybe OXB buys them out, they could do a pseudo capital raise with FIXX’s cash balance while eliminating the JV put option liability. Or FIXX could pursue the usual paths of a reverse-merger, buyout or liquidation.

Disclosure: I own shares of FIXX