Eicher Motors Ltd. – Made Like A Gun

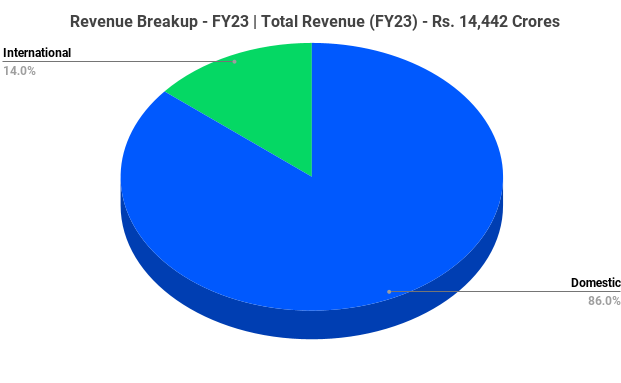

Eicher Motors Limited (EML), incorporated in 1982, is the listed flagship company of the Eicher Group in India and a leading player in the Indian automobile industry. On a standalone basis, EML manufactures and markets motorcycles under the iconic Royal Enfield brand, with its production facilities based in Chennai, Tamil Nadu. It also has research and development (R&D) facilities at two locations—Leicestershire, UK, and Chennai. Additionally, the company operates as a holding company for investments in Volvo-Eicher Commercial Vehicles (VECV) Limited. A joint venture of EML (54.4%) and AB Volvo (45.6%), VECV came into existence with effect from July 1, 2008. The JV is engaged in EML’s truck and bus operations, auto components business and technical consulting services business and Volvo Group’s Indian truck sales and marketing functions, as well as service and spares network operations for both Volvo trucks and buses. In 2020, VECV successfully integrated Volvo Buses India into VECV, including the manufacture, assembly, distribution, and sale of Volvo Buses in India.

Products & Services:

The company has various products under its two business segments.

- Royal Enfield – The Company has models like Bullet 350, Classic 350, Meteor 350, Himalayan, Scram 411, Hunter 350, Super Meteor 650 and 650 Twins.

- VECV – It consists of Heavy, Light & Medium Duty trucks, Buses, special applications like ambulances from Eicher and Volvo Brands. It also has Engine Business, Engineering component business and Powertrain business.

Subsidiaries: As on FY23, the company has 6 subsidiaries, 1 Joint Ventures and 4 step down subsidiaries.

Key Rationale:

- Market Leader – Eicher Motors (EML) is the Global leader in the 250cc -750cc mid segment motorcycle. It has a market share of ~90% in the Indian Mid size segment through its aspirational models under the Royal Enfield (RE) brand, such as Bullet, Classic, Interceptor among others. The company has been gaining market share in the above 125cc segment with 32.9% share as on Q1FY24. Overall share in Motorcycles stands at 7.6% as on Q1FY24. In the International market, the company has a market share of about 8% in Americas, 9% in APAC and 9% in EMEA in the same mid segment with a volume growth of 4.5 times from 20,825 in FY19 to 89,226 in FY23. The VECV division has a overall CV market share of 17.1% in FY23. The market share across segments as of July end 2023 are 36.9% in L&MCV, 8.5% in HCV, 24.7% in Buses and 94.7% in Volvo trucks India (High End premium Segment). The dealer network of the Royal Enfield (2W Division) have grown 2.5x in 6 years from just 825 stores in FY18 to 2059 stores in FY23. In that 2059 stores, 1090 belongs to studio stores and 969 belongs to Large Size stores. These stores are spread across ~1750 cities in India.

- Sales Growth – The overall Motorcycles volume under the Royal Enfield segment have crossed the pre-covid levels at 8.35 lakh units in FY23 from 8.24 lakh units in FY19. The volumes in FY20, 21 and 22 were impacted due to COVID 19 pandemic and supply chain constraints. Royal Enfield is one of the few companies in the 2W segment which crossed the pre-covid sales mark and outperformed the industry growth. Sales Volume in Q1FY24 stands at 2.27 lakh units, a growth of 22% YoY. VECV has achieved a highest ever first quarter (Q1) sales across many segments in Q1FY24. Overall VECV sales also achieved the Highest ever first quarter sales of 19,571 units in Q1FY24 exceeding previous record of 17,469 units in Q1FY23.

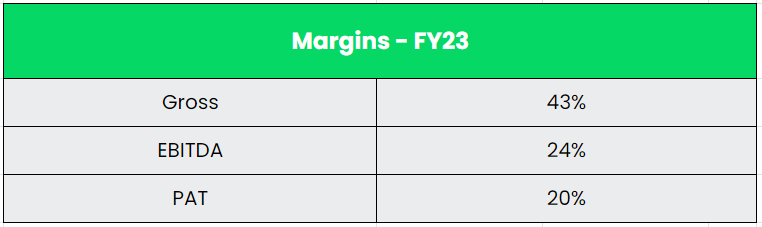

- Q1FY24 – Eicher Motors reported a strong revenue growth of 17% YoY Q1FY24 to Rs.3986 crore from Rs.3397 crore for the same period last year. EBITDA had a growth of 23% of Rs.1021 crore in Q1FY24 vs. Rs.831 crore for the same period last year. EBITDA Margin has improved by ~120 bps from 24.4% in Q1FY23 to 25.6% in Q1FY24 on account of 1.5% price hike in certain models. PAT showed a massive growth of 50% YoY to Rs.918 crore in Q1FY24 from Rs.611 crore in Q1FY23.

- Financial Performance – The 3 Year revenue and profit CAGR stands at 16% and 17% respectively between FY20-23. The share of non-Motorcycle business (Accessories, Apparels, etc.) have grown nearly 4x between FY17-FY23. The company has a strong balance sheet with a debt-to-equity ratio of just 0.02x which equals to near zero debt. The cash and investments in the balance sheet totals to ~Rs.13180 crores which is nearly 14% of the Market Capitalisation. This shows the strong cash balance of the company. The last 5-year accumulated FCF (Free Cash Flow) have crossed over Rs.6000 crores, depicting the cash generating potential of the company.

Industry:

The Indian automotive industry has seen a healthy revival in FY22-23, aided by a recovery in the economic activities and recovery in mobility post COVID impacted period (FY 2021-22). However, the two-wheeler segment is yet to reach the pre-pandemic levels as the industry navigates through high inflation, supply chain hurdles, sharp increase in input costs, and the rising cost of ownership due to regulatory changes. According to the Society of Indian Automobile Manufacturers (SIAM), the two-wheelers segment grew by a relatively moderate 17% YoY growth, after witnessing de-growth for the previous three consecutive years. The domestic sales of two wheelers in FY 2022-23 were 15.9 million units as against 13.5 million units in FY 2021-22. Motorcycle sales increased by 14% YoY to 10.2 million units, while scooter sales grew over 25% YoY to 5.2 million units. The sales of Electric two-wheelers in India grew over two-and-half-fold to 7,28,090 units in FY 2022–23 over the previous fiscal, aided by subsidies offered by the government(s) and growing penetration of electric vehicles across segments.

Growth Drivers:

- The Foreign Direct Investment (FDI) inflow into the Indian automotive industry between April 2000-March 2023 stood at US$ 34.7 billion as per the data released by the Department for Promotion of Industry and Internal Trade (DPIIT).

- According to the Economic Survey, by 2031, the working age population i.e., 20-59 years is poised to increase by 300 bps from 55.8% in 2021 to 58.8% in 2023.

- India to become the youngest nation by 2025 with an average age of 25 years. With Royal Enfield having a large young customer base (31% in the age of 18-25 and 41% in the age of 26-35), they have the high chances of getting benefitted.

Competitors: Hero MotoCorp, TVS Motors, etc.

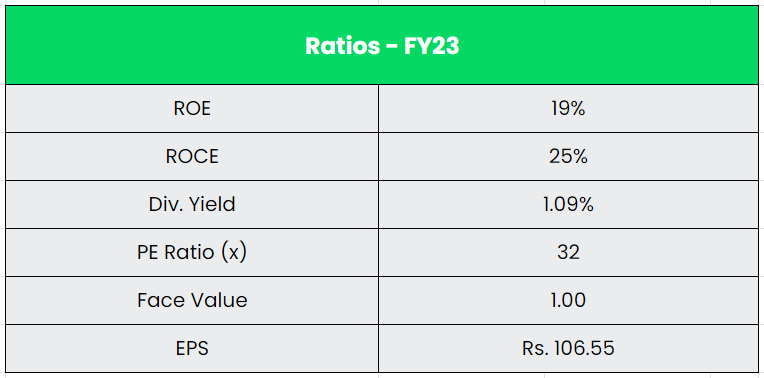

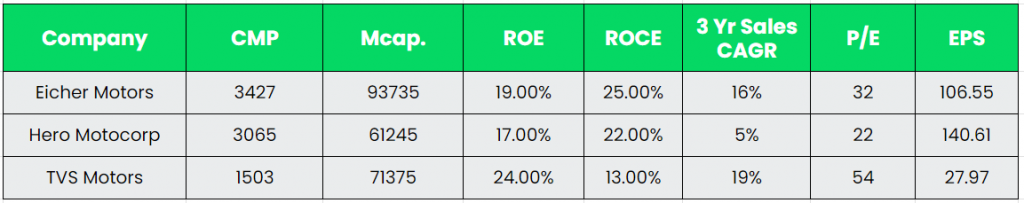

Peer Analysis:

Among the above competitors, Eicher motors has better return ratios and stable revenue growth than the other two. The balance sheet strength of Eicher is way better than Hero and TVS in comparison. The high ROE and Low ROCE of TVS is due to the impact of high Debt and low equity.

Outlook:

In the Motorcycle segment, the company has launched “The Hunter 350” model in the August last year and it has been successful, with over 200,000 units sold in just 11 months. The recently launched above 500cc segment “Super Meteor” had a good response globally. The company is planning to launch around 11-12 products in the medium term which includes the very latest Bullet launch and a Himalayan 450 launch in the near term. In the International front, Eicher is planning to open New Retail formats – Studio stores, Shop-in-shop for apparel, and motorcycle displays to increase customer reach. It has 92, 68 and 50 exclusive stores in Americas, EU&MEA and APAC regions. It is also evaluating opportunities to set up CKD (Completely Knocked Down) facility in priority markets in APAC and LATAM regions and recently opened a CKD facility at Nepal. The company also making a significant progress in the EV space with a dedicated 100+ people. They are currently in the execution phase of the project.

Valuation:

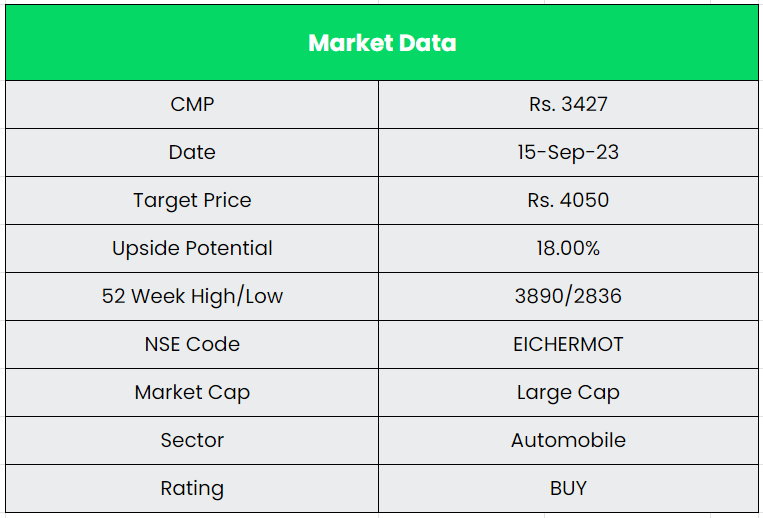

We believe Eicher Motos will continue to gain the market share through aggressive network expansion in both the domestic and International, Multiple launches, Entering new territories and Infrastructure boost by Government Initiatives. We recommend a BUY rating in the stock with the target price (TP) of Rs.4050, 28x FY25E EPS.

Risks:

- Dependency Risk – The company’s growth has been driven by the over 250-cc motorcycle sub segment in the last few years. It has no presence in the high volume (75-110 cc) sub-segments. Even in the over 250-cc sub-segment, its Classic & Hunter 350 model accounts for most of the sales. Strong competition to its leading model could significantly hurt its volumes.

- Cyclical Risk – The VECV segment of the company is highly susceptible to the cyclicality of the Commercial Vehicle Industry which can impact the sales growth of the same segment.

- Slowdown Risk – EML has negligible presence in the mid-market 2-wheeler segment. A sustained slowdown in the economy could hamper the discretionary spending and can also result in downtrading across consumer categories which can impact growth of premium motorcycles in short to medium term.

Other articles you may like

Post Views:

57