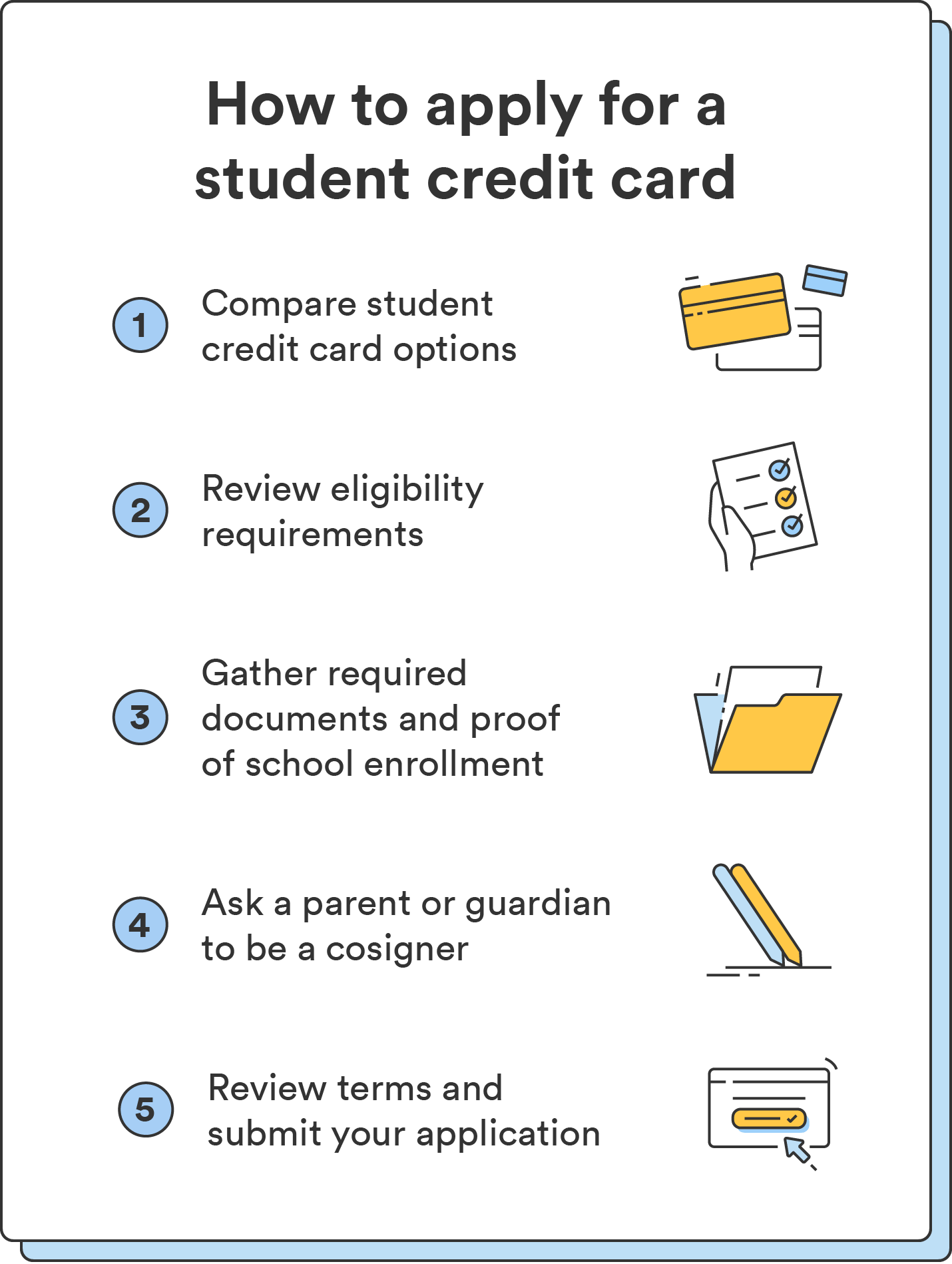

Getting a student credit card is fairly straightforward. Follow the steps below to get started.

1. Compare different student credit card options

When comparing student credit cards, consider the following factors:

- Annual percentage rate (APR): Look for the lowest APR possible to minimize interest charges on any carried balances. Some cards may come with a 0% introductory APR, which means you won’t be charged interest on purchases or balance transfers for a specific time frame.

- Low fees: Different cards can come with fees like annual account fees or late fees. Look for student cards with few or no fees.

- Rewards: Choose cards that offer rewards or cashback programs aligned with your spending habits. Some cards may provide extra cashback on dining, textbooks, or other common student expenses, allowing you to earn rewards on everyday purchases.

- Credit limit and credit-building features: Consider cards with higher credit limits that give you enough room for essential expenses. Additionally, some cards may offer credit-building features, such as reporting your payments to credit bureaus, helping you build a positive credit history.

There are many student credit cards to choose from, so review your options to select the one that best fits your needs.

2. Review the eligibility requirements

Before applying, review the eligibility criteria for student credit cards, which typically include:

- Minimum age requirement (usually 18 years).

- Proof of enrollment in college.

- Income verification or a co-signer for those under 21.

- Proof of identity and U.S. citizenship or legal residency.

Eligibility requirements can vary by credit card issuer, so confirm that you meet the criteria for any cards you’re considering.

3. Gather required application documents

Once you find a card you want to apply for, review the application and gather required documents. These typically include:

- Personal identification (driver’s license, passport, state-issued ID).

- Social Security number.

- Proof of college enrollment (student ID, official letter, online verification).

- Proof of income (W-2 form or recent pay stubs).

- Co-signer’s information and income details (if applicable).

Prepare the required documents and information upfront for a smoother application process.

4. Ask a parent or guardian to cosign your application (if needed)

If you’re under 21 and don’t have an independent income (most college students don’t!), choose a co-signer for your application.

Ask a parent, guardian, or other trusted family member who understands the responsibilities of cosigning and is willing to support you in building credit. Ensure they can provide accurate income details for your application and understand their role in opening the account.

5. Submit your application

Once you’ve decided on a student credit card and have the required documents, you can apply online or in person. Take time to review the terms and conditions before you submit your application.

If you apply online, you may receive your approval immediately or have to wait for an approval letter in the mail.