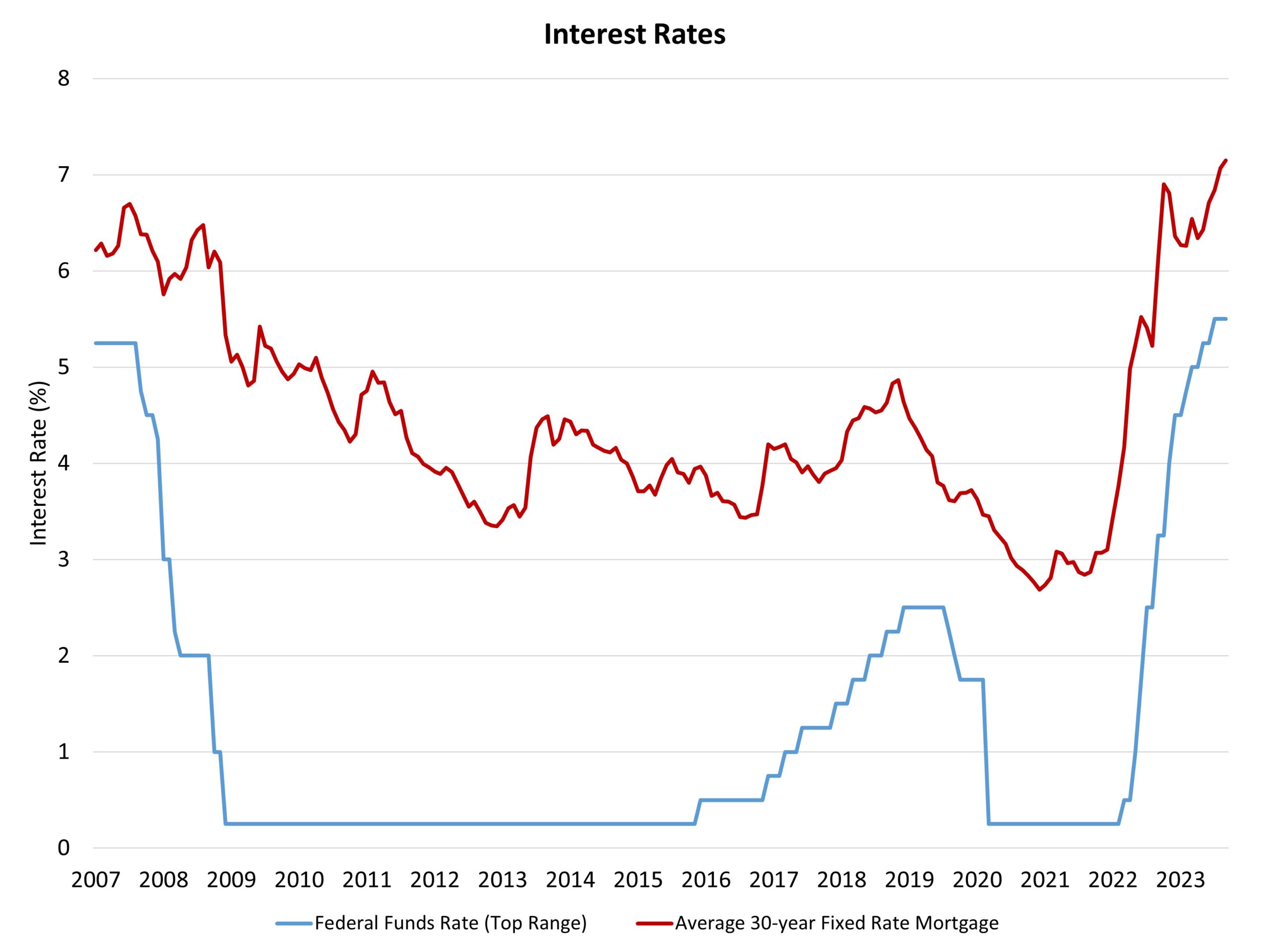

The Federal Reserve’s monetary policy committee held the federal funds rate at a top target rate of 5.5% at the conclusion of its September meeting. The Fed will also continue to reduce its balance sheet holdings of Treasuries and mortgage-backed securities as part of quantitative tightening. These actions are intended to slow the economy and bring inflation back to 2%.

After an increase in rates in July, the pause for September will likely be temporary. Indeed, the Fed maintained a hawkish bias by noting: “additional policy firming may be appropriate to return inflation to 2 percent over time.” The Fed’s dot-plot projections imply one more 25 basis point increase in 2023 (presumably in November), which would be the last increase for this cycle. Then the Fed will hold this higher rate for longer – with the Fed’s projections suggesting no rate cuts until the second half of 2024. And as a revision, the Fed’s projections suggest only two rate cuts for 2024. And during that time, quantitative tightening will continue, keeping the spread between the 10-year Treasury and the 30-year fixed rate mortgage elevated. It is currently near 300 basis points.

The Fed faces competing risks: elevated but trending lower inflation combined with ongoing risks to the banking system and macroeconomic slowing. Chair Powell has previously noted that near-term uncertainty is high due to these risks. Nonetheless, economic data remains better than expected. The Fed stated today: “economic activity has been expanding at a solid pace,” and that “job gains have slowed but remain strong, the unemployment rate has remained low.”

Despite this positive assessment from the Fed, there are ongoing challenges for regional banks, as well weakness for commercial real estate. Going from near zero to 5.5% on the federal funds rate is a dramatic policy move with possible unintended consequences. More caution seems prudent. In fact, prior risks for smaller banks will result in tighter credit conditions, which will slow the economy and reduce inflation. Thus, these financial challenges act as additional surrogate rate hikes in terms of tightening credit availability, doing some of the work for the Fed.

The 10-year Treasury rate, which determines in part mortgage rates, increased to near 4.4% upon the Fed announcement. Mortgage rates will remain above 7% range, which is currently home builder sentiment.

Related