One of the major amendments implemented as per the Finance Bill 2023 is to curtail LTCG (Long Term Capital Gain) benefits by deeming the gains arising from ‘specified mutual funds’ as short-term capital gains (STCG).

What are these Specified Mutual Fund Schemes as per the Income Tax Act? What is the major amendment with respect to the taxation of the gains arising out a specified mutual fund for Financial Year 2023-24 (AY 2024-25)?

What are Specified Mutual Fund Schemes as per the Income Tax Act?

A mutual fund by whatever name called, where not more than 35% of its total proceeds is invested in the equity shares of domestic companies. Examples are : Liquid Funds, Short Duration Debt Funds, Gold Mutual Funds, Equity Fund of Funds etc.,

For the purposes of section 50AA of the Income Tax Act, “specified mutual fund” means a mutual fund by whatever name called, where not more than 35% of its total proceeds is invested in the equity shares of domestic companies. Accordingly, an “equity-oriented fund” which invests in units of another fund instead of investing directly in equity shares of domestic company may be regarded as “specified mutual fund”. – AMFI

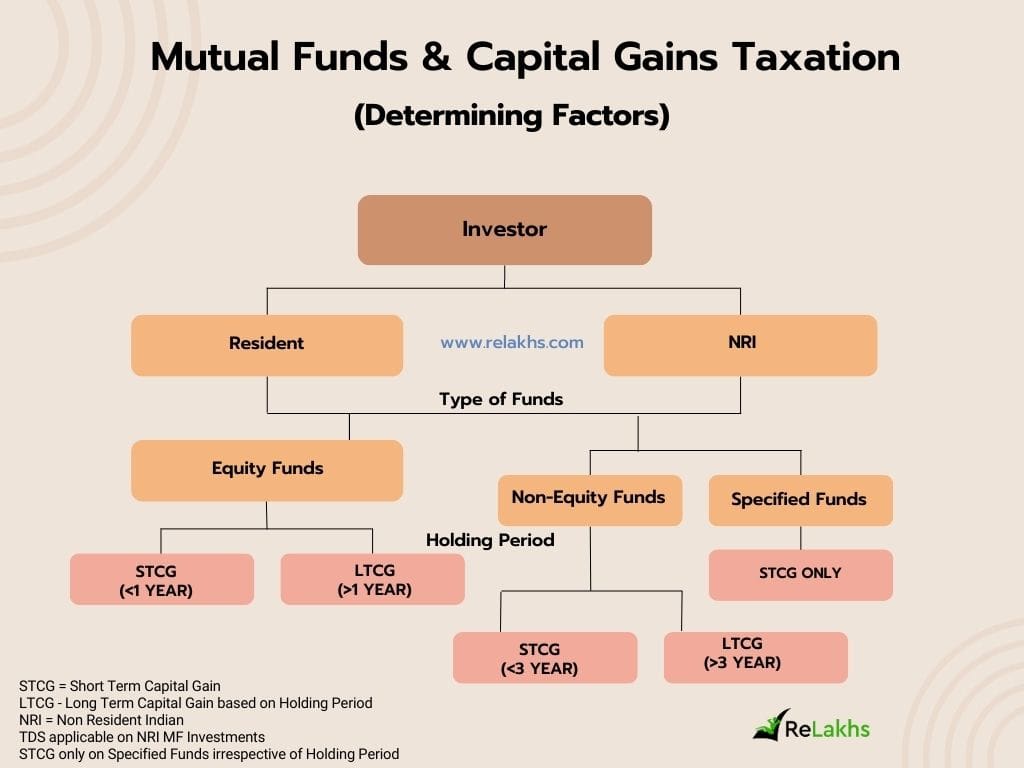

With this new amendment, we now have three broad type of funds – Equity, Non-Equity & Specified Funds.

| Percentage of Equity Exposure | 0% to 35% | 36% to 64% | 65% & more |

| Type of Fund | Specified Fund | Non-Equity oriented Fund (Hybrid Funds) |

Equity Mutual Fund |

What is the new Tax amendment w.r.t Specified Mutual Funds?

Let’s first understand how the capital gains of a mutual fund scheme are categorized as Short-term or Long-term?

Period of Holding & Capital Gains on Mutual Funds

Capital gains on Mutual funds could be either long term capital gains or short-term capital gains, depending on your investment horizon.

- Long Term Capital Gains

- If you make a gain / profit on your investment in a Equity Mutual Fund scheme that you have held for over 1 year, it will be classified as Long-Term Capital Gain.

- If you make a gain / profit on your investment in a Non-Equity Mutual Fund scheme (or in a Debt Fund) that you have held for over 3 years, it will be classified as Long Term Capital Gain.

- Short Term Capital Gains

- If your holding in a Equity mutual fund scheme is less than 1 year i.e. if you withdraw your mutual fund units before 1 year, after making a profit, then the profit will be considered as Short Term Capital Gain.

- If you make a gain / profit on your Non-Equity (or other than equity oriented schemes) that you have held for less than 36 months (3 years), it will be treated as Short Term Capital Gain.

The new amendment that we are discussing is related to non-equity oriented funds.

The Capital gains from transfer or redemption of units of “specified mutual fund schemes” acquired on or after 1st April 2023 are treated as short term capital gains taxable at applicable income tax slab rates as provided above irrespective of the period of holding of such mutual fund units.

So, the indexation benefit is also not available while calculating long-term capital gains on Specified Mutual Funds. Pursuant to the above change, benefits in the form of lower tax rates and indexation available to LTCG on the sale of non-equity mutual funds will be replaced by taxation at the maximum marginal rate, as applicable to STCG.

However, as the gains are still characterized as capital gains, investors are allowed to set off any other short-term capital losses that are incurred by them against capital gains of specified mutual fund.

Related Article : What is Indexaton? How is it beneficial?

If you have bought units of a non-equity oriented fund prior to 1st April 2023 then this new tax rule is not applicable.

Continue reading:

(Post published on : 25-Sep-2023)