What are the latest Post Office Small Saving Schemes Interest rates Oct – Dec 2023? What are the interest rates of PPF, SSY, SCSS, NSC, and MIS interest rates for October to December 2023?

As currently, the inflation rate is still high, the government retained the same interest rates for all the schemes (except for the 5-year Post Office Recurring Deposit or RD).

Updates –

Earlier the interest rates used to be announced yearly once. However, from 2016-17, the rate of interest will be fixed quarterly. I already wrote a detailed post on this. I am providing the link to that earlier post below.

Below is the timetable for change in interest rates for all Post Office Savings Schemes.

As per the above schedule, the Government announced the interest rate applicable to all Post Office Savings Schemes from 1st October 2023 to 31st December 2023.

Latest Post Office Small Saving Schemes Interest rates Oct – Dec 2023

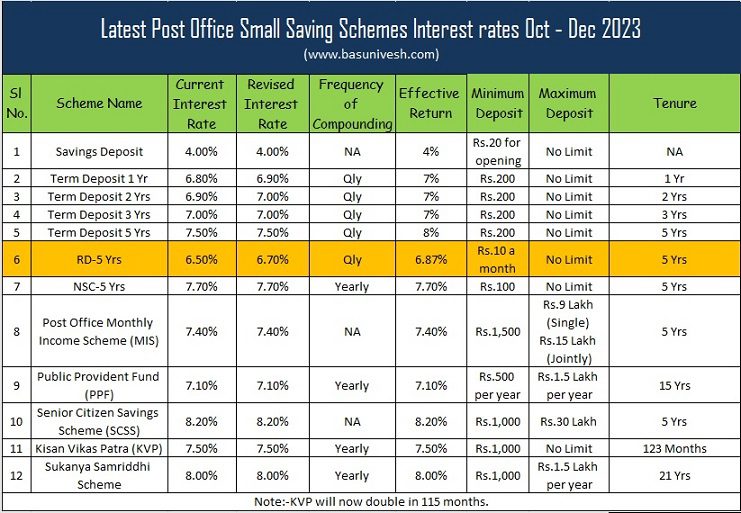

As per the notification from the Department of Economic Affairs, Ministry of Finance, the below interest rates are applicable for the third quarter of this financial year (2023-24).

As I have mentioned above, all other scheme rates were unchanged except 5 years of RD. Earlier the 5-year RD used to fetch 6.5% and now it is increased to 6.7%. Hence, the effective rate of return for RD is 6.87%. I have highlighted the same with yellow colour in the above table.

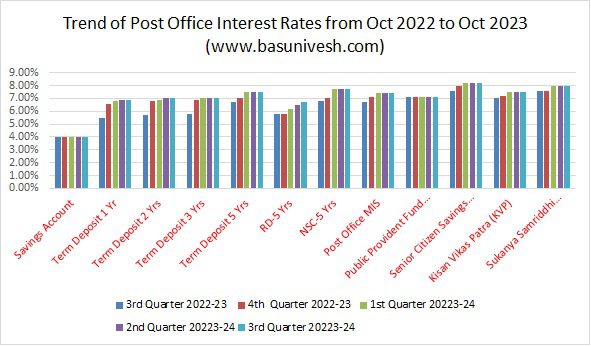

The trend of Post Office Interest Rates from July 2022 to July 2023

Now let us look at the trend of Post Office Small Savings Interest rates of last year. They are as below.

You noticed that for many schemes the rate which we are getting now is highest since 2-3 quarters. It is mainly because of high inflation and a high-interest rate regime.

Features of Post Office Savings Schemes

Now let us glance the Post Office Small Savings Schemes features. This will give you more clarity on choosing the right product for you.

# Post Office Savings Account

Like Bank Account, Post Office also offers you the savings account to its customers. The few features are as below.

- Minimum Rs.500 is required to open the account.

- Account can be opened single, jointly, Minor (above 10 years of age), or a guardian on behalf of a minor.

- Minimum balance to be maintained in an account is INR 500/- , if balance Rs. 500 not maintained, a maintenance fee of one hundred (100) rupees shall be deducted from the account on the last working day of each financial year and after deduction of the account maintenance fee, if the balance in the account becomes nil, the account shall stand automatically closed.

- Cheque facility/ATM facility are available

- Interest earned is Tax-Free up to INR 10,000/- per year from the financial year 2012-13

- Account can be transferred from one post office to another

- One account can be opened in one post office.

- At least one transaction of deposit or withdrawal in three financial years is necessary to keep the account active, else account became silent (Dorment).

- Intra Operable Netbanking/Mobile Banking facility is available.

- Online Fund transfer between Post Office Savings Accounts/Stop Cheque/Transaction View facility is available through Intra Operable Netbanking/Mobile Banking.

- The facility to link with IPPB Saving Account is available.

- Funds Transfer (Sweep in/Sweep out) facility is available with IPPB Saving Account.

# Post Office Fixed Deposits (FDs)

- Minimum of Rs.1,000 and in multiples of Rs.100. There is no maximum limit.

- FD tenure currently available is 1 yr, 2 Yrs, 3 Yrs and 5 Yrs.

- Account can be opened single, jointly, Minor (above 10 years of age) or a guardian on behalf of minor.

- Account can be opened by cash /Cheque and in case of Cheque the date of realization of cheque in Govt. account shall be date of opening of account.

- Account can be transferred from one post office to another

- Single account can be converted into Joint and Vice Versa .

- Any number of accounts can be opened in any post office.

- Interest shall be payable annually, No additional interest shall be payable on the amount of interest that has become due for payment but not withdrawn by the account holder.

- The annual interest may be credited to the savings account of the account holder at his option.

- Premature encashment not allowed before expiry of 6 month, If closed between 6 month to 12 month from date of Opening, Post Office Saving Accounts interest rate will be payable.

- 5 Yrs FD is eligible for tax saving purposes under Sec.80C.

# Post Office Recurring Deposit (RD)

- Minimum is Rs.100 a month and in multiple of Rs.10. There is no maximum limit.

- Account can be opened single, jointly, Minor (above 10 years of age) or a guardian on behalf of minor.

- Tenure of RD is 5 years.

- Account can be opened by cash / Cheque and in case of Cheque the date of deposit shall be date of clearance of Cheque.

- Premature closure is allowed after three years from the date of opening of the account.

- Account can be transferred from one Post Office to another Post Office.

- Subsequent deposit can be made up to 15th day of next month if account is opened up to 15th of a calendar month and up to last working day of next month if account is opened between 16th day and last working day of a calendar month.

- If a subsequent deposit is not made up to the prescribed day, a default fee is charged for each default, default fee @ 1 Rs for every 100 rupee shall be charged. After 4 regular defaults, the account becomes discontinued and can be revived in two months but if the same is not revived within this period, no further deposit can be made.

- If in any RD account, there is a monthly default amount, the depositor has to first pay the defaulted monthly deposit with default fee and then pay the current month deposit.

- There is rebate on advance deposit of at least 6 installments, Rs. 10 for 6 month and Rs. 40 for 12 months Rebate will be paid for the denomination of Rs. 100.

- One loan up to 50% of the balance allowed after one year. It may be repaid in one lumpsum along with interest at the prescribed rate at any time during the currency of the account.

- Account can be extended for another 5 years after it’s maturity.

# Post Office Monthly Income Scheme (MIS)

- Maximum investment is Rs.9 lakh in a single account and Rs.15 lakh jointly (It is revised during the Budget 2023). Earlier it was Rs.4.5 lakh for a single account and Rs.9 lakh for joint accounts.

- Account can be opened single, jointly, Minor (above 10 years of age) or a guardian on behalf of minor.

- Any number of accounts can be opened in any post office subject to maximum investment limit by adding balance in all accounts (Rs. 4.5 Lakh).

- Single account can be converted into Joint and Vice Versa.

- Maturity period is 5 years.

- Interest can be drawn through auto credit into savings account standing at same post office,orECS./In case of MIS accounts standing at CBS Post offices, monthly interest can be credited into savings account standing at any CBS Post offices.

- Can be prematurely en-cashed after one year but before 3 years at the discount of 2% of the deposit and after 3 years at the discount of 1% of the deposit. (Discount means deduction from the deposit.).

- Interest shall be payable to the account holder on completion of a month from the date of deposit.

- If the interest payable every month is not claimed by the account holder such interest shall not earn any additional interest.

# Post Office Senior Citizen Savings Scheme (SCSS)

I have written a detailed post on this. Refer to the same at ” Post Office Senior Citizen Scheme (SCSS)-Benefits and Interest Rate“.

Note – Effective from 1st April 2023, the maximum limit is currently Rs.30 lakh. Earlier it was Rs.15 lakh. This change happened during Budget 2023.

# Public Provident Fund (PPF)

I have written various posts on PPF. Refer the same:-

# National Savings Certificate NSC (VIII Issue)

- Minimum Rs.1,000 and in multiple of Rs.100.

- No maximum limit.

- Account can be opened single, jointly, Minor (above 10 years of age) or a guardian on behalf of minor.

- Tax Benefit under Sec.80C is available.

- Tenure is 5 years.

# Kisan Vikas Patra (KVP) Account

- Minimum Rs.1,000 and in multiples of Rs.100. There is no maximum limit.

- Account can be opened single, jointly, Minor (above 10 years of age) or a guardian on behalf of minor.

- The money will be double at maturity. However, as the interest rate changes on a quarterly basis. The maturity period also varies once in a quarter.

# Sukanya Samriddhi Account Yojana (SSY)

I have written various posts on this. Refer the same:-

Conclusion:- As again the inflation slowly inching up due to crude price increase, draught in many parts of the countries, and higher inflation, this time government retained the same interest for the majority of the schemes.