Groww Mutual Fund has recently launched the Groww Nifty Total Market Index Fund. It is India’s first Total Market Index Fund. Do you really need this Index in your portfolio?

The fund will be open for subscription from 3rd October 2023 to 17th October 2023. The fund re-opens for regular investment and redemption within five business days from the date of allotment of units on or before.

What is the Nifty Total Market Index?

The Nifty Total Market Index will track the performance of 750 stocks covering large, mid, small, and microcap segments. All stocks that are part of the Nifty 500 index and Nifty Microcap 250 index form part of the Nifty Total Market index. The weight of the stocks in the index is based on their free-float market capitalization. The index can be used for a variety of purposes such as benchmarking, and the creation of index funds, ETFs, and structured products.

The index has a base date of April 01, 2005, with a base value of 1000. All stocks that are part of the Nifty 500 index and Nifty Microcap 250 index will form part of the Nifty Total Market index at all points in time. The weight of each stock in the index is based on its free float market capitalization. The index is reviewed semi-annually.

Let us look at the Top 20 constituents of the Nifty Total Market Index (as of 4th Oct 2023).

| Top 20 constituents of the Nifty Total Market Index (as of 4th Oct 2023) |

|

| HDFC Bank | 13.73% |

| Reliance | 9.49% |

| ICICI Bank | 7.67% |

| Infosys | 5.98% |

| ITC Ltd | 4.68% |

| L&T | 4.34% |

| TCS | 4.27% |

| Axis Bank | 3.64% |

| Kotak Bank | 2.91% |

| SBI | 2.68% |

| HUL | 2.67% |

| Airtel | 2.52% |

| Bajaj Finance | 2.35% |

| Mahindra and Mahindra | 1.67% |

| Maruti | 1.62% |

| HCL | 1.56% |

| Sun Pharma | 1.48% |

| Titan | 1.41% |

| NTPC | 1.36% |

| Asian Paints | 1.35% |

| Total % | 77.38% |

Notice that except Airtel, remaining all the stocks are part of the Nifty 50 Index. If we remove Airtel exposure from the Nifty Total Market Index, then 74.86% means almost 75% of the Nifty Total Market Index is from the Nifty 50 Index.

By investing in the Nifty Total Market Index, you are indirectly exposed to the Nifty 50 Index. As is evident from the above data the rest 23% of the Index is from the UNIVERSE Of the remaining 730 stocks!!

This is mainly because the Index is constructed based on the market cap of stocks where due to heavy weightage, Nifty 50 stocks take higher weightage. The remaining part is from Nifty Midcap 150, Nifty Smallcap, and Nifty Microcap. I have already shown in my earlier post that by exposing to a small cap index, you are taking huge risks but that does not deliver in better risk-adjusted return (You can refer to the same at “Who CAN Invest In Small Cap Funds?“.) by comparing to Midcap.

Groww Nifty Total Market Index Fund – Should you invest?

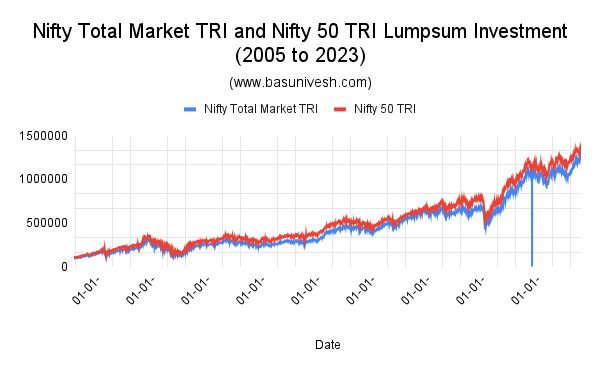

To validate my point of what I am trying, let us track the Nifty Total Market Index TRI Vs Nifty 50 Index TRI indices. As the Nifty Total Market Index base was 1st April 2005 (The launch date is October 13, 2021, and the base backtested date is from 1st April 2005.), I am taking both the indices starting date as 1st April 2005. We have around 4,500+ daily data points.

# Lump Sum Investment comparison Nifty Total Market Index TRI Vs Nifty 50 TRI

what if someone invested Rs.1,00,000 in both indices on 1st April 2005 and what is the current value as of today?

Notice that there is no such huge difference. The final value of Rs.1,00,000 invested in both indices is Rs.12,50,506 and Rs.13,27,241 respectively for Nifty Total Market Index TRI and Nifty 50 Index TRI. The above chart and the final numbers again prove that there is no such great advantage by choosing the Nifty Total Market Index.

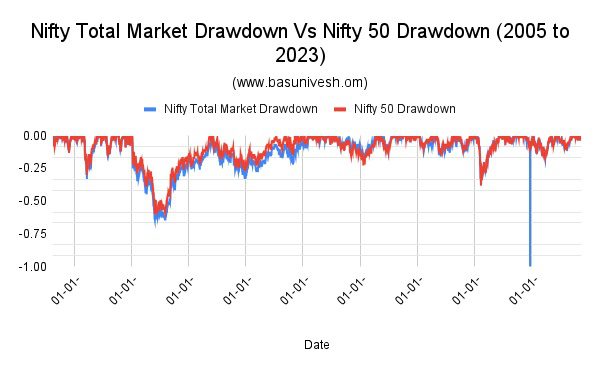

Let us now see the drawdown of both indices. Drawdown means how much the value has fallen from its earlier peak. Notice that the Nifty Total Market Index shows a slightly higher drawdown than Nifty 50.

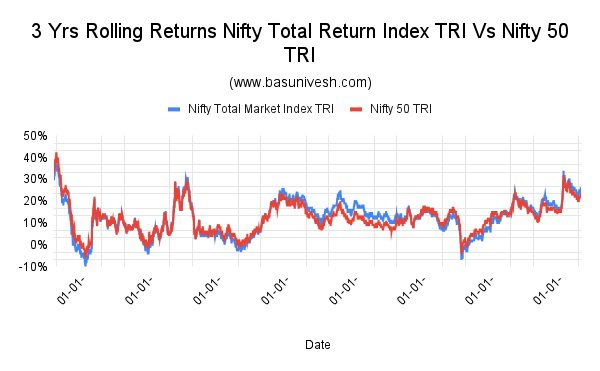

Let us now look into the volatility aspect of both indices by comparing 3 years, 5 years, or 10 years rolling returns.

# 3 Yrs Rolling Returns Nifty Total Return Index TRI Vs Nifty 50 Index TRI

Notice that in data from 2005 to 2023, there is no great difference between both indices’ volatility.

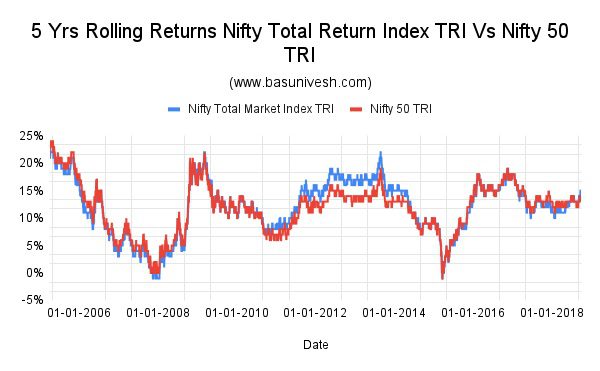

# 5 Yrs Rolling Returns Nifty Total Return Index TRI Vs Nifty 50 Index TRI

Notice that for 5 years rolling returns results are also the same.

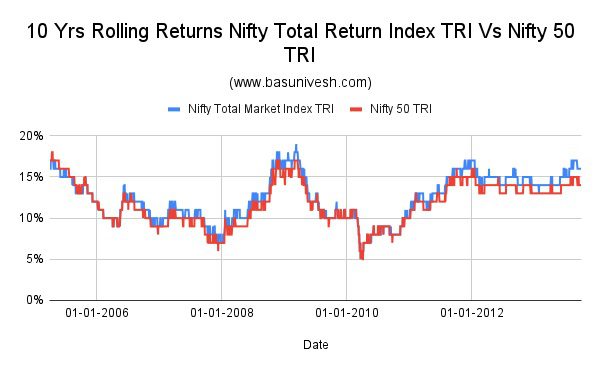

# 10 Yrs Rolling Returns Nifty Total Return Index TRI Vs Nifty 50 Index TRI

10 years rolling returns results are also the same.

Conclusion – You notice history proves that by exposing yourself to the Nifty Total Market Index, you hardly beat the Nifty 50 Index. The majority of the time Nifty Total Market Index did not outperform the Nifty 50 Index. The reason is its higher exposure to Nifty 50 stocks. Even if there may be few instances where the Nifty Total Market Index outperformed the Nifty 50 Index, it is not consistent.

Hence, choosing the Groww Nifty Total Market Index Fund hardly creates any difference for you if you already investing in Nifty 50 or Sensex Funds. However, do remember that this conclusion is based on past performance comparisons. However, this may or may not hold true in the future. But as of now, we can surely conclude that the Nifty Total Market Index is not required if you are already holding the Nifty 50 Index or Sensex Fund.