Growing up in the aftermath of the Great Recession, Gen Z saw their parents and siblings struggle financially. They’ve watched as interest rates climbed,¹ housing prices soared,² and our economy dealt with uncertainty. Despite these challenges, Gen Zers are blazing their own trail.

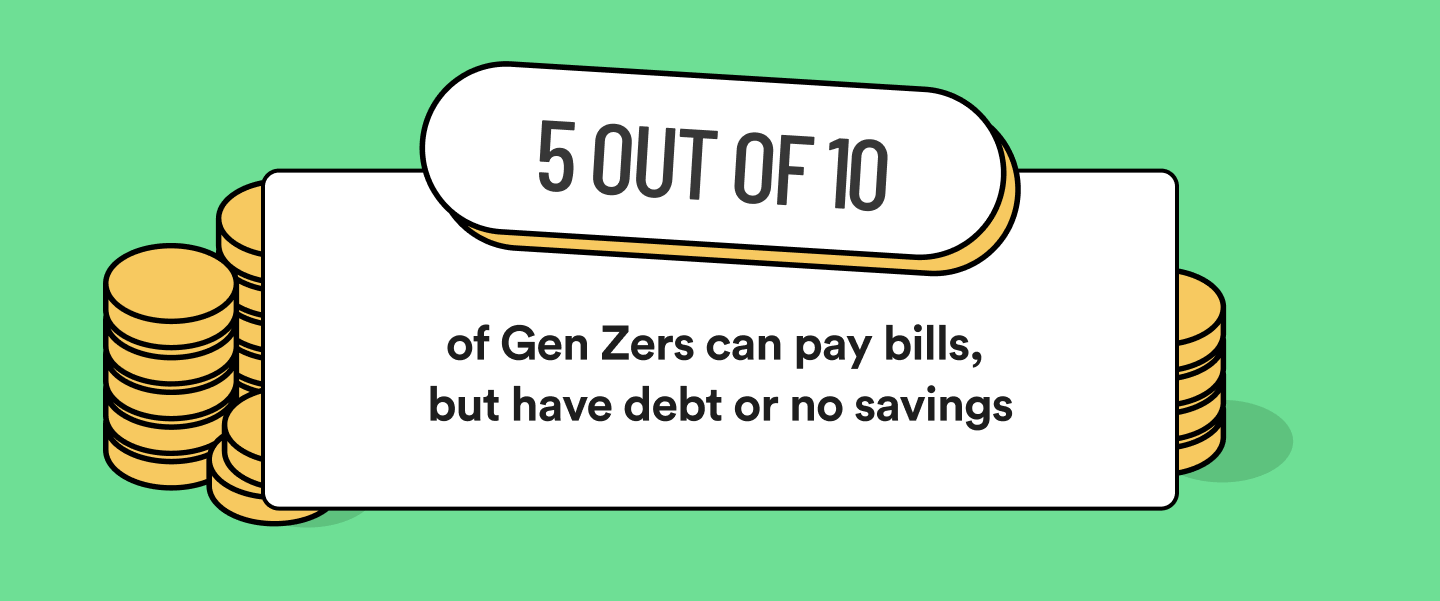

Our survey data highlights that more than 50% of Gen Zers have a combination of debt and savings or debt without any savings. However, they actively manage their finances by paying their bills on time and covering essential expenses like groceries and necessities.

Within this group, approximately 30% of surveyed Gen Zers can pay their bills but currently lack savings. They need to explore new saving strategies to start building a financial cushion for their future.

On a positive note, around 10% of those surveyed are debt-free and possess additional savings. They demonstrate the potential for financial independence.

What is Gen Z’s average income?

Gen Zers are beginning their professional journeys or still pursuing education. They earn an average income of $32,500 annually.³ While this seems low compared with more established generations, as Gen Zers progress in their careers, their income levels should increase.

But it’s not just about the income they bring in. It’s about how they manage it. Gen Zers have shown they are thinking ahead when it comes to managing money. They are budgeting, saving, and planning for their financial futures. These habits, combined with increasing income over time, lay a strong foundation for growing wealth.

Gen Z’s approach to earning money goes beyond traditional jobs. Many are exploring side hustles and becoming entrepreneurs.4 This has enabled them to establish multiple money streams and gain valuable experience in money management and business, better positioning them to increase their wealth over time.

How Gen Z handles their money

Gen Z, being at the early stages of their financial journeys, typically have lower net worths than other generations.5 But their proactive money management habits and focus on building wealth indicate their determination to improve their financial standing over time.

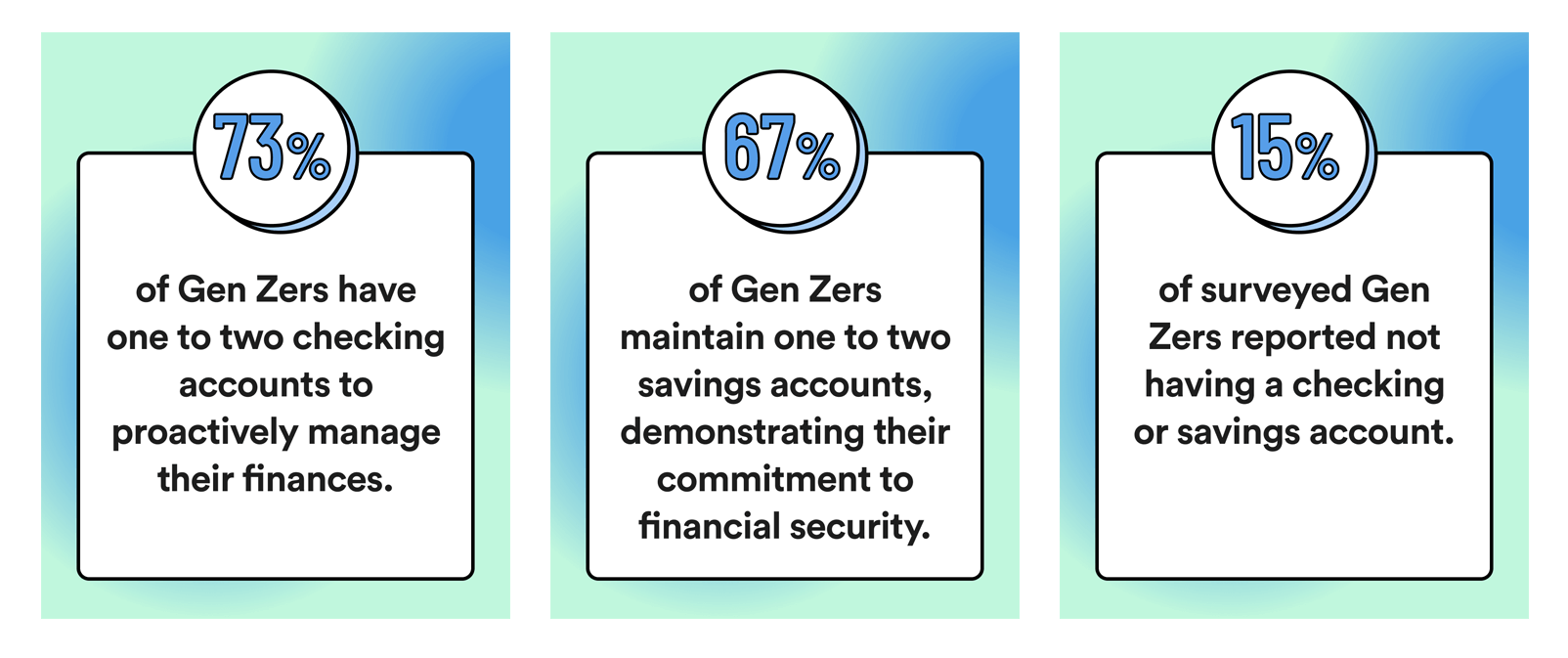

Gen Z’s approach to money management reflects a combination of caution and foresight. Here’s a breakdown of how Gen Z handles their money, according to our survey results:

Gen Z’s financial habits showcase their thoughtful approach to managing their money, with a focus on maintaining checking and savings accounts to support their financial goals

Gen Z’s financial habits showcase their thoughtful approach to managing their money, with a focus on maintaining checking and savings accounts to support their financial goals