Less than 100 stocks to go after this post…I took some time to continue because I lost a full post to the bloody WordPress editor. As the random generator picked some quite interesting stocks this time, I had written quite a lot. This verson is shorter, but 5 stocks are worth to “watch”. I am still optimistic to finish before year end. Enjoy !!!

166. Zaptec

Zaptec is a 175 mn EUR market cap 2020 IPO that is surprisingly trading above its IPO price. According to Euronext, Zaptec is a “technology company within Electric vehicle (EV) charging systems in Europe. The company develops EV charging systems for multi and single-family homes and office buildings.”

The company actually has decent sales, is growing quickly, is almost break even, and more surprisingly doesn’t seem to have debt. In Q1, the company showed revenue growth of +100% at a slightly positive EBITDA margin. Orders even went up +200%.

The company seems to be a a manufacturer of charging stations and active in Norway but also exporting ~2/3 of their production. As Norway is clearly an early adopter of EVs, Zaptec might have used this to develop a certain edge compared to competitors. Overall, despite being a recent IPO, this could be one to “watch”.

167. Lea Bank

Lea Bank is a 77 mn EUR market cap bank basd in Oslo that despite its small size, seems to be active across Europe as a “digital niche bank”. The stock looks cheap at 6x P/E but looking at the loan losses which are ~1/4 of Revenue, it looks like that they cater to the “subprime” market. “Pass”.

168. Treasure ASA

Treasure ASA is a 360 mn EUR company that is majority owned (78%) by Wilh. Wilhelmsen. The main activity of Treasure seems to be to “own 4 125 000 (11.0%) shares in Hyundai Glovis Co., Ltd. (Hyundai Glovis), a global transportation and logistics provider based in Seoul, Korea.”

I don’t know the background of this, but Korean logistics companies are clearly outside my CoC, therefore I “pass”.

169. Ice Fish Farm

Ice Fish Farm is , as the name indicates a 293 mn EUR market cap fish farm, farming Salmon in Iceland. Being IPOed in 2020, they are still loss making. “Pass”.

170. Hunter Group

Hunter is (accordig to Euronext) a 4 mn EUR market cap investment company that used to won oil tankers. As of year end, they had no operating assets left. They seem to have dividended out everything and have a few millions left in cash and claim to focus now on CO2 in some way. “Pass”.

171. Softox

Softox is a 7 mn EUR market cap company that “will develop a portfolio of antimicrobial solutions to solve global challenges related to skin infections, both antibiotic resistant and chronic infections.” The company has new management since January 1st and is making losses, cash might run out this year. “Pass”.

172. Vow ASA

Vow ASA is a 150 mn EUR market cap company which main business is treating waste water from Cruise ships. During the Covid/ESG/Cleantech hype, they managed to position themselves as a kind of Green circular economy stock with some JVs and the share price took of like a rocket:

Since then however, things calmed down a lot. Sales have increased, but profitability has been decreasing. My impression is that the management is quite promotional and every new order is celebrated like a Nobel price win, no matter how small it is. “Pass”.

173. Rana Gruber

Rana Gruber is a 190 mn EU market cap Norwegian Iron ore miner that has been IPOed in 2021. Surprisingly for this vintage, the share trades above the IPO price.

At first sight, it does look interesting. At current market prices, the company is quite profitable and cheap (6x trailing P/E). They seem to have net cash. They also claim that they will be able to mine “CO2 neutral” Iron ore by 2025.

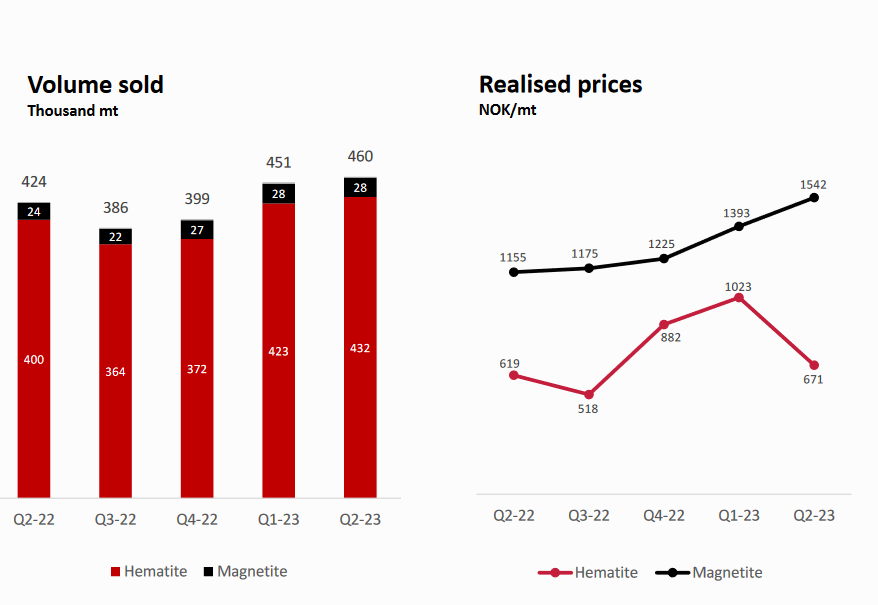

However, market prices for their main prodcut Hematide seem to be quite volatile as we can see in this chart from the 6M presentation:

Although I have little to no clue about iron ore mining, I somehow find this interesting, therefore “watch”.

174. Philly Shipyard

As the name indicates, this Norwegian listed company is actually a shipyard in Philadelphia, US. At the time of writing, the stock just had jumped +30% after a rumor surfaced that a Korean shipbuilder might be interested in taking over the company. With a market cap of around 45 mn, this is a small fish and the company is majority owned by the Aker Group, which in turn is owned by one of the richest Norwegian guys, self made billionaire Kjell Inge Roekke who is supposed to be a good capital allocator.

The company has been loss making for some time and still is, despite increasing sales. “Pass”.

175. Protector Forsikring

Protector is a 1,3 bn EUR market cap insurance company that has been something like a “challenger” Insurance company in the Nordics. They have been very successful with selling insurance only via the broker channel and have recently expanded into the UK where they are growing like crazy. I had written in the blog about them in March last year and not invested. Since then the stock has gone up another 50%:

To be honest, I have absolutely no idea, how especially in the US they manage to grow so fast and as a new entrant, have loss ratios far below the competition. This goes against everything I have learned in insurance, especially if you only sell through brokers. Protector is quite fast with their results, Q3 numbers will be released on October 20th. I will continue to “watch” but at least the UK results look too good to be sustainable to me. But I could of course be wrong again.

176. Nork Hydro

Norsk Hydro is a 11 bn EUR market cap Aluminium and Power producer that enjoyed a very good 2022 as energy prices rose and prices for Aluminium went up significantly. In 2023, the prices seem to be declining, but Norsk Hydro is still quite profitable and trading at a p/E of 12x and an EV/EBIT of 9x which is around long term averages. However, profitability is still far above historical averages, which might implay some “mean reversion” downside potential.

The Norwegian Government owns 34% of the company. The company also seems to develop its Power segement further, adding wind and solar renewables on top of its traditional Hydro power generation.

The company mentions in their IR presentation, that the current plan to tax carbon emissions on imports at the borders of Europe somehow excludes scrap aluminium, which would be a great disadvantage for European producers.

Overall, this kind of business is too volatile for me, so I’ll “pass”.

177. Goodtech

Goodtech is a 28 mn EUR market company that claims to be “one of the Nordic region’s leading system integrators with more than 300 skilled engineers and specialists” . Despite the nice name, the company showed losses for 7 out of the last 10 years. “Pass”.

178. Aquila Holdings

Aquila Holdings is a 20 mn EUR market cap company that changed its name recently from “Carbon Transition” and seems do do something with Seismic Data and Investments. “Pass”.

179. TGS

TGS (former TGS-Nopec) is a stock I owned in the past. The 1, 7 bn EUR market cap company is acquiring seismic data which it then sells to oil companies. In the past, their competitive advantage was that they didn’t own ships themselves but rented them when they were cheap.

Over the past years, the consolidated the markets and took over Spektrum and more revently, PGS, which however owns its own ships. Apart from a spike in 2019, long term shareholder value generation was very limited over the past 10 years as we can see in the chart:

In 2020 and 2021, they showed losses, 2022 was very good. For whatever reason, 2023 looks quite bad again with operating profit down -20% for the first 6M. The PGS deal will close in early 2024. I will definitely revisit them after the PGS deal, so “Watch”.

180. Pareto Bank

Pareto Bank is a 370 mn market cap Bank that is part of the wider Pareto Group, but not it’s Topco. As many Nordic banks, the stock looks cheap at around 7x P/E and 1x book value. ROE has been constantly in the 13%-15% range which is very good. EPS has doubeld from 2016 to 2022.

The stock chart is unspectacular but steady:

Overall, this looks to me like maybe the most intersting Norwegian Bank I have seen so far, therefore I’ll “watch”.