Many financial advisors take pride in the comprehensive nature of the advice they provide to clients and use the variety of services offered as a point of differentiation between themselves and other types of advisors. Though, at some point, covering a large number of financial planning topics can eat into an advisor’s time, which is problematic if clients won’t pay substantially more to receive that more comprehensive advice. For advisors who are feeling a time crunch from producing extensive comprehensive plans, but having trouble commanding a premium fee from clients for their additional work, there are a variety of ways to reduce this burden (from getting outside help, to changing the way plans are developed) while continuing to meet the planning needs that their clients are willing to pay for.

The results of the 2022 Kitces Research study on “How Financial Planners Actually Do Financial Planning” show that financial plan comprehensiveness has increased over time as advisors try to do more and more for clients to validate their fees, hitting them with a proverbial “sledgehammer of value”. In the research data, this is reflected in a big uptick in advisors doing the most comprehensive plans: 54% of respondents offered ‘Extensive’ plans (with at least 13 planning components) in 2022, up from 35% in the 2020 edition of the study and 39% in 2018. At the same time, the percentage of advisors offering ‘Broad’ plans (‘only’ 10–12 components, less than the most Extensive plans) fell to 23% in 2022, from 35% in 2020 and 31% in 2018, and those offering ‘Narrow’ plans (6–9 components) dropped to 18% from 23% in both 2020 and 2018. Further, the study found that client age was a key variable driving plan breadth, with a younger median client age being associated not with ‘simpler’ plans but instead with more extensive plans for their uniquely complex needs.

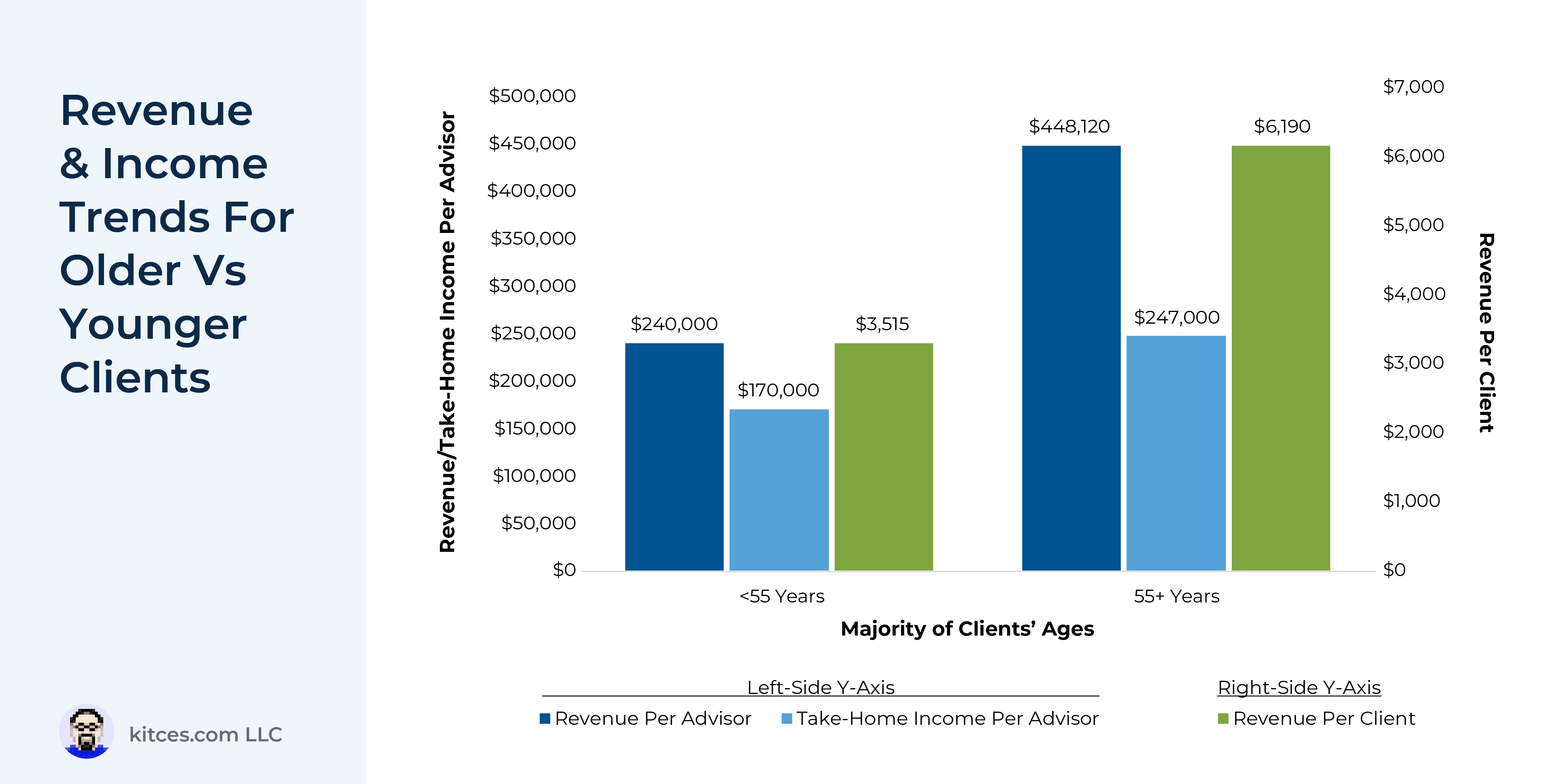

Unsurprisingly, service teams producing plans covering the widest breadth of topics tend to spend more time preparing them, according to the Kitces Research data, and this appears to come at a financial cost for these advisors, as those producing Extensive plans had lower median revenue per advisor and take-home income compared to those producing less-comprehensive plans. Which implies that advisors who are providing such “premium” financial plans – as measured by their breadth and comprehensiveness – are struggling to charge a “premium” fee for that work, resulting in a decrease in productivity and profitability.

However, this doesn’t mean that advisors need to sacrifice the quality of service they provide their clients in order to reduce the time they spend producing plans. For instance, rather than trying to be an expert in the full range of planning areas, advisors could focus on 1 or 2 narrow but especially relevant service areas to ‘go deep’ for their ideal target clients, which not only would reduce the time spent developing plans on a broader number of topics but also could attract clients whose more specialized planning needs reflect the specific topics chosen. In addition, advisors could reduce the amount of time they spend on plan development by bringing on staff assistance (e.g., in the form of an associate planner or paraplanner) or engaging outsourced planning service providers. Finally, Kitces Research data indicate that developing plans in collaboration with clients (i.e., putting the planning software on a big screen to walk through together, rather than preparing a custom pre-written plan for each) could reduce the time advisors spend preparing plans.

Ultimately, the key point is that as advisors increasingly provide comprehensive plans that examine a wider range of planning topics for their clients, the question of whether using the ‘sledgehammer of value’ meets both the specific needs of clients as well as supporting a healthy advisory business (by being able to charge effectively for the time it takes to produce such lengthy plans) becomes more important. And for advisors who do feel overwhelmed, there are a variety of ways to reduce the burden of providing the most comprehensive plans, from focusing on the advisor’s unique value proposition to outsourcing financial plan preparation tasks to changing their approach to plan delivery, which can all help advisors reduce the time they spend on plan preparation while still providing a high level of service to their clients!