Last Car Payment

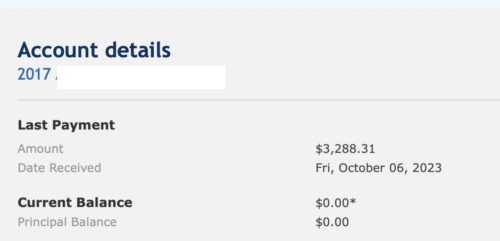

Guess what, friends! I did a thing! In one fell swoop, I paid off my 2017 car loan. My balance is now $0!

This is my big win to report, as this was my only “consumer debt.” My only remaining debts are for my student loans and our mortgage.

Student Loan Drama

I’ve mentioned before that I’m putting my student loans on the back burner. While I’ll be making monthly payments toward my loans as required, I’m not planning to put anything “extra” towards them right now. Instead, I’m officially enrolled in PSLF and plan to ride that out until my remaining loans are forgiven. That said, the government and loan service providers have made the process “clear as mud.” Last time I mentioned my student loans back in February, I reported that the online platform indicated I had 44 qualifying payments to go.

Somehow, today, I logged in and see that 2 of my loans indicate only 15 payments remaining….while 2 of my loans show 0 eligible payments (thus, 120 payments to go). Like….what? Absolutely nothing has changed in the interim between February and now, so I don’t know why the online platform is telling me such disparate information. It cannot be accurate. I called my service provider, Mohela, to try to talk to a customer service rep and gave up after a full hour on hold because I had a meeting I had to jump into.

I pretty much loathe these loans and allllll the interest I’ve already paid. And the servicers do not make it easy to get information. Long wait times, rampant misinformation, etc. Ick. Unfortunately, this is something I’ll have to tackle another day. Moving on…..

New Financial Goals

When we had our coffee date, I mentioned being unsure how to proceed after my car is paid in full. This is a “blogging away debt” blog. But I’m now feeling my priorities shift more toward saving and investing. My husband and I do pay extra on our mortgage, but not with the steadfast determination with which I paid off my car.

Instead, I’m thinking about shifting to more savings/investment options. My open enrollment period opens very soon. I’d like to increase my savings/investments in several categories. Here are my thoughts:

| CURRENT in 2023 | NEW for 2024 |

|---|---|

| HSA: $5500/year | HSA: $7750/year |

| FSA: $700/year | FSA: $1000/year |

| 403B: $125/check | 403B: $175/check |

| 529: $50/child/month | 529: $60/child/month |

If I’m doing my math right, the total amount of investments annually from this table would amount to $14,740 (FYI: I’m paid biweekly. I have 2 kids, and each has their own 529).

That also does not include my normal retirement investments. By default, I invest 7% of my salary toward retirement, which is matched by my employer dollar-for-dollar for the full 7%. In other words, I have 14% of my salary automatically invested into retirement (my husband has a similar situation with his salary, too). Then I’m proposing an additional $15,000/year in investments and savings spread among HSA, FSA, 529, and 403B.

This change is approx. $4,000/year higher than my contributions for 2023. A difference of $153/paycheck. But is that enough? Or should I be aiming to increase this even more?

Pulled in a million directions

I have lots of other shorter-term savings currently stored in CapitalOne360 savings accounts. By nature, I’m a “splitter” versus a “lumper” when it comes to savings. This is why I have different savings accounts for so many different things. Currently, I have savings accounts for:

- student loan savings. My original plan was to save a little each month until I have enough to pay off one of the 4 student loans in full. But I just dipped into this savings to help cover the overage from my car payment. Also, I’m not sure if I even want to pay “extra” to my student loans….

- car repairs or new car

- emergency fund

- travel/Christmas/fun. I save a little each month so I can always pay cash for anything “big” or “extra” we might do as a family. This is mostly used for travel, but could be used to help fund Christmas gifts and experiences, or anything that would be over and above to where it would blow the monthly budget… I have a savings just for that!

- annual fees. Examples: life insurance, car insurance (paid bi-annually), HOA (paid quarterly), etc.

After all my recent home repairs, folks have also suggested budgeting and saving specifically for home repairs, so that might be an account to add (or maybe change my student loan savings to “home repair” savings…..)

Another idea I’m considering is to open a money market account – something that’s not necessarily long-term savings, but something that will yield a higher interest rate than my current savings. While this might be impractical for the annual fees I regularly use-and-restock, it might work great for things like the Emergency Fund and New Car savings. Yes, I know I literally just paid off my vehicle. And I plan to keep it for quite awhile. But I’d LOVE to be able to buy my next car in 5-ish years with cash fully debt-free! That seems better kept in a money market vs savings account.

This said, I honestly don’t know where to start! I’ve never had a money market account before. Only retirement accounts, the investment vehicles listed above (e.g., HSA, FSA, etc.) and normal old savings accounts. I’d want one with low-to-no fees, but a decent rate of return. Any recommendations? I have longer-term (retirement) investments with Fidelity and Vanguard already. Should I see about opening up a Money Market account?

What are your thoughts? What should be my next big goal or focus for savings and short- and long-term investments?

The post Car Paid Off and New Financial Goals appeared first on Blogging Away Debt.