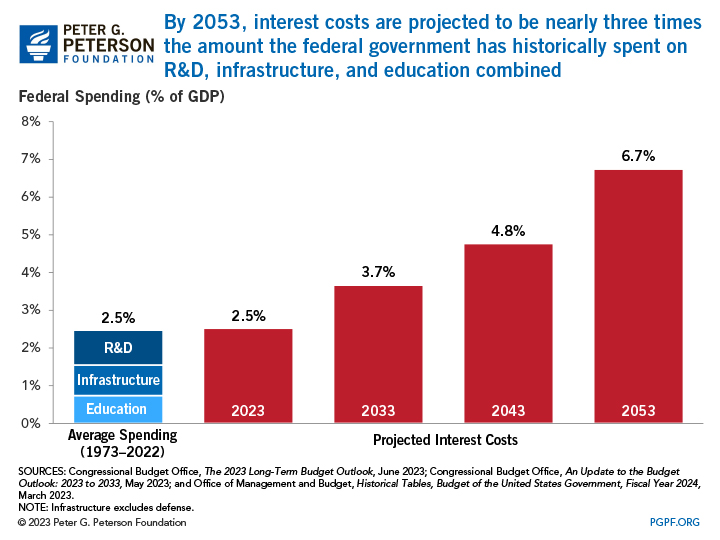

The chart in this morning’s reads shows what it is going to cost to fund the interest payments on the federal debt. It’s gone vertical as rates have moved from effectively 0 to over 5%.

When rates were zero all of corporate America refinanced, lowering the cost of their debt to historically low levels. Households did the same; today 61% of homeowners with a mortgage are paying 4% or less in interest.

The US government? They never bothered.

Within a few short years, we will be paying one trillion dollars in excess interest due to this missed opportunity. Note that this is not hindsight bias, but rather discussions we had repeatedly here in the mid-2010s.

As the Peterson Institute noted:

In June, the Congressional Budget Office (CBO) projected that annual net interest costs would total $663 billion in 2023 and almost double over the upcoming decade, soaring from $745 billion in 2024 to $1.4 trillion in 2033 and summing to $10.6 trillion over that period. However, if inflation is higher than CBO’s projections and if the Fed raises interest rates by larger amounts than the agency projected, such costs may rise even faster than anticipated.

There are a handful of reasons why this once-in-a-lifetime, missed opportunity to refinance $33 trillion at the lowest possible levels was missed. Some of it was merely incompetency but a lot of it was purposeful. The idea was that if we somehow made carrying our debt smaller, it would encourage more of it. Instead, we now have massive amounts of liabilities. This goes back to Grover Norquists‘ idea that the government should be made so small it could be “drowned in a bathtub.”

That poor belief system has disadvantaged America — it has made us economically weaker, prevented the country from performing basic maintenance on its infrastructure, and generally made it a harsher place to live. Note that we undertook much of the work anyway (airports, electrical grid, roads, etc.), just decades later at a much greater cost.

All simply unnecessary.

Your grandchildren will blame the toxic combination of incompetency and ideology for the massively increased carrying costs of unfunded spending and tax cuts.

After 50 years of shrill deficit warnings, I have come to recognize that most of the claims from this camp are false: We haven’t seen a destruction of the US dollar or refusal to lend money to Uncle Sam or a crowding out of private capital, as was promised by the deficit scolds.

But that doesn’t mean we should not have taken advantage of the lowest interest rates in modern history to refinance the United States debt.1

Instead of being financially secure and the strongest country economically by far, we have created an unforced error that weakens us over the long term. If you were a Senator or a Congressman from 2015-20, and you didn’t spend most of that time pushing for a giant refinance of our debt, you should spend the rest of your life embarrassed for your failure.

The excess costs of not refinancing the federal debt will soon be an extra trillion dollars a year. This will be looked at as the greatest missed opportunity of our lifetimes.

This is what happens to nations governed by 535 innumerate asshats…

Previously:

Time for a 50-Year U.S. Treasury Bond (May 19, 2016)

Last Call for 50-Year Treasury Bonds (March 16, 2017)

Deficit Spending Should Be Counter-Cyclical Not Pro-Cyclical (August 28, 2017)

Can We Please Have an Honest Debate About Tax Policy? (October 2, 2017)

100-Year Bonds Can Fund Big Infrastructure Projects (September 3, 2019)

Cost of Financing US Deficits Falls (December 18, 2020)

Time to Stop Believing Deficit Bullshit (September 3, 2021)

MiB: Gary Cohn, Director of the National Economic Council, President of Goldman Sachs (September 30, 2023)

__________

1. Just because I don’t believe deficits are nearly as bad as the crazies have claimed does not mean we should be overpaying for the carrying costs of it. These are not mutually exclusive ideas