Yes, it is possible for many middle-income earners to legally get away with paying zero taxes…that is, if you know how to be smart about it.

I was recently interviewed by Channel News Asia to share my tips on how one can reduce one’s income taxes in Singapore, and you can watch the video below (which includes expert appearances by an IRAS Director).

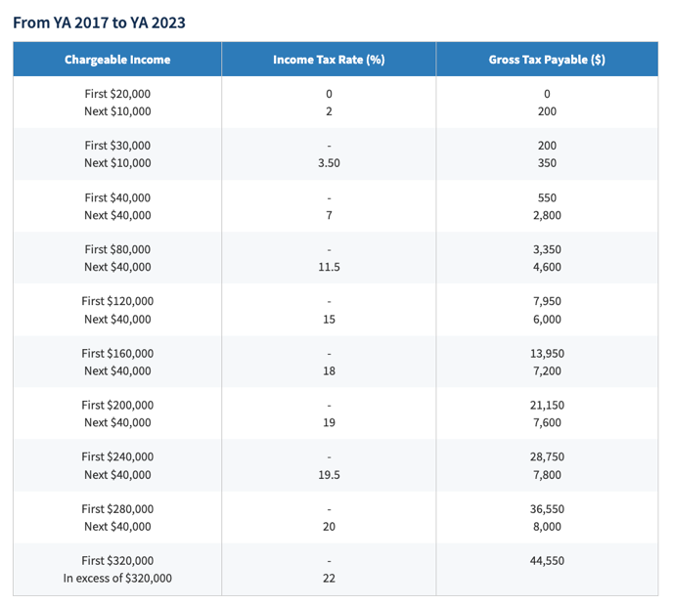

In case you hadn’t noticed, IRAS will be raising the income taxes for high income earners from YA 2024 onwards.

Previously, folks earning more than $320k yearly were taxed at the maximum level of 22%, but moving forward, 2 new income tax brackets will be implemented:

- Anyone earning more than $500k will be taxed at 23%

- Anyone earning over $1 million will be taxed at 24%

Before you fret over your tax bill, let me share the good news.

In Singapore, as long as you’re smart about it, there are legitimate ways to reduce your income taxes without breaking the law or being convicted for tax evasion.

These include the various schemes below which you can use to reduce your taxes payable. While the maximum reliefs you can claim is capped at $80,000, planning for and claiming the various reliefs properly could mean the difference between 2 entire income tax tiers – which can shave off a few thousand dollars for many folks!

I’ve successfully helped many of my friends reduce their income tax bill over the years simply by applying for the correct reliefs (yes, the reliefs are NOT automatically given to you – there’s a bit of planning and claims required!).

Let’s dive into how each of them work, and who’s eligible for which.

1. CPF Cash Top-Up Relief

When you make voluntary cash contributions to your CPF account or that of your loved ones, you can claim for tax reliefs on these. The maximum CPF Cash Top-up Relief per Year of Assessment has also recently been raised to $16,000 (maximum $8,000 for self, and maximum $8,000 for family members) as of last year.

This means you can claim for the maximum by doing the following moves:

- Make a voluntary cash top up to your Special/Retirement/MediSave Account

- Top up your loved ones Special/Retirement/MediSave Account

Note: Loved ones refer to parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings. However, you can only get tax reliefs for top-ups to your spouse or siblings’ if they have an annual income less than $4,000 in the year prior (salary, bank interest, dividends and/or pension) or they are handicapped.

The tax relief is only up to the Full Retirement Sum (FRS), so it is a good idea to check whether you and/or your loved ones are approaching the FRS in your CPF account(s) before you make the contribution.

Check out more information and eligibility criteria here.

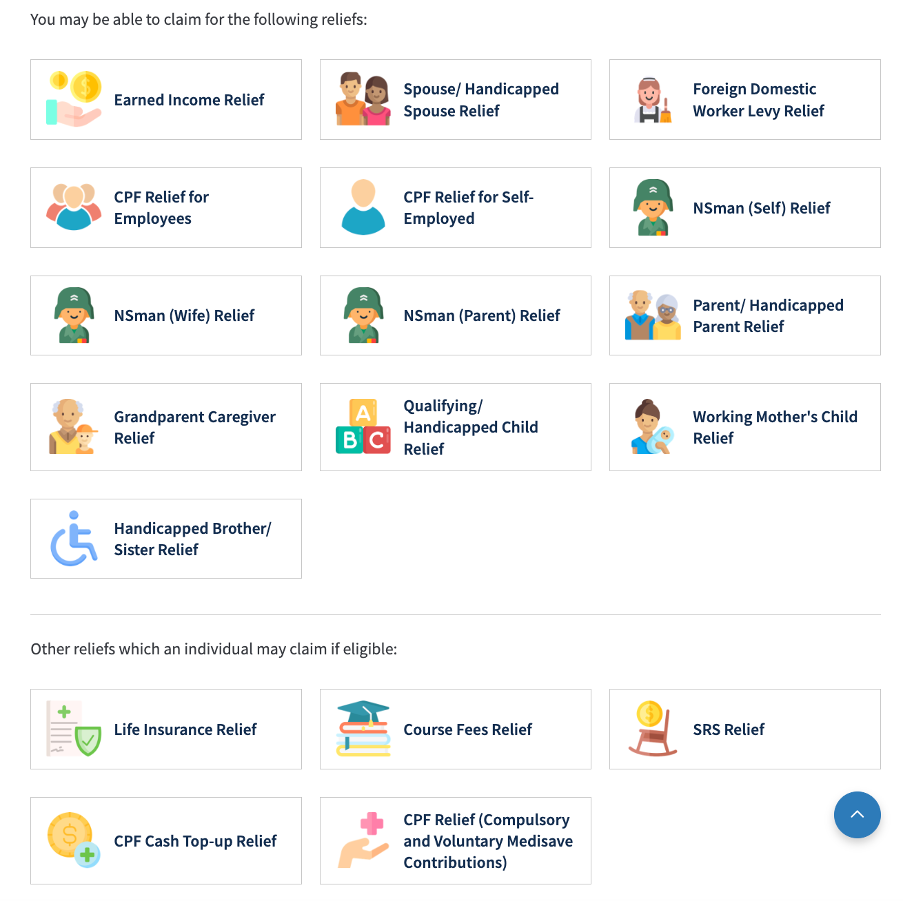

Note that your total CPF relief (including your voluntary top-ups) is also subject to the prevailing CPF wage ceilings, so if you earn a salary in excess of these thresholds, then please read this page for more information on the maximum CPF relief you can qualify for.

2. Contribute to your Supplementary Retirement Scheme (SRS) account

Another easy hack is to open an SRS account with any of the 3 local banks and contribute cash into the account, which will allow you to enjoy up to $15,300 of tax reliefs ($35,700 for foreigners).

The only downside of this is that deposits in your SRS account earn only 0.05% p.a. interest, so you might want to consider investing it instead. Read this for some ideas on what you can invest your SRS monies in!

If you want a simpler, fuss-free method of investing your SRS funds that doesn’t need so much monitoring, check out ETFs instead – here are some of the most popular ones that fellow SRS investors are going for.

3. Course fees relief

If you attended any approved course(s) that is relevant to your employment or vocation, then you can also claim up to a maximum of $5,500 in course fees reliefs each year.

Note: You cannot claim for courses that are for leisure purposes or general skills (e.g. baking / social media / basic website building). Neither can you claim for courses that were paid via SkillsFuture credits or your employer. I know, because I tried and had to call in to clarify!

4. Donate to charity

When you donate to any charity that is an approved Institution of a Public Character (IPC), you can enjoy a 250% tax deduction based on your donation amount.

This is usually automatically calculated and applied on your tax bill – provided that your donation went to a registered IPC.

This means your donation amount will be deducted from your statutory income to reflect your assessable income. From there, you can then apply or claim your tax reliefs to derive your final chargeable income and tax bill.

As an example, if you donated $1k to an approved charity, $2.5k will be deducted from your total income to be assessed. And if that brings you down to the lower income tax bracket tier, it’ll definitely bring you even more joy than the gratification you felt from doing a good deed. Talk about killing two birds with one stone!

CNA asked me this question during the interview, and although it didn’t make it to the final video cut, the answer is definitely worth sharing here!

2 different Singaporeans, both earning the median income of $5,070. One pays over $2,000 in taxes while the other gets away legally with paying ZERO taxes.

How is it possible?

Someone who doesn’t make any effort to reduce their taxes may probably end up paying:

- $5,070 x 13 months = $65,910

- Minus $1k Earned Income Relief (given automatically)

- Tax Payable = $550 on first 40k + (7% x $24,910) = $2,293.70

Now, contrast that with my friend’s case, who is of a similar income level and has learned to claim for the following reliefs:

- WMCR relief of 15% + 20% on 2 kids = 35% = $23,068.50

- $4,000 x 2 Qualifying Child reliefs

- Maxed out her SRS contributions to get $15,300 of SRS relief

- Maxed out her CPF voluntary cash top-ups for $18,000 of reliefs

- $3,000 claimed under Grandparent Caregiver Relief (her retired mom stays with her to look after her kids)

- $1,440 FDW levy relief for her domestic helper

- $750 NSman Wife relief (since her husband served the nation last year)

- Total reliefs = $69,558.50

- Total chargeable income = $65,910 – $69,558.50 = zero taxes

And that, my dear, is how you can legally get away with not paying income taxes in Singapore without going to jail!

Ok, now for my situation and for all of you guys who can relate to raising kids in expensive Singapore. What tax relief schemes can we ride on and max out?

For parents who are supporting their children

There are various schemes you can leverage for tax reliefs, including but not limited to:

- Working Mother’s Child Relief

- Qualifying Child Relief / Handicapped Child Relief

- NSman Parent Relief

- Foreign Maid Levy Relief

- Grandparent Caregiver Relief

The most powerful scheme is the WMCR, but the rest can make a difference too.

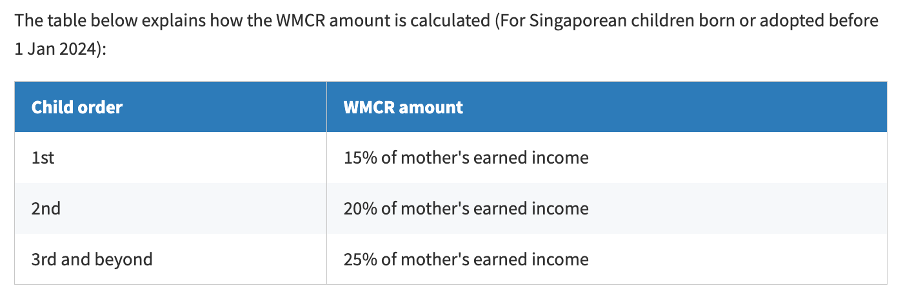

5. Working Mother’s Child Relief (WMCR)

In a bid to encourage married women to remain in the workforce after having kids, the Singapore government offers the WMCR as an incentive.

As long as your child is born before 1 January 2024, you’ll qualify for the above WMCR amounts.

This means that for instance, a working mother of 3 young kids with a yearly income of $150,000 can claim for the maximum of $80k tax reliefs (see calculation below):

- 15% x $150k = $22,500

- 20% x $150k = $30,000

- 25% x $150k = $37,500

- Total = $90k but capped at $80k personal tax reliefs

That is sufficient to reduce her income tax tiers by 2 levels, which translates into an initial 15% tax rate being cut to 7% instead (!!!).

Unfortunately, if you’re still pregnant right now and your child is to be born after 1 Jan 2024, the bad news is that the WMCR policy has been changed – mothers who give birth after this date will now have their reliefs pegged at a fixed dollar rather than a percentage of their income.

Read here for why I think this is NOT ideal.

6. Qualifying Child Relief (QCR) / Handicapped Child Relief (HCR)

You can also claim QCR of $4,000 per child or $7,500 HCR per child as long as you are a parent and your child is still not really earning an income.

This can be split between you and your spouse, if need be.

Tip: As confirmed by IRAS, it would be a financially smarter decision to give the QCR to the higher income spouse.

7. Grandparent Caregiver Relief (GCR)

For working parents who engage the help of their parents / parents-in-law / grandparents / grandparents-in-law to take care of your children while you’re at work, you can also claim for this category.

This is provided that the caregiver is already retired or does not earn any annual income exceeding $4,000.

And even if your child has more than 1 caregiver, you can only claim for a maximum of $3,000 on one related caregiver under GCR.

8. Foreign Domestic Worker Levy (FDWL) Relief

For the women who hired a foreign domestic worker for your household, you can claim for two times of the total foreign domestic worker levy paid in the previous year on 1 domestic worker.

If you’re rich enough to afford and employ more than 1 domestic helper, please read here for how much relief you can claim.

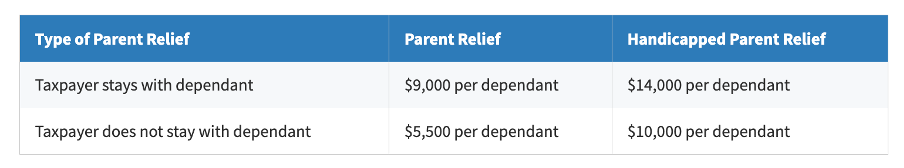

9. Parent Relief / Handicapped Parent Relief

To promote filial piety and recognise individuals who are supporting their parents, grandparents, parents-in-law or grandparents-in-law in Singapore, the government gives tax reliefs under this category. The requirements are:

- The elderly dependent must be living in your household OR you incurred $2k or more in supporting the elderly dependent living in a separate household

- Must be either 55 years of age or older, or is physically or mentally disabled.

- For Parent Relief, your parent/parents-in-law must not have earned an annual income exceeding $4,000

You can claim for up to 2 dependants, meaning a maximum of $18k, or $11k if they do not stay with you.

However, each dependant can only have one claimant, so if you have any siblings who might contest this with you, you may want to work it out with them to decide who gets to claim for this tax relief.

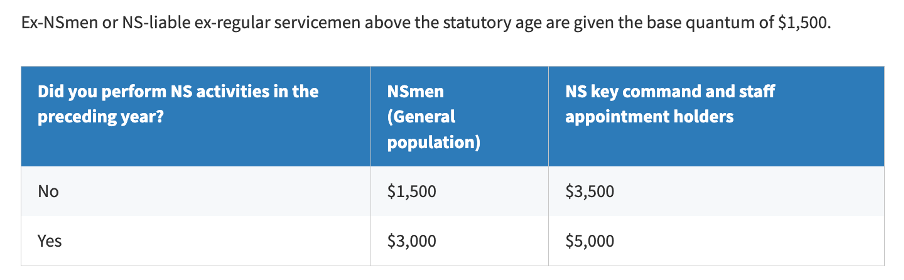

10. NSman Relief (Self, Wife and Parent)

All eligible operationally ready National Servicemen (NSmen) are entitled to NSman tax relief, including their wife and parents in recognition of the support given.

If your husband is an NSman, you can also claim $750 under the NSman Wife Relief. Think of it as the nation thanking you for supporting your husband in his service to the country.

And if you are a parent whose son is an NSman, each parent can claim $750 regardless of the number of children who are NSmen. Yes, so that means even though I have two boys, I won’t be able to claim 2 x the reliefs on each of them in the future.

Well, what if you are a mother where both your husband and son are NSmen? In that case, you can only get EITHER the Wife OR Parent relief of $750 (and not $750 x 2). Not fair? Yeah, I think so too 🙁

11. Life insurance relief

This may be less applicable to most of you readers here (including myself), but still worth a mention anyway because if you’re self-employed, this might be applicable.

If your total CPF contributions were less than $5,000 in the year before and you paid insurance premiums on your own life insurance and that of your wife (for the married men), you will be eligible to claim tax reliefs on these.

Read about the criteria for the various amounts of reliefs for life insurance here.

Tip: Use the last quarter of the year to look at your taxes so that you can make the moves you need to reduce your tax bill for when March – April 2024 comes along! The move / contribution needs to be made in the same assessment year as your income, so DO NOT wait until it is time to submit your tax filing to act – that’s the biggest mistake made by most people!

Ok, so now that I’ve covered all the various schemes and tax reliefs, here’s how a checklist for you to work with + an illustration of my own case, so you can see how I use the reliefs to my advantage each year to legally reduce my tax bill!

Illustration: Taxes payable as a working mother

In my scenario, I’m a working mother of 2 young children and supporting my retired father who does not live with me. I also contribute to 3 other parents (my mum and in-laws), but since they are still working, there are no reliefs that I can use for their case.

Hence, the amount of reliefs that apply in my scenario are:

| Earned Income Relief | $1,000 |

| CPF Cash Top-Up Relief | $8,000 for myself $8,000 for my dad |

| Supplementary Retirement Scheme Relief | $15,300 |

| Course Fees Relief | N.A. since I paid via SkillsFuture credits |

| Charity donations | $2,500 |

| Working Mother Child Relief | 15% + 20% (for 2 children) |

| Qualifying Child Relief | $4,000 x 2 children |

| Grandparent Caregiver Relief | N.A. since only my dad is retired, and he is physically incapable of looking after my kids. My in-laws, who help out with my kids occasionally, are both working and hence do not qualify under this relief. |

| Foreign Domestic Worker Levy Relief | $60 x 12 months x 2 = $1,440 |

| Parent Relief | $5,500 since my dad does not stay with me (this may soon rise to $10k since as of this year, he is no longer capable of walking by himself) |

| NSman Relief | N.A. (this ceased as of last year since my husband has officially MR-ed and finished his reservist) |

| Life Insurance Relief | N.A. since my total CPF employment contributions alone are already >$5k |

Tip: You can use the above table as a “checklist” to work against and calculate / claim for your own applicable tax reliefs!

The most significant tax relief that I get is definitely the WMCR, followed by my moves in topping up cash to my CPF, my dad’s CPF and also to my own SRS account.

The other reliefs barely move the needle, but help to inch closer to the maximum income reliefs cap of $80,000. And whenever I find myself on the edge of one income tax bracket, I’ll resort to Method #4 (donate to charity) to try and see if I can bring myself down one tier.

If you’re in a household where the husband is the higher-income spouse, then it may be worth giving the entire QCR, GCR and Parent Relief to them so that your total household income taxes payable will become much lower.

What other income tax hacks do you use?

Share if you found this article helpful!

With love,

Budget Babe