Biotech is a hot sector. It’s on the cutting edge of science and technology and that always attracts investor attention. But what is biotech, really, and what are the best biotech stocks and ETFs?

Let’s find out.

About Biotech

Historically, medicine has been dominated by pharmaceutical companies, an outshoot of the chemical industry, producing drugs to modify the body’s functions.

Since the late 1970s, a new method has emerged. Biotechnology or biotech produces more complex products using living organisms or producing replicas of proteins, cells, and other biological molecules.

These developments have saved countless lives, starting with clean and safe lab-grown insulin that has transformed the lives of thousands of type 1 diabetics.

The sector is undergoing a new phase of explosive growth, thanks to a new wave of treatments using progress in genetics, from gene therapies to mRNA vaccines, stem cells, and innovative cancer treatments, and investors can’t help but wonder what are the best biotech stocks to invest in.

Best Biotech Stocks

Because biotechnology is a very technical field, many investors shy away from it. But with the US spending 18.3% of its GDP on healthcare, this is not a sector to ignore, especially when the pace of innovation is equal to or beyond that of better-known tech sectors like software or EVs.

We’ll try to offer a diverse view of the sector and focus on a few of the best biotech stocks, but we won’t even come close to covering all the possibly attractive stocks.

This list of the best biotech stocks is designed as an introduction; if something catches your eye, you’ll want to do additional research!

📊 Learn more: If you’re in search of the best stock charting software, our recent article provides a comprehensive review and comparison.

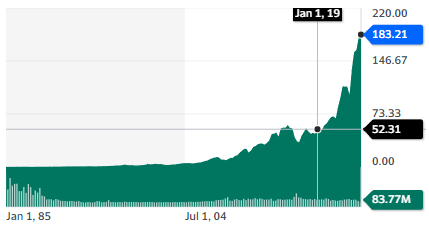

1. Novo Nordisk (NVO)

| Market Cap | $414B |

| P/E | 45.13 |

| Dividend Yield | 0.97% |

Novo Nordisk is a leader in diabetes treatment, which until recently made up a large majority of the company’s business (79% of the total in 2022). This is still an area of interest to the company, with 10 clinical trials ongoing.

The new focus of the company and market is on obesity care, thanks to Wegovy, an injectable medicine (initially a diabetes drug) that appears to help dramatically against obesity.

The drug has been a viral sensation, with even Elon Musk praising it. It has also been regularly sold out, despite Novo Nordisk upgrading its manufacturing capacity regularly. The drug is proving so popular that a Tik Tok-induced mania even increased the shortage.

🤵 Learn more: For a comprehensive look at one of tech’s most influential figures, our latest post provides an Elon Musk profile.

The diabetes business is likely now maturing and will be stable for the years to come. So, a lot of the quickly growing stock price and high P/E ratio are based on the optimism for Wegovy. It is also possible that patients might need to keep taking Wegovy if they want to see the weight loss benefits persist.

This is a large and growing market, and it has been only growing in the last decade, with 42% of Americans now classified as obese and other countries quickly catching up.

The only serious competitor in the short term seems to be Eli Lilly (LLY), which is developing Mounjaro, a drug somewhat similar to Wegovy. It is hard to predict if the drug will have better results from its clinical trial and if it will be able to dislodge Wegovy from its first-mover marketing position. In any case, it is possible the market is large enough for both drugs to bring large benefits to both companies.

Like for any biotech company highly reliant on a signal molecule/treatment, there is also the always looming risk of a safety issue, with side effects that can have been missed during the initial clinical trials.

Known side effects can in themselves be significant, including the low probability of thyroid cancer, pancreas inflammation, kidney problems, and gallstones.

Although Novo Nordisk is one of the best biotech stocks on the market, and no matter how promising Wegovy seems to be, investors should be cautious about diversifying their risk and not bet it all on a single drug.

🤳 Learn more: If you’re considering adding TikTok stock to your portfolio, our latest article guides you through the process.

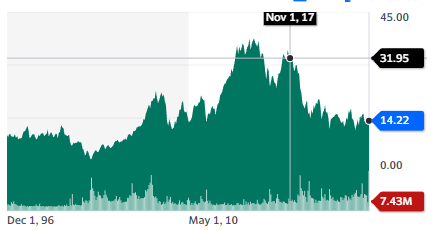

2. Bayer (BAYRY)

| Market Cap | $56.4B |

| P/E | 16.34 |

| Dividend Yield | 4.57% |

Bayer is engaged in biotech, pharmaceuticals, and agricultural biosciences at the same time. It is a perfect example of how biotechnology can be applied beyond the medical field, but also for biomaterials or agriculture.

In the last year, the agricultural segment has been causing the company a lot of headaches following the acquisition of the industry giant Monsanto. Legal actions accusing the herbicide Roundup – a key Monsanto product – of causing cancer have been weighing heavily on the company’s finances and stock price.

The pharmaceutical part of the company is highly diversified, with chemical drugs and biotech products in multiple applications, of which the largest are cardiovascular and women’s health.

Bayer’s legal issues are a concern but also create a potential buying opportunity. The company is rumored to want to separate its pharmaceutical activity from its crop biotech. So investors in Bayer might either want to buy now and decide later which part they are the most interested in or wait and buy only the post-break-up company.

In both cases, the current discount might be exaggerated compared to the actual cost of the Roundup trials, especially considering the already large amount of money put aside by Bayer to pay for settlements.

So, it is possible that Bayer could make for a great turnaround story. It is also obviously a stock with a complex story, and in which investors will want to do more than the usual amount of due research.

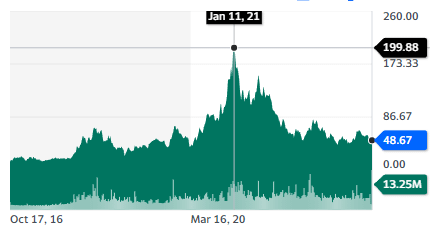

3. CRISPR Therapeutics AG (CRSP)

| Market Cap | $3.8B |

| P/E | – N/A |

| Dividend Yield | – N/A |

The 2020 Nobel Prize for chemistry was granted for the discovery of CRISPR-Cas9, a new tool for gene editing. This new technology allows for changing genetic sequences in a very controlled and predictable way.

CRISPR Therapeutics was founded by one of the co-discoverers of CRISPR-Cas9 and is working on applying this technology to cure rare diseases.

At the moment, CRISPR Therapeuticäs flagship clinical trials are for blood disease, in particular, Beta-thalassemia and sickle cell diseases (SCD). It is also working on using CRISPR to create special cell lines that could target cancers.

Lastly, CRISPR is looking to create a potential permanent cure for type-1 diabetes, a disease affecting more than 8 million people in the world.

The blood disease therapies and diabetes cure are developed in partnership with the larger and more established biotech company Vertex (VRTX), which specializes in rare diseases, especially cystic fibrosis.

The endorsement of Vertex and the scientific pedigree of the CRISPR Therapeutic founder are the main arguments in favor of the company.

Other startups are looking to use CRISPR-based gene editing systems but are less advanced in their clinical trials, most of the time years behind CRISPR Therapeutics.

Considering that products are still in development and clinical trials, traditional financial metrics are of little use in evaluating the stock. Instead, investors will need to rely on calculating the potential markets and the likelihood of successfully developing the new treatments.

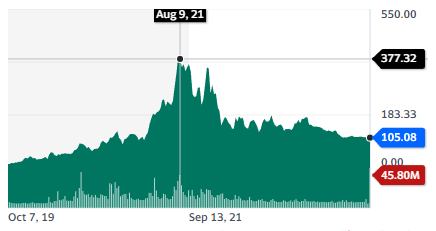

4. BioNTech (BNTX)

| Market Cap | $25.3B |

| P/E | 3.7 |

| Dividend Yield | – N/A |

The company behind the most sold mRNA Covid vaccine is a true pioneer in mRNA technology. It is now looking to use the windfall from the pandemic to massively expand the potential of mRNA.

The first part is using mRNA vaccines to create new vaccines and/or replace existing ones. BioNTech is working on mRNA vaccines for shingles, tuberculosis, malaria, HIV, and the herpes virus. It is a leader in the field, with only its competitor Moderna (MRNA) developing more mRNA vaccines than BioNTech.

But the really interesting part is expanding mRNA beyond the vaccine application. BioNTech believes it can be used for cancer therapies, with 12 candidate therapies for cancer treatment in its pipeline. This is a segment where BioNTech’s lead is almost uncontested, with only Moderna (2 candidates) and Curevac (CVAC) (1 candidate) investigating this idea.

In the long run, it is possible that mRNA has even more possible applications or can be improved further, with BioNTech expected to be a key partner for any pharmaceutical company looking into this sector.

The stock was a market darling during the pandemic, and its current earnings still reflect the massive cash flow of the Covid-19 vaccines. So, investors will want to be cautious in extrapolating any financial data from this point.

BioNTech’s value is more likely to be in the long-term prospect of new innovative vaccines, maybe exterminating HIV, malaria, or tuberculosis.

The cancer therapy idea is also promising, and the massive number of ongoing clinical trials reflects the company’s management’s enthusiasm for the idea. Coming from the people who turned a scientific concept into a blockbuster product when it was needed the most, this is one of the best biotech stocks out there.

Best Biotech ETFs

Biotechnology is a sector where 80-95% of R&D efforts fail. It can take several billion dollars to develop a new drug or treatment, and there is no assurance that the product will ever produce revenue, a serious concern for investors. It is also a highly profitable industry overall.

So, while looking for the best biotech stocks, it is highly recommended to diversify your exposure to the sector. ETFs can help you do so while reducing trading costs.

1. iShares Biotechnology ETF (IBB)

This ETF is focused on the largest and most established biotech companies, with its top 5 holdings being Amgen, Vertex, Gilead, Regeneron, and IQVIA.

This a good ETF pick for investors looking for biotech exposure and counting on the largest companies to either develop new treatments themselves or partner with or acquire smaller innovative startups.

2. SPDR S&P Biotech ETF (XBI)

This ETF is more “handcrafted”, with a lot of different stocks and none making up more than 2.32% of the whole ETF. Most holdings comprise less than 1.5% of the whole ETF. The top holdings are mostly focused on cancer treatment and rare diseases.

3. ARK Genomic Revolution ETF (ARKG)

ARK ETFs are often at the forefront of promoting “hypergrowth” tech stocks. Their biotech ETF is similar, with a focus on very innovative companies like CRISPR Therapeutics, cancer testing (Exact Sciences), drug development digital tools (Schrodinger), genome sequencing machines (Pacific Biosciences), or telemedicine (Teladoc), among other themes.

This can make ARKG a good complement to more drugs and treatment-focused biotech ETFs, with ARKG more focused on innovation and tools.

4. ALPS Medical Breakthroughs ETF (SBIO)

This ETF includes biotech companies with drugs in development (phase II or III of clinical trials) and capitalization between $200M and $5B. It is mostly focused on DREEN (dermatology, respiratory, eye, ear, and neurology) and rare diseases.

This unusual focus gives SBIO exposure to medical segments and companies ignored by other biotech ETFs. It can be used to diversify exposure alongside direct purchase of specific stocks or more generalist biotech ETFs.

5. China BioPharma ETF (CHNA)

Not all biotech innovation is conducted in Western countries. China is a new challenger and aggressive innovator with a very dynamic research ecosystem. CHNA provides exposure to this sector, with stocks in the ETFs either listed in Hong Kong (86.44%) or the Nasdaq (13.56%), while its own shares are listed on Nasdaq and easy to buy.

It can be a good alternative to more Western-focused ETFs

6. Kelly CRISPR & Gene Editing Technology ETF (XDNA)

While most biotech ETFs contain some exposure to gene editing and CRISPR technology, this ETF is solely focused on this revolutionary innovation.

The largest holding of the ETF is ThermoFisher, a life science lab equipment producer, followed by leading CRISPR startups like Intellia Therapeutics, CRISPR Therapeutics, and Caribou Biosciences.

This makes this ETF a good pick for investors enthusiasts about CRISPR technology as a whole but who are unwilling to pick one specific application or technical choice, a decision that requires a great deal of scientific expertise.

Conclusion

Biotechnology is a complex field, making it challenging for many investors to pinpoint the best biotech stocks to invest in. It is also likely to be the source of most medical revolutions and truly transformative medical technologies. There are also applications in agriculture and other industries. So, this is an attractive sector, but one that requires expertise and disciplined diversification.

Investors might want to go for an array of handpicked stocks based on track records or special situations, offering the opportunity to buy the stock at a discount.

Or they might prefer to take a broader approach, using one or several ETFs to get wide exposure to the sector and simply benefit from the sector’s overall growth and success in developing life-saving treatments.