Banks are at the heart of modern economies, providing the liquidity that greases the economic wheels. They are also consistent profit generators, which means investor attention keeps coming back to the best banking stocks and ETFs

Banks are also prone to seemingly random panics and crashes. This can be both a risk and an opportunity to buy quality assets at a bargain-basement price. This is especially true when major macroeconomic changes happen, like a war or a quick change in interest rates.

Early 2023 saw a new banking crisis, with a few regional US banks going bust. This does not mean the entire sector is at risk, and some of the best banking stocks might even be on a discount as a result of that panic.

The Best Bank Stocks

Bank stocks are very diverse, from specialized firms to giant conglomerates. Their profile can range from distressed assets to dominant players quickly swallowing smaller competitors.

We’ll try to offer a diverse view of the sector and focus on a few of the best banking stocks, but we won’t even come close to covering all the possibly attractive stocks.

This list of the best banking stocks is designed as an introduction; if something catches your eye, you’ll want to do additional research!

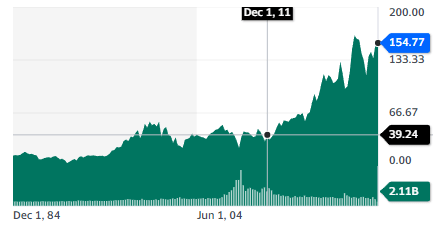

1. JPMorgan Chase & Co. (JPM)

| Market Cap | $449B |

| P/E | 9.95 |

| Dividend Yield | 2.59% |

Our first pick on the list of the best banking stocks is JP Morgan, as it is active in virtually any segment a bank can be working in, including asset management, commercial banking, investment banking, payments, private banking, and wealth management.

JP Morgan has grown a lot in the last few years, including growing its market share of total US retail deposits from 7.1% in 2012 to 10.9% in 2022 and reaching 22.4% of credit card sales while managing $4T of client assets.

JP Morgan is also investing massively in technology, with total technology investments of $7.2B in 2023, of which $1B is in digital, data, and AI.

Due to its size, JP Morgan is one of the best banking stocks for investors who are looking for exposure to the banking sector but are wary of taking risks. The bank has reinforced its balance sheet significantly since 2019, adding $800B in net deposits and $600B in liquidity sources.

US regional bank trouble might be a good thing for JP Morgan, which has recently absorbed troubled First Republic Bank, leading to record profits. The strong inflow of deposits is equally likely due to bank clients looking for safety.

With a Q2 2023 dividend payout of $2.9B and $1.8B in share repurchases, JP Morgan is focused on delivering value to its shareholders, either through growth or profit distribution. This makes a good banking stock for cautious investors looking for a long-term holding.

💸 Learn more: The dynamic between technology and how we manage money is ever-changing; our latest post delves into this transformation.

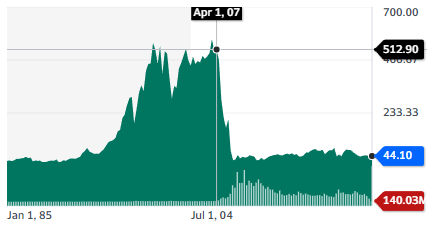

2. Citigroup Inc. (C)

| Market Cap | $84.9B |

| P/E | 6.99 |

| Dividend Yield | 4.62% |

Because the banking sector is marked by crises, it is worth checking on companies that have made the headlines in previous crises. Citigroup was at the core of the 2008 banking crisis, with its stock dropping dramatically and getting $306B of government support.

Since then, the stock price has not really gone anywhere. But Citigroup is now highly profitable and trading at a very low P/E ratio while distributing a rather large dividend.

And Citigroup also seems to have learned from its more troubled days in 2008, when risky subprime loans almost took it under. In 2023, Citigroup saw its assets grow by 2%, and its deposit levels and loan growth stayed steady.

The company is refocusing its activity on the US and the Americas and is progressively closing and/or selling its activities in China, Russia, Poland, and Korea.

While larger competitors like JP Morgan or Bank of America are focused on growth, Citigroup is a rather “boring” banking stock, not taking risks like in the old days, and not growing quickly.

This also seems already priced in, and it can make for a good income stock while its shareholders can wait (probably several years) for a repricing to reflect the safer profile and slowly healing reputation of the company.

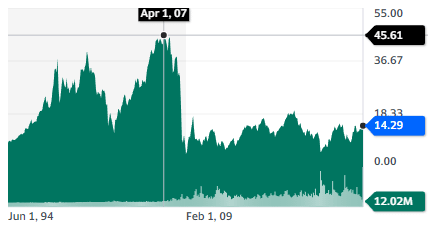

3. ING Groep N.V. (ING)

| Market Cap | $51.5B |

| P/E | 9.53 |

| Dividend Yield | 4.19% |

ING is an international bank with activities in 40 countries, employing 60,000 people and serving 37 million customers. It is the market leader in the Netherlands, Belgium, and Luxembourg and has a strong presence in Germany, Italy, Spain, and Australia.

The company has steadily grown its income and net results in the last quarter, completely ignoring any US turmoil. Just in Q2 2023, it added 227,000 customers and grew total income by 23% year-to-year. In the long run, the company plans to grow total income by 4-5 % CAGR.

The company’s return on equity is 11.7%. ING has a high level of mobile customers, with 60% using the mobile app at least once in the last quarter. The company’s progress on digital is also showing, with 63% of new customers in the Netherlands coming on board digitally.

ING is profitable, has developed advanced digital banking solutions, and is growing aggressively in new markets beyond its Benelux core region. This diversification provides some safety and also makes it one of the best banking stocks for US investors looking for international exposure in the banking sector.

The quite moderate P/E ratio and relatively high dividend yield also make it a good pick for a banking stock, delivering value, growth, and income simultaneously.

📊 Learn more: Looking to clarify the difference between Value vs Growth investing strategies? Our new post has you covered.

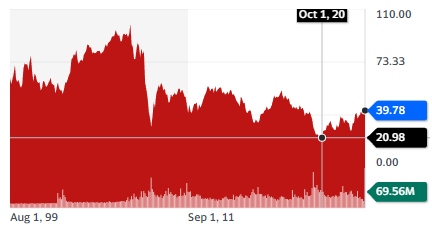

4. HSBC Holdings plc (HSBC)

| Market Cap | $157.2B |

| P/E | 7.1 |

| Dividend Yield | 6.36% |

HSBC is a bank with a long history since its founding in Hong Kong in 1865. It is now active in 62 countries and serves 39 million people.

Its core activity is in Asia, and this will be even more true in the future, with an ongoing strategic repositioning. HSBC plans to sell its French, Canadian, Russian, Greek, New Zealand, and Oman operations to refocus on Asia, including India. This repositioning matches the flow of new assets in the bank, now mostly coming from Asia.

HSBC is less retail-focused and more centered around commercial banking and wealth management.

Beyond the recentering on Asia and its dynamic economies and industries, HSBC is also very active in ESG investing (Economic/Social/Governance), with $255.5B of cumulative investments in the sector. HSBC is also the world’s largest underwriter of GSSS bonds (Green, social, sustainability, and sustainability-linked) while also having room to grow from its current 4.4% market share.

One potential risk for HSBC is the Chinese real estate market, which is undergoing a long-lasting crisis after decades of boom. HSBC’s exposure is $14.3B, down by $2.5B since the end of 2022. So, while not insignificant, this should not in itself be a systemic risk for HSBC. Another risk to look out for is the escalating US-China tensions.

The bank’s stock has somewhat recovered from its pandemic low but still trades at a low P/E and high dividend yield. It is one of the best banking stocks for investors who want to catch Asia’s rebound in industrial and commercial activity.

It is also highly vulnerable to any disruption in the Chinese and Hong Kong economies, so investors in HSBC will want to carefully assess risks in the region, both economic and geopolitical.

5. Nu Holdings Ltd. (NU)

| Market Cap | $37.2B |

| P/E | – N/A |

| Dividend Yield | – N/A |

Not all banks are operating in developed economies. One of the most dynamic regions for banking is Latin America, where a largely unbanked population is now joining the global economy, using smartphones instead of bank branches or computers.

Nu Bank has more than 85 million customers in Brazil, Mexico, and Colombia. Its digital-first approach is more akin to the one you could expect from a startup rather than a bank. So is the explosive growth it displayed in the last 4 years and its 37% year-to-year growth in April 2023.

On all metrics, the company growth is astonishing, with customer growth at a 46% CAGR and both revenue and gross profit growing at a CAGR of over 100%.

The company’s growth might slow down in Brazil, where it already reached 46% of the adult population (171M people). But it has plenty of space to grow in Mexico and Colombia, with a 2% market share of a combined population of 136 million people.

Within Latin America, a region of 660 million people, NuBank has a lot of room left to grow, both in its present market and the region as a whole. Now that the business model has been demonstrated, it can be expanded quickly.

It is rare for a banking stock to offer a double or triple-digit growth rate. NuBank’s success will also be heavily driven by the economic success of the region where it operates. In turn, this is likely to depend on political stability and global prices for commodities, as well as the region’s industrialization. So, investors will want to keep an eye on all these factors before buying Nu Bank stock.

Best Banking ETFs

When it comes to identifying the best banking stocks, it’s often challenging to evaluate the quality of a bank’s balance sheet directly. To mitigate this uncertainty and diversify your exposure to the sector, considering ETFs can be a strategic move, as they also help in reducing trading costs.

1. Invesco KBW Bank ETF (KBWB)

This ETF invests in all the major banking US corporations, with its top 5 holdings being JP Morgan, Bank of America, Wells Fargo, Morgan Stanley, and Goldman Sachs, combining for 38.7% of the total ETF.

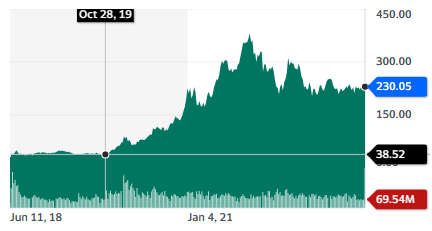

2. SPDR® S&P® Regional Banking ETF (KRE)

This fund specializes in US regional banks, the sector that has been the center of controversy and panic in the first half of 2023. This makes it a good investment vehicle for investors looking to bet the crisis is over, and the stock prices of these banks will rebound. The ETF is highly diversified, with no stock accounting for more than 2.5% of the whole ETF.

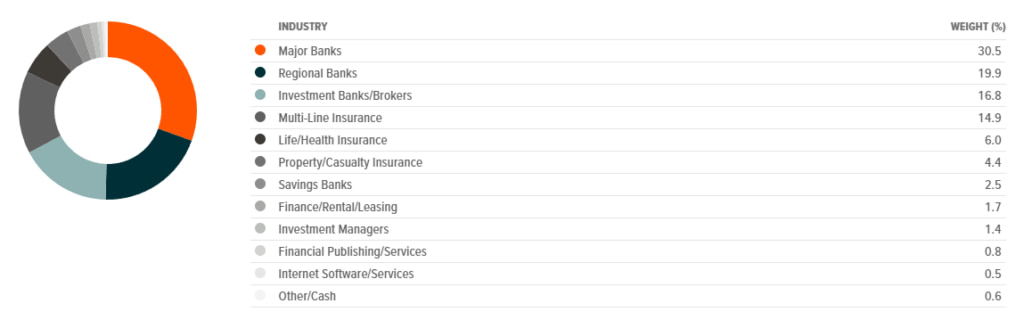

3. iShares MSCI World Financials Sector ESG UCITS ETF (WFNS)

This ETF covers the global banking sector while also including insurance groups (AXA, Allianz) and global financial firms (Moodys, American Express). This makes this ETF a good proxy for the world economy, globalization, and the financialization of the global economy.

4. MSCI China Financials ETF (CHIX)

This ETF provides exposure to the Chinese financial sector, with a focus on large banks and regional banks, but also covering insurance, brokers, and service providers. It can be a good pick for investors looking for exposure to the Chinese economy or unsure about the US banking sector.

Conclusion On The Best Banking Stocks

Banks are often said to rule the world, and it often pays to be one of their shareholders. This is still not a monolithic sector. There are multiple options available: large growing banks potentially turning into national oligopolies, troubled regional lenders, international banks expanding abroad, or neobanks with a focus on digital services and the unbanked population of the developing world.

When considering the best banking stocks to invest in, you’ll need to pay special attention to the balance sheet, as rising rates can dramatically reduce the value of bonds held by the bank.

At the same time, the lessons of 2008 have been well learned, and both banks and regulators are taking a much more cautious and proactive approach. So, after a short-lived turmoil and concern of a repeat of the Great Financial Crisis, maybe it is time to bet on banks to stay around and turn handsome profits for their shareholders.

In any case, diversification and careful analysis of individual companies or ETFs is always desirable.