Cannabis is a relatively new business. Up until quite recently, it was completely illegal in the US. Now, it is legal in many of the most populous states, creating a new niche that has investors scouting for the best cannabis stocks.

Sin stocks (alcohol, tobacco, gambling, weapons, etc.) often outperform the broader market. This is because some investors, institutional and individual, will refuse to partake in such activities. They are nonetheless highly profitable, allowing these businesses to reward their shareholders with generous buyback, dividends, and accretive growth.

A new category of sin stock has emerged with the progressive legalization of cannabis.

Cannabis is still illegal at the federal level but partially or fully authorized by many US states. This matches widespread public acceptance. Only 1/10th of Americans think the drug should be fully illegal. 59% support complete legalization.

The Best Cannabis Stocks

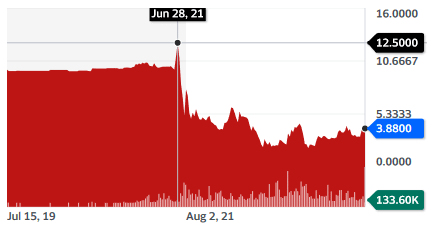

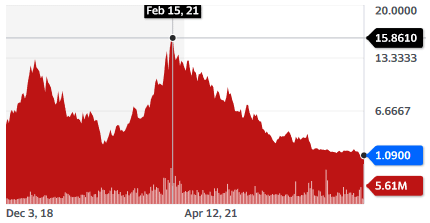

Cannabis as a sector went through a massive enthusiasm wave in 2021 when state legalization felt like the first step before imminent federal-level legalization.

The US Congress has failed to pass the SAFE Act (Secure and Fair Enforcement) that would normalize banking, taxation, and investing in cannabis companies. That failure has dragged the sector down, producing an overall 90% decline in cannabis stock prices. This somewhat mimics a previous wave of optimism and disillusion after Canada’s legalization of cannabis.

The focus in cannabis investing should be on high-quality companies that are able to survive the sector’s crises, capture market share, stay profitable in downturns, and benefit from possible future legalization at the federal level.

We’ll try to offer a diverse view of the sector and focus on a few of the best cannabis stocks, but we won’t even come close to covering all the possibly attractive stocks.

This list of the best cannabis stocks is designed as an introduction; if something catches your eye, you’ll want to do additional research!

📊 Learn more: If you’re new to the scene, our guide on stock investing for beginners can help clarify things.

1. Glass House Brands Inc. (GLASF)

| Market Cap | $268.8M |

| P/E | – N/A |

| Dividend Yield | – N/A |

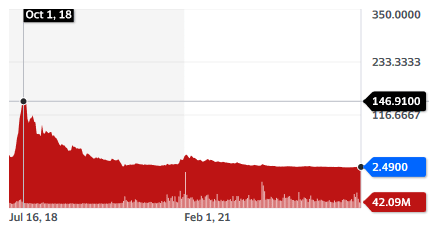

By far, the largest cannabis market in the US (and the world) is California. It is also the toughest, with low prices driven by intense competition. This has driven local cannabis prices even lower, with the smaller & less efficient producers being forced out of the market.

It is in that context that Glass House has acquired a truly massive 6 million square foot greenhouse facility. Half is already retrofitted to grow cannabis, with the rest to be ready in 2024.

The company is highly focused on having the best unit economics possible. Combined with the almost ideal Californian weather, this makes Glass House one of the most cost-efficient cannabis growers in the USA. Glass House has earned the nickname “Walmart of weed” for its cheap mass production.

The continuous improvement has allowed Glass House to produce at costs below the market price for Californian cannabis since 2021 despite the 2022 crash. It plans to increase production volumes by another 70% by 2024.

In the realm of the best cannabis stocks, Glass House stands out. Thanks to an extremely robust cost structure, the company has been able to weather the lowest price in the whole country and thrive through it. So, for investors worried about cannabis cyclicality and profitability potential, Glass House is a good example of a company embracing a future where cannabis can become a commodity consumer product similar to mass-produced beer or vodka.

2. Innovative Industrial Properties, Inc. (IIPR)

| Market Cap | $2.15B |

| P/E | 13.59 |

| Dividend Yield | 9.44% |

One of the hurdles in cannabis investing can be the difficulty of finding a broker willing to buy shares of companies in the industry. Many investment funds and banks can’t get involved due to the status of cannabis as an illegal drug at the federal level.

This creates a very difficult financing environment, where capital can be very costly. Cannabis companies often pay interest rates of 13-15% or more.

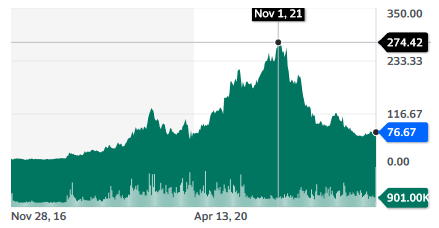

IIPR is an industrial REIT specializing in cannabis production facilities (greenhouses, oil extraction & purification plants, etc.). As a REIT, IIPR is not exposed to the same constraints as a cannabis company, so it can build the infrastructure with a much lower cost of capital. The facilities are then rented out to cannabis companies, usually on 15 to 20-year leases.

IIPR manages 108 properties in 19 states for a total of 8.1 million rentable square feet, with no tenant making more than 13.5% of total invested capital.

The company has grown its net operating income by 119% CAGR since 2017. Leverage is low, only 12% of total assets, and it distributes an almost double-digit dividend yield.

IIPR is one of the best cannabis stocks on the market, as it can provide good exposure to the sector while also generating a decent dividend income. Its large acreage is also likely to be hard to replicate at the same costs, with most materials and supplies having gone up in price since IIPR built its greenhouses, giving it a solid competitive advantage over new entrants in the market.

3. Curaleaf Holdings, Inc. (CURLF)

| Market Cap | $2.1B |

| P/E | – N/A |

| Dividend Yield | – N/A |

The third on our list of the best cannabis stocks is Curaleaf, a massive cannabis company active in 20 US states with 152 dispensaries and a total of 4.2 million square feet under cultivation. It is also aggressively expanding internationally, with existing or developing operations in the UK, Germany, Italy, Sweden, Czechia, Portugal, and Switzerland. This expansion into Europe gives Curaleaf a good chance at becoming the first “global” cannabis company in a sector often very focused on specific geographies.

The company’s product range is very large and covers virtually all cannabis products, including “classic” dried flowers, vaping liquid, gummies, mints, drinks, etc.

Curaleaf’s aggressive expansion allows it to diversify its income stream, with Europe expected to be a serious growth driver for the company.

This makes Curaleaf one of the best cannabis stocks for investors looking to invest in a large cannabis company, with the potential to become, over time, like the big tobacco companies, with a scale allowing it to support global brands and to progressively swallow smaller brands and competitors.

4. Tilray Brands, Inc. (TLRY)

| Market Cap | $1.75B |

| P/E | – N/A |

| Dividend Yield | – N/A |

In consumer goods, brands can make the difference between poor profit and margin and outstanding businesses. A perfect example of the power of branding can be found in Coca-Cola, whose most valuable asset is its brand: people come back, even when cheaper alternatives exist.

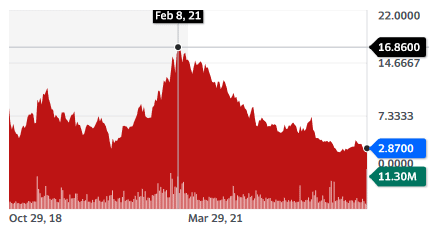

There is still an open question of whether cannabis will be a market dominated by bulk, commoditized products or a consumer brand people trust to deliver a consistent taste and effect. This is the strategy followed by Tilray.

The company is well-positioned in Canada, where it ranks #1 for most of the product categories. It is also active in the US cannabis market and has recently expanded into alcoholic beverages.

The expansion into alcohol started with craft distillers and beer makers, followed by the recent purchase of 8 beer brands from Anheuser-Buschfollowing a poor marketing campaign.

Overall, Tilray is working on building an ecosystem of “lifestyle” brands, where their consumers will relax and enjoy life by consuming either cannabis products, beer, whiskey, or even energy drinks.

Tilray is more of a play on building a strong brand in the cannabis space, as well as counting on the normalization of cannabis alongside other addictive substances like alcohol. This should also make Tilray less vulnerable to delay in cannabis reforms, as the alcohol segment can grow no matter when the SAFE Act or full legalization is enacted, making it one of the best cannabis stocks out there.

5. Cresco Labs Inc. (CRLBF)

| Market Cap | $370M |

| P/E | – N/A |

| Dividend Yield | – N/A |

Many cannabis companies rely mostly or exclusively on their own dispensaries to sell their branded product. This allows a strong control of the distribution channel but can also be expensive and limit the reach of their products.

Cresco Labs stands out as one of the best cannabis stocks for investors to consider, primarily functioning as a wholesaler of cannabis products, offering cannabis in almost any possible form, even as marshmallows, resin, etc… The company operates some dispensaries (69 locations) but mostly sells through a network of 1,600 third-party resellers.

This makes Cresco’s business model more akin to Craft’s or Nestle’s, selling their products anywhere the customer might be. Currently, this is not so crucial, as cannabis sales are restricted to highly regulated dispensaries requiring specific licenses.

But if (when?) cannabis becomes fully legal and more accepted, we might find it on sale in the same spaces that sell alcohol and tobacco, from supermarkets to fuel stations. In such a market, Cresco could be at an advantage, having already established strong wholesale processes for and having brands that are widely recognized by customers, thanks to having seen them in thousands of dispensaries all over the USA.

Once again, investors will need to decide what they think is the most likely future of the cannabis market. If generalized acceptance of cannabis is on the horizon, sales will not be limited anymore to licensed dispensaries, and wholesalers might be the winning sub-sector of the industry.

Best Cannabis ETFs

As a very new market, cannabis is still a space where various business models are being tested while dealing with a quickly evolving regulatory landscape.

So, besides picking the best cannabis stocks on the market, investors might simply want wide exposure to the sector as a whole. ETFs can help you do this while reducing trading costs.

1. AdvisorShares Pure US Cannabis ETF (MSOS)

This US-focused ETF includes all the largest US cannabis names, including Green Thumb, Curaleaf, Verano, and Trulieve, in its top holdings. The top 5 holdings represent 80.49% of the whole ETF, so investors might want to look at these companies in further detail before purchasing this ETF.

2. Global X Cannabis ETF (POTX)

This ETF is focused on smaller cannabis players, especially in limited license states or medical cannabis with names like Cronos Group or Aurora Cannabis. It is also more diversified, with the top 5 holdings making up “just” 61.19% of the whole ETF.

3. Amplify Seymour Cannabis ETF (CNBS)

This ETF includes cannabis companies like Tilray and Curaleaf but also suppliers to the industry like IIPR and hydroponic equipment supplier GrowGeneration. So, it gives wider exposure to the sector, including not only cannabis sellers but also key suppliers to the industry.

4. AXS Cannabis ETF (THCX)

This ETF is strongly focused on suppliers to the cannabis industry, with the top holdings being commercial real estate companies IIPR & AFC Gamma. The ETF also includes plant growth and equipment companies like Scott Miracle Grow, GrowGeneration, Waters Corps, WM Technology, etc…

This makes this ETF a good “pick & shovel” play on the cannabis industry, counting on the expansion of production and not looking to guess the future winner in the industry.

5. Cambria Cannabis ETF (TOKE)

This ETF is centered on cannabis brands, with Constellation Brands, Imperial Brands, and Tilray among its top holdings. It also includes large tobacco companies with an interest in the cannabis sector, like Philip Morris, Altria, and British American Tobacco. “Big Tobacco” may ultimately acquire or merge with cannabis brands, and this ETF is a good way to get exposure to this possibility.

Conclusion

Cannabis is a widely used and increasingly accepted mild narcotic. It is likely that over the next years, its status will slowly stop being an illegal drug and, more akin to alcohol, expected to be “used with moderation”.

The uncertain legal status of the product is likely to be a drag on stock values, and there is a strong possibility that values could surge if federal legalization occurs.

This growing acceptance will still likely see cannabis stocks stay in the “sin stocks” category, with both the associated stigma and premium returns that come with that label.

In addition, the industry and the stock prices are now in a deep and brutal downturn caused by slower-than-expected changes in US federal regulations. It is likely that the saving grace of the industry will come from such changes but also from the growing parallel movements for legalization in the EU.

So investors will have to be patient and diversify cautiously to be sure to buy companies able to survive and even thrive in that difficult environment until then.

If you’re looking for more detailed information on the sector and some of the best cannabis stocks, read our detailed industry report!