And on we go, another 15 randomly selected stocks from Norway. This time, four of them made it into the preliminary watch list. Only 80 stocks more to go….

181. Circio Holding

Circio Holding is a 6 mn EUR market cap Biotech that is loss making and has renamed itself recently from Targovax. “Pass”.

182. Borgestad

Borgestad is a 17 mn EUR market cap company that manufactures and distributes refractory products and also owns a shopping center. The company seems to have seen better days and is highly leveraged. “Pass”.

183. Pexip Holding

Pexip, with a market cap of 160 mn EUR, is a video conferencing technology company that was IPOed 2 monhts into the Covid lockdown 2020. The company was profitable until 2019, but loss making since 2020 which helps to explain that the stock lost -80% since the IPO. “Pass”.

184. Yara

With around 8,9 bn EUR market cap, Yara is one of the large Norwegian Industrial groups and one of the largest ammonia fertilizer producers globally.

Normally, this is a low margin, low return on capital business, but with the Ukraine war, fertilizer bacame a scarce commodity last year and Yara was virtually printing money. Nvertheless, looking at the chart, Yara seems to be a long term steady grower:

Things seems to normalize in 2023 and in Q2 they actually showed a loss due to investory write-downs. Knowing that Ammonia production is one of the biggest CO2 emitters globally, it is clear that Yara is facing challenges, however this also could turn into an opportunity if the manage to be ahead of the crowd. For me a stock to “watch”.

185. Aurora Eiendom

Aurora is a 220 mn EUR market cap real estate company that has been created and IPOed in 2021. They seem to own mostly shopping center, which, surprise, seems not to be much in favor right now. The company is highly leveraged as well. “Pass”.

186. MPC Container Ships

As the nam indicates, MPC is “a leading container tonnage provider with a focus on small to mid-size containerships. Its main activity is to own and operate a portfolio of container ships serving intra-regional trade lanes on fixed-rate charters”. With a market cap of 700 mn EUR it is not small and has only a small amount of debt. According to TIKR, the stock trades at 2,3x P/E and a 35% dividend yield, which kind of indicates that the ggod days in container shipping might come to an end. The stock did more than 10x since 2020. Not my area of expertise, “pass”.

187. VOW Green Metals

VOW Green Metals, with a market cap of 40 mn EUR, seems to be a Spin off of VOW ASA and focuses on the production of “biocarbon”. From what I understand, this is a CO2 neutral replacment to metallurgical coal used for instance in steel production. This sounds like a sexy “climate” story, however profuction hasn’t yet begun, so it’s more a venture case.

I also doubt a little but the scalability, as competition for Biomass feedstock is high and Hydrogen based Green Steel production seems to be the more scalable approach. “Pass”.

188. Eidesvik Offshore

Eidesvik is a 89 mn EUR market cap company that “operates a modern fleet of highly specialised offshore support vessels.” The company is profitable right now, but has been loss making for 7 out of the last 10 years. “Pass”.

189. Masoval

Masoval is a 260 mn EUR market cap Salmon farmer which still seems to be majority owned by a family and went public in 2021. The company made a big profit in 2022 but seems to be loss making in 2023. As mentioned before, that sector seems “too hard” fro me, “pass”.

190. Byggma

Byggma is a 100 mn EUR market cap company “manufacturing and selling building material products. The Group consists of 12 manufacturing plants and 4 sales comp. in Norway, Sweden, Finland, UK and US.”

Even in super rich Norway, buildig is struggling and Byggma’s margin have been dropping in 2023. The chart looks more like a supplier of Covid tests than a builing materials company:

Byggma seems to produce mostly wood based products such as beams and windows, but also lamps. The company seems to be controlled by it’s CEO who owns almost 90%. The debt load is quite high and has increased yoy significantly. “Pass”.

191. Edda Wind

Edda Wind is a 220 mn EUR market cap company that went public in 2021 and mostly provides services to the offshore wind industry. The company owns 6 ships and has comissioned more that mainly serve as an off shore base for service personal that is required to maintain and repair off shore windfarms. In theory, the sector should grow for some time and business should be great as the vessels are in high deman. Revenue is increasing, but the number of shares is even increasing faster as capital increases are required to finance the new ships, which meaybe explains why the shares are down ~-20% from the IPO.

Rising debt costs is clearly also an issue, but overall this looks like one of the few shipping related stocks that could be interesting. According to TIKR, the share price is ~0,75x tangible book value. “Watch”.

192. Magnora

Magnora is a 185 mn EUR market cap company that “operates as a renewable energy development company. It primarily focuses on developing wind and solar photovoltaic (PV) projects.”

A first look at the numbers show a strange picture with a single digit P/E but a high 10x multiple on sales. The solution for this is that as a developer, they were able to sell a project with a large profit in 2023. Overal, Magnora has a pipeline of around 6,7 GW with the majority in PV projects. Up unitl 2018, they seem to have serviced also the oil industry but then focused fully on renewable energy. Looking at he share price, this was a positive move:

In contrast to many other developers, Magnora has net cash which I find interesting. As I like the developer model in general, I’ll put hem on “watch”.

193. Ayfie Group

Ayfie is a 8 mn EUR market cap nano cap offering “unique AI solutions” that seem to be so successfull that they just had to do a capital increase. “Pass”.

194. Odfjell SE

Odfjell is a 600 mn EUR market cap that “engages in the transportation and storage of bulk liquid chemicals, acids, edible oils, and other special products.”

So they basically own ships and terminals which is an interesting combination. The long term chart looks REALLY interesting:

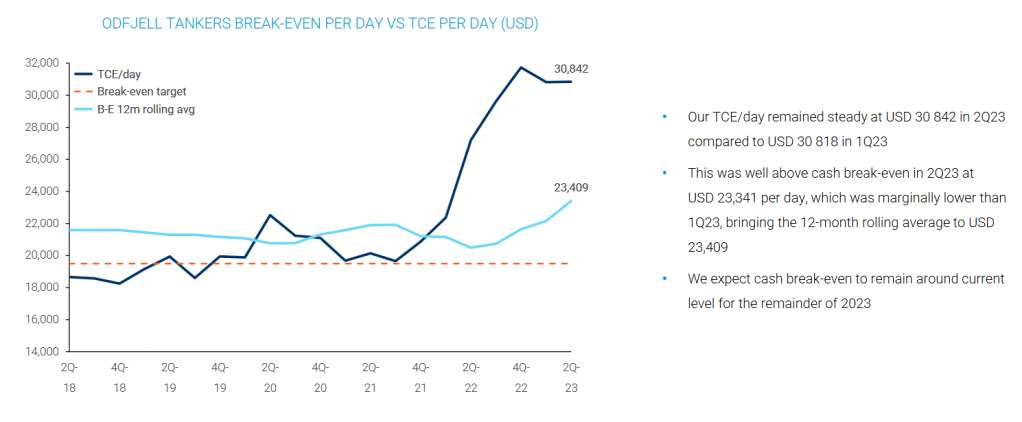

After a peak in 2005, the stock did nothing for 13-14 years before increasing significantly just in the past few months. It seems that prices have suddenly increased a lot and translated into a lot higher earnings for Odfjell. However, I have no idea how sustanable that is:

I guess that this business is again “too hard” for me, so I’ll “pass” depite the currently low valuation.

195. Selvaag Bolig

Selvvag Bolig is a 210 mn EUR market cap company that develops residential properties in Norway. Developing residential properties in Norway is simlar difficult right now than elsewhere in the world, which shows inthe share price:

Superficially, the stock looks cheap with a 6x P/E according to TIKR. The bsuiness model seems to be that they actually acquire the land, but only after 60% of the units have been pre sold. The company has quite good reporting and an impressive track record:

The company seems to be still majority owned by the founding Selvaag family. Overall this could be an intersting bet on a housing recovery in the Nordics, therefore I’ll “watch”.