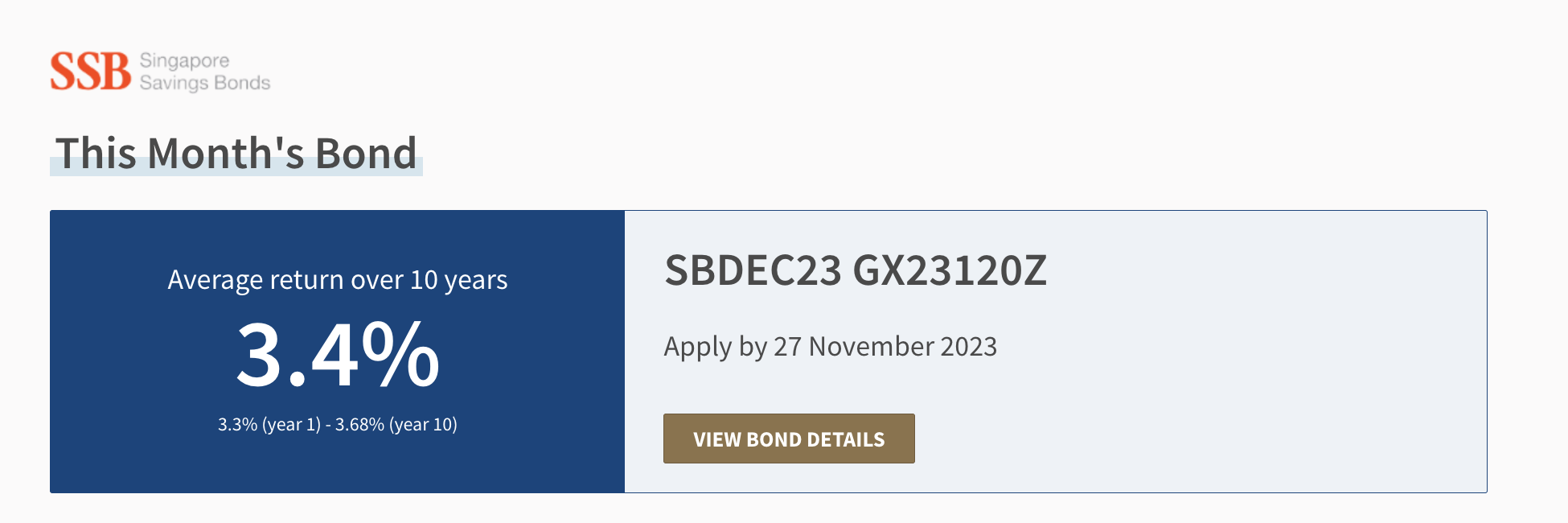

Announcement: If you haven’t seen it yet, the latest Singapore Savings Bonds yield 3.4% over 10 years, which is the highest yielding SSBs for all of 2023 till date!

This is also one of the highest since SSBs were launched, with a few exceptions such as last year’s December 2022 tranche, which yielded a slightly higher return of 3.47% in the uncertain interest rate climate back then.

At this rate, SSBs are now more attractive than other short-term risk-free options such as banks’ fixed deposits or MAS Treasury Bills. The problem with these 2 other instruments is that they have a shorter term duration, which means you have to keep finding new places to put your funds in after 6 months / 1 year / 2 years. For those of you who have no time to keep shopping around for alternative options, then this month’s SSB might just be your answer.

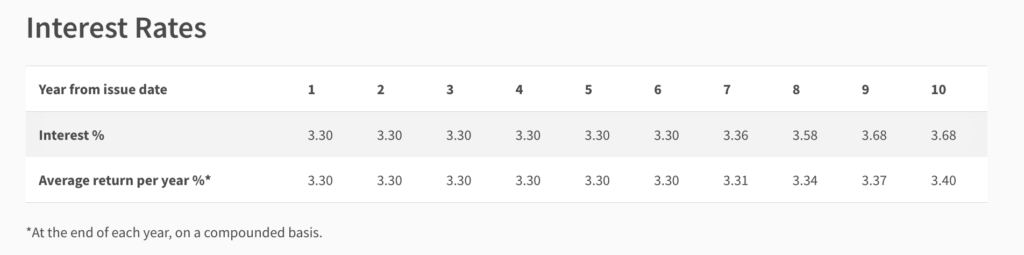

Here’s the interest rates for this month’s SSB over the next 10 years:

What I like about the Singapore Savings Bonds

The big benefit with SSBs is that you lock in interest rates for 10 years. If interest rates are going to get slashed in 2024, this gives you the option of holding onto a higher yield via this month’s SSB.

Yields aside, the next best thing about SSBs are in its liquidity because you only need to wait for 1 month to liquidate your funds. At any time when you need the cash back, you can get it within the start of the following month.

The minimum sum is also fairly low, starting at just $500 and in multiples of $500. The maximum amount of SSBs you can hold at any one time (including from previous months’ tranches) are capped at $200,000.

SSBs are also backed by the Singapore government, making it a pretty risk-free choice for those of you who are super risk-adverse. There may be other higher yield options in today’s market, but do note that these are not risk-free:

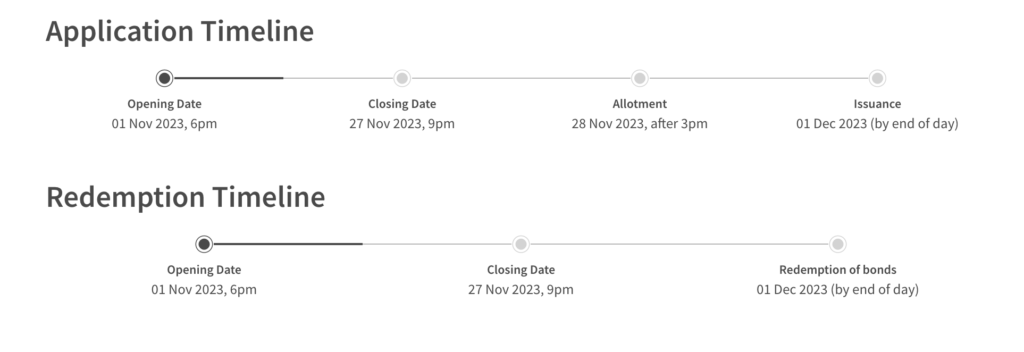

The application timeline can be found below, or here at the official SSB link:

If you’re intending to apply, you can do so through your DBS/POSB, OCBC or UOB internet banking portals or ATMs. And if you intend to use your Supplementary Retirement Scheme (SRS) funds instead, then you’ll have to use the online banking portal of the bank where you have your SRS funds deposited in.

The only cost is the $2 application fee and a few minutes to get it set up via internet banking.

Note: You cannot use your CPF funds to buy SSBs.

Share this with anyone you know who might want to check out this month’s bond.

For more details, you may cross-verify on the official SSB website by MAS here.