The IMF regularly conduct ‘missions’ to member countries, where a group of highly paid economists trot out to a capital city somewhere, hole up in some luxury hotel, and have a few meetings with Treasury officials and the like and then shoot through after the short visit back to whence they came and produce their report. On October 31, 2023, the IMF published – Australia: Staff Concluding Statement of the 2023 Article IV Mission – which attracted a lot of mainstream press attention in Australia. The message that the public received was summarised in this article – International Monetary Fund says Australia needs higher interest rates. The article carried no qualifications or reflection on the methodology. The journalists who have a high profile in the mainstream national media sanctioned without question the IMFs conclusions. That is what goes for information in these times. It is an assault on our collective intelligence really.

The aforementioned press article started with the lurid headline and then went immediately into the sub-plot:

The International Monetary Fund has urged the Reserve Bank to lift official interest rates further while warning they may have to go even higher if the nation’s governments don’t abandon or delay some of their multibillion- dollar infrastructure projects.

That is the narrative.

Rising rates – why?

Answer: Excessive fiscal deficits – governments have to abandon major projects that are, in part, designed to help in the transition to a more sustainable economy.

And the lack of critical scrutiny by these journalists is stunning and, in my view, makes them just lackeys of the IMF rather than investigative and independent press agents.

If you read the IMF Report (cited in the Introduction) you will find out more than the journalists were willing to write.

Essentially, the media report failed to even put the pieces together.

The IMF claims that in relation to Australia that:

Unemployment remains low, output above potential, and housing prices have picked up after a correction in 2022 … headline inflation has peaked … but staff assess that more is needed to bring inflation back to target and keep inflation expectations anchored.

In terms of inflation, they write:

… despite a recent moderation, services inflation remains high and broad-based, driven by strong demand, input cost pressures from both labor costs (reflecting historically tight labor markets and weak productivity outcomes) and non- labor costs (such as rent and electricity),

I must live in a parallel universe because labour costs are not rising significantly and real wages are still being cut.

Further, real wages are trailing the ‘weak’ productivity growth, which means that real unit labour costs are falling as more national income is redistributed towards profits.

And, in relation to the so-called non-labour costs they mention, electricity pricing is high because the privatised corporations have been profit gouging to their hearts content and failing to invest in the necessary infrastructure to integrate the growing supply from solar.

That source of CPI inflation will not be sensitive to higher interest rates.

What is needed is tighter regulation and a reversal of the privatisation of the public utilities.

And, rental prices are rising fast because the Reserve Bank of Australia has been hiking interest rates – it is a classic example of monetary policy that is alleged to be fighting inflation actually causing inflation.

As a note, I consider it an insult that the IMF uses American spelling when discussing Australia but then the IMF considers their approach to be a one-size-fits-all, which is why they get things badly wrong in many situations.

It is a modern form of Imperial colonialism!

Further, as I reported last week in the blog post covering the latest inflation data in Australia – Slight rise in Australian inflation rate driven by factors that do not justify further rate hikes (October 25, 2023) – inflationary expectations in Australia are not signalling any major upward shift.

Two of the main time series are within the RBA target range and the others are approaching the upper limit as they fall.

There is no justification for further interest rate hikes based on the data we have available on inflationary expectations.

The IMF also claim that:

Output is estimated at around 1 percent above potential …

This is really the nub of it.

It is programatic that if ‘output gaps’ are above positive – that is output is estimated to be above potential – then the appropriate response is to tighten fiscal and monetary policy.

Why?

Because it would mean that overall spending was outstripping the supply capacity of the economy to absorb it and the adjustment fuse would be rising prices.

The RBA and the IMF are clearly claiming that the current inflationary episode is being driven by demand factors, whereas I consider it clear that supply factors have instigated the episode and will abate over time, without any need to adjust interest rates.

But even with that, the use of output gaps to guide policy is controversial.

The IMF article from its Finance and Development series – The Output Gap: Veering from Potential – will help you understand what the IMF means when they talk about output gaps and their relation to policy.

But the problem is that these measures are notoriously innacurate and biased to support the IMF ideology that predicates against government intervention as a starting point.

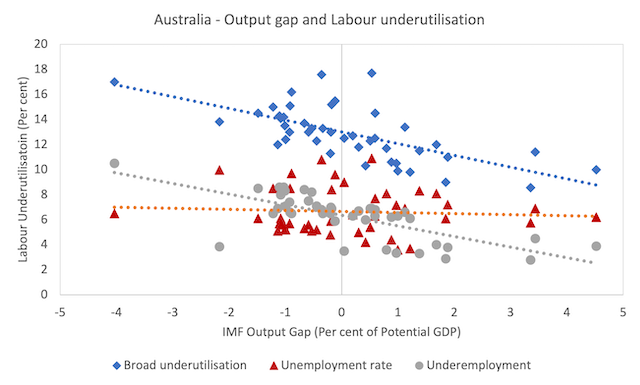

The following graph shows the IMF Output Gap measure on the horizontal axis (per cent of potential GDP) and the various labour underutilisation measures on the vertical axis (per cent of labour force).

The three labour underutilisation measures are:

1. Official unemployment rate.

2. Underemployment rate (part-time worker who want more hours of work but cannot find them).

3. Broad underutilisation rate (the sum of 1 and 2).

The dotted lines associated with each of the labour underutilisation measures are the linear trends.

The graph is actually very interesting as I am sure you will see.

Effectively, increases and decreases in the IMF output gap measure are invariant to shifts in the official unemployment rate, which surely should cast doubt on your confidence in the IMF measure.

According to the IMF, Australia can have a 4 per cent output gap (an aggregate measure of excess capacity) when the unemployment rate is around 6 per cent.

But, equally, they claim the output gap can be positive 4 per cent, meaning GDP is at 104 per cent of Potential GDP – which the IMF classifies as over full employment at exactly the same official unemployment rate.

If you believe that then send me an E-mail and I can sell you the Sydney Harbour Bridge for cheap and throw in the Sydney Opera House just for fun.

The problem is in the way they estimate potential GDP and the underlying NAIRU measures they use to depict full capacity in the labour market.

The NAIRU is the Non-Accelerating-Rate-of-Unemployment and is estimated indirectly (because it is no observable) from econometric equations, which are themselves subject to extreme imprecision.

So you get standard errors around point estimates of the NAIRU that are wide, which means we can be equally confident that the NAIRU is somewhere between say 2 and 8 per cent when the point estimate is say 5 per cent.

In other words, it is so imprecise that even if you believe in the underlying theoretical framework, the imprecision renders it useless for policy purposes.

Yet, organisations such as the IMF persist in using it exactly for that purpose because they know the imprecision is systematically biased towards the conclusion that the current degree of fiscal expansion is excessive.

In other words, their measures of potential GDP are always biased downwards because their estimates of the full employment unemployment rate is always biased upwards.

So, this bias suits their ideological agenda for smaller government involvement in the economy.

It is of course a loaded game.

And in the reports that the media love to publish with lurid headlines, the details are never reported and so all the public gets is the ideological bias packaged in statements such as “interest rates have to rise further”.

I doubt the journalists that write these reports even know the detail themselves.

They are just pawns in the ideological battle that the elites wage against ordinary workers and which over the last several decades have resulted in elevated levels of labour underutilsation, suppressed wages growth and rather large redistributions of national income to profits.

The result has been income and wealth inequality has risen and the quality and scope of public service delivery has been degraded.

Such shifts benefit some at the expense of the many.

Testing the proposition

I would like to test the proposition by announcing that the Federal government will abandon the mean-spirited income support system for unemployment and instead offer a Job Guarantee at a socially-inclusive living wage (which would become the minimum wage) to any worker who desired to work and could not find a job and any worker who was currently seeking more hours of work but due to demand constraints could not find them.

What do you think would happen?

Socially and environmentally useful output would rise.

The well-being of those currently unemployed and underemployed who took up the job offers would rise.

Poverty among the jobless and those trapped in the gig economy would fall.

Inflation wouldn’t respond at all.

That would suggest the output gap measures of the IMF, which motivate the policy advice are hopelessly wrong.

I consider it impossible to have around 10 per cent of available and willing labour not working in one way or another (either unemployed or underemployed) and the economy to be judged to be over capacity.

Conclusion

Unfortunately, the local media provides no insights into the garbage that the IMF continues to pump out.

How many times does the IMF have to be discredited (think Greek bailout, failed SAPs for decades, etc) for the local press to, at least, be critical of the reports the IMF publishes?

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.