What if we no longer had to compare between comparison sites and blogs just to get the best deal?

Whenever I apply for a new credit card or need to buy insurance online, I usually make the effort to shop around first for offers to make sure I always get the best deal.

- Credit card applications: cash or freebie(s), or both.

- Insurance purchase: lowest premiums

As we know, the banks and insurers do change their offers or quotes from time to time, which is why it could be worth the extra minutes searching online to find the best deal (or lowest premiums) before you apply or purchase. The best deal could sometimes come from the provider themselves, or one of their intermediaries such as an affiliate partner or a comparison site.

Most of the time, my search almost always leads me back to SingSaver, which has been my go-to anyway since they first launched in 2015. Over the years, I’ve managed to snag some of their awesome deals, including $350 cash and a free Apple iPad, and I’ve continued sharing this tip to my friends who aren’t aware of it.

But are they always the best? What if we could skip time spent comparing and simply go to a single site where we can be guaranteed of the best deals?

Well, that’s what SingSaver wants you to do, which is why they’ve launched their Best Deal Guarantee campaign.

You read that right, SingSaver is going one step further to guarantee Singapore residents that we will always find the best deal on SingSaver.

Right now, this is for any new credit card sign-up or insurance purchase (travel / car / domestic helper / home insurance) that you make online. And should you somehow manage to find a better offer or quote elsewhere, then SingSaver is promising to refund you with at least double the price difference (capped at S$300) in vouchers.

| Offer / Price difference | Voucher gift from SingSaver |

| S$0.01 – S$4.99 | S$10 |

| S$5.00 – S$9.99 | S$20 |

| S$10 – S$19.99 | S$40 |

| S$20 – S$49.99 | S$100 |

| S$50 – S$99.99 | S$200 |

| > S$100 | S$300 |

For example, this means that if you’re able to find a better offer that is worth S$120 more than the deal you got on SingSaver, then not only will you get your existing gift, but SingSaver will also give you S$300 of cash vouchers (e.g. Grab vouchers) to make up for the difference.

Shiok.

SingSaver Best Deal Guarantee – How does it work?

SingSaver’s Best Deal Guarantee promises you the best deal only with SingSaver, and if you find a better offer elsewhere, simply submit a claim and be rewarded with double the difference.

This is meant to give you a peace of mind that as long as you apply through SingSaver , you can be reassured that you’re getting the best deal. And should that not be the case , SingSaver will guarantee that you get that refunded anyway – something that no other provider will give (you’ll just have to live with the regret of having applied through the wrong channel).

The campaign runs from now until 30 November 2023 and covers credit cards from CIMB, HSBC, Maybank, OCBC and StanChart, together with selected insurance policies.

The full list of eligible products can be found here.

The campaign mechanics are pretty straightforward:

- Get the best deal when you sign up for a new credit card or purchase travel, car, domestic helper or home insurance via SingSaver.

- If you find a like-for-like offer or a price quote that beats SingSaver’s, you’ll get rewarded for up to 2X the difference. Note: the offer or quote has to be found within 3 days, with the same financial provider and for the same product that you have applied for.

- Send proof of the better offer, along with your proof of purchase or application with SingSaver via this form here.

SingSaver will assess your claim and provide a decision within 10 working days via email. If your claim is successful, you’ll receive Grab vouchers to make up for the difference by at least 2X, aimed to give you a complete peace of mind that you’ll definitely be getting the best deal on SingSaver no matter what.

Note that the Grab vouchers will only be paid out within 16 weeks after the campaign ends on 30 November 2023. The reason for the wait is because SingSaver needs to determine your eligibility for the offer in question, which in turn is dependent on when the financial institution provides the report.

If you fail to meet the actual eligibility criteria for your rewards with the financial institution, you won’t be entitled to the Grab vouchers either. So for instance, you can’t put in a claim for a new-to-bank offer when you’re in fact an existing customer; neither can you put in a claim for a free gift if you did not meet the minimum spend criteria required.

The full Terms and Conditions for the Best Deal Guarantee campaign can be found here.

The campaign should be a good one for both SingSaver and Singapore residents in general, since this saves you all the hassle from having to do your own comparisons in order to find the best deal out there. You can now have a peace of mind that you’ll always be getting the best deal with SingSaver, guaranteed.

But as loyal readers would know, I’m always skeptical whenever any brand says they’re the “best”. What’s more, you guys know I’m pretty skilled when it comes to comparisons, so I decided to put it to the test and find out!

Experiment 1: Credit card sign-up – PASS

I searched online for various sign-up offers for the Standard Chartered Journey Credit Card, and the best I found was via SingSaver, which is currently giving a S$140 cash via PayNow upon card approval for new cardholders. In contrast, the bank’s own website and MoneySmart did not have any additional perks beyond the bank’s welcome 45,000 miles promotion (S$3,000 min. spend with annual fee payment, within first 2 months).

Experiment 2: Domestic helper insurance – PASS

Since our helper’s work permit will be due for renewal soon, I decided to check out premiums for a 26-month plan for renewal helpers, and for the purpose of this comparison, focused on the cheapest plan among each of the insurers’ offerings.

As it turned out, going direct to the insurer’s website didn’t necessarily get me a better quote. The premiums were the same, with the exception of AIG where my quote ended up being higher than when I went through SingSaver, but in return, I would get a $50 grocery voucher and a free helper medical screening (which can only be utilized at 4 clinics in Singapore).

Are the freebies worth the $155 difference? That’s debatable.

| MSIG MaidPlus (Standard) |

FWD Maid Insurance (Essential) |

TIQ Maid Insurance (Plan A) | AIG Domestic Helper Insurance (Classic) | |

| Offer via insurer | $434.97 (25% off) |

$599.76 (15% off) |

$486.13 (34% off with MAID34) | $1714.22 and S$50 DairyFarm voucher and free domestic helper medical screening |

| Premium via SingSaver | $434.97 (25% off) |

$599.76 (15% off) |

$486.13 (34% off with TIQSINGSAVER) | $1558.40 |

| SingSaver additional offer | S$30 e-vouchers and S$25 PayNow (up to S$45 for higher plans) | – | – | S$70 PayNow |

| Valid until | 11 Nov | 11 Nov | 30 Nov | 31 Oct |

Going through SingSaver to get an additional S$25 (for MSIG) or S$70 cash (for AIG) via PayNow is definitely the best deal if you asked me, hands down.

Ok, so the results of my experiments speak for itself. If you’re keen, you can duplicate the same for the other products (20 credit cards and 23 insurance policies) in the campaign.

I might be a little biased because we’ve almost always applied through SingSaver (with the exception of DBS cards since these don’t get any extras) but this Best Deal Guarantee definitely lends more assurance that we have, and will always be getting, the Best Deal on SingSaver.

Will the BEST deal always be on SingSaver?

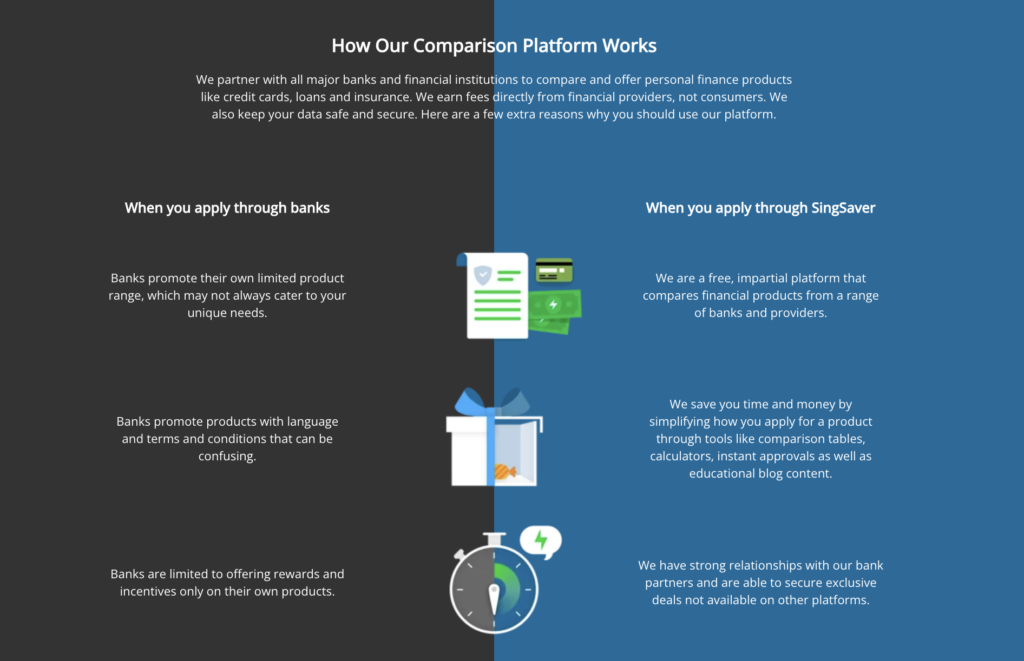

Savvy consumers would probably know by now that financial institutions do not always go direct to consumers, but often work with intermediaries – such as affiliates (including content creators), brokers, agents, partners or sponsors. The promotions change from time to time, and while people often think that going directly to the FI would give them the best deal (since there are no intermediary fees to be paid), reality has shown that this is often not the case.

On the other hand, SingSaver has made it their mission to always provide the best finance deals to their users, and is now cementing that further with their Best Deal Guarantee campaign to promise Singapore residents that you will always find the better deal on SingSaver.

And if you don’t? Well, then SingSaver will make it up to you by more than doubling the difference during this period and reward you with the equivalent cash vouchers.

While this is a pilot campaign, it remains to be seen if SingSaver will extend this as a more permanent feature among their offerings.

When that happens, we can officially say goodbye to the days of comparing elsewhere…and just go to SingSaver for all our needs.

Sponsored Message SingSaver’s Best Deal Guarantee promises that customers can expect the highest offers and lowest premiums when applying for cards or insurance policies via SingSaver. If a better deal is found elsewhere, SingSaver will reward you with Grab vouchers to make up the difference. T&Cs apply. What’s more, don’t forget that SingSaver is also concurrently running their 101 Milestone Giveaway campaign, with a prize pool of up to S$200,000 on top of the usual welcome offers and sign-up gifts! All applicants for eligible products are automatically entered so there’s no further action needed from you.

Disclaimer: This article is sponsored and written in collaboration with SingSaver. All opinions are that of my own, including the choices for the experiments.