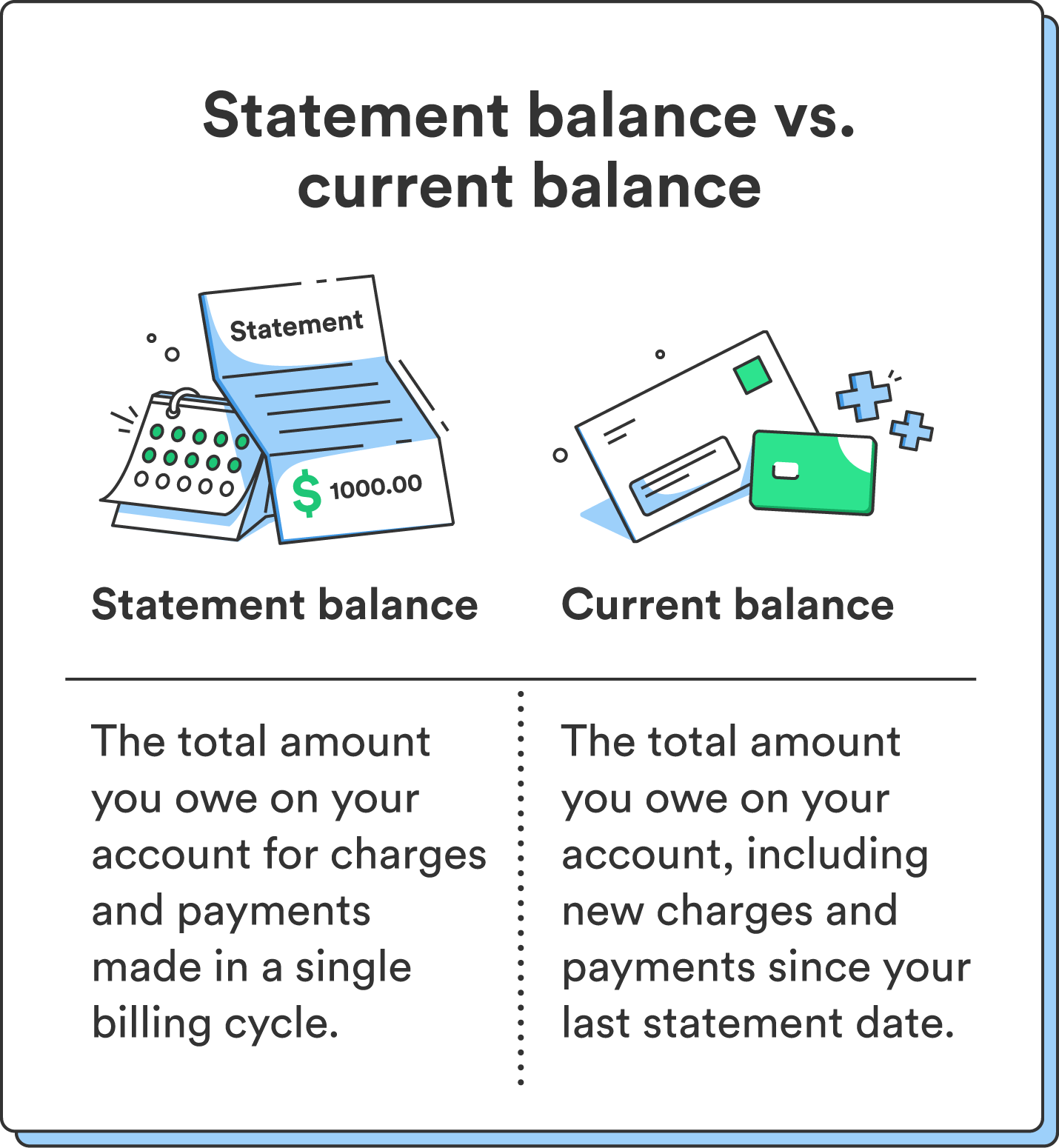

Your statement balance and current balance may not always match up depending on how you use your credit cards.

That’s because your statement balance doesn’t consider any transactions you make after the cycle ends – but those transactions would appear on your current balance. Your current balance includes all your recent spending and payments, whether your billing cycle recently ended or not.

Because of this, your statement balance can either be lower or higher than your current balance.

Here’s an example of when your current balance may be higher than your statement balance:

Say you spent $1,000 during one billing cycle, and your billing cycle ends on the 30th of each month. Your statement balance on the 30th would be $1,000. If you make a $250 purchase on the 31st, your statement balance would remain the same ($1,000), but your current balance would be $1,250. In this case, your current balance is higher than your statement balance.

Alternatively, your current balance may be lower than your statement balance:

Let’s say you spent the same $1,000 during your billing cycle that ends on the 30th of each month. Then, you made a $500 payment toward your account balance on the 31st. In this case, your statement balance would still be $1,000, but your current balance would be $500.