Retirement is often framed as one’s “golden years”, a time to enjoy the fruits of several decades of hard work. And for many retirees who have planned accordingly, this transition is not a problem as they might spend generously on travel, hobbies, or other pursuits. Nevertheless, some retirees can find it emotionally challenging to bring themselves to go beyond the basics in retirement spending (e.g., because they have a hard time switching from ‘savings’ mode to ‘spending’ mode) and can be hesitant to spend on the full range of activities that would bring them the most happiness and meaning in retirement (even though they have the resources to do so).

For instance, after a lifetime of ‘maximizing’ their finances (likely seeing their net worth increase steadily over time), some clients might find it difficult to see their portfolio balances decline in retirement as they draw down their assets to support their lifestyles. This could lead some to spend less than they otherwise might want to, as they prioritize maximizing their wealth (for its own sake) over enjoying their overall lifestyle. Some retired clients might feel a great deal of emotional distress when spending (and therefore could be reluctant to spend more on themselves in retirement), while still, others might be hesitant to spend due to concerns about an unpredictable future (e.g., market conditions or their own longevity).

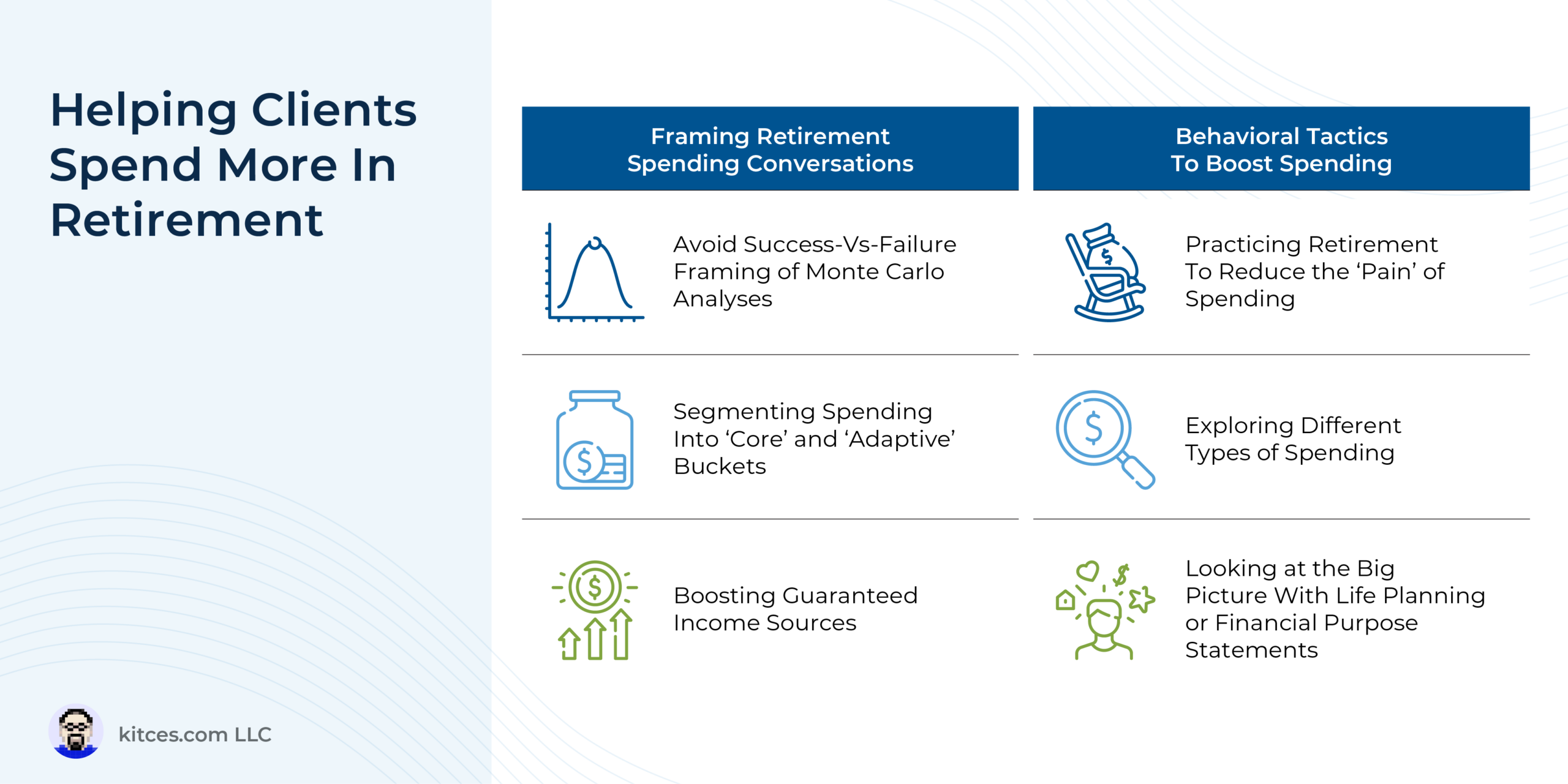

Nevertheless, advisors have an opportunity to add value through technical and behavioral-based strategies that can help hesitant clients increase their spending and have a more enjoyable retirement. For instance, framing the results of Monte Carlo analyses as a “probability of adjustment” rather than a “probability of success” can give clients more confidence that they are on a sustainable financial path. In addition, instead of grouping client expense categories as either essential (e.g., housing and food) or discretionary (e.g., entertainment, travel), advisors can group each category to have its own portion of “core” and “adaptive” expenses with ‘core’ buckets including spending that would otherwise be defined as “essential” spending and an amount of “discretionary” spending a client would have a hard time living without (e.g., housing – mortgage and weekly housecleaning service), leaving the “adaptive” bucket for the spending items that are truly discretionary for the client (e.g., housing – interior art). This encourages clients to ‘splurge’ on spending in the ‘adaptive’ bucket without guilt if the advisor can show that they can be confident about covering their “core” expenses. Also, given research suggesting that individuals are more likely to spend from ‘guaranteed’ income sources (e.g., Social Security or a defined-benefit pension), maximizing these pieces of the retirement income puzzle could give clients more confidence to spend.

On the behavioral side, clients could ‘practice’ retirement (e.g., through an extended sabbatical or series of mini-retirements) to experience what it would be like to spend their assets while not receiving wages. Advisors also could work with clients to explore different types of spending that have been shown to boost happiness, from ‘buying’ time (e.g., by hiring someone to clean their house) to spending on experiences, to philanthropic giving while they are alive (rather than waiting until their death to do so). Finally, advisors could help their clients step back and look at the ‘big picture’ by creating a Financial Purpose Statement or going through the Life Planning process.

Ultimately, the key point is that while some clients have no problem finding ways to spend down their nest egg in retirement (in which case an advisor can add value by ensuring they do so in a sustainable manner), the transition from saving to spending mode in retirement can be tricky for others, who might struggle to bring themselves to spend as much as they would like (even if they could afford to). For these clients, advisors can potentially add value by framing financial planning and retirement income conversations in a way that encourages these clients to explore their goals and the spending options that might fit their unique interests!